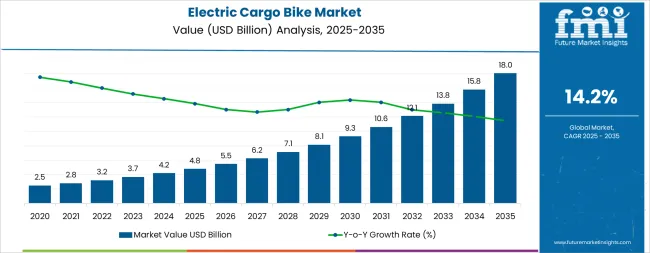

The electric cargo bike market is likely to rise from USD 4.8 billion in 2025 to USD 18 billion in 2035, registering a CAGR of 14.2%. The elasticity of growth in this market is closely linked to macroeconomic indicators such as fuel prices, disposable income levels, and government investment in sustainable mobility infrastructure. As fuel and transportation costs fluctuate, demand for cost-efficient and eco-friendly transport alternatives tends to rise, amplifying market responsiveness. Urban delivery services, logistics startups, and commercial users are increasingly shifting toward electric cargo bikes to reduce operating expenses and comply with emission regulations, reinforcing the connection between economic conditions and adoption rates.

Between 2025 and 2030, market elasticity is expected to remain high as global economies prioritize green transport policies and consumers respond to volatile fuel costs. From 2030 to 2035, the elasticity may moderate slightly as the market matures, supported by technological improvements and broader consumer acceptance. GDP growth and urbanization trends will continue to influence sales patterns, with regions experiencing higher income growth showing faster adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 4.8 billion |

| Market Forecast Value (2035) | USD 18 billion |

| Forecast CAGR (2025–2035) | 14.2% |

Market expansion is being supported by the exponential growth of e-commerce and last-mile delivery requirements in urban environments, where traditional delivery vehicles face increasing challenges from traffic congestion, parking limitations, and environmental restrictions. Modern logistics operations require flexible, efficient transportation solutions capable of navigating dense urban infrastructure while meeting demanding delivery timeframes and customer expectations. Electric cargo bikes offer superior maneuverability in congested areas, eliminate parking complications, and provide direct access to pedestrian zones and restricted traffic areas where conventional delivery vehicles cannot operate.

The growing emphasis on environmental carbon emission reduction is compelling municipalities, corporations, and individual consumers to adopt zero-emission transportation alternatives for goods movement and personal cargo needs. Urban centers worldwide are implementing progressive policies including low-emission zones, congestion pricing, and vehicle access restrictions that favor electric mobility solutions.

Technological advancements in electric drivetrain systems, battery energy density, and cargo bike design engineering have dramatically improved performance characteristics, payload capacities, and operational reliability of electric cargo bikes. Contemporary models feature powerful mid-drive motors, extended-range lithium-ion battery systems, and sophisticated cargo compartment designs that accommodate diverse payload requirements from parcel delivery to passenger transportation. The integration of smart connectivity features, GPS tracking, and fleet management systems enhances operational efficiency for commercial operators while improving user experience for personal consumers.

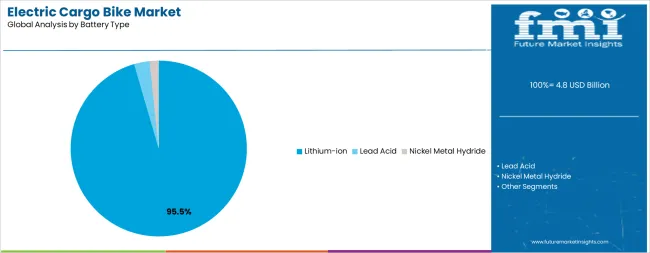

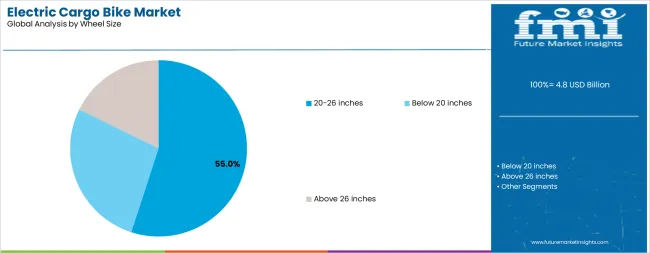

The market is segmented by battery type, product type, wheel size, end user, and region. By battery type, the market is divided into Lithium-ion (95.5% market share in 2025), Lead Acid, and Nickel Metal Hydride. Based on product type, the market is categorized into Two-Wheeled (42% market share), Three-Wheeled (fastest growing at 15.6% CAGR), and Four-Wheeled configurations. By wheel size, the market includes Below 20 inches, 20-26 inches (55% market share), and Above 26 inches. Based on end user, the market comprises Courier & Parcel Services (48% market share, growing at 15.4% CAGR), Large Retail Suppliers, Personal Transportation, Service Delivery, and Municipal Waste Management. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Lithium-ion battery configurations are projected to account for 95.5% of the electric cargo bike market in 2025. This overwhelming dominance is supported by the technology's superior energy density, extended cycle life, reduced weight characteristics, and consistent performance across varied temperature conditions. Lithium-ion batteries enable electric cargo bikes to achieve operational ranges exceeding 100 kilometers on single charges while maintaining compact dimensions and manageable weight profiles that preserve vehicle handling characteristics and payload capacities.

Modern lithium-ion battery systems incorporate advanced battery management systems (BMS) that optimize charging cycles, protect against thermal runaway conditions, and provide accurate state-of-charge monitoring for operators. The technology's rapid charging capabilities enable commercial fleet operators to maintain continuous operational availability through strategic charging during brief service interruptions. Lithium-ion batteries demonstrate minimal capacity degradation over thousands of charge cycles, ensuring consistent range performance throughout extended service periods and supporting favorable total cost of ownership calculations for commercial applications.

The segment benefits from continuous technological improvements including higher energy density cell chemistries, enhanced thermal management systems, and cost reductions driven by automotive industry battery production scale. These advancements progressively improve electric cargo bike range capabilities while reducing upfront equipment costs and operating expenses. The lithium-ion battery recycling infrastructure is also developing rapidly, addressing end-of-life environmental concerns and supporting circular economy principles within the electric mobility sector.

The lithium-ion technology's compatibility with regenerative braking systems and solar charging accessories provides operational flexibility and sustainability benefits that align with environmental objectives driving electric cargo bike adoption. Major cargo bike manufacturers standardize on lithium-ion systems across product portfolios, ensuring parts availability, service expertise, and upgrade pathways for existing fleet operators.

The 20-26 inches’ wheel size segment is 55% market share, representing the optimal balance between maneuverability, ride comfort, and cargo capacity for urban electric cargo bike applications. This wheel size range provides excellent low-speed handling characteristics essential for dense urban navigation while maintaining sufficient rolling efficiency for extended-range operations. The moderate wheel diameter enables lower cargo platform heights that facilitate easier loading and unloading operations while preserving acceptable ground clearance for urban infrastructure obstacles.

Wheels in this size category offer broad availability of tire options including puncture-resistant designs, high-traction patterns for varied weather conditions, and heavy-duty constructions capable of supporting substantial cargo loads. The standardized dimensions ensure widespread parts availability and straightforward maintenance procedures for commercial fleet operators. Manufacturing economies of scale within this wheel size range contribute to favorable component pricing and replacement part accessibility across global markets.

The segment benefits from optimal integration with cargo box dimensions and frame geometries that maximize usable cargo volume while maintaining compact vehicle footprints suitable for bike lane navigation and indoor storage. Suspension systems designed around 20-26 inch wheels effectively absorb road irregularities and provide comfortable ride characteristics for both operators and transported cargo. The wheel size also enables efficient integration of hub motors or mid-drive systems without compromising ground clearance or introducing excessive unsprung weight.

The wheel size range accommodates diverse rider heights through adjustable saddle and handlebar configurations, supporting fleet operations where multiple operators share vehicles across shift rotations. The balanced rolling characteristics reduce operator fatigue during extended delivery routes while maintaining responsive steering and braking performance essential for urban traffic conditions.

The electric cargo bike market is advancing rapidly due to accelerating urbanization, explosive e-commerce growth, and strengthening environmental regulations promoting zero-emission transportation alternatives. The market faces challenges including higher initial purchase costs compared to conventional cargo bikes, limited cycling infrastructure in many markets, and varying regulatory frameworks across jurisdictions. Weather exposure, limited cargo capacity compared to motorized vehicles, and concerns about vehicle theft continue to influence adoption patterns across different geographic regions and application segments.

The unprecedented growth of online retail and home delivery services is fundamentally reshaping urban logistics operations and creating massive demand for efficient last-mile delivery solutions. E-commerce penetration continues accelerating across consumer categories, generating exponential increases in small parcel delivery volumes concentrated in urban residential areas. Traditional delivery vehicle fleets struggle to maintain service levels amid growing traffic congestion, parking scarcity, and labor cost pressures.

Electric cargo bikes emerge as optimal solutions for dense urban parcel delivery, offering superior maneuverability, elimination of parking challenges, and direct access to residential neighborhoods and pedestrian zones. Major logistics providers and e-commerce platforms are investing heavily in cargo bike delivery infrastructure, establishing urban micro-hubs and consolidation facilities that support cargo bike operations. The cost structure advantages including fuel elimination, reduced vehicle maintenance, and lower labor requirements per delivery create compelling business cases for large-scale fleet deployments.

Municipal governments worldwide are implementing comprehensive urban mobility strategies that prioritize sustainable transportation modes and restrict conventional vehicle access to city centers. Low-emission zones, congestion pricing schemes, and vehicle access restrictions increasingly prohibit or penalize diesel and gasoline vehicle operations in dense urban cores. These policy frameworks create favorable operating conditions for electric cargo bikes while imposing cost penalties on traditional delivery vehicles.

Progressive cities are investing significantly in cycling infrastructure including protected bike lanes, cargo bike parking facilities, and charging station networks that support commercial electric cargo bike operations. Financial incentive programs including purchase subsidies, tax credits, and preferential access permits reduce adoption barriers and accelerate fleet conversion timelines. The regulatory environment increasingly favors electric cargo bikes through exemptions from vehicle restrictions, parking fee waivers, and dedicated loading zone access that provide operational advantages over motorized alternatives.

| Country | CAGR (2025–2035) |

|---|---|

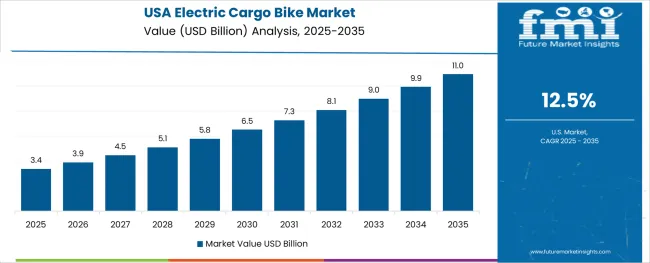

| United States | 12.5% |

| China | 11.3% |

| India | 10.8% |

| Netherlands | 10.2% |

| France | 9.1% |

| Germany | 8.5% |

| United Kingdom | 8.2% |

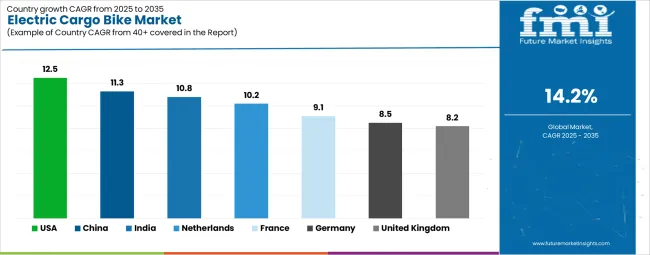

The electric cargo bike market is growing rapidly, with the United States leading at a 12.5% CAGR through 2035, driven by explosive e-commerce growth, corporate environmental initiatives, and expanding urban cargo bike infrastructure in major metropolitan areas. China follows at 11.3%, supported by massive urban population concentrations, government support for electric mobility, and established bicycle manufacturing expertise. India demonstrates strong growth at 10.8%, driven by rapid urbanization, expanding delivery services, and government initiatives promoting electric vehicle adoption. The Netherlands records substantial growth at 10.2%, emphasizing established cycling culture, comprehensive bicycle infrastructure, and progressive urban mobility policies. France grows steadily at 9.1%, integrating cargo bikes into urban logistics networks and municipal service operations. Germany maintains strong expansion at 8.5%, supported by premium product manufacturing, corporate fleet adoption, and environmental consciousness. The United Kingdom demonstrates solid growth at 8.2%, driven by urban consolidation initiatives and expansion of zero-emission delivery zones.

The report covers an in-depth analysis of 40+ countries, Top-performing countries are highlighted below.

The electric cargo bike market in the United States is projected to exhibit strong growth with a CAGR of 12.5% through 2035, driven by unprecedented e-commerce expansion, corporate Eco commitments, and progressive urban mobility policies in major metropolitan areas. Major logistics providers and e-commerce platforms are deploying extensive cargo bike fleets in dense urban markets including New York, San Francisco, Seattle, and Chicago. Urban policy initiatives including congestion pricing proposals and vehicle restriction zones are accelerating commercial cargo bike adoption.

Demand for electric cargo bikes in China is expanding at a CAGR of 11.3%, supported by massive urban population concentrations, extensive e-commerce platforms, and government policies promoting electric vehicle adoption across all transportation categories. Chinese cities face severe traffic congestion and air quality challenges that drive demand for sustainable urban logistics solutions. Domestic manufacturers provide cost-competitive cargo bike options that address diverse commercial and personal transportation requirements.

The electric cargo bike market in India is growing at a CAGR of 10.8%, driven by rapid urbanization, expanding e-commerce penetration, and government initiatives promoting electric mobility solutions. Indian cities face severe traffic congestion and pollution challenges that create favorable conditions for cargo bike adoption. Domestic startups and international manufacturers are developing products specifically adapted to Indian market requirements and price sensitivities.

Demand for electric cargo bikes in the Netherlands is projected to grow at a CAGR of 10.2%, supported by the country's exceptional cycling culture, comprehensive bicycle infrastructure, and progressive urban mobility policies. Dutch consumers embrace cargo bikes for family transportation, shopping, and recreational activities, creating substantial personal-use market segments alongside commercial applications. Urban planning prioritizes bicycle access and safety, supporting cargo bike operations throughout residential and commercial districts.

Demand for electric cargo bikes in France is expanding at a CAGR of 9.1%, driven by urban logistics transformation initiatives, municipal sustainability commitments, and expanding cargo bike infrastructure in major cities. French municipalities are establishing low-emission zones, cargo bike parking facilities, and urban consolidation centers that support commercial cargo bike operations. National government programs provide purchase incentives and infrastructure funding that accelerate adoption.

Demand for electric cargo bikes in Germany is projected to grow at a CAGR of 8.5%, supported by premium product manufacturing, corporate fleet adoption, and comprehensive environmental consciousness. German manufacturers lead global markets in cargo bike design innovation, manufacturing quality, and technological sophistication. Corporate sustainability initiatives and employer mobility programs encourage cargo bike adoption for commuting and business operations.

Demand for electric cargo bikes in the United Kingdom is expanding at a CAGR of 8.2%, driven by urban consolidation initiatives, expansion of ultra-low emission zones, and growing commercial fleet operations in London and other major cities. UK logistics providers are establishing cargo bike delivery networks responding to vehicle access restrictions and environmental regulations. Municipal programs provide funding support and infrastructure development for cargo bike operations.

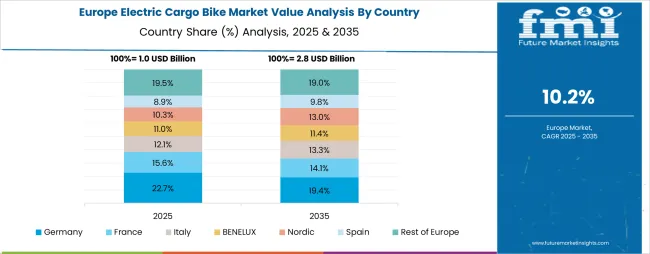

The electric cargo bike market in Europe is projected to grow from USD 1.85 billion in 2025 to USD 5.92 billion by 2035, registering a CAGR of 12.3% over the forecast period. Germany is expected to maintain its leadership with a 28.2% share in 2025, supported by its premium manufacturing sector, strong cycling culture, and comprehensive corporate adoption programs. The Netherlands follows with 22.5% market share, driven by exceptional cycling infrastructure, cultural acceptance, and progressive urban mobility policies. France holds 18.3% of the European market, benefiting from urban logistics transformation and municipal sustainability initiatives. The United Kingdom represents 15.7% of regional demand, with growing focus on ultra-low emission zones and consolidation programs. Belgium, Denmark, and Austria collectively account for 10.8% of the market, supported by strong cycling traditions and urban infrastructure investments. The Rest of Europe region represents 4.5% of the market, with emerging adoption in Southern and Eastern European cities.

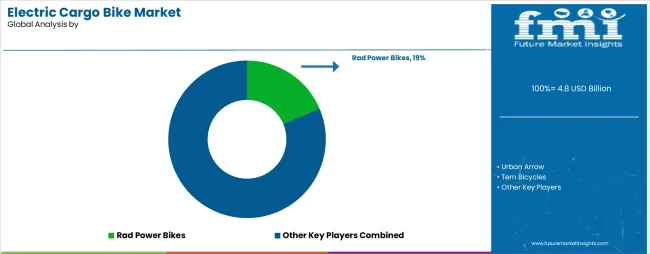

The electric cargo bike market is defined by competition among established bicycle manufacturers, specialized cargo bike brands, and new market entrants bringing innovative designs and business models. Companies are investing in electric drivetrain technology, modular cargo solutions, smart connectivity features, and direct-to-consumer distribution channels to deliver compelling value propositions. Strategic partnerships, technological innovation, and geographic expansion are central to strengthening market positions and capturing growth opportunities.

Rad Power Bikes, prominent US-based manufacturer, offers comprehensive electric cargo bike solutions with focus on scalable platforms, accessible pricing, and direct-to-consumer sales models. The company provides versatile cargo bike designs suitable for commercial fleet operations and personal transportation applications across diverse user requirements.

Urban Arrow, leading European cargo bike specialist, delivers premium modular designs with emphasis on Dutch engineering excellence, sophisticated cargo systems, and family transportation applications. The company serves both commercial fleet operators and individual consumers with high-quality products emphasizing safety and functionality.

Tern Bicycles, innovative cargo bike manufacturer, provides versatile folding and compact designs with focus on space-efficient storage, multi-modal transportation integration, and urban lifestyle applications. The company emphasizes engineering innovation and modular accessory systems that adapt to diverse user needs.

Riese & Müller, premium German cargo bike brand, specializes in high-performance electric cargo bikes with focus on corporate fleet applications, superior build quality, and comprehensive customization options. The company benefits from German engineering reputation and strong dealer network supporting commercial and personal markets.

Douze Cycles, French modular cargo bike manufacturer, offers design-driven solutions with emphasis on customization, aesthetic appeal, and practical functionality. The company provides flexible cargo configurations and French design sensibilities addressing European market preferences.

Additional market participants including Babboe, Bakfiets.nl, Butchers & Bicycles, Cargo Bike, Christiania Bikes, Larry vs Harry, Omnium, Packster, XYZ Cargo, Yuba Bicycles, Benno Bikes, Bunch Bikes, Carqon, and Cero contribute specialized expertise, regional market presence, and product innovations across global and regional markets.

The electric cargo bike market underpins sustainable urban logistics, zero-emission transportation adoption, livable city development, and climate action implementation. With accelerating e-commerce growth, strengthening environmental regulations, and expanding urban populations, the sector must address infrastructure requirements, cost barriers, and operational challenges. Coordinated contributions from governments, industry associations, manufacturers, logistics operators, and investors will accelerate the transition toward cargo bike-enabled sustainable urban mobility systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.8 billion |

| Battery Type | Lithium-ion, Lead Acid, Nickel Metal Hydride |

| Product Type | Two-Wheeled, Three-Wheeled, Four-Wheeled |

| Wheel Size | Below 20 inches, 20–26 inches, Above 26 inches |

| End User | Courier & Parcel Services, Large Retail Suppliers, Personal Transportation, Service Delivery, Municipal Waste Management |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, India, Netherlands, France, Germany, United Kingdom, +40 others |

| Key Companies Profiled | Rad Power Bikes, Urban Arrow, Tern Bicycles, Riese & Müller, Douze Cycles, Babboe, Bakfiets.nl, Butchers & Bicycles, Larry vs Harry, Yuba Bicycles, Benno Bikes, Bunch Bikes, XYZ Cargo, Omnium, Packster, Christiania Bikes |

| Additional Attributes | Dollar sales by battery type, product type, wheel size, and end user application; regional demand trends across North America, Europe, and Asia-Pacific; competitive landscape with established manufacturers and emerging brands; buyer preferences for commercial vs. personal applications; integration with urban logistics networks and last-mile delivery infrastructure; innovations in electric drivetrain systems and battery technologies; adoption of smart connectivity features (GPS tracking, fleet management, mobile applications) |

The global electric cargo bike market is estimated to be valued at USD 4.8 billion in 2025.

The market size for the electric cargo bike market is projected to reach USD 18.0 billion by 2035.

The electric cargo bike market is expected to grow at a 14.2% CAGR between 2025 and 2035.

The key product types in electric cargo bike market are lithium-ion, lead acid and nickel metal hydride.

In terms of wheel size, 20-26 inches segment to command 55.0% share in the electric cargo bike market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric 3-wheeler Cargo Bikes Market Size and Share Forecast Outlook 2025 to 2035

Cargo Bike Tire Market Growth – Trends & Forecast 2025-2035

Cargo Bike Market Growth - Trends & Forecast 2024 to 2034

Electric Bike Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Bike Market Growth - Trends & Forecast 2025 to 2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA