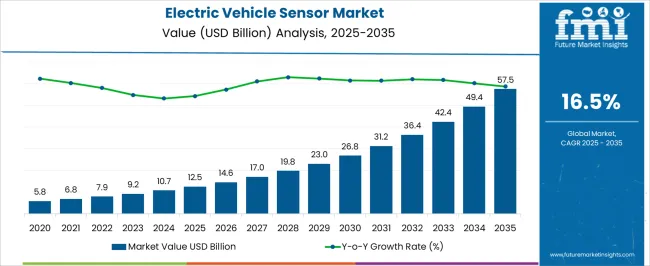

The Electric Vehicle Sensor Market is estimated to be valued at USD 12.5 billion in 2025 and is projected to reach USD 57.5 billion by 2035, registering a compound annual growth rate (CAGR) of 16.5% over the forecast period.

The Electric Vehicle Sensor market is witnessing significant growth, driven by the rapid adoption of electric vehicles, technological advancements, and stringent emission reduction regulations across the globe. Rising demand for battery electric vehicles (BEVs), hybrid electric vehicles, and plug-in hybrid electric vehicles is accelerating the need for advanced sensor systems that ensure performance, safety, and energy efficiency. Key drivers include the growing focus on real-time monitoring of vehicle dynamics, battery management, propulsion control, and driver assistance systems.

Integration of high-precision sensors with electric powertrains enables optimized energy usage, enhanced vehicle safety, and predictive maintenance capabilities. Increasing investments by automakers in research and development for autonomous driving and connected vehicle technologies are further supporting sensor adoption.

Growing awareness of environmental sustainability and government incentives for electric vehicle production and adoption are also boosting market expansion As vehicle electrification continues to gain momentum, demand for reliable and advanced sensors that can operate in harsh conditions and support complex EV architectures is expected to remain robust, ensuring long-term market growth.

| Metric | Value |

|---|---|

| Electric Vehicle Sensor Market Estimated Value in (2025 E) | USD 12.5 billion |

| Electric Vehicle Sensor Market Forecast Value in (2035 F) | USD 57.5 billion |

| Forecast CAGR (2025 to 2035) | 16.5% |

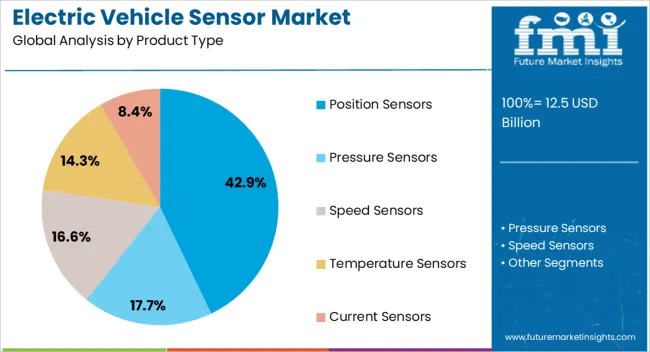

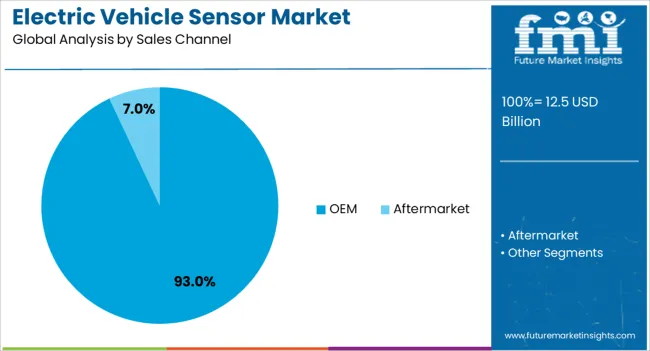

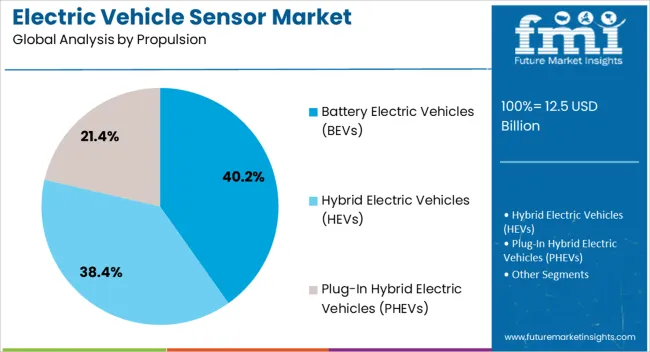

The market is segmented by Product Type, Sales Channel, and Propulsion and region. By Product Type, the market is divided into Position Sensors, Pressure Sensors, Speed Sensors, Temperature Sensors, and Current Sensors. In terms of Sales Channel, the market is classified into OEM and Aftermarket. Based on Propulsion, the market is segmented into Battery Electric Vehicles (BEVs), Hybrid Electric Vehicles (HEVs), and Plug-In Hybrid Electric Vehicles (PHEVs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The position sensors segment is projected to hold 42.9% of the market revenue in 2025, establishing it as the leading product type. Growth in this segment is driven by the critical role position sensors play in monitoring motor rotor and wheel positions, steering systems, and transmission components in electric vehicles. These sensors provide precise measurements that are essential for accurate propulsion control, efficient energy management, and safe operation of battery electric vehicles.

The adoption of high-precision magnetic and optical position sensors enables real-time feedback to vehicle control units, improving performance and extending battery life. Integration with advanced driver-assistance systems and autonomous driving technologies further strengthens their relevance.

Manufacturers are increasingly focusing on sensor miniaturization, reliability, and high-temperature performance, which supports broad deployment across various EV platforms With ongoing EV production growth and increasing vehicle complexity, position sensors are expected to maintain their leadership, driven by their ability to enhance operational efficiency, safety, and overall vehicle performance.

The OEM sales channel segment is anticipated to account for 93.0% of the market revenue in 2025, making it the dominant distribution route. Growth is being driven by the strategic integration of sensors directly into electric vehicle assembly lines, ensuring system compatibility, quality control, and long-term reliability.

Original equipment manufacturers are increasingly prioritizing standardized sensor solutions for propulsion, battery management, and vehicle safety systems to enhance performance and meet regulatory requirements. Direct integration through OEM channels reduces aftermarket dependency, enables synchronized calibration with other vehicle systems, and enhances warranty support.

The preference for OEM sourcing is further reinforced by close collaborations between sensor suppliers and automakers, which facilitates innovation, rapid deployment, and cost optimization As EV production volumes continue to rise and consumer demand for high-performance, safe, and energy-efficient vehicles grows, the OEM sales channel is expected to remain the primary driver of market expansion, providing seamless integration, reliable supply, and long-term adoption of sensor technologies.

The battery electric vehicles (BEVs) propulsion segment is projected to hold 40.2% of the market revenue in 2025, positioning it as the leading propulsion category. Growth in this segment is being fueled by the increasing global adoption of fully electric vehicles due to environmental regulations, declining battery costs, and expanding charging infrastructure.

Sensors in BEVs play a crucial role in monitoring battery performance, thermal management, motor operation, and vehicle stability, ensuring energy efficiency and safety. Integration of position, current, temperature, and voltage sensors allows for precise real-time control of electric powertrains, which is essential for extending battery life and improving vehicle range.

Government incentives, subsidies, and initiatives to reduce carbon emissions are driving investment in BEV production, further supporting sensor adoption As electrification of passenger and commercial fleets accelerates, the BEV propulsion segment is expected to remain the primary driver of sensor market growth, supported by continuous technological advancements and increasing demand for sustainable mobility solutions.

Position sensors assume the top position in the product type segment. OEM is the preferred sales channel for electrical vehicle sensors.

In 2025, position sensors are expected to account for 42.9% of the market share by product type. Some of the key drivers for the developing demand for position sensors are:

| Attributes | Details |

|---|---|

| Top Product Type | Position Sensor |

| Market Share (2025) | 42.9% |

OEM sales are anticipated to account for 93.0% of the market share in 2025. Some of the key drivers for the progress of OEM sales of EV sensors include:

| Attributes | Details |

|---|---|

| Top Sales Channel | OEM |

| Market Share (2025) | 93.0% |

Rising disposable income in Europe is seeing greater adoption of electrical vehicles, which is conducive to the growth of the market. Concerns over sustainability are also informing market growth in Europe.

The automobile industry racing ahead at full throttle is seeing the market press ahead in the Asia Pacific. Government schemes related to electric vehicle manufacturing are also seeing the market gain speed in the region.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| Spain | 17.1% |

| France | 16.9% |

| South Korea | 17.9% |

| Australia | 18.2% |

| India | 18.8% |

The market is set to register a CAGR of 17.1% in Spain for the forecast period. The key drivers for growth are:

The CAGR for the electric vehicle sensor market in France is tipped to be 16.9% over the forecast period. Some of the key factors driving the growth are:

The CAGR for the electric vehicle sensor market in Australia is tipped to be 18.2% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 17.9% in South Korea for the forecast period. Some of the key trends include:

The market is expected to register a CAGR of 18.8% in India over the forecast period. Some of the key trends include:

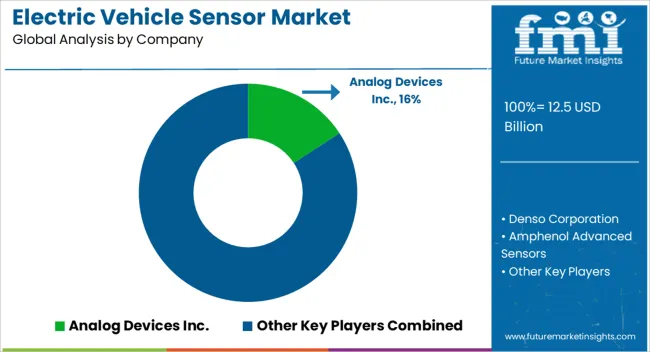

The electrical vehicle sensor market is dominated by a few leading players, although there is room to grow for smaller players and startups. Analog Devices Inc. is using its superior software and data handling capabilities to bring innovations to sensors that go beyond just normal automotive improvements.

Denso Corporation is thriving on the back of its established relationships with reputed car makers like Toyota and Subaru. Startups in the market are relying on product differentiation to carve out a piece of the pie for themselves.

Recent Developments in the Electric Vehicle Sensor Market

The global electric vehicle sensor market is estimated to be valued at USD 12.5 billion in 2025.

The market size for the electric vehicle sensor market is projected to reach USD 57.5 billion by 2035.

The electric vehicle sensor market is expected to grow at a 16.5% CAGR between 2025 and 2035.

The key product types in electric vehicle sensor market are position sensors, pressure sensors, speed sensors, temperature sensors and current sensors.

In terms of sales channel, oem segment to command 93.0% share in the electric vehicle sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA