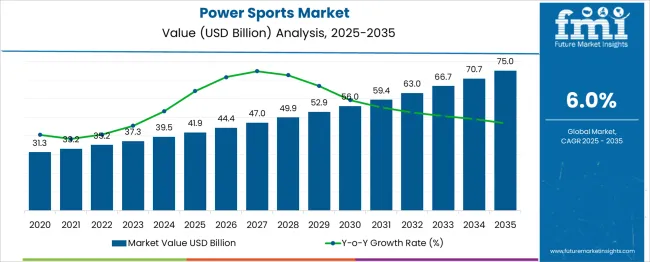

The global power sports market is likely to reach from USD 41.9 billion in 2025 to approximately USD 75 billion by 2035, recording an absolute increase of USD 33.1 billion over the forecast period. This translates into a total growth of 79%, with the market forecast to expand at a compound annual growth rate (CAGR) of 6% between 2025 and 2035. The market size is expected to grow by nearly 1.79X during the same period, supported by increasing consumer interest in outdoor recreational activities, rising disposable income in emerging markets, and growing demand for adventure tourism and off-road experiences.

Quick Stats for Power Sports Market

Between 2025 and 2030, the power sports market is projected to expand from USD 41.9 billion to USD 57.2 billion, resulting in a value increase of USD 15.3 billion, which represents 46.2% of the total forecast growth for the decade. This phase of growth will be shaped by rising consumer interest in outdoor adventure activities, increasing penetration of electric power sports vehicles, and growing demand for premium recreational vehicles in emerging markets. Power sports manufacturers are expanding their product portfolios to address the growing demand for versatile and environmentally friendly recreational vehicles.

| Metric | Value |

| Estimated Value in (2025E) | USD 41.9 billion |

| Forecast Value in (2035F) | USD 75 billion |

| Forecast CAGR (2025 to 2035) | 6% |

From 2030 to 2035, the market is forecast to grow from USD 57.2 billion to USD 75 billion, adding another USD 17.8 billion, which constitutes 53.8% of the ten-year expansion. This period is expected to be characterized by expansion of electric vehicle adoption, integration of advanced connectivity features, and development of green manufacturing practices. The growing adoption of eco-friendly recreational vehicles and technology-enhanced off-road experiences will drive demand for next-generation power sports vehicles with improved performance and environmental profiles.

Between 2020 and 2025, the power sports market experienced steady expansion, driven by increasing consumer focus on outdoor recreational activities and growing interest in adventure tourism. The market developed as manufacturers recognized the need for versatile recreational vehicles that could serve multiple purposes from utility work to recreational adventures. Social media influence and outdoor lifestyle trends began emphasizing the importance of power sports vehicles in active lifestyle choices and outdoor exploration experiences.

Market expansion is being supported by the increasing consumer interest in outdoor recreational activities and the corresponding demand for versatile power sports vehicles. Modern consumers are increasingly focused on active lifestyle choices that include off-road adventures, trail riding, and outdoor exploration activities. The proven versatility of power sports vehicles in both recreational and utility applications makes them preferred choices for consumers seeking multipurpose recreational investments.

The growing emphasis on adventure tourism and outdoor experiences is driving demand for power sports vehicles that can handle diverse terrain and weather conditions. Consumer preference for vehicles that combine recreational enjoyment with practical utility applications is creating opportunities for innovative product development. The rising influence of social media outdoor lifestyle trends and recreational vehicle communities is also contributing to increased product adoption across different age groups and demographics.

The market is segmented by product type, fuel type, and region. By product type, the market is divided into SXS, heavyweight motorcycle, ATV, off-road motorcycle, and others. Based on fuel type, the market is categorized into gasoline, diesel, and electric. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

The SXS (Side-by-Side) product type is projected to account for 45.0% of the power sports market in 2025, reaffirming its position as the category's leading segment. Consumers increasingly prefer SXS vehicles for their versatility, safety features, and ability to accommodate multiple passengers while providing excellent off-road performance. SXS vehicles' well-documented utility in both recreational and work applications directly addresses consumer needs for multipurpose recreational investments.

This product type forms the foundation of most market growth, as it represents the most versatile and family-friendly option in the power sports category. Manufacturer innovations and ongoing feature enhancements continue to strengthen consumer preference for SXS vehicles. With consumer lifestyles emphasizing family outdoor activities and group adventures, SXS vehicles align with both recreational and practical transportation goals. Their broad appeal across demographics ensures steady dominance, making them the central growth driver of power sports market demand.

Gasoline fuel type is projected to represent 60% of power sports market demand in 2025, underscoring its role as the preferred fuel option for performance-oriented recreational vehicles. Consumers gravitate toward gasoline-powered vehicles for their proven reliability, widespread fuel availability, and established performance characteristics that maximize power sports vehicle capabilities. Positioned as traditional, proven powertrains, gasoline engines offer both immediate performance benefits and familiar maintenance requirements.

The segment is supported by the established infrastructure for gasoline fuel distribution and consumer familiarity with gasoline engine maintenance. The manufacturers are increasingly improving gasoline engine efficiency while maintaining performance standards, enhancing appeal and operational cost-effectiveness. As performance-focused consumers prioritize reliability and power delivery, gasoline-powered power sports vehicles will continue to dominate demand, reinforcing their established positioning within the recreational vehicle market.

The power sports market is advancing steadily due to increasing consumer interest in outdoor recreational activities and growing demand for versatile recreational vehicles. The market faces challenges including environmental regulations, seasonal demand fluctuations, and competition from alternative recreational activities. Innovation in electric powertrains and eco-friendly manufacturing practices continue to influence product development and market expansion patterns.

The growing adoption of electric powertrain technology is enabling manufacturers to develop environmentally friendly power sports vehicles with reduced emissions and noise levels. Electric technology offers quiet operation, instant torque delivery, and reduced maintenance requirements that appeal to environmentally conscious consumers. Advanced battery technology and charging infrastructure development are driving broader acceptance of electric power sports vehicles, particularly in recreational areas with noise restrictions.

Modern power sports vehicle manufacturers are incorporating advanced connectivity systems, GPS navigation, and safety technologies to enhance user experience and vehicle performance monitoring. These technologies improve rider safety while providing better vehicle management and maintenance tracking capabilities. Advanced safety features also enable enhanced vehicle security and theft prevention systems that provide better ownership experience and peace of mind for consumers.

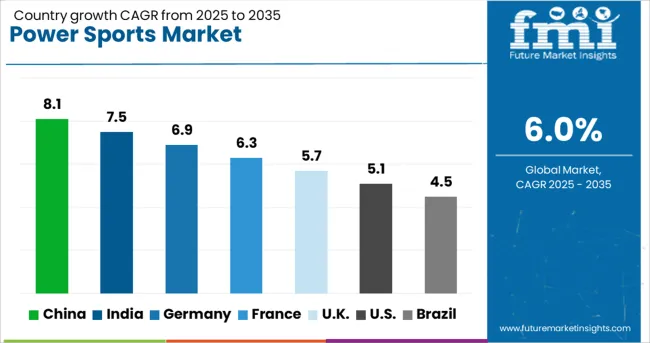

| Country | CAGR (2025-2035) |

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

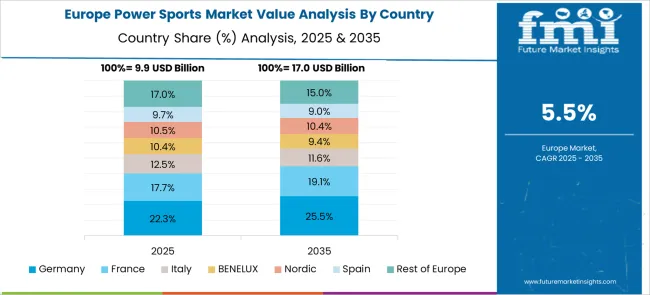

The power sports market is experiencing steady growth globally, with China leading at an 8.1% CAGR through 2035, driven by rising disposable income, increasing interest in outdoor recreational activities, and growing penetration of international power sports brands. India follows closely at 7.5%, supported by expanding middle class, adventure tourism growth, and increasing demand for recreational vehicles. Germany shows steady growth at 6.9%, emphasizing engineering excellence and premium vehicle technologies. France records 6.3%, focusing on outdoor recreation culture and adventure tourism. The UK shows 5.7% growth, prioritizing outdoor lifestyle trends and recreational vehicle enthusiasm.

The report covers an in-depth analysis of 40+ countries; six top-performing countries are highlighted below.

Revenue from power sports vehicles in China is projected to exhibit strong growth with a CAGR of 8.1% through 2035, driven by rapid adoption of outdoor recreational activities among younger consumers and increasing influence of adventure tourism trends. The country's expanding middle class and growing interest in outdoor experiences are creating significant demand for premium power sports vehicles. Major international and domestic manufacturers are establishing comprehensive distribution networks to serve the growing population of outdoor recreation enthusiasts across tier-1 and tier-2 cities.

Revenue from power sports vehicles in India is expanding at a CAGR of 7.5%, supported by increasing disposable income, growing outdoor recreation awareness, and rising penetration of international recreational vehicle brands. The country's young demographic profile and increasing exposure to global adventure trends are driving demand for effective recreational vehicle solutions. International manufacturers and domestic companies are establishing distribution channels to serve the growing demand for quality outdoor recreation vehicles.

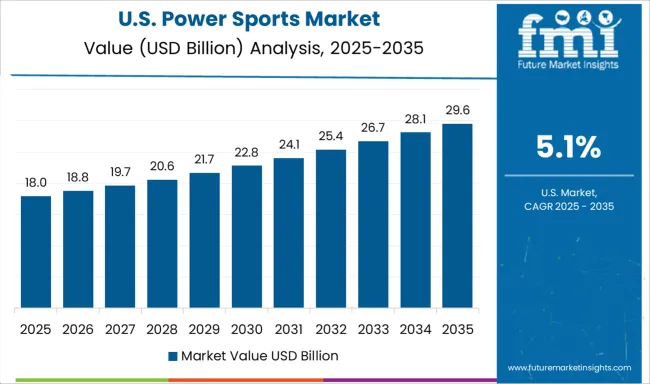

Demand for power sports vehicles in the USA is projected to grow at a CAGR of 5.1%, supported by consumer preference for advanced technology integration and high-performance recreational vehicles. American consumers are increasingly focused on vehicle innovation, performance capabilities, and ecological recreational practices. The market is characterized by strong demand for premium vehicles that combine traditional power sports performance with modern technology features for enhanced outdoor experiences.

Revenue from power sports vehicles in Germany is projected to grow at a CAGR of 6.9% through 2035, driven by the country's strong focus on engineering excellence, premium product positioning, and consumer preference for technically advanced recreational vehicles. German consumers consistently demand high-quality, reliable products that deliver superior performance while maintaining safety standards and environmental responsibility.

Revenue from power sports vehicles in France is projected to grow at a CAGR of 6.3% through 2035, supported by rising consumer interest in outdoor recreation and adventure tourism experiences. French consumers value design aesthetics, performance reliability, and proven effectiveness, positioning premium power sports vehicles as a core component of active lifestyle choices.

Revenue from power sports vehicles in the UK is projected to grow at a CAGR of 5.7% through 2035, supported by the country's strong emphasis on outdoor recreation, countryside access, and recreational vehicle safety standards. British consumers prioritize proven performance and reliable operation, making premium power sports vehicles a trusted choice in the outdoor recreation segment.

The power sports market is characterized by competition among established recreational vehicle manufacturers, specialty outdoor equipment companies, and emerging electric vehicle players. Companies are investing in advanced powertrain technologies, green manufacturing practices, premium design features, and digital marketing strategies to deliver effective, appealing, and accessible recreational vehicle solutions. Brand positioning, performance innovation, and distribution expansion are central to strengthening product portfolios and market presence.

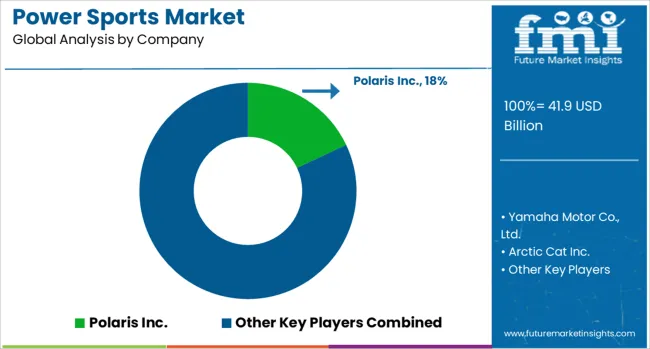

Polaris Inc., USA-based, leads the market with significant global presence, offering comprehensive power sports vehicle portfolios with a focus on performance, versatility, and outdoor recreation applications. Yamaha Motor Co., Ltd., Japan-based, provides reliable, high-performance vehicles with emphasis on engineering excellence and consumer satisfaction. Arctic Cat, USA, delivers specialized off-road vehicles with focus on extreme performance and durability. BRP, Canada-based, focuses on innovative recreational vehicles that combine advanced technology with proven performance capabilities. Honda Motor Co., Ltd. and Kawasaki Heavy Industries, Ltd., operating globally, provide comprehensive power sports vehicle ranges across multiple performance levels and price points. Textron Inc., USA, emphasizes specialized utility and recreational vehicles with premium positioning. Harley Davidson, USA, offers premium motorcycle products with heritage brand positioning and luxury features. CFMoto and KTM provide performance-focused recreational vehicles with emphasis on specific market segments and competitive pricing. Kymco, Taiga Motors, and Alpina Burkard Bovensiepen GmbH & Co. KG further expand the competitive landscape with distinct product offerings tailored to specialized consumer needs.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 41.9 Billion |

| Product Type | SXS, Heavyweight Motorcycle, ATV, Off Road Motorcycle, Others |

| Fuel Type | Gasoline, Diesel, Electric |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Polaris Inc, Yamaha Motor Co Ltd, Arctic Cat, BRP, Honda Motor Co Ltd, Kawasaki Heavy Industries Ltd, Textron Inc, Harley Davidson, CFMoto, KTM, Kymco, Taiga Motors, Alpina Burkard Bovensiepen GmbH & Co KG, Suzuki Motor Corporation |

| Additional Attributes | Dollar sales by product type and fuel type, regional demand trends, competitive landscape, buyer preferences for performance versus utility applications, integration with advanced technology and connectivity features, innovations in electric powertrains, lightweight materials, and green manufacturing practices |

Product Type:

Fuel Type:

Region:

The global power sports market is estimated to be valued at USD 41.9 billion in 2025.

The market size for the power sports market is projected to reach USD 75.0 billion by 2035.

The power sports market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in power sports market are sxs, heavyweight motorcycle, atv, off road motorcycle and others.

In terms of fuel type outlook, gasoline segment to command 60.0% share in the power sports market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Sports Accessories Market Size and Share Forecast Outlook 2025 to 2035

Online Powersports Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Sports Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Isolation Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Window Lift Motor Market Size and Share Forecast Outlook 2025 to 2035

Powered Surgical Staplers Market Size and Share Forecast Outlook 2025 to 2035

Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Power Over Ethernet (PoE) Controllers Market Size and Share Forecast Outlook 2025 to 2035

Power Inverter Market Size and Share Forecast Outlook 2025 to 2035

Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Power Control Commercial Surge Protection Devices Market Size and Share Forecast Outlook 2025 to 2035

Power Transmission Component Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA