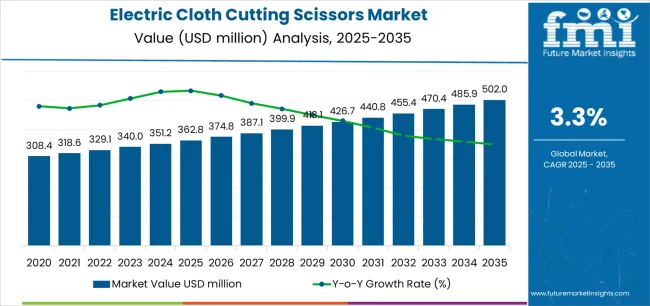

The global electric cloth cutting scissors market, valued at USD 362.8 million in 2025, is projected to reach USD 502 million by 2035, expanding at a CAGR of 3.3%. The regional adoption landscape shows diverse dynamics influenced by industrial textile capacities, consumer-level sewing activity, and the modernization of garment production facilities. The demand for electric cloth cutting scissors is shifting from traditional tailoring setups toward automated textile processing environments, reflecting a broader transformation in material handling and fabric finishing methods.

East Asia emerges as the leading region, accounting for the largest share of the electric cloth cutting scissors market due to strong textile manufacturing infrastructure in China, Japan, and South Korea. China dominates production, with widespread integration of electric scissors in both industrial textile factories and small-scale tailoring workshops. The rapid digitization of garment cutting and the rise of mid-tier sewing device manufacturers support higher penetration rates. Japan and South Korea contribute through innovations in cordless systems with lithium-ion battery packs and ergonomic blade alignment for high-speed fabric cutting. The region’s focus on operational precision, cost efficiency, and energy optimization reinforces its leadership in both production and consumption.

The latter half (2030-2035) will witness continued growth from USD 426.8 million to USD 502 million, representing an addition of USD 75.2 million or 54% of the decade's expansion. This period will be defined by mass market penetration of advanced cordless technologies, integration with comprehensive sewing management platforms, and seamless compatibility with existing textile processing infrastructure. The electric cloth cutting scissors market trajectory signals fundamental shifts in how sewing facilities approach fabric cutting and precision crafting, with participants positioned to benefit from growing demand across multiple power types and application segments.

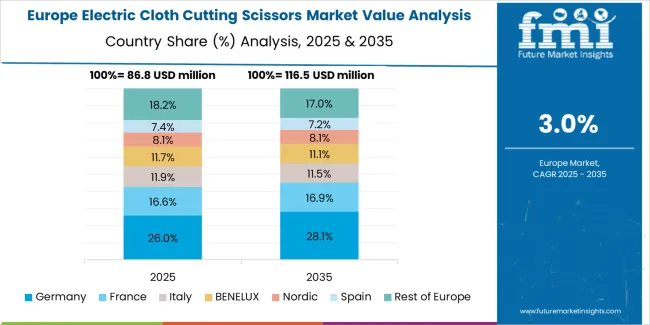

Europe shows steady market expansion supported by a mature apparel industry and the resurgence of small garment design studios emphasizing customized textile applications. Germany, Italy, and France are primary contributors, adopting electric scissors for precision pattern cutting and sample preparation. The adoption of electric cloth cutting scissors in this region is shaped by ergonomics, safety standards, and low-noise operation requirements. Manufacturers across Europe are integrating lightweight motorized systems suited for both leather and technical textiles, which strengthens their adoption in premium apparel and interior furnishing industries.

North America represents a high-value regional segment, driven by a combination of domestic crafting demand and large-scale garment manufacturing. The United States leads with rising consumer-level purchases through e-commerce platforms, while industrial users in upholstery, denim, and sportswear benefit from high-torque, long-life battery scissors designed for heavy-duty fabric cutting. The growing presence of direct-to-consumer sewing brands enhances market access for portable, rechargeable scissor models, signaling the region’s transition toward user-centric design and convenience-led manufacturing tools.

South Asia and Pacific, led by India, Vietnam, and Indonesia, displays rapid market acceleration, primarily due to expanding textile export operations and modernization of cutting and stitching lines. Local assembly of electric scissors for industrial applications is increasing, supported by low-cost manufacturing and import substitution efforts. The rising demand for electric cloth cutting scissors from garment hubs in Tiruppur, Ho Chi Minh City, and Bandung underscores the region’s move toward digital and cordless equipment adoption.

Latin America and the Middle East are emerging markets, showing potential growth through small tailoring units and localized garment repair facilities. Brazil and Turkey lead early adoption, where cordless and safety-enhanced electric scissors are used in mixed textile and leather operations.

Where revenue comes from - now vs next (industry-level view)

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New scissor sales (cordless, corded) | 58% | Consumer-led, hobby and professional purchases |

| Replacement blades & batteries | 18% | Cutting blades, battery packs for cordless units | |

| Maintenance & servicing | 12% | Blade sharpening, motor repairs | |

| Accessories & attachments | 12% | Storage cases, additional blades, charging stations | |

| Future (3-5 yrs) | Advanced cordless systems | 52-55% | Extended battery life, lightweight designs |

| Professional-grade scissors | 16-19% | High-speed cutting, industrial durability | |

| Blade subscription services | 12-15% | Regular blade replacement programs | |

| Accessories & consumables | 10-13% | Specialty blades, carrying cases, chargers | |

| Maintenance contracts | 6-9% | Professional servicing, warranty extensions | |

| Digital integration tools | 2-4% | Smart cutting guides, pattern integration apps |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 362.8 million |

| Market Forecast (2035) | USD 502 million |

| Growth Rate | 3.3% CAGR |

| Leading Technology | Cordless Electric Scissors |

| Primary Application | Household Segment |

The electric cloth cutting scissors market demonstrates strong fundamentals with cordless electric scissor systems capturing a dominant share through advanced portability capabilities and sewing operation optimization. Household applications drive primary demand, supported by increasing DIY sewing activities and crafting hobby requirements. Geographic expansion remains concentrated in developing consumer markets with expanding home crafting infrastructure, while established sewing regions show steady adoption rates driven by hobby diversification initiatives and rising convenience standards.

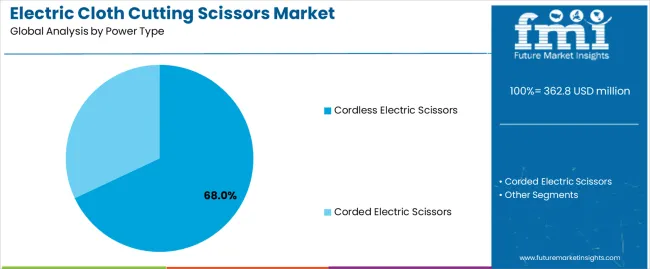

Primary Classification: The electric cloth cutting scissors market segments by power type into cordless electric scissors and corded electric scissors, representing the evolution from power-dependent cutting tools to portable precision cutting solutions for comprehensive fabric processing optimization.

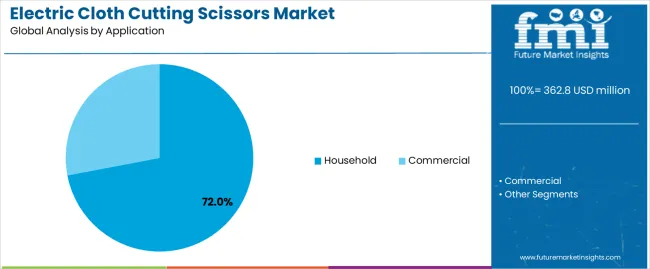

Secondary Classification: Application segmentation divides the electric cloth cutting scissors market into household and commercial sectors, reflecting distinct requirements for usage frequency, cutting capacity, and operational environment standards.

Tertiary Classification: Geographic distribution covers major consumer and textile manufacturing regions including East Asia, South Asia Pacific, Western Europe, North America, Latin America, and other emerging markets, with developing markets leading adoption while established regions show replacement-driven growth patterns.

The segmentation structure reveals technology progression from corded cutting equipment toward sophisticated cordless systems with enhanced battery life and portability capabilities, while application diversity spans from home sewing enthusiasts to professional garment manufacturing requiring precision fabric cutting solutions.

Market Position: Cordless Electric Scissors systems command the leading position in the electric cloth cutting scissors market with 68% market share through advanced portability features, including superior mobility, operational convenience, and fabric cutting optimization that enable sewing operations to achieve optimal cutting precision across diverse household and commercial environments.

Value Drivers: The segment benefits from consumer preference for portable cutting systems that provide consistent cutting performance, unrestricted movement, and operational flexibility without requiring power outlet proximity. Advanced design features enable extended battery runtime, lightweight construction, and ergonomic handling, where operational convenience and cutting precision represent critical user requirements.

Competitive Advantages: Cordless Electric Scissors systems differentiate through proven battery reliability, consistent cutting characteristics, and compatibility with various fabric types that enhance user effectiveness while maintaining optimal cutting standards suitable for diverse sewing and crafting applications.

Key market characteristics:

Corded Electric Scissors systems maintain a 32% market position in the electric cloth cutting scissors market due to their continuous power supply advantages and professional application suitability. These systems appeal to commercial operations requiring extended cutting sessions with uninterrupted power for high-volume garment manufacturing applications. Market presence is driven by industrial textile processing, emphasizing reliable power delivery and operational consistency through direct electrical connection designs.

Market Context: Household segment demonstrates the highest market share in the electric cloth cutting scissors market with 72% share due to widespread adoption of DIY sewing activities and increasing focus on home crafting hobbies, fabric alteration projects, and creative textile work that maximize creative expression while meeting diverse cutting requirements.

Appeal Factors: Home users prioritize tool convenience, cutting precision, and ease of use that enables efficient fabric processing across various sewing projects. The segment benefits from substantial home crafting trend growth and hobby diversification programs that emphasize the acquisition of electric cutting tools for creative projects and garment alteration applications.

Growth Drivers: DIY culture expansion incorporates electric scissors as essential tools for sewing operations, while online crafting community growth increases demand for professional-quality cutting capabilities that support creative expression and minimize manual cutting fatigue.

Market Challenges: Varying skill levels and occasional usage patterns may limit investment in premium cutting tools across different household user scenarios.

Application dynamics include:

Commercial applications capture 28% market share through specialized cutting requirements in garment manufacturing, tailoring shops, and textile production facilities. These operations demand high-durability cutting systems capable of extended operation while providing consistent cutting performance and operational reliability throughout intensive work cycles.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | DIY culture & home crafting boom (social media influence, hobby diversification) | ★★★★★ | Growing home sewing activities increase demand for convenient cutting tools; online tutorials driving adoption of electric scissors. |

| Driver | Ergonomic health awareness & repetitive strain prevention | ★★★★★ | Manual cutting causes hand fatigue and injuries; electric scissors reduce physical strain; health-conscious consumers prioritize ergonomic tools. |

| Driver | E-commerce growth & online hobby supply accessibility | ★★★★☆ | Digital shopping platforms expand product availability; consumer reviews and demonstrations increase awareness and purchasing confidence. |

| Restraint | Price sensitivity & manual scissor alternatives (budget constraints for hobbyists) | ★★★★☆ | Casual sewers hesitate at premium pricing; manual scissors remain cost-effective alternatives slowing electric adoption among price-conscious users. |

| Restraint | Battery degradation & replacement costs (cordless models) | ★★★☆☆ | Battery longevity concerns and replacement expenses create ongoing ownership costs; impacts perceived value and long-term satisfaction. |

| Trend | Lightweight design & extended battery life innovation | ★★★★★ | Reduced weight and longer runtime enhance user experience; lithium battery advancements transform cordless scissor performance and appeal. |

| Trend | Professional-grade features for home users | ★★★★☆ | Serious hobbyists demand commercial-quality tools; premium home market growing with features like multiple speed settings and specialized blades. |

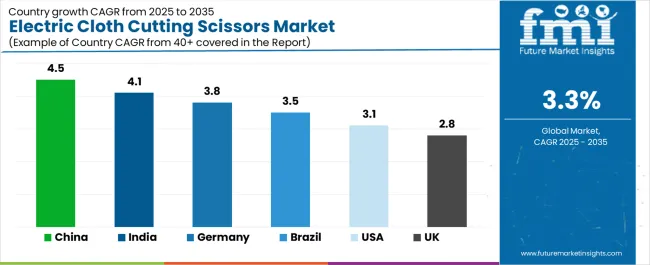

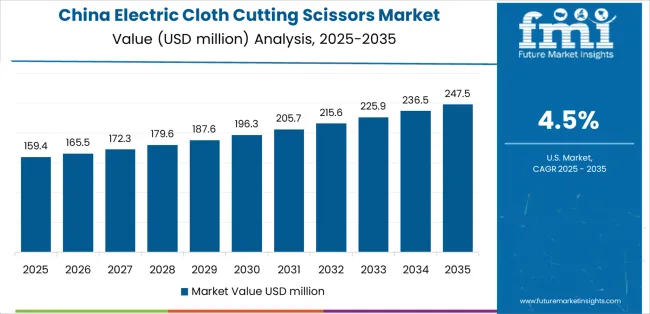

The electric cloth cutting scissors market demonstrates varied regional dynamics with Growth Leaders including China (4.5% growth rate) and India (4.1% growth rate) driving expansion through textile manufacturing growth and home crafting adoption. Steady Performers encompass Germany (3.8% growth rate), Brazil (3.5% growth rate), and developed consumer markets, benefiting from established sewing cultures and hobby market maturity. Emerging Markets feature developing regions where growing middle-class populations and crafting interest support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through textile manufacturing presence and consumer electronics familiarity, while South Asian countries maintain strong growth supported by garment industry expansion and DIY culture emergence. Western European markets show moderate growth driven by established sewing traditions and hobby market sustainability.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 4.5% | Lead with value-for-money, durable designs | Intense local competition; brand differentiation |

| India | 4.1% | Focus on affordable, multi-fabric capability | Price sensitivity; distribution challenges |

| Germany | 3.8% | Offer premium quality, precision engineering | High expectations; warranty requirements |

| Brazil | 3.5% | Value-oriented models with local support | Import duties; economic volatility |

| United States | 3.1% | Provide brand reputation, online presence | Market saturation; hobbyist demographics |

| United Kingdom | 2.8% | Push ergonomic features, safety certifications | Mature market; replacement cycles |

China establishes fastest market growth through robust textile manufacturing industry and expanding consumer crafting activities, integrating electric cloth cutting scissors as essential tools in garment production and home sewing operations. The country's 4.5% growth rate reflects growing middle-class population and increasing DIY culture adoption that support the use of convenient cutting tools in household and commercial facilities. Growth concentrates in major textile manufacturing centers, including Guangdong, Zhejiang, and Jiangsu, where garment production showcases integrated cutting technology that appeals to manufacturers seeking operational efficiency and home consumers pursuing crafting hobbies.

Chinese manufacturers are developing cost-effective cutting scissor solutions that combine domestic production advantages with functional operational features, including reliable motor systems and ergonomic designs. Distribution channels through e-commerce platforms and retail networks expand market access, while competitive pricing supports adoption across diverse consumer and commercial segments.

Strategic Market Indicators:

In Mumbai, Delhi, and Bangalore, household consumers and small garment operations are implementing electric cloth cutting scissors as practical tools for sewing and tailoring applications, driven by increasing urbanization and growing middle-class craft interest that emphasize the importance of convenient cutting solutions. The electric cloth cutting scissors market holds a 4.1% growth rate, supported by expanding garment manufacturing sector and rising home crafting activities that promote efficient cutting tools for household and small business operations. Indian consumers are adopting electric scissors that provide affordable cutting performance and multi-fabric compatibility features, particularly appealing in regions where traditional tailoring and home sewing represent significant cultural activities.

Market expansion benefits from growing online retail presence and social media crafting community influence that enable consumer-level adoption of modern cutting tools for sewing applications. Technology adoption follows patterns established in consumer electronics, where value-for-money and reliability drive procurement decisions and household deployment.

Market Intelligence Brief:

Germany establishes technology leadership through comprehensive crafting culture and advanced consumer product standards, integrating electric cloth cutting scissors across household sewing and professional tailoring applications. The country's 3.8% growth rate reflects established sewing tradition and mature hobby market adoption that supports widespread use of precision cutting tools in household and commercial facilities. Growth concentrates in urban centers where crafting communities showcase premium tool adoption that appeals to consumers seeking quality engineering and reliable performance applications.

German equipment providers leverage established retail networks and comprehensive product quality standards, including safety certifications and ergonomic design, that create customer trust and purchasing confidence. The electric cloth cutting scissors market benefits from mature consumer protection regulations and quality expectations that mandate reliable tool performance while supporting innovation, advancement, and user safety optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse textile manufacturing presence, including garment production in São Paulo and Santa Catarina, home sewing growth, and expanding middle-class consumer activities that increasingly incorporate electric cutting tools for sewing applications. The country maintains a 3.5% growth rate, driven by rising crafting interest and increasing recognition of electric scissor benefits, including reduced hand fatigue and improved cutting precision.

Market dynamics focus on affordable cutting solutions that balance functional performance with price considerations important to Brazilian consumers. Growing DIY culture and online crafting community influence create continued demand for convenient cutting tools in household sewing and small tailoring operations.

Strategic Market Considerations:

United States establishes established market position through comprehensive hobby crafting culture and advanced retail infrastructure development, integrating electric cloth cutting scissors across household sewing and quilting applications. The country's 3.1% growth rate reflects mature hobby market relationships and established cutting tool adoption that supports widespread use of convenient scissor systems in home crafting facilities. Growth concentrates in suburban regions where sewing and quilting communities showcase established electric scissor deployment that appeals to hobbyists seeking reliable cutting capabilities and ergonomic benefits.

American retailers leverage established distribution networks and comprehensive product selection, including specialty crafting stores and online platforms that create customer access and purchasing convenience. The electric cloth cutting scissors market benefits from mature consumer product standards and hobby infrastructure that support electric scissor use while encouraging innovation, advancement, and feature enhancement.

Market Intelligence Brief:

United Kingdom's consumer market demonstrates steady electric cloth cutting scissor deployment with documented user satisfaction in home sewing applications and small tailoring operations through integration with existing crafting activities and hobby infrastructure. The country leverages traditional sewing culture and modern crafting trends to maintain a 2.8% growth rate. Urban and suburban regions showcase installations where electric scissors integrate with comprehensive hobby supplies and crafting communities to optimize cutting efficiency and user comfort.

British consumers prioritize product safety and ergonomic design in electric scissor selection, creating demand for tools with certified features, including blade guards and comfortable grips. The electric cloth cutting scissors market benefits from established retail infrastructure and consumer protection standards that encourage adoption of reliable cutting tools, providing long-term usability and compliance with safety regulations.

Market Intelligence Brief:

The electric cloth cutting scissors market in Europe is projected to grow from USD 92.4 million in 2025 to USD 126.8 million by 2035, registering a CAGR of 3.2% over the forecast period. Germany is expected to maintain its leadership position with a 36.5% market share in 2025, declining slightly to 35.8% by 2035, supported by its strong crafting culture and established hobby market infrastructure.

United Kingdom follows with a 24.2% share in 2025, projected to reach 24.6% by 2035, driven by traditional sewing heritage and active quilting communities. France holds a 18.7% share in 2025, expected to maintain 18.9% by 2035 through fashion industry influence and home sewing activities. Italy commands a 11.3% share, while Spain accounts for 6.8% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 2.5% to 3.2% by 2035, attributed to increasing hobby adoption in Nordic countries and emerging Eastern European crafting communities implementing modern sewing practices.

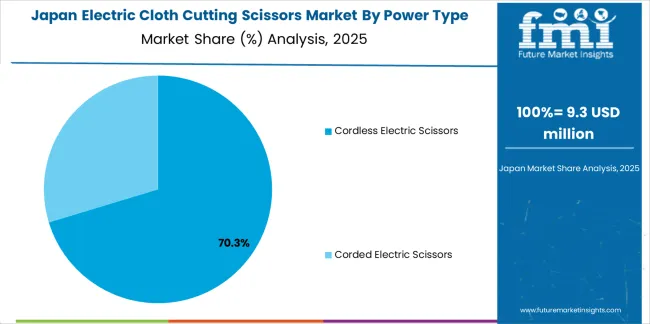

Japan's electric cloth cutting scissors market reflects the country's emphasis on precision manufacturing and quality craftsmanship, maintaining a 2.5% growth rate through 2035. The electric cloth cutting scissors market benefits from established textile heritage and growing interest in traditional and modern sewing techniques among urban consumers. Japanese consumers in Tokyo, Osaka, and other metropolitan areas are adopting high-quality electric scissors with advanced blade technology and ergonomic features. The emphasis on product durability and cutting precision drives preference for premium tools that deliver consistent performance. Market development is supported by specialty crafting retail networks and strong brand loyalty patterns, enabling adoption of innovative cutting technologies in kimono making, fashion design education, and contemporary home sewing activities that value quality construction and reliable operation.

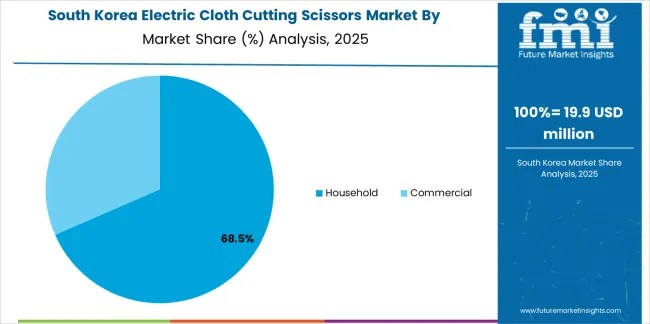

South Korea's electric cloth cutting scissors market maintains steady growth with a projected rate of 2.3% through 2035, driven by expanding hobby culture and increasing interest in DIY fashion and upcycling activities among young urban consumers. The country's crafting community in Seoul, Busan, and other cities is adopting electric scissors as lifestyle tools that support creative expression and sustainable fashion practices. Market development is characterized by strong social media influence and online community engagement that drives awareness and adoption of convenient cutting tools. Growing focus on hobby development and stress-relief activities increases demand for accessible sewing tools that reduce physical effort. The electric cloth cutting scissors market benefits from robust e-commerce infrastructure and trendsetting consumer culture, while international brands collaborate with local distributors to deliver solutions tailored to Korean consumer preferences for compact designs and aesthetic appeal that align with modern apartment living and crafting spaces.

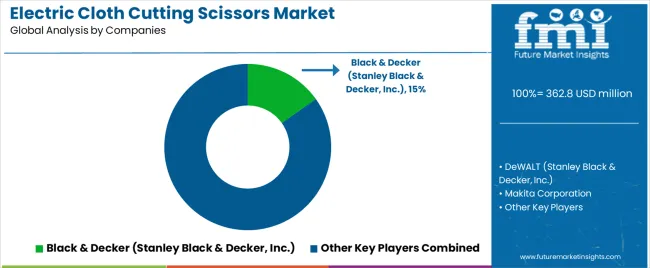

The electric cloth cutting scissors market exhibits a moderately fragmented competitive structure with 20-25 credible players, where the top 4-5 companies hold approximately 38-45% of global revenue. Market leadership is maintained through brand reputation, retail distribution networks, and continuous innovation in battery technology, blade sharpness retention, and ergonomic design. The competitive landscape is evolving from basic electric cutting tools toward comprehensive sewing solutions that incorporate extended battery life, lightweight construction, and user-friendly safety features.

Leadership positioning is driven by brand recognition in power tools or sewing equipment, retail shelf presence, and the ability to provide reliable cutting performance across various fabric types. Established players leverage consumer trust built through adjacent product categories and proven quality standards to maintain market share, while emerging competitors differentiate through specialized features such as ultra-lightweight designs, professional-grade cutting power, or aesthetic appeal targeting specific consumer segments.

Commoditization trends affect basic corded electric scissors and standard blade designs, pushing manufacturers to differentiate through value-added features including rechargeable battery systems, quick-charge capabilities, blade longevity, and ergonomic grip innovations. Margin opportunities concentrate in premium cordless models, specialized blade sets for different fabric types, subscription blade replacement services, and professional-grade scissors for commercial applications that command higher pricing through enhanced durability and cutting capacity.

The electric cloth cutting scissors market structure creates distinct competitive advantages for different stakeholder types. Established power tool brands maintain leadership through brand trust, cross-category consumer loyalty, and extensive retail distribution networks serving both DIY and professional markets. Sewing equipment specialists compete through category expertise, dedicated crafting community engagement, and product designs specifically optimized for fabric cutting applications. Value-oriented manufacturers focus on affordable pricing and functional performance for price-sensitive consumers entering the electric scissor market. E-commerce native brands differentiate through direct-to-consumer sales models, influencer partnerships, and niche positioning such as eco-friendly materials or fashion-forward aesthetics. Professional tool manufacturers address commercial garment operations with industrial-grade durability and extended warranty programs tailored to high-volume usage requirements.

The competitive dynamics favor companies that can balance product reliability with competitive pricing while maintaining a strong distribution presence across both traditional retail and online channels.

| Item | Value |

|---|---|

| Quantitative Units | USD 362.8 million |

| Power Type | Cordless Electric Scissors, Corded Electric Scissors |

| Application | Household, Commercial |

| Regions Covered | East Asia, South Asia Pacific, Western Europe, North America, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, United States, Brazil, United Kingdom, Japan, South Korea, France, Italy, Spain, Australia, Canada, and 20+ additional countries |

| Key Companies Profiled | Black+Decker, DeWALT, Makita, Positec (Worx), Bosch, Ryobi Limited, Hi-Spec Tools, Dremel, Pink Power Tools, Milwaukee Tool |

| Additional Attributes | Dollar sales by power type and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with power tool manufacturers and sewing equipment suppliers, consumer preferences for portability and cutting precision, integration with home crafting activities and commercial garment operations, innovations in battery technology and blade durability enhancement, and development of ergonomic cutting solutions with enhanced user comfort and fabric processing optimization capabilities. |

The global electric cloth cutting scissors market is estimated to be valued at USD 362.8 million in 2025.

The market size for the electric cloth cutting scissors market is projected to reach USD 502.0 million by 2035.

The electric cloth cutting scissors market is expected to grow at a 3.3% CAGR between 2025 and 2035.

The key product types in electric cloth cutting scissors market are cordless electric scissors and corded electric scissors.

In terms of application, household segment to command 72.0% share in the electric cloth cutting scissors market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA