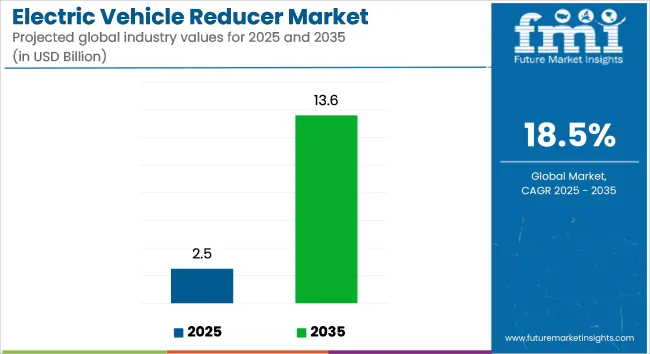

The global electric vehicle reducer market is estimated at USD 2.5 billion in 2025 and is forecast to reach USD 13.6 billion by 2035, expanding at a CAGR of 18.5% during the period. Market expansion is driven by increasing EV adoption, demand for compact e-drive systems, and advancements in reducer efficiency and modularity.

| Attributes | Key Insights |

|---|---|

| Estimated Market Value, 2025 | USD 2.5 billion |

| Projected Market Value, 2035 | USD 13.6 billion |

| Value CAGR (2025 to 2035) | 18.5% |

In March 2024, Punch Powertrain described its EV reducer as essential for matching e-motor output to wheel torque while preserving motor compactness. According to Joris Bronckaers, Engineering Leader EV, “What makes the difference between a good reducer and an exceptional one is the effort you put in it.”

The company reported that its modular reducer design-including TwinSpeed and coaxial solutions-allows vehicle-specific integration, with noise, vibration, harshness (NVH), and efficiency optimised through CFD-based development. Reducer losses were stated to account for roughly one-third of total drivetrain losses, making efficiency gains critical.

Technical trends have centred on reducing NVH and enabling multi-speed transmission options. Coaxial and offset reducer formats have been developed with park-lock features and flexible installation angles. Punch emphasized that modular “tech bricks” can be added within a year to enable multi-speed capability or locking functions for both two-wheel and four-wheel-drive EV applications.

In 2024, Jabil cited shorter product development cycles in automotive electronics as a critical trend. According to Jabil’s market briefing, modular and software-definable EV components-such as reducers-were being integrated into smart assembly platforms to support mass adoption as development lead times shrink.

In August 2024, Ford confirmed that its expanded electrification roadmap would include electric commercial vans and pickup trucks. These vehicles were reported to require compact and efficient e-drive systems, including advanced reducers, and battery sourcing was being aligned to support new model launches from 2026 onward.

Material advances have included the use of high-strength steel and optimized immersion coatings for durability under repeated torque cycles. Lubrication and cooling channels have been included in reducer housings to reduce thermal losses and maintain control under high loads. Reducers for e-LCV and mid-size EVs have been confirmed to utilise lightweight alloy bodies and integrated sealing systems.

Aftermarket and supplier ecosystems have been aligned through digital twin modelling and supplier-portable components. Standardised gear-pitch accuracy modules and production test benches have been deployed to ensure quality and accelerated time to market.

The below table represents the global Electric Vehicle Reducer annual growth rates from 2025 to 2035. In this study, we took into consideration the trend of growth in the industry from January to December but differentiated the first half of the year (H1) with respect to H2 for a given year 2025 against the base year 2024. Stakeholders get a full view of the performance of the sector throughout time, which can also be used to identify potential future trends.

Graphs contain sectoral growth in the first and second halves of 2024 to 2034. Originally forecasted to have an annual growth rate of 26.3% in H1 2024, it seems the proposed switch-over into H2 will deliver a much higher increase in that forecast trend.

| Particulars | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 26.3% |

| H2 (2024 to 2034) | 26.9% |

| H1 (2025 to 2035) | 26.1% |

| H2 (2025 to 2035) | 27.2% |

For the next period, H1 2025 to H2 2025, the CAGR is expected to dip slightly down to 26.1% in first half and pick up some pace at about 27.2% in second half. The sector has seen a 20 BPS dip in the first half (H1), but there was a marginal gain of 30 BPS recorded for this sector in the second half (H2).

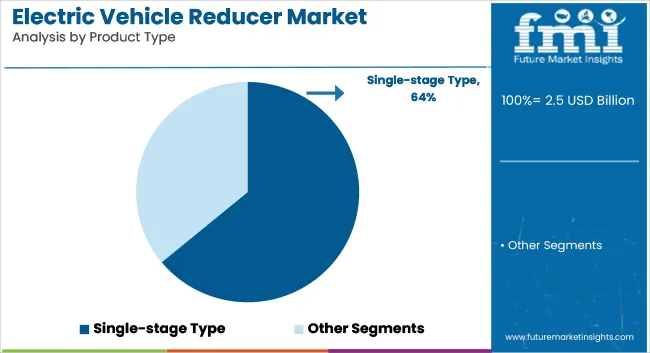

Single-stage reducers are estimated to account for nearly 64% of the global electric vehicle reducer market in 2025 and are projected to grow at a CAGR of 18.7% through 2035. Their dominance is driven by simple architecture, low weight, and suitability for high-speed electric drivetrains that require efficient torque delivery with minimal mechanical losses. In 2025, single-stage designs are widely integrated into compact and mid-sized Battery Electric Vehicles (BEVs), offering benefits in terms of assembly cost, drivetrain compactness, and energy conversion efficiency.

Automakers favor these systems in front- and rear-wheel drive architectures due to reduced gear meshing, lower noise, and minimal maintenance. Suppliers continue to innovate in gear material selection, lubrication design, and integration with e-axle modules to enhance power density and thermal management.

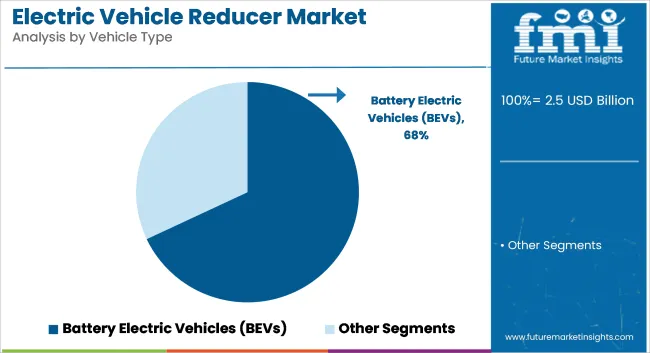

BEVs are projected to account for approximately 68% of the global EV reducer market share in 2025 and are expected to grow at a CAGR of 18.9% through 2035. This growth is fueled by rising global EV adoption, supported by zero-emission mandates, subsidies, and expanding charging infrastructure.

In BEVs, reducers play a critical role in matching electric motor speed to wheel torque while enabling smooth acceleration and regenerative braking. In 2025, most OEMs deploy single- or multi-stage reducer systems based on platform power ratings and driving profiles, with a focus on noise reduction, efficiency, and weight minimization. As BEV penetration accelerates across China, Europe, and North America, the demand for integrated, high-efficiency reducer assemblies is expected to remain a central component in electric powertrain architecture.

Growing Focus on Lightweight EV Components

Lightweight components for electric vehicles are under full swing push. The companies look forward to efficiency of vehicles as well as reduction in the impact on the environment.

Lightweight composites and high-strength aluminum replace many critical parts such as reducers instead of the conventional steel and iron. This will not only improve energy efficiency but also lengthen the lifespan of the batteries, making electric vehicles more comparable to internal combustion engine vehicles.

The lightweight designs go hand-in-hand with the overall global goals toward sustainability. Introducing advanced materials in reducers for EVs means a significant reduction in weight and energy consumption in the whole automobile system.

It can be very distinctly observed in areas like Europe and North America, where stringent emission standards create an urge among car manufacturers to develop something new and innovative.

Surge in Multi-Stage Reducer Adoption

Multi-stage reducers are now emerging as the preferred choice in the EV sales because they ensure seamless torque and speed transitions without the use of clutches. It is especially a very vital component for high-performance EVs and PHEVs because it creates greater efficiency and smoother operation under different load conditions.

This segment will be dominated by innovations that eliminate torque interruptions and enhance driving comfort. As EV manufacturers continue to focus on improving drivetrain efficiency, multi-stage reducers will lead the sales, capturing over 68% of the global share.

Their versatility across different EV platforms further enhances their adoption, especially in countries with high penetration of EVs like China and the United States.

Investments in Charging Infrastructure Boost Reducer Demand

The electric vehicle reducer sales growth is following the growth in the global provision of EV charging infrastructure. Increased demand for electrification is increasingly seen in North America and particularly Asia-Pacific areas.

Governments along with private business investments are majorly investing their capital in various networks of charging centers, which encourages widespread adoption in broader terms in this sector, giving further impetus to the sales of reducers.

Range anxiety will also be minimized with better charging infrastructure, promoting more consumers to switch to EVs. Once charging solutions improve and become accessible, manufacturers can expect more sales, thus giving a good platform for the wide spread of advanced reducers for high-performance and energy-efficient EVs.

Technological Advancements in Reducer Design

Continuously developing designs of reducers becomes one significant driver for sales growth. The modern reducer ranges from high-efficiency materials that use low friction coatings along with durable composite to prevent wear and tear. This now extends the life span of reducers and allows it to reduce maintenance costs while improving overall performance of the vehicle.

Electric drive train systems are now increasingly using modular designs to make easy manufacturing and scalability of the system across multiple electric vehicle models.

This design will make reducers even more versatile, cost-effective, and reliable. Addressing performance-related challenges while aligning with the environmental objectives and making reducers part of the electric vehicle future of tomorrow.

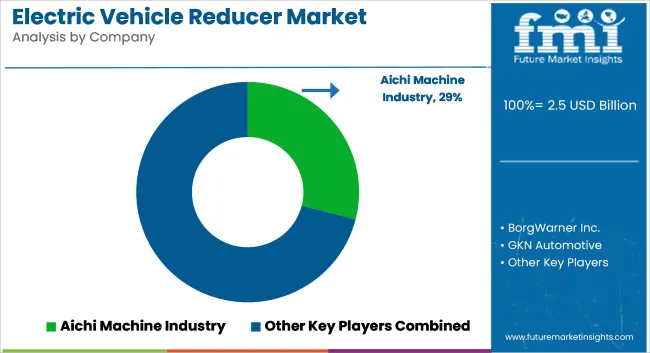

The global Electric Vehicle Reducer sales has a moderate-to-high sales concentration among the top five players, which are classified as Tier 1 companies. These Tier 1 Companies-BorgWarner Inc., Robert Bosch GmbH, ZF Friedrichshafen AG, GKN Automotive, and Magna International-account for about 20-30% share.

These players enjoy over USD 200 million of annual sales revenue from the business of Electric Vehicle Reducer due to excellent R&D capability, global production networks, and strategic collaborations with world's leading electric vehicle companies.

Their strength has been further sustained by their capacity to provide highly efficient, lightweight, and compact reducers that match the increasing trend in electric vehicles worldwide, especially across high-growth regions like North America, Europe, and Asia-Pacific.

Tier 2 companies include HOTA Industrial, Aichi Machine Industry, and SAGW (SAIC General Motors). They are medium-sized players with annual revenues between USD 10-200 million. These firms are cost-effective in manufacturing and sell to regional sales or specific OEM partnerships.

Although they do not have the massive global presence and innovation pipelines of Tier 1 companies, Tier 2 players capitalize on the economies of scale of high-volume manufacturing and strong local partnerships with regional OEMs. Market share is also highly diversified. This class is gaining significant ground in developing countries and middle-of-the-range EV brands.

Tier 3 companies, including smaller manufacturers and niche players, generate annual revenues below USD 10 million. They primarily serve local industry or niche applications, and they are usually low-cost or customized solutions. They have minimal shares, but as a whole they do contribute to the competition in the industry.

However, the growth potential is not much because the R&D budget is low, and the production capacities are small, along with high price competition. In the growing global EV sales, most Tier 3 companies are finding it difficult to scale up or compete with major players, thus paving the way for consolidation trends.

The electric vehicle reducer sales is currently dominated by East Asia, driven by its strong EV manufacturing base in China, South Korea, and Japan market. However, South Asia and the Pacific are poised for the highest growth, fueled by rising EV adoption, government incentives, and expanding production capabilities in India and Southeast Asia. Europe also holds a significant share with sustained growth potential.

| Countries | CAGR 2025 to 2035 |

|---|---|

| Kingdom of Saudi Arabia | 27.1% |

| Brazil | 26.8% |

| Turkiye | 26.5% |

| South Korea | 26.2% |

| Mexico | 26.0% |

The electric vehicle (EV) ecosystem in the United States market is growing fast, and as such, Electric Vehicle Reducers have gained importance in that sales. With tax credits and subsidies at the federal and state level, consumers have been nudged into adopting EVs.

Moreover, investments by companies like Electrify America in the expansion of EV charging infrastructure are helping alleviate range anxiety, which is a major concern for consumers, and thereby increasing EV sales. All these developments are leading to high demand for reducers as the producers of automobiles mass-produce high-performance EVs to meet sales demand.

China is the world's largest EV sales and is witnessing unparalleled growth in demand for Electric Vehicle Reducers as consumers grow more aware of them and start adopting EVs. Aggressive policies from the government, like offering subsidies as well as mandates for EV production, have made EVs accessible to the average consumer.

Strong local presence of automakers and advanced battery technologies accelerate the adoption of products. China continues to be critical to the global Electric Vehicle Reducer sales, as almost 45% of the global EV sales are originating from this country.

India is developing as a high-growth sale, mainly influenced by the heightened awareness of producers about the opportunities for EV production. Government-lead initiatives in the form of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme are accelerating investment in EV production.

The opening of local production bases and provision of production-linked incentives for local battery and drivetrain component sourcing is encouraging homegrown innovation. This is leading to a substantially increasing demand for Electric Vehicle Reducers in India.

The Electric Vehicle Reducer Market is highly dynamic and has been influenced by the growing adoption of EVs, technological advancement, and strict environmental regulations.

It is undergoing huge developments in terms of innovation for performance, durability, and efficiency of reducers as manufacturers are investing heavily in R&D in order to incorporate lightweight materials and advanced technologies like multi-speed gearboxes to meet the increasing demand for high-performance EVs.

Competitors are adopting partnerships, acquisitions, and collaboration to gain strengths in the markets. BorgWarner Inc., Robert Bosch GmbH, and ZF Friedrichshafen AG leading companies are designing next-generation reducers optimized for most EV platforms so that torque delivery becomes seamless and the energy consumption rate is minimized. Startups and regional players have also gained pace by offering locally relevant cost-effective solutions.

Market Sizing The markets are further fueled by strategic activities such as regional manufacturing facilities, joint ventures with automobile companies, and investments into EV startups as a way to expand its worldwide presence.

Some examples include that ZF Friedrichshafen AG has developed the 800V electric drive axle, and BorgWarner, in partnership with Hyundai, developed integrated drive modules. All this shows how very competitive and hard-pressured the Electric Vehicle Reducer market becomes in this journey of creating and defining the emerging ecosystems in the electric vehicles.

Industry Updates

Based on product type the segment is divided into single-stage type, and multi-stage type.

Based on vehicle typee the segment is divided into Battery Electric Vehicles (BEVs), Plug-In Hybrid Electric Vehicles (PHEVs), Hybrid Electric Vehicles (HEVs), and Fuel Cell Electric Vehicle.

Based on sales channel the segment is divided into Original Equipment Manufacturer (OEM), Aftermarket.

Regions considered in the study include North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and the Middle East and Africa.

The global market was valued at USD 997.1 million in 2020.

The global market is set to reach USD 2.5 billion in 2025.

Global demand is anticipated to rise at 26.6% CAGR.

The industry is projected to reach USD 13.6 billion by 2035.

Multi-stage type segment dominates in terms of share.

Table 1: Global Market Value (US$ million) Forecast by Region, 2017 to 2032

Table 2: Global Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 3: Global Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 4: North America Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 5: North America Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 6: North America Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 7: Latin America Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 8: Latin America Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 9: Latin America Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 10: Europe Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 11: Europe Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 12: Europe Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 13: South Asia Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 14: South Asia Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 15: South Asia Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 16: East Asia Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 17: East Asia Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 18: East Asia Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 19: Oceania Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 20: Oceania Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 21: Oceania Market Value (US$ million) Forecast by Application, 2017 to 2032

Table 22: MEA Market Value (US$ million) Forecast by Country, 2017 to 2032

Table 23: MEA Market Value (US$ million) Forecast by Type, 2017 to 2032

Table 24: MEA Market Value (US$ million) Forecast by Application, 2017 to 2032

Figure 1: Global Market Value (US$ million) by Type, 2022 to 2032

Figure 2: Global Market Value (US$ million) by Application, 2022 to 2032

Figure 3: Global Market Value (US$ million) by Region, 2022 to 2032

Figure 4: Global Market Value (US$ million) Analysis by Region, 2017 to 2032

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 7: Global Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 8: Global Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 9: Global Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 10: Global Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 11: Global Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 13: Global Market Attractiveness by Type, 2022 to 2032

Figure 14: Global Market Attractiveness by Application, 2022 to 2032

Figure 15: Global Market Attractiveness by Region, 2022 to 2032

Figure 16: North America Market Value (US$ million) by Type, 2022 to 2032

Figure 17: North America Market Value (US$ million) by Application, 2022 to 2032

Figure 18: North America Market Value (US$ million) by Country, 2022 to 2032

Figure 19: North America Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 22: North America Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 23: North America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 24: North America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 25: North America Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 26: North America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 28: North America Market Attractiveness by Type, 2022 to 2032

Figure 29: North America Market Attractiveness by Application, 2022 to 2032

Figure 30: North America Market Attractiveness by Country, 2022 to 2032

Figure 31: Latin America Market Value (US$ million) by Type, 2022 to 2032

Figure 32: Latin America Market Value (US$ million) by Application, 2022 to 2032

Figure 33: Latin America Market Value (US$ million) by Country, 2022 to 2032

Figure 34: Latin America Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 37: Latin America Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 40: Latin America Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 43: Latin America Market Attractiveness by Type, 2022 to 2032

Figure 44: Latin America Market Attractiveness by Application, 2022 to 2032

Figure 45: Latin America Market Attractiveness by Country, 2022 to 2032

Figure 46: Europe Market Value (US$ million) by Type, 2022 to 2032

Figure 47: Europe Market Value (US$ million) by Application, 2022 to 2032

Figure 48: Europe Market Value (US$ million) by Country, 2022 to 2032

Figure 49: Europe Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 52: Europe Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 53: Europe Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 55: Europe Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 56: Europe Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 57: Europe Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 58: Europe Market Attractiveness by Type, 2022 to 2032

Figure 59: Europe Market Attractiveness by Application, 2022 to 2032

Figure 60: Europe Market Attractiveness by Country, 2022 to 2032

Figure 61: South Asia Market Value (US$ million) by Type, 2022 to 2032

Figure 62: South Asia Market Value (US$ million) by Application, 2022 to 2032

Figure 63: South Asia Market Value (US$ million) by Country, 2022 to 2032

Figure 64: South Asia Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 65: South Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 66: South Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 67: South Asia Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 68: South Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 69: South Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 70: South Asia Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 71: South Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 72: South Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 73: South Asia Market Attractiveness by Type, 2022 to 2032

Figure 74: South Asia Market Attractiveness by Application, 2022 to 2032

Figure 75: South Asia Market Attractiveness by Country, 2022 to 2032

Figure 76: East Asia Market Value (US$ million) by Type, 2022 to 2032

Figure 77: East Asia Market Value (US$ million) by Application, 2022 to 2032

Figure 78: East Asia Market Value (US$ million) by Country, 2022 to 2032

Figure 79: East Asia Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 80: East Asia Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 81: East Asia Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 82: East Asia Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 83: East Asia Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 84: East Asia Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 85: East Asia Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 86: East Asia Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: East Asia Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: East Asia Market Attractiveness by Type, 2022 to 2032

Figure 89: East Asia Market Attractiveness by Application, 2022 to 2032

Figure 90: East Asia Market Attractiveness by Country, 2022 to 2032

Figure 91: Oceania Market Value (US$ million) by Type, 2022 to 2032

Figure 92: Oceania Market Value (US$ million) by Application, 2022 to 2032

Figure 93: Oceania Market Value (US$ million) by Country, 2022 to 2032

Figure 94: Oceania Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 95: Oceania Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 96: Oceania Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 97: Oceania Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 98: Oceania Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 99: Oceania Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 100: Oceania Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 101: Oceania Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 102: Oceania Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 103: Oceania Market Attractiveness by Type, 2022 to 2032

Figure 104: Oceania Market Attractiveness by Application, 2022 to 2032

Figure 105: Oceania Market Attractiveness by Country, 2022 to 2032

Figure 106: MEA Market Value (US$ million) by Type, 2022 to 2032

Figure 107: MEA Market Value (US$ million) by Application, 2022 to 2032

Figure 108: MEA Market Value (US$ million) by Country, 2022 to 2032

Figure 109: MEA Market Value (US$ million) Analysis by Country, 2017 to 2032

Figure 110: MEA Market Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 111: MEA Market Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 112: MEA Market Value (US$ million) Analysis by Type, 2017 to 2032

Figure 113: MEA Market Value Share (%) and BPS Analysis by Type, 2022 to 2032

Figure 114: MEA Market Y-o-Y Growth (%) Projections by Type, 2022 to 2032

Figure 115: MEA Market Value (US$ million) Analysis by Application, 2017 to 2032

Figure 116: MEA Market Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 117: MEA Market Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 118: MEA Market Attractiveness by Type, 2022 to 2032

Figure 119: MEA Market Attractiveness by Application, 2022 to 2032

Figure 120: MEA Market Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Electric Vehicle Reducer Market Growth – Innovations, Trends & Forecast 2025-2035

USA Electric Vehicle Reducer Market Outlook – Share, Growth & Forecast 2025-2035

Japan Electric Vehicle Reducer Market Analysis – Growth, Applications & Outlook 2025-2035

ASEAN Electric Vehicle (EV) Reducer Market Analysis – Demand, Growth & Forecast 2025-2035

Germany Electric Vehicle (EV) Reducer Market Trends – Size, Share & Growth 2025-2035

Electric Traction Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA