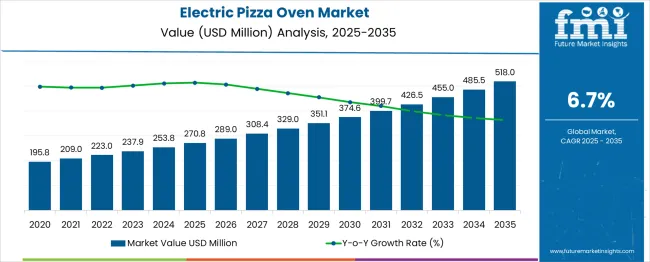

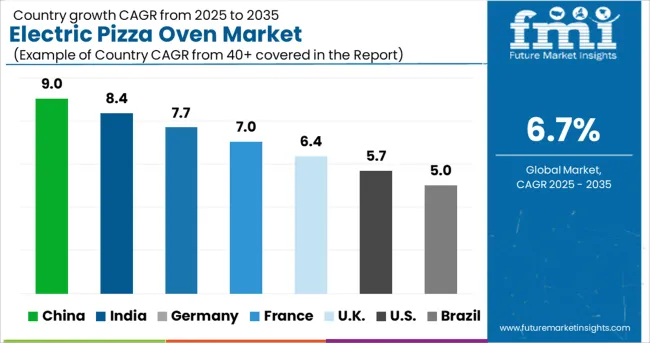

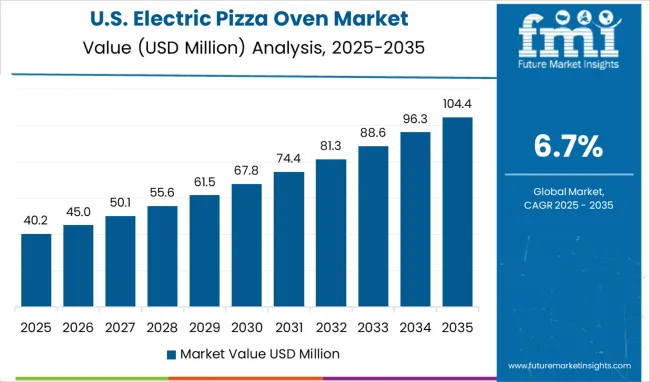

The Electric Pizza Oven Market is estimated to be valued at USD 270.8 million in 2025 and is projected to reach USD 518.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period.

The electric pizza oven market is witnessing notable growth as demand for energy-efficient, consistent, and high-capacity cooking solutions increases across commercial and residential settings. This expansion is being driven by rising consumer expectations for quick service, uniform quality, and cleaner operations compared to traditional fuel-based ovens.

Advances in heating technology and insulation materials are contributing to improved efficiency and performance, while regulatory focus on energy conservation and indoor air quality is accelerating adoption. Future growth is expected to be supported by continued innovation in automation and digital controls, as well as increasing investments by foodservice chains seeking to standardize operations.

Shifts in dining habits toward delivery and takeout, along with growing preferences for artisanal and gourmet offerings, are paving the way for further adoption of specialized electric pizza ovens in both urban and suburban markets.

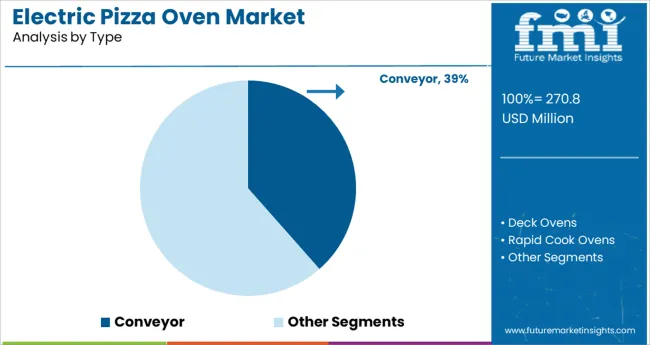

The market is segmented by Type, Automation Type, Load, Max. Temperature, Application, Commercial, and Sales Channel and region. By Type, the market is divided into Conveyor, Deck Ovens, and Rapid Cook Ovens. In terms of Automation Type, the market is classified into Automatic and Semi-Automatic. Based on Load, the market is segmented into 2400W, 1600W, 4500W, and Others. By Max. Temperature, the market is divided into 600 ⁰F, 350 ⁰F, 400 ⁰F, 800 ⁰F, 1000 ⁰F, and Others. By Application, the market is segmented into Commercial and Residential. By Commercial, the market is segmented into Restaurants, Hotels, Fast Food Chains, and Others. By Sales Channel, the market is segmented into Wholesalers/Distributors, Direct Sales, Online Retailers, Specialty Stores, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Insights into the Conveyor Type Segment

When segmented by type, the conveyor segment is anticipated to hold 38.5 % of the total market revenue in 2025, establishing itself as the leading type. This dominance is being supported by its ability to deliver consistent, high-volume output with minimal operator intervention.

The continuous cooking mechanism enables uniform heat distribution and precise control over cooking times, which has been particularly effective in meeting the demands of busy foodservice environments. Operators have been favoring conveyor ovens due to their capability to maintain quality during peak hours, reduce dependency on skilled labor, and improve throughput.

The flexibility to handle various crust styles and toppings while maintaining efficiency has reinforced the preference for conveyor ovens among commercial kitchens and chain restaurants.

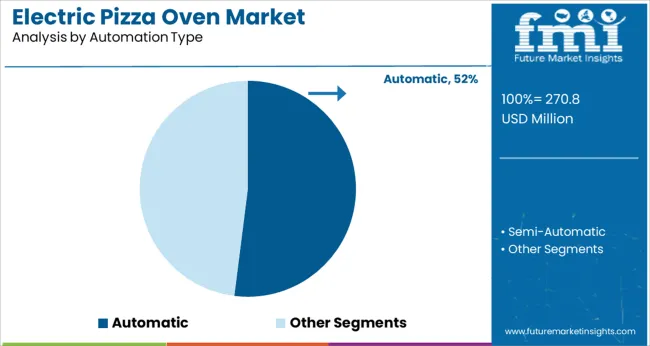

Segmented by automation type, the automatic segment is projected to account for 52.0% of the market revenue in 2025, maintaining its position as the most preferred automation type. This prominence is being driven by the rising need for labor optimization and operational consistency in the foodservice sector.

Automatic electric pizza ovens have been enabling operators to reduce manual oversight, improve repeatability, and minimize errors, which has translated into better customer satisfaction and reduced wastage. The integration of programmable settings, digital interfaces, and automated temperature control has further enhanced their appeal.

Businesses have been adopting automatic ovens to streamline workflows, support unskilled or semi-skilled staff, and achieve greater efficiency under regulatory pressures to control labor costs and improve productivity.

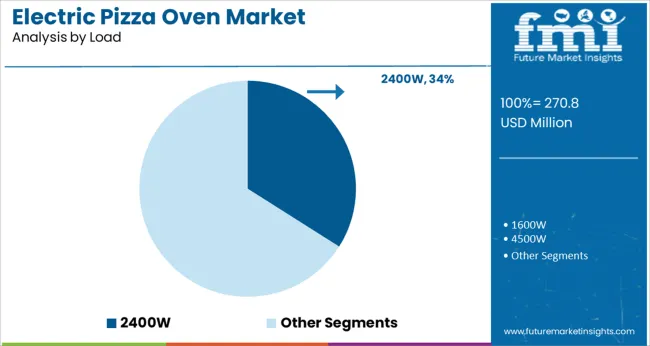

When segmented by load, the 2400W segment is expected to capture 34.0 % of the market revenue in 2025, securing its role as the leading load category. This leadership has been underpinned by its ability to strike an optimal balance between energy consumption and cooking performance.

The 2400W segment has been preferred for its capacity to achieve high temperatures quickly while maintaining energy efficiency, making it suitable for small to medium-sized operations. Operators have been drawn to this load category as it offers reliability without overburdening electrical infrastructure, particularly in compact kitchens.

Its compatibility with standard commercial power supplies and ability to deliver consistent baking results have contributed to its sustained adoption in restaurants, cafes, and catering setups.

Pizza outlets have grown to be a highly popular area for individuals, especially millennials, to spend their extra money as a result of urbanization and a rise in consumer purchasing power. As a result, there is a huge possibility even in emerging nations where brand-new hospitality facilities are being established.

As each commercial kitchens have distinct demands concerning size, fuel utilized, ease of cleaning, size of the grill, number of burners, simplicity of regulating temperature, cost-effective pricing, custom heat settings, timer, etc., providing customized solutions is one of the current industry trends. Electric pizza ovens provide them with all. The market players are attempting to meet these customer demands with these characteristics, which are current market trends. Brands are gaining a competitive advantage owing to such personalized products and a thoughtful combination of crucial elements.

Additionally, since this sector is already established and pizza ovens are practically ubiquitous in commercial kitchens in developed nations, it is simpler to enter. Offering pioneering styles and designs can provide players with new opportunities. When it comes to electric pizza ovens commercial, producers may create profitable market prospects by including popular features based on consumer demand.

Investing in renewable energy sources like solar panels, which are subsidized in many nations, might lower the cost of electricity. Electric ovens are more expensive initially but take less time and work to run in general, making them ideal for a busy restaurant.

Following a thorough market analysis, FMI experts found that the electric pizza oven market has shown remarkable growth in recent years. FMI researchers discovered after conducting a thorough market analysis that the electric pizza oven market has shown remarkable growth recently. Since pizza ovens are one of the most popular products in the culinary and hospitality industries, the CAGR has increased in proportion. The CAGR of the market ascended from 5.8% from 2020 to 2025 to 6.7% from 2025 to 2035. The overall market value increased by about USD 270.8 million from 2025 to 2025.

A device that uses electricity to make pizzas is an electric pizza oven. These electric ovens are commonly used today. These electric ovens come in a few different varieties. The flames within the gas and electric pizza ovens are produced by venting hot air from the cooking chamber. A heating element or a fan serves as the heat source. Since they utilize less electricity, the electrical systems are far more effective. To produce a high temperature, an electric pizza cooker uses electricity to spark ignition. Given the constant high temperature used throughout the cooking, food is prepared evenly. The dough will get crispy on the outside without drying out if it is cooked at high heat for a shorter period of time. Hence, these are typically preferred by chefs.

The popularity of electric pizza ovens is growing as more people choose to eat healthily. A benefit of having this small appliance in a home kitchen is the ability to make homemade pizza in an outdoor electric pizza oven that produces restaurant-style pizza. All people need to bake the best pizza ever is a fantastic pizza recipe in their possession because these ovens are simple to operate and do not require any baking experience. Customers value their energy efficiency, portability, convenience, ease of use, and ease of maintenance.

An idle electric pizza oven needs to be suited for a kitchen at home and run on home voltage. As a result, a number of manufacturers are presently creating electric pizza ovens for use in both residential and commercial settings. Additionally, they now provide electric pizza ovens with various electrical loads. Customers can now review the parameters of these ovens to confirm that the power supply of their kitchen can support the energy load of the electric pizza oven, and they can make their purchasing decision based on this information. Furthermore, several manufacturers are now producing portable electric pizza ovens for small parties and get together. Wherever there is an electricity connection, these ovens can be used as countertop electric pizza ovens.

Deck Ovens - By Type

On the basis of type, the electric pizza oven market is categorized into the conveyor, deck ovens, and rapid cook ovens. Among these sub-segments, the deck ovens segment holds the most significant market share by obtaining almost 58.3% global market share during the forecast period.

The following elements are fueling the market expansion:

Automatic - By Automation Type

Depending on the automation type, the electric pizza oven market is bifurcated into automatic and semi-automatic. The automatic segment dominates the market acquiring almost 73.4% global market share.

The expansion of the market is being influenced by the following variables:

The expansion of the region has been assisted by the greater penetration of the food service sector in North American and European nations. Since there are so many different types of cuisine in the food sector, other regions including East Asia, South Asia, and the Middle East are expected to witness expansion in the pizza oven market. Pizza is one of the most often ordered foods online. The business appears to be flourishing overall as a result of rising demand and popularity in the food sector.

The USA continues to lead the North American electric pizza oven market. The American restaurant market has a significant portion devoted to pizza restaurants. Pizza restaurant sales totaled over USD 253.8 billion in 2024 owing to diners who ate in, ordered takeaway, and requested delivery. In the USA, the sales of pizza restaurants have increased practically continuously over the historical period. As a result, the USA electric pizza oven market now maintains a share of roughly 32.6%. The expanding market shares can be attributed to:

Europe is thought to hold significant influence over the electric pizza oven market. In the United Kingdom, pizza and Italian restaurants were among the most common. Another significant element of the UK takeout market is pizza eateries. The largest global franchise Domino's Pizza - Domino's Pizza Group, is based in this country. As a result, the adoption of commercial electric pizza ovens is fairly clear in this nation. Over the course of the forecast period, the CAGR for the United Kingdom electric pizza oven market is anticipated to be 4.1%. Elements contributing to the growth of the market in the European region are:

China, nationally recognized for producing an enormous amount of electronics and smart devices, has made its fortunes in the electronics sector. During the forecast period, it is expected that the Chinese electric pizza oven market will expand at a CAGR of 5.4%. These elements contribute to the market expansion in China:

Growing Companies to Improve the Electric Pizza Oven Market Subtleties

New competitors in the electric pizza oven market are offering innovative products and obtaining a competitive edge by utilizing technical breakthroughs. These companies continuously spend money on Research and Development in order to stay on top of changing customer tastes and expectations from the end-use industry. The industry for electric pizza ovens is being helped by initiatives to improve its standing in the forum.

Leading Start-ups to Concentrate on

Arise Equipments India - Indian Start-up

Since its establishment in 2020, Arise Equipments India has built a solid name for itself as a manufacturer, wholesaler, trader, and retailer of a wide selection of bakery equipment, including ovens and waffle makers. This is why a wide range of industries/applications, including those in the food and beverage industry, quality control, research and development, and educational institutions, use its Product Line on a daily basis. Its highly trained employees exclusively use the newest equipment to make these goods with extreme precision. The business is able to provide its products to different regions of the country thanks to the development of a substantial distribution network.

MPM Food Equipment Group - United States of America

The MPM Food Equipment Group was established with the straightforward goal of offering the greatest customer service in the business together with the highest-quality food equipment and design services. Due to its modest size, MPM is able to give each of its clients, from family-run restaurants to major national grocery chains, unparalleled individual attention. Every step of the way, from the planning phases to grand openings, it works closely with each client.

This statistical analysis of the associated industry by Future Market Insights reveals the effective marketing techniques used by the major producers of electric pizza ovens. The suppliers are using both organic and inorganic expansion approaches to engage in the competitive marketplace for electric pizza ovens. To advance technology in the equipment that produces the perfect piece of pizza for consumers and increase their market share, manufacturers are substantially spending on research and development.

Pointing towards the Perfect Slice of Pizza with an Electric Pizza Oven, ft. Avantco Equipment, Garland, and Nemco Food Equipment

Garland has spent the last 140 years working closely with our clients to develop workable, long-lasting solutions that let them express their passion every day. The company put a lot of effort into gaining their trust while always innovating and adapting to stay up with our rapidly evolving sector. To address the various demands of our customers, the company has collaborated on a number of advancements, ranging from ranges and clamshell grills to whole island suites. To solve the actual problems the organization encounters, they were all built with the same fundamental objective of practical application in mind.

Ovens from Avantco are perfect for busy establishments with constrained space. With the ease and effectiveness you want, you can quickly prepare chicken, burgers, steaks, and vegetable dishes owing to the durable stainless steel construction and powerful burners. For precise heat distribution and even cooking, Avantco ovens employ a radiant heat source. Business is conducted via Avantco Equipment's Unified division. Among the several easy-to-use griddles offered by the firm are a removable oil pan and a sturdy stainless steel frame with 3" high sides and backsplashes. Among the griddles in this category are the Avantco AG36MG 36" Countertop oven with Manual Controls - 90,000 BTU and Avantco EG16N 16" Electric Countertop Griddle - 120V.

Nemco Food Equipment is well recognized for being an inventor of novel equipment solutions that speed up and reduce the cost of preparing special menu items, which would normally need a lot of manpower. Along with its portfolio of ovens, toasters, boiling units, waffle and cone bakers, industrial food-waste disposers, and other countertop solutions, Nemco continues to develop, produce, and sell further countertop solutions for hot-dog cooking, food retailing, and food holding.

The global electric pizza oven market is estimated to be valued at USD 270.8 million in 2025.

It is projected to reach USD 518.0 million by 2035.

The market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types are conveyor, deck ovens and rapid cook ovens.

automatic segment is expected to dominate with a 52.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA