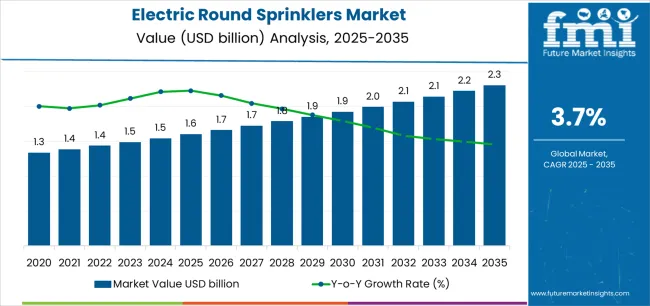

The global electric round sprinklers market, valued at USD 1.6 billion in 2025, is projected to reach USD 2.3 billion by 2035, registering an absolute increase of USD 700 million and expanding at a CAGR of 3.6% during the forecast period. The overall market size is expected to grow by approximately 1.4X, driven by rising investments in automated irrigation systems, improved farm productivity requirements, and the adoption of electric round sprinklers for precision water management. The regional modernization and irrigation penetration index reflects how modernization efforts, water resource efficiency programs, and agricultural mechanization levels shape adoption patterns across key geographic regions. The demand for electric round sprinklers continues to strengthen as both developed and developing regions shift toward data-based irrigation control and automated water delivery mechanisms.

East Asia dominates the electric round sprinklers market, led by China, Japan, and South Korea, where advanced irrigation infrastructure and government incentives for water-efficient technologies have accelerated system installations. China’s agricultural modernization programs have prioritized electric sprinkler adoption in high-value crop zones, particularly in fruit orchards, tea estates, and greenhouse cultivation. Japan demonstrates high penetration due to precision irrigation practices in protected agriculture and horticulture farms, supported by localized manufacturing of automated sprinklers. South Korea shows steady adoption growth with strong integration of remote-controlled irrigation systems across smart farms and rice-growing belts. The region’s progress is largely linked to policy-driven precision farming and the rapid electrification of water management systems.

The latter half (2030-2035) will witness continued growth from USD 1.9 billion to USD 2.3 billion, representing an addition of USD 381.1 million or 55% of the decade's expansion. This period will be defined by mass market penetration of intelligent irrigation technologies, integration with comprehensive farm management platforms, and seamless compatibility with existing agricultural infrastructure. The electric round sprinklers market trajectory signals fundamental shifts in how agricultural facilities approach water management and crop irrigation, with participants positioned to benefit from growing demand across multiple installation types and application segments.

North America shows significant penetration levels supported by advanced agricultural technology adoption and large-scale mechanized farming systems. The United States leads in the demand for electric round sprinklers, particularly across fruit, vegetable, and turf cultivation sectors. Increased awareness of energy-efficient irrigation methods and integration with soil moisture monitoring technologies enhance their operational relevance. Canada supports moderate yet growing adoption, emphasizing smart irrigation controllers and water conservation strategies suited to varying climatic conditions.

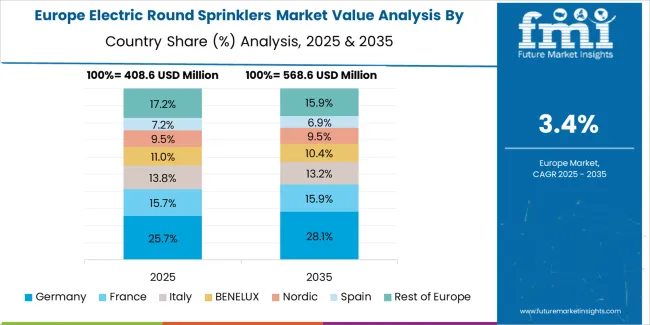

Europe reflects stable adoption patterns, driven by modernization of existing irrigation systems in Spain, Italy, and France. The European Union’s water use efficiency policies and emphasis on sustainable crop yield optimization have increased the adoption of electric sprinklers among small and medium farm owners. The integration of battery-powered, corrosion-resistant sprinklers with weather-based scheduling systems is gaining traction across vineyards and olive plantations.

South Asia and the Pacific exhibit accelerated adoption, particularly in India, Thailand, and Vietnam, where government-led irrigation development programs and subsidies for energy-efficient systems support strong growth. The demand for electric round sprinklers in this region is tied to the modernization of drip and surface irrigation networks, improving crop yield under variable climatic conditions.

The Middle East and Africa are emerging regions, characterized by high potential due to chronic water scarcity and rising investments in controlled irrigation infrastructure. Countries such as the UAE, Saudi Arabia, and South Africa are adopting mobile electric sprinklers for horticulture and date palm cultivation, supported by renewable power integration and sensor-based irrigation control. Collectively, the regional modernization and irrigation penetration index underscores that East Asia and North America will remain the leading markets for electric round sprinkler adoption, while South Asia and the Middle East will register the highest incremental growth due to expanding agricultural mechanization and rising emphasis on precision water management through 2035.

| Period | Primary Revenue Buckets | Share | Notes |

|---|---|---|---|

| Today | New equipment sales (mobile, fixed) | 48% | Capex-led, water efficiency-driven purchases |

| Spare parts & components | 22% | Nozzles, motors, control panels for operations | |

| Installation & commissioning | 18% | System setup, field configuration | |

| Service & maintenance contracts | 12% | Preventive maintenance, system optimization | |

| Future (3-5 yrs) | Smart mobile systems | 42-46% | IoT integration, precision agriculture |

| Digital monitoring & analytics | 16-20% | Real-time water management, predictive maintenance | |

| Service-as-a-subscription | 14-18% | Performance guarantees, outcome-based pricing | |

| Components & parts | 10-14% | Advanced nozzles, sensors, control systems | |

| Installation & training services | 8-12% | Technical support, operator training | |

| Data services (water usage, crop health, efficiency metrics) | 4-7% | Benchmarking for agricultural operators |

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast (2035) | USD 2.3 billion |

| Growth Rate | 3.7% CAGR |

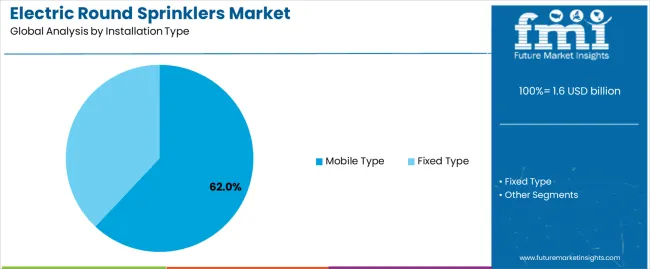

| Leading Technology | Mobile Type Electric Round Sprinklers |

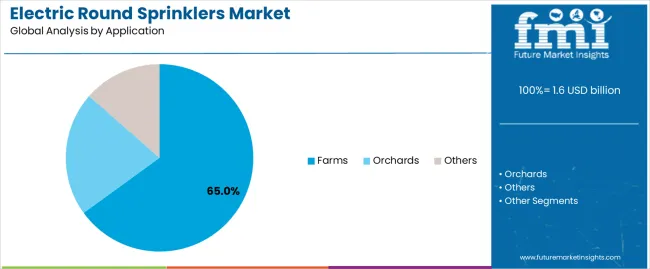

| Primary Application | Farms Segment |

The electric round sprinklers market demonstrates strong fundamentals with mobile electric round sprinkler systems capturing a dominant share through advanced irrigation capabilities and agricultural water management optimization. Farm applications drive primary demand, supported by increasing crop production and water efficiency requirements. Geographic expansion remains concentrated in developing agricultural markets with expanding irrigation infrastructure, while established farming regions show steady adoption rates driven by irrigation modernization initiatives and rising sustainability standards.

Primary Classification: The electric round sprinklers market segments by installation type into mobile type and fixed type electric round sprinklers, representing the evolution from stationary irrigation equipment to flexible water management solutions for comprehensive agricultural irrigation optimization.

Secondary Classification: Application segmentation divides the electric round sprinklers market into farms, orchards, and other sectors, reflecting distinct requirements for crop types, water management efficiency, and irrigation coverage standards.

Tertiary Classification: Geographic distribution covers major agricultural regions, including East Asia, South Asia Pacific, Western Europe, North America, Latin America, and other emerging agricultural markets, with developing markets leading adoption while established regions show modernization-driven growth patterns.

The segmentation structure reveals technology progression from basic irrigation equipment toward sophisticated water management systems with enhanced precision and automation capabilities, while application diversity spans from large-scale farming operations to specialized orchard irrigation requiring precise water delivery solutions.

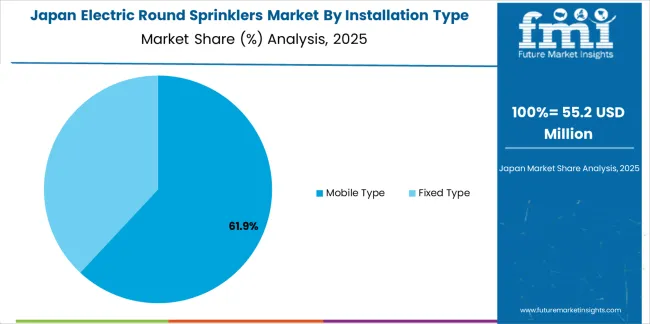

Market Position: Mobile type electric round sprinklers systems command the leading position in the electric round sprinklers market with 62% market share through advanced flexibility features, including superior field coverage, operational versatility, and agricultural irrigation optimization that enable farming operations to achieve optimal water distribution across diverse agricultural and horticultural environments.

Value Drivers: The segment benefits from agricultural facility preference for adaptable irrigation systems that provide consistent water delivery performance, reduced setup time, and operational efficiency optimization without requiring permanent infrastructure installations. Advanced design features enable automated irrigation control systems, water pressure consistency, and integration with existing agricultural equipment, where operational performance and water efficiency represent critical facility requirements.

Competitive Advantages: Mobile Type Electric Round Sprinklers systems differentiate through proven operational reliability, flexible positioning characteristics, and integration with automated farm management systems that enhance facility effectiveness while maintaining optimal irrigation standards suitable for diverse agricultural and horticultural applications.

Key market characteristics:

Fixed Type Electric Round Sprinklers systems maintain a 38% market position in the electric round sprinklers market due to their permanent installation advantages and operational stability. These systems appeal to facilities requiring consistent irrigation coverage with established infrastructure for specialized agricultural applications. Market growth is driven by orchard expansion, emphasizing reliable irrigation solutions and water efficiency through optimized system designs for permanent crop installations.

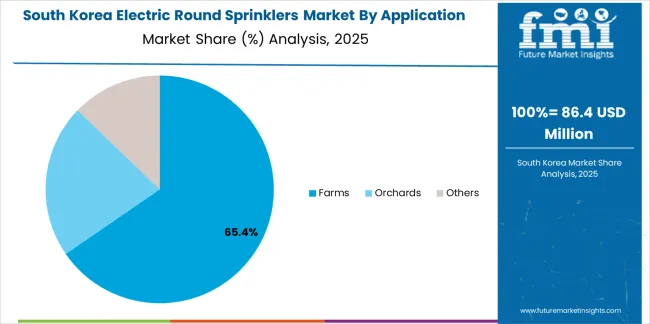

Market Context: Farms segment demonstrates the highest market share in the electric round sprinklers market with 65% share due to widespread adoption of large-scale irrigation systems and increasing focus on agricultural productivity optimization, operational water efficiency, and crop yield maximization applications that ensure consistent water delivery while maintaining sustainability standards.

Appeal Factors: Farm operators prioritize system coverage, irrigation efficiency, and integration with existing agricultural infrastructure that enables coordinated water management across extensive cultivation areas. The segment benefits from substantial agricultural investment and modernization programs that emphasize the acquisition of electric round sprinkler systems for crop production optimization and water resource management applications.

Growth Drivers: Agricultural expansion programs incorporate electric round sprinklers as standard equipment for irrigation operations, while precision farming growth increases demand for intelligent irrigation capabilities that comply with environmental standards and minimize water wastage.

Market Challenges: Varying field conditions and terrain complexity may limit system standardization across different farming operations or crop scenarios.

Application dynamics include:

Orchards applications capture 28% market share through specialized irrigation requirements in permanent crop cultivation, fruit production, and tree farming applications. These facilities demand precise water delivery systems capable of operating with diverse tree spacing while providing effective irrigation coverage and operational reliability capabilities throughout growing seasons.

Others applications account for 7% market share, including specialized agricultural operations, landscaping projects, and research facilities requiring customized irrigation capabilities for specific water management and cultivation requirements.

| Category | Factor | Impact | Why It Matters |

|---|---|---|---|

| Driver | Water scarcity & conservation initiatives (drought conditions, regulatory pressures) | ★★★★★ | Efficient irrigation systems essential for water resource management; governments mandating water-efficient technologies driving adoption. |

| Driver | Precision agriculture & smart farming adoption (IoT, sensors, automation) | ★★★★★ | Transforms irrigation from scheduled to data-driven; vendors offering digital integration gain competitive advantage. |

| Driver | Agricultural productivity demands & crop yield optimization | ★★★★☆ | Farmers need consistent water delivery for maximum yields; demand for reliable irrigation solutions expanding addressable market. |

| Restraint | High initial investment & installation costs (especially for small farms) | ★★★★☆ | Small agricultural operators defer purchases; increases price sensitivity and slows automated equipment adoption in developing regions. |

| Restraint | Energy costs & power availability challenges | ★★★☆☆ | Rural areas face electricity reliability issues; off-grid locations limiting operational flexibility and increasing infrastructure requirements. |

| Trend | Solar-powered integration & renewable energy adoption | ★★★★★ | Reduces operational costs and energy dependency; sustainability focus transforms product development toward renewable solutions. |

| Trend | Variable rate irrigation & precision water management | ★★★★☆ | Site-specific water application for optimized resource use; intelligent systems and sensor integration drive competition toward customization. |

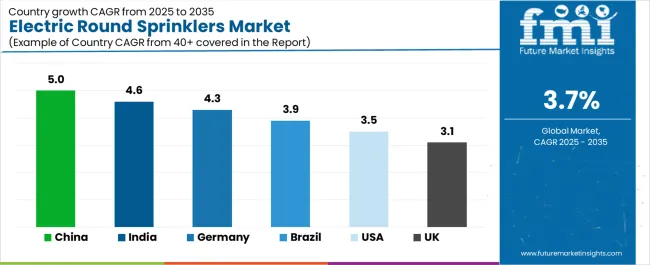

The electric round sprinklers market demonstrates varied regional dynamics with Growth Leaders including China (5.0% growth rate) and India (4.6% growth rate) driving expansion through agricultural modernization initiatives and irrigation infrastructure development. Steady Performers encompass Germany (4.3% growth rate), Brazil (3.9% growth rate), and developed agricultural regions, benefiting from established farming industries and precision agriculture adoption. Emerging Markets feature developing regions where agricultural expansion and irrigation modernization support consistent growth patterns.

Regional synthesis reveals East Asian markets leading adoption through agricultural expansion and irrigation infrastructure development, while South Asian countries maintain strong growth supported by government agricultural initiatives and water management requirements. Western European markets show moderate growth driven by sustainable agriculture applications and precision irrigation integration trends.

| Region/Country | 2025-2035 Growth | How to win | What to watch out |

|---|---|---|---|

| China | 5.0% | Lead with smart irrigation systems | Localization requirements; domestic competition |

| India | 4.6% | Focus on cost-effective, durable solutions | Infrastructure challenges; fragmented market |

| Germany | 4.3% | Offer precision agriculture integration | Environmental regulations; subsidy dependencies |

| Brazil | 3.9% | Value-oriented models with local support | Currency fluctuations; financing availability |

| United States | 3.5% | Provide data analytics capabilities | Labor shortages; maintenance requirements |

| United Kingdom | 3.1% | Push sustainability features | Brexit impacts; policy uncertainties |

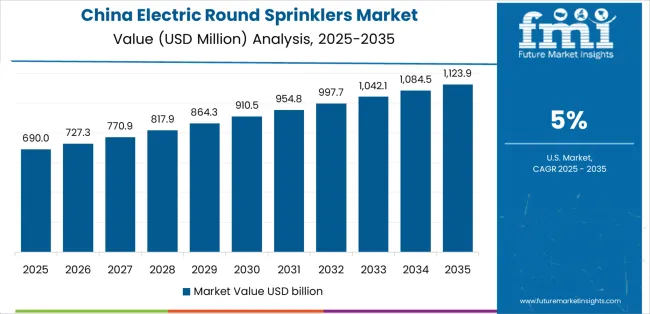

China establishes fastest market growth through aggressive agricultural modernization programs and comprehensive irrigation infrastructure development, integrating advanced electric round sprinklers as standard components in crop production and water management installations. The country's 5.0% growth rate reflects government initiatives promoting precision agriculture and water conservation capabilities that mandate the use of efficient irrigation systems in farming and horticultural facilities. Growth concentrates in major agricultural provinces, including Heilongjiang, Shandong, and Henan, where agricultural technology development showcases integrated irrigation systems that appeal to farm operators seeking advanced water management capabilities and crop optimization applications.

Chinese manufacturers are developing cost-effective irrigation solutions that combine domestic production advantages with advanced operational features, including automated control systems and weather integration capabilities. Distribution channels through agricultural equipment suppliers and farming cooperatives expand market access, while government subsidies for water-efficient irrigation support adoption across diverse agricultural and horticultural segments.

Strategic Market Indicators:

In Punjab, Maharashtra, and Uttar Pradesh, agricultural facilities and farming operations are implementing advanced electric round sprinklers as standard equipment for crop irrigation and water management applications, driven by increasing government agricultural investment and irrigation infrastructure programs that emphasize the importance of water efficiency capabilities. The electric round sprinklers market holds a 4.6% growth rate, supported by government agricultural initiatives and rural development programs that promote efficient irrigation systems for farming and horticultural facilities. Indian operators are adopting irrigation systems that provide consistent water delivery performance and resource conservation features, particularly appealing in regions where water scarcity and agricultural productivity represent critical operational requirements.

Market expansion benefits from growing agricultural mechanization and government subsidy programs that enable farm-level adoption of modern irrigation systems for crop production applications. Technology adoption follows patterns established in agricultural equipment, where reliability and cost-effectiveness drive procurement decisions and operational deployment.

Market Intelligence Brief:

Germany establishes technology leadership through comprehensive precision agriculture programs and advanced farming infrastructure development, integrating electric round sprinklers across agricultural and horticultural applications. The country's 4.3% growth rate reflects established agricultural industry relationships and mature irrigation technology adoption that supports widespread use of precision irrigation systems in farming and specialty crop facilities. Growth concentrates in major agricultural regions, including Lower Saxony, Bavaria, and North Rhine-Westphalia, where agricultural technology showcases mature irrigation deployment that appeals to farm operators seeking proven water management capabilities and environmental compliance applications.

German equipment providers leverage established distribution networks and comprehensive service capabilities, including technical training programs and maintenance support that create customer relationships and operational advantages. The electric round sprinklers market benefits from mature environmental standards and agricultural requirements that mandate efficient irrigation system use while supporting technology advancement and sustainability optimization.

Market Intelligence Brief:

Brazil's market expansion benefits from diverse agricultural demand, including farming modernization in Mato Grosso and São Paulo, agricultural facility development, and government rural programs that increasingly incorporate irrigation solutions for crop production applications. The country maintains a 3.9% growth rate, driven by rising agricultural activity and increasing recognition of efficient irrigation benefits, including enhanced crop yields and improved water management.

Market dynamics focus on durable irrigation solutions that balance operational performance with affordability considerations important to Brazilian agricultural operators. Growing agricultural industrialization creates continued demand for modern irrigation systems in new farming infrastructure and agricultural expansion projects.

Strategic Market Considerations:

The United States establishes an established market position through comprehensive agricultural programs and advanced farming infrastructure development, integrating electric round sprinklers across diverse agricultural applications. The country's 3.5% growth rate reflects mature agricultural industry relationships and established irrigation technology adoption that supports widespread use of efficient irrigation systems in farming and specialty crop facilities. Growth concentrates in major agricultural states, including California, Nebraska, and Kansas, where agricultural technology showcases established irrigation deployment that appeals to farm operators seeking proven water management capabilities and operational efficiency applications.

American equipment providers leverage established distribution networks and comprehensive service capabilities, including precision agriculture integration and data analytics that create customer relationships and operational advantages. The electric round sprinklers market benefits from mature water management regulations and agricultural requirements that mandate efficient irrigation system use while supporting technology advancement and sustainability optimization.

Market Intelligence Brief:

United Kingdom's agricultural market demonstrates steady electric round sprinkler deployment with documented operational effectiveness in farming applications and horticultural facilities through integration with existing water management systems and agricultural infrastructure. The country leverages precision agriculture expertise and environmental stewardship to maintain a 3.1% growth rate. Agricultural regions, including East Anglia, Yorkshire, and Scotland, showcase installations where irrigation systems integrate with comprehensive farm management platforms and environmental monitoring systems to optimize water use and crop effectiveness.

British farmers prioritize water efficiency and environmental compliance in irrigation equipment selection, creating demand for systems with advanced features, including weather monitoring integration and automated control capabilities. The electric round sprinklers market benefits from established agricultural support infrastructure and environmental regulations that encourage adoption of water-efficient technologies providing long-term operational benefits and compliance with sustainability standards.

Market Intelligence Brief:

The electric round sprinklers market in Europe is projected to grow from USD 380.5 million in 2025 to USD 542.8 million by 2035, registering a CAGR of 3.6% over the forecast period. Germany is expected to maintain its leadership position with a 32.4% market share in 2025, declining slightly to 31.8% by 2035, supported by its advanced agricultural infrastructure and major farming regions, including Lower Saxony and Bavaria.

France follows with a 21.6% share in 2025, projected to reach 22.1% by 2035, driven by comprehensive agricultural modernization programs and extensive crop cultivation areas. The United Kingdom holds a 16.2% share in 2025, expected to maintain 16.0% by 2035 through steady precision agriculture adoption. Italy commands a 13.8% share, while Spain accounts for 11.4% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 4.6% to 5.3% by 2035, attributed to increasing irrigation adoption in Nordic countries and emerging Eastern European agricultural operations implementing modernization programs.

Japan's electric round sprinklers market reflects the country's focus on precision agriculture and efficient resource utilization, maintaining a 2.8% growth rate through 2035. The electric round sprinklers market benefits from government initiatives promoting smart farming technologies and water conservation in agricultural production. Japanese agricultural facilities in Hokkaido, Niigata, and other major farming regions are implementing advanced irrigation systems with sophisticated control mechanisms and sensor integration capabilities. The emphasis on high-value crop production and limited arable land drives demand for precision irrigation solutions that maximize yield per unit area. Market development is supported by strong agricultural cooperative networks and technology partnerships between equipment manufacturers and research institutions, enabling rapid adoption of innovative irrigation technologies in rice cultivation, vegetable production, and specialty crop farming operations.

South Korea's electric round sprinklers market maintains steady growth with a projected rate of 2.5% through 2035, driven by government agricultural modernization programs and the need for efficient water management in intensive farming systems. The country's agricultural sector in regions like Jeolla and Gyeongsang provinces is adopting advanced irrigation technologies to address labor shortages and enhance productivity. Market development is characterized by integration with smart farm platforms and IoT-enabled agricultural systems, aligning with the government's fourth industrial revolution initiatives for agriculture. Growing focus on high-value horticultural crops and protected cultivation drives demand for precise irrigation control systems. The electric round sprinklers market benefits from strong government support through subsidies and technology development programs, while domestic manufacturers collaborate with international technology providers to deliver solutions tailored to Korean agricultural conditions and farming practices.

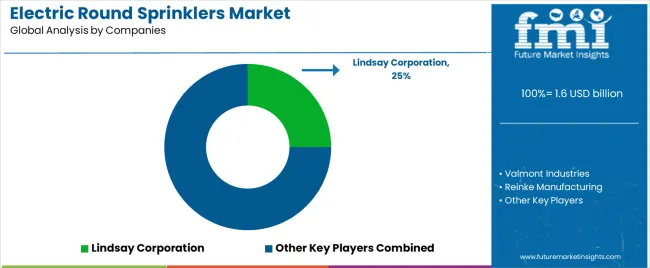

The electric round sprinklers market exhibits a moderately consolidated competitive structure with 12-15 credible players, where the top 4-5 companies hold approximately 55-62% of global revenue. Market leadership is maintained through extensive dealer networks, technical support infrastructure, and continuous innovation in irrigation efficiency, automation capabilities, and digital integration. The competitive landscape is evolving from traditional equipment sales toward comprehensive irrigation management solutions that incorporate data analytics, weather integration, and precision agriculture capabilities.

Leadership positioning is driven by service network density, technical expertise in agricultural applications, and the ability to provide end-to-end irrigation solutions including equipment, installation, training, and ongoing support. Established players leverage decades of field experience and proven reliability to maintain customer loyalty, while emerging competitors differentiate through innovative technologies such as IoT connectivity, solar power integration, and intelligent water management systems.

Commoditization trends affect basic irrigation coverage and standard flow control mechanisms, pushing manufacturers to differentiate through value-added services including precision agriculture integration, remote monitoring platforms, and outcome-based performance guarantees. Margin opportunities concentrate in service contracts, digital subscription services, precision nozzle technologies, and comprehensive farm management integration that connects irrigation systems with crop monitoring, weather forecasting, and agricultural ERP platforms.

The electric round sprinklers market structure creates distinct competitive advantages for different stakeholder types. Global agricultural equipment platforms maintain leadership through worldwide distribution reach, comprehensive product portfolios, and established brand recognition with large-scale farming operations. Technology innovators focus on smart irrigation systems with advanced sensors, weather-responsive controls, and data analytics capabilities that appeal to progressive farmers adopting precision agriculture. Regional specialists compete through localized technical support, understanding of specific crop requirements, and competitive pricing for small and medium agricultural operations. Service-focused ecosystems differentiate through installation excellence, rapid maintenance response, and agricultural advisory services. Niche specialists address specialized applications including organic farming, specialty crops, and research institutions requiring customizable irrigation solutions with precise control capabilities.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.6 billion |

| Installation Type | Mobile Type, Fixed Type |

| Application | Farms, Orchards, Others |

| Regions Covered | East Asia, South Asia Pacific, Western Europe, North America, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, United States, Brazil, United Kingdom, Japan, South Korea, France, Australia, Canada, Mexico, and 20+ additional countries |

| Key Companies Profiled | Lindsay Corporation, Valmont Industries, Reinke Manufacturing, T-L Irrigation, BAUER GmbH, Senninger, Opal Pivot, Atlantis, Visser, RmIrrigation |

| Additional Attributes | Dollar sales by installation type and application categories, regional adoption trends across East Asia, South Asia Pacific, and Western Europe, competitive landscape with agricultural equipment manufacturers and irrigation system suppliers, farm operator preferences for water efficiency control and system mobility, integration with farm management platforms and weather monitoring systems, innovations in irrigation technology and water conservation enhancement, and development of smart irrigation solutions with enhanced performance and agricultural optimization capabilities. |

The global electric round sprinklers market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the electric round sprinklers market is projected to reach USD 2.3 billion by 2035.

The electric round sprinklers market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in electric round sprinklers market are mobile type and fixed type.

In terms of application, farms segment to command 65.0% share in the electric round sprinklers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA