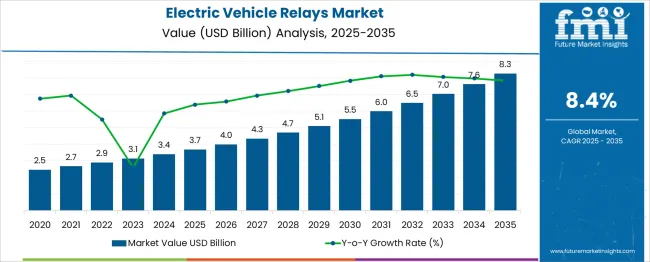

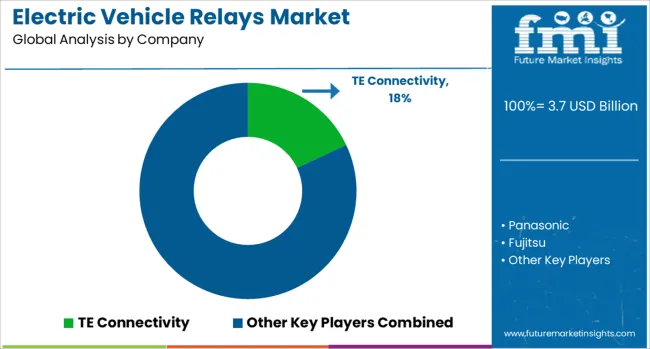

The Electric Vehicle Relays Market is estimated to be valued at USD 3.7 billion in 2025 and is projected to reach USD 8.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period. Year-on-year (YoY) growth analysis indicates a steady upward trajectory driven by rising EV adoption, expansion of charging infrastructure, and increasing demand for high-voltage relays to manage power distribution and safety in electric drivetrains.

From 2025 to 2030, the market expands from USD 3.7 billion to USD 5.5 billion, adding USD 1.8 billion, supported by robust growth in battery electric vehicles and hybrid models, alongside regulatory mandates targeting zero-emission transportation. YoY growth during this phase averages around 7.5–8%, reflecting strong penetration in Asia-Pacific and Europe. In the second half of the forecast (2030–2035), annual gains accelerate as the market moves from USD 5.5 billion to USD 8.3 billion, with YoY growth maintaining between 8% and 9%, driven by demand for solid-state relays and advanced thermal management solutions required for ultra-fast charging and higher battery voltages. Competitive advantage will favor manufacturers investing in compact, lightweight designs with enhanced heat resistance and intelligent switching features, ensuring efficiency, durability, and compliance with evolving EV safety standards worldwide.

| Metric | Value |

|---|---|

| Electric Vehicle Relays Market Estimated Value in (2025 E) | USD 3.7 billion |

| Electric Vehicle Relays Market Forecast Value in (2035 F) | USD 8.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The electric vehicle relays market holds a niche but vital position within its broader parent segments, contributing an estimated 8–10% share of the global electric vehicle components market, which includes motors, connectors, sensors, and controllers. Within the automotive electrical systems market, the share is lower at approximately 3–4%, as this segment spans traditional ICE components as well. For the powertrain and drivetrain systems market, electric vehicle relays represent nearly 2–3%, given their role in high-voltage circuit switching and current management. In the battery management system (BMS) market, the contribution is more prominent, reaching about 6–7%, since relays are essential for thermal protection, isolation, and safe power transfer. Within the automotive safety and control systems market, the share stands at roughly 4–5%, as relays provide emergency disconnect and interlock functions. The overall market influence of electric vehicle relays is increasing due to rising demand for high-voltage architectures, fast-charging compatibility, and thermal safety requirements in modern electric vehicles. Their adoption is further supported by the expansion of electric mobility platforms and integration of advanced energy management systems, making them an indispensable component in ensuring safety and performance standards in electric vehicle ecosystems.

Demand for high-performance relays has increased substantially, driven by the surge in electric vehicle manufacturing and the integration of advanced safety and powertrain electronics. Relays are playing a crucial role in high-voltage circuit protection, battery management, and system isolation, aligning with the strict safety standards and energy efficiency requirements in modern EV platforms.

The proliferation of battery electric vehicles, along with supportive government mandates and infrastructure investments, is fueling this trend. Manufacturers are prioritizing miniaturization, durability, and high-voltage tolerance in relay systems to meet evolving EV architecture.

Continuous innovations in relay design to withstand higher loads and optimize switching reliability have positioned these components as critical to long-term vehicle performance and safety. With the growing consumer and regulatory push toward sustainable transportation, the market is expected to witness strong momentum across various vehicle types and propulsion systems..

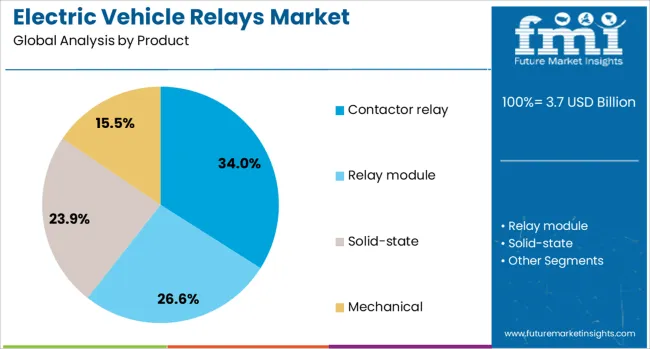

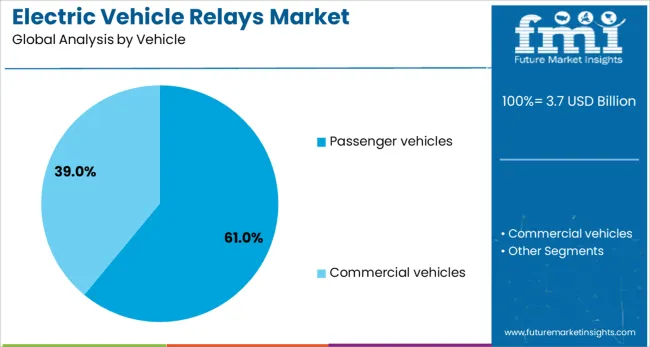

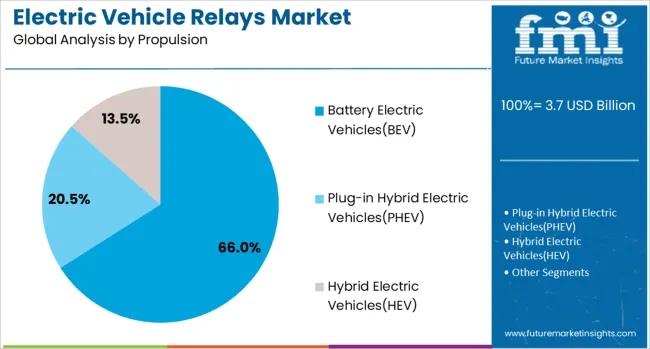

The electric vehicle relays market is segmented by product, vehicle, propulsion, application, sales channel, and geographic regions. The electric vehicle relays market is divided into Contactor relay, Relay module, Solid-state, and Mechanical. In terms of vehicles, the electric vehicle relay market is classified into Passenger vehicles and Commercial vehicles. Based on propulsion of the electric vehicle, the market is segmented into Battery Electric Vehicles (BEV), Plug-in Hybrid Electric Vehicles (PHEV), and Hybrid Electric Vehicles (HEV). The electric vehicle relays market is segmented into Battery Management System (BMS), Charging system, Drive system, Thermal management, HVAC system, and Others. The sales channel of the electric vehicle relay market is segmented into OEM and Aftermarket. Regionally, the electric vehicle relay industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The contactor relay segment is projected to hold 34% of the Electric Vehicle Relays market revenue share in 2025, making it the leading product category. Growth in this segment has been supported by the increasing demand for high-voltage switching components that can safely manage current in EV powertrains. Contactor relays have been adopted extensively due to their ability to handle high load currents while offering mechanical isolation, ensuring system protection during voltage surges and fault conditions.

Their widespread use in battery management systems, onboard chargers, and electric drive units has reinforced their dominance. Additionally, their role in ensuring safe startup and shutdown procedures in electric vehicles has made them an indispensable part of EV safety architecture.

The growing trend toward modular and scalable EV platforms has further supported the integration of advanced contactor relay solutions, particularly those designed for high thermal endurance and arc suppression. As vehicle electrification becomes more complex, contactor relays are expected to retain their leadership position through continued innovation..

The passenger vehicles segment is expected to account for 61% of the Electric Vehicle Relays market revenue share in 2025, positioning it as the dominant vehicle category. The accelerated production of electric passenger cars across global markets has driven the need for compact, high-efficiency relay components that support safe and seamless vehicle operation. Passenger vehicles have increasingly integrated sophisticated electronics, infotainment, and thermal management systems, all of which depend on reliable relay performance.

Market growth has been encouraged by consumer demand for zero-emission personal mobility, coupled with favorable policy incentives and rising fuel economy standards. As OEMs scale up electric model lineups, investment in efficient relay architectures has intensified to address high-voltage circuit control and battery safety.

Additionally, relays customized for compact design and silent operation have become essential in enhancing the user experience in electric passenger vehicles. This segment’s strong performance is expected to persist as urbanization and middle-class affordability trends continue to influence global EV adoption..

The battery electric vehicles segment is projected to capture 66% of the Electric Vehicle Relays market revenue share in 2025, establishing itself as the leading propulsion category. This leadership has been attributed to the rapidly growing adoption of fully electric vehicles, driven by regulatory bans on internal combustion engines and escalating demand for carbon-neutral transportation. Battery electric vehicles require a significantly higher volume of relays per unit compared to traditional platforms, as these components support essential systems including traction control, regenerative braking, and battery protection.

The absence of internal combustion components has elevated the role of electronic systems, further increasing reliance on high-performance relays. Technological advancements in lithium-ion battery systems and increasing range capabilities have also fueled BEV production at scale.

Automakers have been aligning product roadmaps to favor all-electric models, resulting in heightened integration of advanced relay solutions. As charging infrastructure and battery technology continue to evolve, the BEV segment is expected to sustain its leadership, reinforcing its demand for intelligent relay systems..

Electric vehicle relays are electromechanical switching devices designed to handle high voltage and current in battery-powered systems, ensuring safe power distribution for traction motors, charging systems, and auxiliary components. These components enable isolation, fault interruption, and circuit protection in EVs operating at 400 V to 800 V levels or higher. Relays are applied in traction systems, battery management units, on-board chargers, and thermal management circuits, where performance and durability under frequent load cycles are essential. Growing EV production across passenger and commercial segments has elevated relay adoption, with suppliers focusing on high-voltage, arc-resistant, and compact relay designs that meet safety and thermal performance standards. Advanced relays with hermetic sealing, solid-state integration, and low contact resistance continue to define competitive positioning among leading manufacturers.

Adoption of EV relays has been reinforced by increased deployment of high-capacity lithium-ion battery packs requiring robust switching solutions. Regulatory emphasis on functional safety standards such as ISO 26262 has prompted automakers to prioritize relay systems that ensure reliable fault isolation and arc suppression. Growing preference for 800 V architectures in premium EV platforms has increased demand for compact, lightweight relays capable of managing high switching loads. Faster charging speeds and greater current flow have further strengthened the need for durable relay systems with low power loss. Manufacturers offering integrated thermal protection, redundant contact systems, and high dielectric strength have maintained strategic advantage.

Market penetration has been moderated by cost concerns associated with premium relay configurations that incorporate advanced arc quenching and sealed enclosures. The complexity of maintaining low contact resistance under frequent load cycles imposes material and design challenges, leading to higher unit pricing. Limited standardization across regional suppliers complicates sourcing for global OEM platforms, introducing variability in performance consistency. Mechanical wear on contact points over long-term service life raises warranty risks for automakers, while failure under harsh environmental conditions remains a critical reliability constraint. Extended qualification timelines for new designs, including thermal shock and vibration testing, further delay integration into mass-production EV platforms.

Opportunities are emerging from the development of hybrid relay systems combining electromechanical and semiconductor elements to achieve faster switching with reduced arc erosion. Demand for solid-state relay technologies is growing in EV charging applications, thermal control systems, and battery disconnect units where silent operation and higher cycle life are required. Suppliers exploring silicon carbide (SiC) and gallium nitride (GaN) integration for high-efficiency switching see growth potential in high-performance EV models. Expansion of relay applications into DC fast-charging infrastructure opens additional revenue streams for manufacturers capable of meeting grid-to-vehicle interface specifications. Partnerships between relay specialists and EV platform developers are enabling customized solutions that meet stringent space, weight, and energy efficiency targets.

Adoption of parametric design tools and advanced simulation software has enhanced relay optimization for thermal performance and magnetic flux distribution. Manufacturers are increasingly utilizing silver-based contact alloys, ceramic insulators, and high-performance polymers to improve arc resistance and mechanical endurance. Automated assembly processes and robotic welding techniques are being deployed to minimize dimensional variability and improve repeatability. Integration of predictive maintenance features via embedded sensors for contact temperature and current monitoring is under development. Relay housings with hermetic sealing and enhanced ingress protection ratings are gaining traction for use in humid and dust-prone environments. Developments in additive manufacturing for precision components and weight reduction are expected to further streamline next-generation EV relay design.

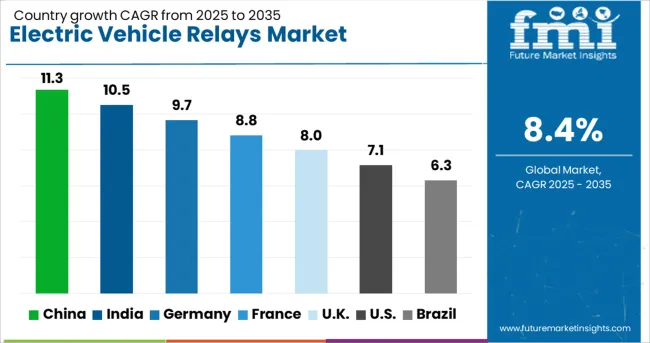

| Country | CAGR |

|---|---|

| China | 11.3% |

| India | 10.5% |

| Germany | 9.7% |

| France | 8.8% |

| UK. | 8.0% |

| USA | 7.1% |

| Brazil | 6.3% |

The electric vehicle relays market is projected to grow at a CAGR of 8.4% through 2035, driven by rising EV production, development of high-voltage powertrains, and expansion of DC fast-charging infrastructure. China leads with 11.3%, supported by aggressive electrification policies and localized relay manufacturing. India follows at 10.5%, driven by mass electrification of two- and three-wheelers and rapid charging network development. Among OECD economies, Germany posts 9.7%, supported by premium EV adoption and integration of advanced safety systems, while the United Kingdom records 8.0% and the United States grows at 7.1%, emphasizing solid-state relay innovation and fast-charging corridor deployment. The analysis includes over 40 countries, with the top five detailed below.

China is projected to grow at a CAGR of 11.3% through 2035, supported by strong EV production and large-scale adoption of battery-electric vehicles. National initiatives promoting clean mobility and localized supply chain development are fueling demand for high-performance relays. Domestic manufacturers are focusing on high-voltage DC relays to meet rapid growth in fast-charging infrastructure and vehicle electrification. Integration of relays in advanced powertrain systems and battery management units is increasing. Strategic partnerships between automakers and component suppliers are improving cost competitiveness and technological capabilities across the value chain.

India is expected to post a CAGR of 10.5% through 2035, driven by expanding EV penetration and significant policy backing for localized manufacturing under national mobility programs. The focus on two-wheeler and three-wheeler electrification is accelerating demand for compact relay solutions with high switching durability. Domestic relay producers are introducing cost-optimized designs suitable for mass-market EV models. Development of fast-charging networks and fleet electrification for commercial transport sectors is providing new opportunities for high-current relay applications. Increased collaboration between automotive OEMs and component suppliers is enhancing design innovation and reliability.

Germany is forecasted to achieve a CAGR of 9.7% through 2035, supported by premium EV production and integration of advanced safety systems. Strict safety regulations and the incorporation of fail-safe switching components in battery and powertrain systems influence relay demand. German manufacturers emphasize advanced relay solutions featuring low contact resistance and arc suppression for high-voltage environments. Rising adoption of hybrid and fully electric vehicles in both passenger and commercial segments underpins relay demand. Integration with thermal management systems and next-generation energy control units is emerging as a key application area.

The United Kingdom is projected to grow at a CAGR of 8.0% through 2035, fueled by government-backed electrification initiatives and the expansion of public charging infrastructure. Adoption of high-current relays is gaining momentum with the rise of battery-swapping stations and DC fast-charging networks. British automakers are prioritizing lightweight and compact relay designs for space-optimized EV platforms. Demand for relays with extended operational life and thermal stability is increasing to ensure reliability under high-frequency switching conditions. Collaborative programs between local relay manufacturers and international technology firms are enhancing innovation pipelines for energy-efficient relay systems.

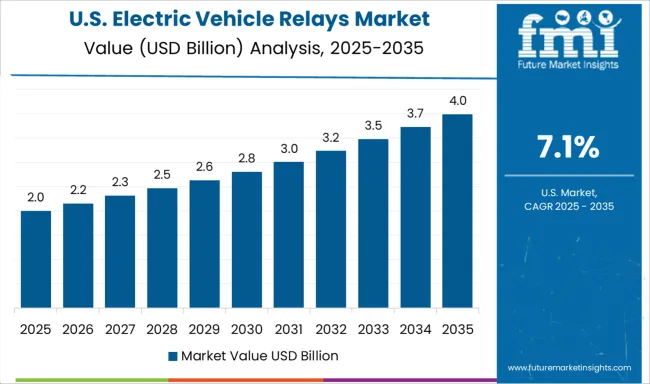

The United States is expected to register a CAGR of 7.1% through 2035, supported by electrification initiatives for passenger cars, light trucks, and commercial vehicles. Federal incentives for EV manufacturing and expansion of high-speed charging corridors are driving relay adoption. USA manufacturers are focusing on introducing solid-state relay technologies to replace conventional mechanical relays in high-performance EVs. Growth in demand for thermal-resistant relay components is evident due to wider operating temperature ranges in advanced EV systems. Strategic collaborations between automakers and relay technology providers are enabling the deployment of innovative switching solutions tailored for North American EV architectures.

The electric vehicle relays market is led by established global manufacturers delivering solutions engineered for high-voltage and high-current requirements across traction systems, battery packs, and charging modules. TE Connectivity dominates through an extensive portfolio of relays featuring advanced arc suppression and thermal stability for 800V systems. Panasonic leverages expertise in automotive electronics to design compact, energy-efficient relays that ensure long service life under high load conditions. Fujitsu specializes in relays offering low contact resistance and strong mechanical endurance, aligning with stringent automotive reliability standards.

Omron Corporation focuses on miniaturized designs and robust insulation performance, serving EV control units and on-board charging infrastructure. Xiamen Hongfa Electroacoustic competes aggressively on pricing and large-scale production, offering cost-effective solutions for emerging EV markets in Asia. Competitive differentiation centers on high-voltage endurance, superior arc control, and compliance with ISO, IEC, and automotive-specific safety norms. Entry barriers include high certification costs, precision engineering needs, and integration complexity with EV power electronics. Strategic priorities involve transitioning toward solid-state relay technologies to enhance reliability and reduce mechanical wear.

Key players are also expanding R&D capabilities to improve thermal management and compatibility with high-capacity battery systems. Partnerships with OEMs for co-development and long-term supply agreements are becoming critical to secure market position. Future competitiveness will depend on innovations enabling compact, lightweight designs with predictive maintenance capabilities, addressing increasing demand for efficiency and performance in the EV ecosystem.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.7 Billion |

| Product | Contactor relay, Relay module, Solid-state, and Mechanical |

| Vehicle | Passenger vehicles and Commercial vehicles |

| Propulsion | Battery Electric Vehicles(BEV), Plug-in Hybrid Electric Vehicles(PHEV), and Hybrid Electric Vehicles(HEV) |

| Application | Battery Management System (BMS), Charging system, Drive system, Thermal management, HVAC system, and Others |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | TE Connectivity, Panasonic, Fujitsu, Omron Corporation, and Xiamen Hongfa Electroacoustic |

The global electric vehicle relays market is estimated to be valued at USD 3.7 billion in 2025.

The market size for the electric vehicle relays market is projected to reach USD 8.3 billion by 2035.

The electric vehicle relays market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in electric vehicle relays market are contactor relay, relay module, solid-state and mechanical.

In terms of vehicle, passenger vehicles segment to command 61.0% share in the electric vehicle relays market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Plastics Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Finance Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Communication Controller Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Cable and Plug Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Formation and Testing Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Range Extender Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Charging Station Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle DC Contactor Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Connector Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Reducer Market Growth - Trends & Forecast 2025 to 2035

Electric Vehicle Insulation Market - Growth & Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA