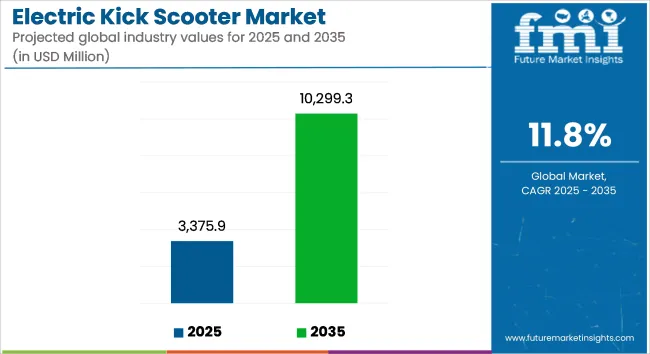

The global electric kick scooter market is projected to expand from USD 3,375.9 million in 2025 to USD 10,299.3 million by 2035, registering a CAGR of 11.8%. This growth is expected to be driven by rising demand for compact, low-emission personal mobility solutions in densely populated urban centers.

Governments across developed and emerging economies are continuing to address traffic congestion, environmental pollution, and the limitations of traditional public transport systems. As a result, electric kick scooters are being positioned as an efficient alternative for short-range commuting.

Recent product innovations have been observed across leading OEMs. In January 2025, Segway-Ninebot introduced a new generation of eKickScooters designed with enhanced battery safety, smart braking systems, and extended mileage per charge. The product upgrades were introduced to meet the evolving performance expectations of urban riders and to support daily commutes with minimal maintenance requirements.

Similarly, NIU Technologies expanded its product line with electric scooters offering longer range, smart connectivity, and stronger frame construction, which were developed for intensive use in urban transport scenarios.

The adoption of electric kick scooters is being further supported by changes in urban planning and public policy. City-level infrastructure enhancements-such as the construction of protected micro-mobility lanes, the designation of low-speed zones, and the provision of public charging stations-have been implemented in multiple metropolitan regions. These measures have been introduced to improve rider safety, reduce urban emissions, and support modal shift away from cars.

Tightened emissions regulations in regions such as Europe and North America have been instrumental in accelerating the deployment of zero-emission transport alternatives. Restrictions on internal combustion engine vehicles and incentive programs for electric mobility have encouraged both consumers and service providers to transition toward battery-powered platforms. As a result, electric kick scooters have become widely accepted in fleet-based rental models as well as individual ownership.

Integration with digital ecosystems has also contributed to the market’s expansion. Devices are now being manufactured with mobile app support, GPS-based tracking, and remote diagnostics. These capabilities are being used to enhance fleet monitoring, theft prevention, and maintenance planning.

With advancements in battery design, regulatory backing, and evolving urban travel behavior, the electric kick scooter market is expected to continue its upward trajectory through 2035, supported by strong public-private alignment in the mobility sector.

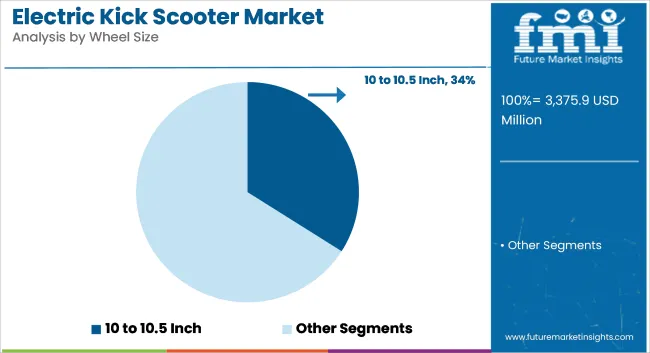

The 10 to 10.5 inch wheel size category accounted for 34% of the global market in 2025 and is projected to grow at a CAGR of 12.4% through 2035. Demand was supported by improved ride stability, shock absorption, and terrain adaptability offered by this configuration, especially in electric scooters and lightweight personal mobility devices.

In 2025, manufacturers standardized this size in new product launches targeting urban and commuter segments. The wheel size was preferred in regions with mixed road surfaces, offering a balance between portability and comfort.

Product designers integrated 10-inch wheels into foldable and app-connected models, enhancing usability across personal and rental platforms. Urban fleet operators in Europe and Southeast Asia also adopted this configuration due to lower maintenance needs and enhanced user safety, particularly for daily short-distance commutes.

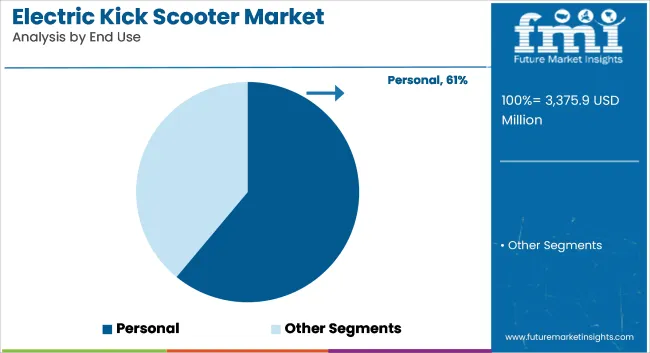

Personal use accounted for 61% of the global market in 2025 and is expected to grow at a CAGR of 12.1% from 2025 to 2035. Individual adoption increased with growing awareness of last-mile mobility solutions, environmental concerns, and congestion in urban centers.

In 2025, consumers in North America, Europe, and parts of Asia opted for personal e-scooters and electric skateboards equipped with IoT features, enhanced braking systems, and mobile app integration. This trend was reinforced by remote work culture, flexible commute patterns, and dedicated mobility infrastructure in select cities.

Sales were also influenced by the availability of government incentives and subsidies on personal electric transport units in Germany, France, and South Korea. Retail purchases through online and offline channels remained strong, supported by multiple financing options and upgrade programs offered by manufacturers.

Challenge

Regulatory and Safety Concerns

Regulatory uncertainty and safety issues regarding the use of electric kick scooters is one of the biggest challenges that has emerged in the market. Cities around the world are imposing limits on electric scooter speeds, parking locations and operating regulations due to a rise in injuries and public safety concerns.

In many, there are no standardized rules, regulations and standards that would enable manufacturers and service providers to grow in a uniform manner. Also, safety concerns regarding battery fires, scooter lifespan, and undesirable riding behavior in crowded areas are risks that should be minimized with better design work and stricter compliance.

Opportunity

Technological Advancements and Smart Mobility Integration

Increasing smart mobility trends is the first big opportunity for electric kick scooter market. It impacts scooter efficiency and the user experience, with rapid charging and extended range being some of the latest advancements in battery tech. IoT-based functionalities, such as real-time GPS tracking, theft protection, and app-based controls are making electric kick scooters more attractive to ton-minded consumers.

Moreover, the establishment of scooter sharing platforms and partnerships with public transport operators will contribute towards creating seamless urban mobility ecosystems. As cities continue to invest in smart infrastructure, the demand for micro-mobility solutions connected to it and more sustainable will likely accelerate, feeding the long-term growth of the electric kick scooter (EKS) market.

Striking a balance between being well-versed in global politics while also staying up to date with micro mobility interactions, the USA electric kick scooter market is increasing on account of same urbanization, rising adoption of micro-mobility solutions, and heightening concern regarding carbon emissions.

Likewise, rising bike lanes in urban areas and government support toward green transport is further propelling market growth. And demand is being driven by the expansion of shared e-scooter services from providers like Bird and Lime, as well as increased consumer interest in personal electric scooters as an affordable form of commuting.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 11.5% |

UK e-scooter rentals are booming and the market for electric kick scooters seems poised for growth amid supportive government policies that have already been trailing electric scooters, increasing investment in sustainable urban transport and a complete consumer shift towards sustainable commuting solutions.

In terms of power, the adoption of rental e-scooters has already been legalized and accelerated, and the improvement of battery technology and LED light design are also factors driving market development. Last-mile delivery services are also contributing to growth, as e-scooter platforms have become part of delivery networks.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.6% |

EU e-kick scooter sales are surging with a focus on strong emissions controls, widespread investment in sustainable mobility, and the speedily growing scale of shared mobility offerings. Major cities such as Paris, Berlin, and Madrid are at the forefront of making a shift to unified micro-mobility systems, with subsidized e-scooter take-up facilitated by state-backed incentives. There is an increasing demand for folding, longer-range personal use e-scooters as users turn away from mass transit.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.0% |

Rising e-kick scooters uses in urban cities, advancements in battery technology, and growing investment in electric mobility, together with new regulations allowing e-scooters in urban cities are able to drive the Japan e-kick scooter market. Smart features like GPS tracking and AI-based security systems are also attractive to tech-savvy buyers. In addition, a new demand for light and foldable e-scooters for personal transportation and delivery services is ascending.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 11.4% |

Another significant growth catalyst lies in South Korea's fast-expanding electric kick scooter market as demand for greener alternative transport options rise among young consumers and the uptake of ride-sharing platforms accelerates with the government's incentives.

Of course, having top-class battery manufacturers and intelligent mobility startups is upping the ante for the industry. In addition, increasing congestion in cities is pushing commuters to adopt electric scooters as a fast and convenient mode of transportation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 11.9% |

The Electric Kick Scooter Market is experiencing rapid growth due to the rising demand for sustainable urban mobility solutions, last-mile connectivity, and eco-friendly transportation alternatives. With increasing concerns about traffic congestion, rising fuel costs, and carbon emissions, electric kick scooters have gained popularity among commuters, students, and ride-sharing service providers.

Governments worldwide are encouraging micro-mobility solutions by implementing infrastructure development, subsidies, and regulatory support, further driving market expansion. Leading companies are focusing on battery efficiency, lightweight designs, smart connectivity features, and rental fleet expansions to strengthen their competitive position.

Micro Mobility Systems AG (18-22%)

A market leader in foldable electric scooters of high quality, Micro Mobility Systems AG deals with light, strong, and efficient designs. The company addresses premium urban commuters and is focused on safety, comfort, and sustainability.

Golabs Inc. (15-19%)

Golabs is reputable for offering inexpensive but high-performing electric kick scooters. Both personal and rental operators use their scooters, and the firm has a firm hold on both the European and North American micro-mobility industries.

Bird Rides Inc. (12-16%)

A leader in community e-scooter sharing, Bird Rides Inc. runs mass-scale rental fleets in key cities globally. The firm invests in AI-driven fleet management, enhanced battery technology, and sustainability efforts to improve the consumer experience.

Segway Inc. (8-12%)

Segway is a leading player in smart mobility solutions, offering self-balancing electric kick scooters with advanced IoT connectivity, app integration, and safety enhancements. The brand is well-known for its innovative designs and technological advancements.

IconBIT Limited (6-10%)

IconBIT specializes in cost-effective electric kick scooters with smart connectivity and compact designs. The company focuses on entry-level and mid-range models to cater to a wide consumer base in Europe and Asia.

Other Key Players (30-40% Combined)

The Electric Kick Scooter Market also includes several regional and emerging companies, such as:

The overall market size for electric kick scooter market was USD 3,375.9 Million in 2025.

The electric kick scooter market is expected to reach USD 10,299.3 Million in 2035.

The rising adoption of micro-mobility solutions in urban areas fuels Electric kick scooter Market during the forecast period.

The top 5 countries which drives the development of Electric kick scooter Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of product type, two-wheeled to command significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 41: Western Europe Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 42: Western Europe Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 43: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 44: Western Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 45: Western Europe Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 46: Western Europe Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 47: Western Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 48: Western Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Eastern Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 53: Eastern Europe Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 54: Eastern Europe Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 55: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: Eastern Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: Eastern Europe Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 58: Eastern Europe Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 59: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: Eastern Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 61: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: South Asia and Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 65: South Asia and Pacific Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 66: South Asia and Pacific Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 67: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 68: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 69: South Asia and Pacific Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 70: South Asia and Pacific Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 71: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 72: South Asia and Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 73: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 74: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 75: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 76: East Asia Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 77: East Asia Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 78: East Asia Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 79: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 80: East Asia Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 81: East Asia Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 82: East Asia Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 83: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 84: East Asia Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 85: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 86: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 87: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 88: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 89: Middle East and Africa Market Value (US$ Million) Forecast by Battery Type, 2018 to 2033

Table 90: Middle East and Africa Market Volume (Units) Forecast by Battery Type, 2018 to 2033

Table 91: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 92: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 93: Middle East and Africa Market Value (US$ Million) Forecast by Wheel Size, 2018 to 2033

Table 94: Middle East and Africa Market Volume (Units) Forecast by Wheel Size, 2018 to 2033

Table 95: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 96: Middle East and Africa Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Battery Type, 2023 to 2033

Figure 33: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 34: Global Market Attractiveness by Wheel Size, 2023 to 2033

Figure 35: Global Market Attractiveness by End Use, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Battery Type, 2023 to 2033

Figure 69: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 70: North America Market Attractiveness by Wheel Size, 2023 to 2033

Figure 71: North America Market Attractiveness by End Use, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Battery Type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Wheel Size, 2023 to 2033

Figure 107: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Western Europe Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 111: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 113: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 114: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Western Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 121: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Western Europe Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 124: Western Europe Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 125: Western Europe Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 126: Western Europe Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 127: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 128: Western Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 129: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 130: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 131: Western Europe Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 132: Western Europe Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 133: Western Europe Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 134: Western Europe Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 135: Western Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 136: Western Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 137: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 138: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 139: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Western Europe Market Attractiveness by Battery Type, 2023 to 2033

Figure 141: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 142: Western Europe Market Attractiveness by Wheel Size, 2023 to 2033

Figure 143: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 144: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Eastern Europe Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 147: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 148: Eastern Europe Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 149: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 150: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Eastern Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 157: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Eastern Europe Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 160: Eastern Europe Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 161: Eastern Europe Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 162: Eastern Europe Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 163: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 164: Eastern Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 165: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 166: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 167: Eastern Europe Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 168: Eastern Europe Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 169: Eastern Europe Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 170: Eastern Europe Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 171: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 172: Eastern Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 173: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 174: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 175: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Eastern Europe Market Attractiveness by Battery Type, 2023 to 2033

Figure 177: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 178: Eastern Europe Market Attractiveness by Wheel Size, 2023 to 2033

Figure 179: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 180: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 181: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: South Asia and Pacific Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 183: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 184: South Asia and Pacific Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 185: South Asia and Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 186: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: South Asia and Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 193: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: South Asia and Pacific Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 196: South Asia and Pacific Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 197: South Asia and Pacific Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 198: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 199: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 200: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 201: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 202: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 203: South Asia and Pacific Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 204: South Asia and Pacific Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 205: South Asia and Pacific Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 206: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 207: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 208: South Asia and Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 209: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 210: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 211: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 212: South Asia and Pacific Market Attractiveness by Battery Type, 2023 to 2033

Figure 213: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 214: South Asia and Pacific Market Attractiveness by Wheel Size, 2023 to 2033

Figure 215: South Asia and Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 216: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 217: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 218: East Asia Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 219: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 220: East Asia Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 221: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 222: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 223: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 224: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 225: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 226: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 227: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 228: East Asia Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 229: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 230: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 231: East Asia Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 232: East Asia Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 233: East Asia Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 234: East Asia Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 235: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 236: East Asia Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 237: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 238: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 239: East Asia Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 240: East Asia Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 241: East Asia Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 242: East Asia Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 243: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 244: East Asia Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 245: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 246: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 247: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 248: East Asia Market Attractiveness by Battery Type, 2023 to 2033

Figure 249: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 250: East Asia Market Attractiveness by Wheel Size, 2023 to 2033

Figure 251: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 252: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 253: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 254: Middle East and Africa Market Value (US$ Million) by Battery Type, 2023 to 2033

Figure 255: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 256: Middle East and Africa Market Value (US$ Million) by Wheel Size, 2023 to 2033

Figure 257: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 258: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 259: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 260: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 261: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 262: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 263: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 264: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 265: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 266: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 267: Middle East and Africa Market Value (US$ Million) Analysis by Battery Type, 2018 to 2033

Figure 268: Middle East and Africa Market Volume (Units) Analysis by Battery Type, 2018 to 2033

Figure 269: Middle East and Africa Market Value Share (%) and BPS Analysis by Battery Type, 2023 to 2033

Figure 270: Middle East and Africa Market Y-o-Y Growth (%) Projections by Battery Type, 2023 to 2033

Figure 271: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 272: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 273: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 274: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 275: Middle East and Africa Market Value (US$ Million) Analysis by Wheel Size, 2018 to 2033

Figure 276: Middle East and Africa Market Volume (Units) Analysis by Wheel Size, 2018 to 2033

Figure 277: Middle East and Africa Market Value Share (%) and BPS Analysis by Wheel Size, 2023 to 2033

Figure 278: Middle East and Africa Market Y-o-Y Growth (%) Projections by Wheel Size, 2023 to 2033

Figure 279: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 280: Middle East and Africa Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 281: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 282: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 283: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 284: Middle East and Africa Market Attractiveness by Battery Type, 2023 to 2033

Figure 285: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 286: Middle East and Africa Market Attractiveness by Wheel Size, 2023 to 2033

Figure 287: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 288: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA