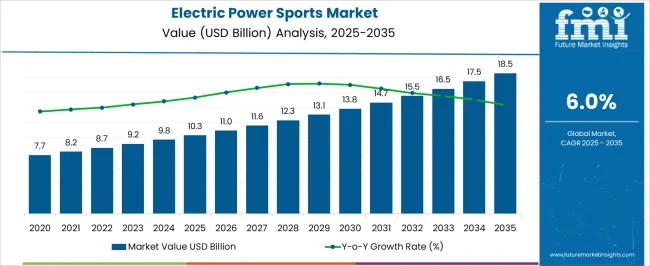

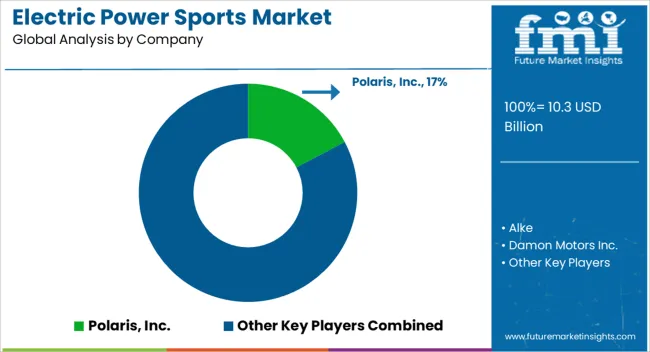

The electric power sports market is estimated to be valued at USD 10.3 billion in 2025. It is projected to reach USD 18.5 billion by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period. The electric power sports market is projected to create an absolute dollar opportunity of USD 8.2 billion over the forecast period. This growth is supported by a CAGR of 6%, driven by the increasing popularity of electric-powered recreational vehicles, advancements in battery technology, and rising consumer demand for environmentally friendly sports and outdoor activities.

In the first five-year phase (2025–2030), the market is expected to grow from USD 10.3 billion to USD 13.6 billion, adding USD 3.3 billion, which accounts for 40.2% of the total incremental growth. The second phase (2030–2035) will contribute USD 4.9 billion, representing 59.8% of the total growth, reflecting stronger momentum driven by increased adoption of electric power sports vehicles, advancements in electric motor technology, and a growing focus on sustainable outdoor activities. Annual increments rise from USD 0.6 billion in early years to USD 1 billion by 2035, signaling robust growth driven by innovations, expanding consumer awareness, and widespread adoption in both developed and emerging markets. Manufacturers focusing on performance, battery efficiency, and affordability will capture the largest share of this USD 8.2 billion opportunity.

| Metric | Value |

|---|---|

| Electric Power Sports Market Estimated Value in (2025 E) | USD 10.3 billion |

| Electric Power Sports Market Forecast Value in (2035 F) | USD 18.5 billion |

| Forecast CAGR (2025 to 2035) | 6.0% |

Recent developments in battery technology, rising fuel costs, and supportive regulatory frameworks have collectively influenced a shift towards electric alternatives across power sports applications. Industry stakeholders are increasingly focusing on enhancing performance and range while reducing environmental impact, leading to higher adoption rates in both developed and emerging markets.

Strong interest from younger, eco-conscious consumers, combined with government incentives for electric vehicle adoption, has further accelerated market penetration. In addition, ongoing innovations in drivetrains, lightweight materials, and connected features are creating differentiation in the market, offering manufacturers new avenues for growth.

Strategic investments in off-road charging infrastructure and partnerships among OEMs and battery suppliers are expected to support future scalability. As the landscape continues to evolve, electrified platforms are anticipated to become mainstream across recreational and commercial use cases within the power sports industry.

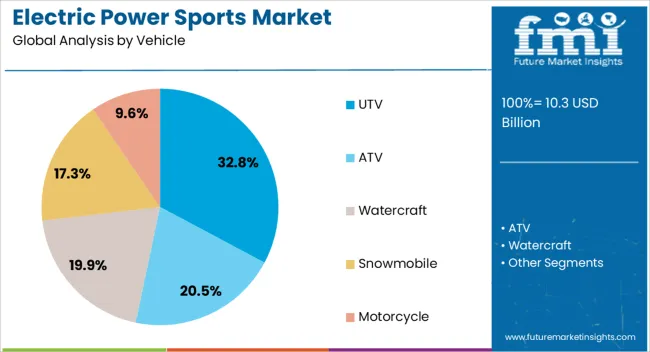

The electric power sports market is segmented by vehicle and geographic regions. By vehicle, the electric power sports market is divided into UTV, ATV, Watercraft, Snowmobile, and Motorcycle. Regionally, the electric power sports industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The UTV vehicle segment is projected to hold 32.8% of the market revenue share in 2025, making it the leading vehicle segment. This dominance has been influenced by the segment’s versatility in both recreational and commercial applications, as seen in product rollouts and OEM announcements. UTVs are being widely adopted across sectors such as agriculture, military, and outdoor tourism due to their ability to carry heavy payloads and navigate challenging terrain.

With the shift toward electrification, electric UTVs are being preferred for their lower maintenance costs, reduced operational noise, and zero emissions. Manufacturers are focusing on integrating longer-range batteries, high-torque motors, and smart control systems, which have elevated the performance standards in this category.

Demand has also been supported by institutional buyers such as national parks and construction firms aiming to meet sustainability goals. These factors have collectively enabled the UTV segment to maintain a stronghold within the Electric Power Sports Market.

The electric power sports market is driven by the growing demand for eco-friendly, high-performance recreational vehicles. Opportunities in expanding sports and recreational vehicle markets, along with emerging trends in battery efficiency, are reshaping the market. However, high initial costs and infrastructure limitations pose challenges. By 2025, overcoming these obstacles through cost-effective solutions and better infrastructure will be essential for continued market growth and wider adoption of electric power sports vehicles.

The electric power sports market is expanding due to the increasing popularity of electric vehicles (EVs) in the sports and recreational segment. Consumers are seeking high-performance, eco-friendly alternatives to traditional fuel-powered vehicles for activities like off-roading, snowmobiling, and motocross. Electric power sports vehicles offer lower operational costs and reduced environmental impact, making them increasingly attractive to enthusiasts. By 2025, the market is expected to continue growing, driven by the demand for sustainable sports vehicles.

Opportunities in the electric power sports market are growing with the expansion of recreational and sports vehicle markets. As outdoor recreational activities continue to rise in popularity, the demand for electric-powered sports vehicles such as electric motorcycles, ATVs, and bicycles is also increasing. By 2025, the expanding adoption of electric sports vehicles across outdoor activities will drive growth, particularly in regions with high participation in adventure sports and eco-conscious consumers seeking electric alternatives.

Emerging trends in the electric power sports market include advancements in battery efficiency and performance enhancements. With ongoing research into improving battery life, charging times, and power output, electric sports vehicles are becoming more competitive with traditional gasoline-powered options. By 2025, more efficient and longer-lasting batteries will lead to broader adoption, offering better performance and reduced charging time, making electric sports vehicles more appealing for enthusiasts and participants.

Despite growth, challenges such as high initial costs and infrastructure limitations persist in the electric power sports market. The higher upfront costs of electric vehicles and the lack of sufficient charging infrastructure, especially in remote areas, can limit their adoption. Additionally, the high-performance capabilities required in power sports vehicles necessitate specialized, costly components. By 2025, addressing these challenges through more affordable pricing strategies and the expansion of charging networks will be crucial for market growth.

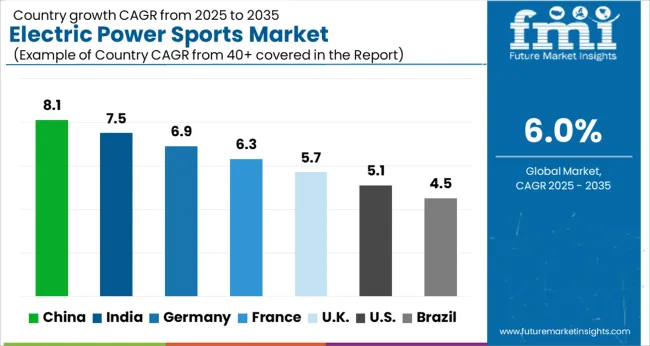

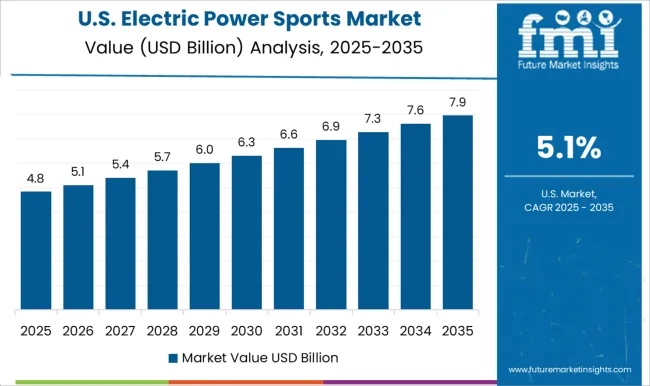

The global electric power sports market is projected to grow at a 6% CAGR from 2025 to 2035. China leads with a growth rate of 8.1%, followed by India at 7.5%, and Germany at 6.9%. The United Kingdom records a growth rate of 5.7%, while the United States shows the slowest growth at 5.1%. These varying growth rates are driven by factors such as increasing demand for sustainable transportation options, growing interest in electric recreational vehicles, and the rising adoption of green technologies. Emerging markets like China and India are experiencing higher growth due to increasing urbanization, rising disposable incomes, and government support for eco-friendly transportation, while more mature markets like the USA and the UK experience steady growth driven by consumer preferences for recreational electric vehicles and advancements in battery technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

The electric power sports market in China is growing rapidly, with a projected CAGR of 8.1%. The country’s increasing demand for sustainable and eco-friendly transportation solutions, coupled with the rising popularity of recreational electric vehicles such as e-bikes and electric off-road vehicles, is driving market growth. China’s strong manufacturing base and advancements in electric vehicle battery technologies further contribute to the adoption of electric power sports. Additionally, government incentives, policies supporting clean energy, and the growing emphasis on green transportation are accelerating market expansion in China.

The electric power sports market in India is projected to grow at a CAGR of 7.5%. India’s increasing urbanization, rising disposable incomes, and growing awareness of environmental sustainability are contributing to the demand for electric power sports. The country’s growing interest in recreational electric vehicles, particularly e-bikes and electric all-terrain vehicles (ATVs), is driving the market. Additionally, India’s government incentives for electric vehicle adoption and investments in charging infrastructure further support the demand for electric power sports in the country.

The electric power sports market in Germany is projected to grow at a CAGR of 6.9%. Germany’s strong automotive industry, along with the rising consumer interest in sustainable and energy-efficient recreational vehicles, is driving steady market growth. The country’s growing focus on reducing carbon emissions and promoting green transportation further accelerates the demand for electric power sports. Additionally, Germany’s investments in electric vehicle infrastructure and advancements in electric drive technologies are contributing to the widespread adoption of electric recreational vehicles in the country.

The electric power sports market in the United Kingdom is projected to grow at a CAGR of 5.7%. The UK market is driven by increasing demand for recreational electric vehicles, particularly e-bikes, electric scooters, and electric off-road vehicles. The country’s focus on sustainability and reducing carbon footprints in transportation is contributing to steady market growth. Additionally, government policies supporting clean energy solutions and the development of electric vehicle infrastructure are accelerating the adoption of electric power sports in the UK

The electric power sports market in the United States is expected to grow at a CAGR of 5.1%. The USA market is driven by the growing interest in recreational electric vehicles such as e-bikes, electric ATVs, and electric scooters. The increasing awareness of environmental sustainability, combined with advancements in electric vehicle technologies and infrastructure, is contributing to steady market growth. Additionally, the USA focus on promoting clean energy solutions and reducing carbon emissions further accelerates the adoption of electric power sports.

The electric powersports space features established OEMs and focused EV specialists. Polaris Inc. leads electric off-road UTVs with the RANGER XP Kinetic and is advancing ORV and snowmobile electrification through a long-term technology partnership with Zero Motorcycles. Commercial electric snowmobiles are led by Taiga Motors.

Road-going electric motorcycles are supplied by LiveWire Group, Zero Motorcycles, and Energica Motor Company. Additional motorcycle players include Damon Motors and TACITA S.r.l. Greenworks Commercial offers electric utility UTVs, while Intimidator Group sells the Classic EV UTV and the eNVy neighborhood vehicle. Industrial and municipal electric utility vehicles are supplied by Alkè.

| Item | Value |

|---|---|

| Quantitative Units | USD 10.3 Billion |

| Vehicle | UTV, ATV, Watercraft, Snowmobile, and Motorcycle |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Polaris, Inc., Alke, Damon Motors Inc., Energica Motor Company S.p.A, Greenworks Commercial, Harley-Davidson, Inc., Intimidator UTV, TACITA S.r.l, Taiga Motors Inc., and Zero Motorcycle |

| Additional Attributes | Dollar sales by vehicle type and application, demand dynamics across electric bikes, scooters, and all-terrain vehicles, regional trends in electric power sports adoption, innovation in battery technology and performance efficiency, impact of regulatory standards on emissions and safety, and emerging use cases in recreational and urban mobility solutions. |

The global electric power sports market is estimated to be valued at USD 10.3 billion in 2025.

The market size for the electric power sports market is projected to reach USD 18.5 billion by 2035.

The electric power sports market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in electric power sports market are UTV, ATV, watercraft, snowmobile and motorcycle.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA