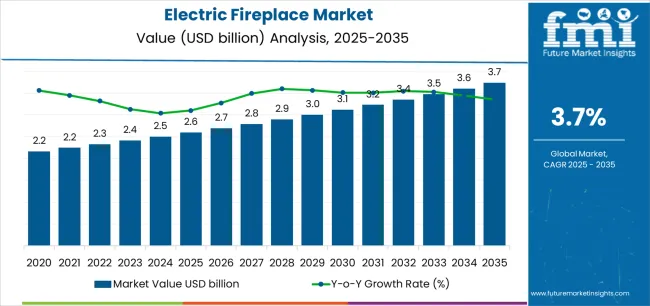

The global electric fireplace market is valued at USD 2.6 billion in 2025. It is slated to reach USD 3.7 billion by 2035, recording an absolute increase of USD 1.1 billion over the forecast period. This translates into a total growth of 42.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2035. The overall market size is expected to grow by nearly 1.4X during the same period, supported by increasing demand for energy-efficient and vent-free heating solutions in urban residential developments, growing adoption of smart home-integrated electric fireplaces with advanced control features, expanding home renovation and remodeling activities in established housing markets, and rising emphasis on safe and convenient supplemental heating alternatives across residential apartments, single-family homes, and commercial hospitality applications.

Between 2025 and 2030, the electric fireplace market is projected to expand from USD 2.6 billion to USD 3.1 billion, resulting in a value increase of USD 0.5 billion, which represents 45.5% of the total forecast growth for the decade. This phase of development will be shaped by increasing urban housing construction requiring vent-free heating solutions, rising adoption of smart home connectivity and remote control features, and growing demand for space-efficient wall-mounted designs in apartment renovations and multi-family residential developments. Home improvement retailers and specialty dealers are expanding their electric fireplace product offerings to address the growing demand for convenient and aesthetic heating solutions that ensure installation flexibility and design versatility.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 2.6 billion |

| Forecast Value in (2035F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 3.7% |

From 2030 to 2035, the market is forecast to grow from USD 3.1 billion to USD 3.7 billion, adding another USD 0.6 billion, which constitutes 54.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of smart home ecosystem integration and voice-controlled heating systems, the development of ultra-realistic flame technology and customizable ambient lighting features, and the growth of specialized applications for outdoor living spaces and commercial hospitality installations. The growing adoption of energy-efficient zone heating strategies and building code preferences for electric heating will drive demand for electric fireplaces with enhanced visual realism and intelligent temperature control features.

Between 2020 and 2025, the electric fireplace market experienced steady growth, driven by increasing residential renovation activities and growing recognition of electric fireplaces as practical heating and design elements for enhancing interior aesthetics and providing supplemental warmth in diverse residential and light commercial applications. The market developed as homeowners and interior designers recognized the potential for electric fireplace technology to deliver realistic flame effects, eliminate venting requirements, and support flexible installation options while meeting safety standards and energy efficiency expectations. Technological advancement in LED flame simulation and heating element efficiency began emphasizing the critical importance of maintaining visual authenticity and user-friendly operation in residential environments.

Market expansion is being supported by the increasing global preference for vent-free heating solutions driven by urban apartment construction trends and building code restrictions on traditional chimney installations, alongside the corresponding need for supplemental heating systems that can provide zone heating capabilities, enhance interior design aesthetics, and maintain operational convenience across residential apartments, single-family homes, condominiums, and boutique hospitality applications. Modern homeowners and property developers are increasingly focused on implementing electric fireplace solutions that can deliver realistic flame effects, provide flexible installation options, and offer consistent heating performance without requiring extensive renovation or ventilation infrastructure.

The growing emphasis on smart home integration and connected heating systems is driving demand for electric fireplaces that can support mobile app control, enable voice assistant compatibility, and ensure comprehensive scheduling and temperature management features. Homeowners' preference for heating solutions that combine visual appeal with operational simplicity and energy efficiency is creating opportunities for innovative wall-mounted and built-in electric fireplace implementations. The rising influence of home renovation activities and multi-family residential construction is also contributing to increased adoption of electric fireplaces that can provide superior installation flexibility without compromising safety standards or design possibilities.

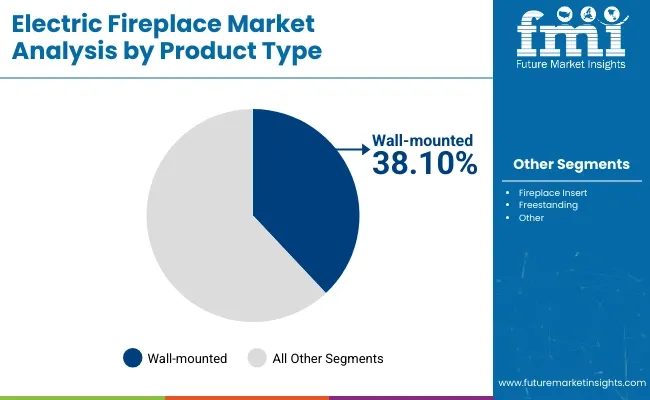

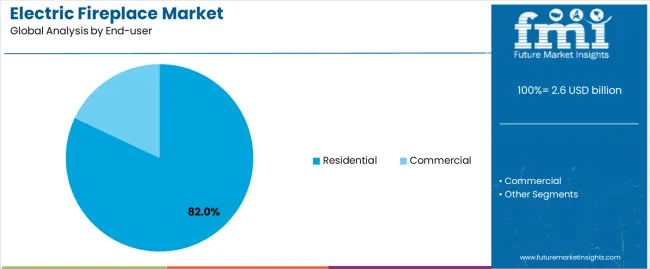

The market is segmented by product type, installation location, end-user category, sales channel, and size specifications. By product type, the market is divided into wall-mounted, built-in, fireplace inserts, and freestanding models. Based on installation location, the market is categorized into indoor and outdoor applications. By end-user, the market is segmented into residential and commercial applications, with residential further divided into fixed and portable configurations. By sales channel, the market includes indirect channels comprising dealers and online platforms, and direct sales channels. By size for wall-mounted units, the market is classified into 45-60 inches, 30-45 inches, greater than 60 inches, and 30 inches or less categories.

The wall-mounted electric fireplace segment is projected to maintain its leading position in the electric fireplace market in 2025 with a 38.1% market share, reaffirming its role as the preferred product category for space-efficient installations and modern interior design applications. Homeowners and property developers increasingly utilize wall-mounted electric fireplaces for their superior space optimization characteristics, streamlined installation procedures, and proven effectiveness in delivering visual impact while providing supplemental heating in urban apartments and contemporary home designs. Wall-mounted technology's proven effectiveness and installation versatility directly address the market requirements for vent-free heating solutions and design flexibility across diverse residential floor plans and room configurations.

This product segment forms the foundation of modern electric fireplace adoption, as it represents the configuration with the greatest contribution to space efficiency and established appeal across multiple residential application scenarios and property types. Real estate development investments in contemporary apartment buildings continue to strengthen adoption among builders and interior designers. With urban housing emphasizing efficient space utilization and installation simplicity, wall-mounted electric fireplaces align with both aesthetic objectives and practical heating requirements, making them the central component of comprehensive residential heating and design strategies.

The residential end-user segment is projected to maintain its leading position in the electric fireplace market in 2025 with a 82% market share, reflecting its critical role in serving homeowners seeking supplemental heating and aesthetic enhancement solutions. Residential consumers prefer electric fireplaces due to installation convenience, operational safety advantages compared to traditional wood or gas fireplaces, and design flexibility enabling placement in locations unsuitable for conventional fireplace installations. Within the residential segment, fixed installations command 64% share while portable units represent 36%, demonstrating diverse consumer preferences for permanent design features versus movable heating appliances.

This end-user segment represents the foundation of electric fireplace market demand as homeowners increasingly recognize the value proposition of vent-free heating combined with realistic flame effects and minimal maintenance requirements. Residential renovation trends and home improvement spending continue driving adoption among existing homeowners and new construction buyers. With housing markets emphasizing energy efficiency and flexible living spaces, residential electric fireplaces align with both practical heating needs and interior design aspirations across diverse property types and price segments.

The indirect sales channel segment is projected to represent the largest share of electric fireplace distribution in 2025 with a 72% market share, emphasizing the continued importance of retail intermediaries in product selection and customer service. Within indirect channels, dealer networks command 46% share while online platforms represent 26%, reflecting evolving consumer purchasing behaviors balancing in-person product evaluation with digital convenience. Direct sales channels represent 28% of market distribution, primarily serving commercial customers and custom installation projects requiring specialized product configurations.

The indirect channel segment benefits from established dealer relationships providing installation services, product demonstrations, and after-sales support that enhance customer confidence and purchasing decisions. Physical dealers enable customers to evaluate flame effects, assess build quality, and receive professional installation recommendations, while online channels offer broader product selection and competitive pricing for self-installation buyers. As retail evolves toward omnichannel strategies, indirect distribution will maintain market leadership while adapting to digital integration and enhanced customer experience expectations.

Among wall-mounted electric fireplace size categories, the 45-60 inches segment is projected to lead with a 34% share in 2025, reflecting consumer preference for statement-piece dimensions that provide visual impact in primary living spaces. The 30-45 inches segment follows with 31% share, serving smaller rooms and secondary spaces, while units exceeding 60 inches command 19% catering to large rooms and commercial installations. Compact models of 30 inches or less represent 16%, addressing niche applications in bedrooms, offices, and tight installation locations.

The 45-60 inches size category represents the optimal balance between visual presence and residential wall space availability, making these dimensions particularly popular for living room focal points and master bedroom installations. This size range provides sufficient heating output for typical residential rooms while maintaining proportional aesthetics relative to standard furniture arrangements and wall dimensions. Consumer preferences for impressive visual scale without overwhelming room proportions position this size category as the market-leading segment for wall-mounted electric fireplace installations.

The electric fireplace market is advancing steadily due to increasing demand for vent-free supplemental heating solutions driven by urban housing density and building code restrictions, and growing adoption of smart home-connected heating appliances providing enhanced convenience and energy management capabilities across residential apartments, single-family homes, and boutique commercial applications. However, the market faces challenges, including competition from alternative heating solutions such as heat pumps and radiant systems, higher initial costs compared to portable space heaters, and market perception challenges regarding heating capacity and operational costs relative to central heating systems. Innovation in flame effect realism and smart connectivity features continues to influence product development and market expansion patterns.

The growing construction of urban apartment buildings and condominium developments is driving demand for electric fireplace solutions that address space constraints and building code restrictions prohibiting traditional gas or wood-burning fireplaces in multi-family residential structures. Modern urban housing requires supplemental heating systems that deliver aesthetic appeal and zone heating capabilities while eliminating venting infrastructure and simplifying installation processes. Property developers and homeowners are increasingly recognizing the competitive advantages of electric fireplace integration for residential differentiation and living comfort enhancement, creating opportunities for innovative wall-mounted and built-in designs specifically optimized for compact urban living spaces.

Modern electric fireplace manufacturers are incorporating smart home connectivity and mobile app control features to enhance user experience, enable remote operation, and support comprehensive home automation integration through Wi-Fi connectivity and voice assistant compatibility. Leading manufacturers are developing products with programmable thermostats, implementing smartphone control applications, and advancing connectivity features that enable scheduling, temperature monitoring, and energy consumption tracking. These technologies improve operational convenience while enabling new value propositions, including voice-controlled ambiance adjustment, automated temperature management, and integration with whole-home energy management systems. Advanced smart home integration also allows manufacturers to support comprehensive connected living objectives and product differentiation beyond traditional heating performance attributes.

The advancement of LED flame simulation technology and multi-color lighting systems is driving product innovation with increasingly realistic flame effects that replicate natural wood-burning fire characteristics and visual depth. These enhanced visual technologies require sophisticated LED arrangements with multiple brightness levels, adjustable flame speeds, and customizable color palettes that exceed basic heating appliance expectations, creating premium product segments with differentiated aesthetic value propositions. Manufacturers are investing in advanced optical engineering and lighting design capabilities to deliver cinema-quality flame effects while supporting customization features for ember bed colors, flame intensity variations, and ambient lighting preferences that enable personalized interior atmospheres.

| Country | CAGR (2025-2035) |

|---|---|

| China | 4.7% |

| Japan | 4.1% |

| Germany | 3.9% |

| United States | 3.4% |

| United Kingdom | 3.3% |

| Canada | 3.2% |

| Spain | 3.1% |

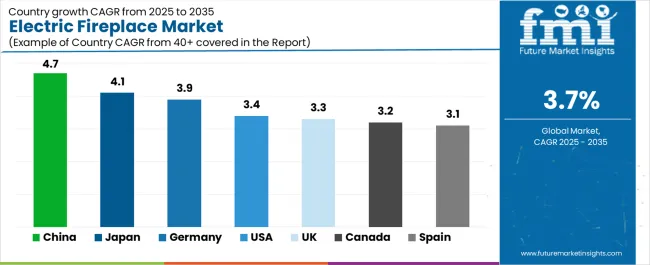

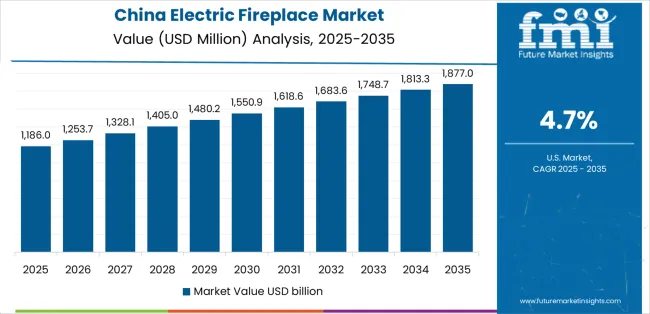

The electric fireplace market is experiencing solid growth globally, with China leading at a 4.7% CAGR through 2035, driven by large urban housing construction projects and growing preference for smart and connected heating solutions in new apartment developments. Japan follows at 4.1%, supported by aging housing stock retrofit requirements and premium market demand for safe, vent-free supplemental heating systems. Germany shows growth at 3.9%, emphasizing residential energy efficiency retrofits under national and European Union programs and adoption of low-emission alternatives to traditional wood and gas fireplaces.

The United States demonstrates 3.4% growth, supported by zone heating adoption with smart home integration and remodeling activity in single-family residential properties. The United Kingdom records 3.3%, focusing on urban apartment and new-build developments where flue restrictions favor electric heating solutions. Canada exhibits 3.2% growth, emphasizing supplemental heating in multi-residential buildings and tighter building codes steering toward electric heating alternatives. Spain shows 3.1% growth, supported by home improvement activities in apartments and holiday rental properties with compact wall-mounted unit preferences.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from electric fireplaces in China is projected to exhibit exceptional growth with a CAGR of 4.7% through 2035, driven by large-scale urban housing construction programs and rapidly growing consumer preference for smart and connected heating solutions in new apartment developments supported by rising middle-class living standards and urban modernization initiatives. The country's massive residential construction scale and increasing adoption of premium home appliances are creating substantial demand for electric fireplace solutions. Major appliance manufacturers and international brands are establishing comprehensive production and distribution capabilities to serve both domestic urban markets and export opportunities.

Revenue from electric fireplaces in Japan is expanding at a CAGR of 4.1%, supported by the country's aging housing stock requiring heating system upgrades and strong consumer preference for safe, vent-free supplemental heating solutions addressing earthquake safety concerns and compact living environments. The nation's technological sophistication and quality standards are driving demand for premium electric fireplace products throughout residential renovation sectors. Leading appliance manufacturers and specialty retailers are establishing extensive product offerings and customer service capabilities to address growing replacement and upgrade demand.

Revenue from electric fireplaces in Germany is expanding at a CAGR of 3.9%, driven by comprehensive residential energy efficiency retrofit programs under national and European Union climate initiatives and growing adoption of low-emission heating alternatives to traditional wood-burning and gas fireplace systems. Germany's environmental commitment and building efficiency standards are driving sophisticated electric heating solutions throughout residential sectors. Leading home improvement retailers and specialty fireplace dealers are establishing comprehensive product portfolios incorporating energy-efficient electric fireplace technologies.

Revenue from electric fireplaces in the United States is expanding at a CAGR of 3.4%, supported by growing zone heating adoption strategies that reduce whole-home heating costs through targeted room heating combined with smart home integration capabilities, and continuing residential remodeling activities in single-family housing markets. The nation's established home improvement retail infrastructure and smart home technology penetration are driving demand for connected electric fireplace solutions. Major retailers and specialty dealers are investing in product selection expansion and customer education programs to serve both new construction and renovation markets.

Revenue from electric fireplaces in the United Kingdom is expanding at a CAGR of 3.3%, supported by urban apartment and new-build residential developments where building regulations and flue installation restrictions in dense urban cores favor electric heating solutions over gas and wood-burning alternatives. The nation's urban housing density and regulatory environment are driving demand for vent-free electric fireplace options. Property developers and interior design professionals are increasingly specifying electric fireplaces for urban residential projects.

Revenue from electric fireplaces in Canada is expanding at a CAGR of 3.2%, supported by supplemental heating requirements in multi-residential buildings addressing cold climate comfort needs and evolving building codes emphasizing energy efficiency and steering construction toward electric heating systems over fossil fuel alternatives. The nation's climate conditions and environmental policy direction are driving demand for supplemental electric heating solutions. Residential developers and retrofit specialists are investing in electric fireplace installations to enhance comfort and meet efficiency standards.

Revenue from electric fireplaces in Spain is growing at a CAGR of 3.1%, driven by expanding home improvement activities in apartment properties and holiday rental accommodations with growing preference for compact wall-mounted units that provide heating flexibility and visual appeal without requiring extensive installation modifications. Spain's tourism-oriented property market and urban apartment renovations are supporting investment in electric fireplace technologies. Home improvement retailers and online marketplaces are establishing comprehensive distribution channels incorporating diverse product offerings.

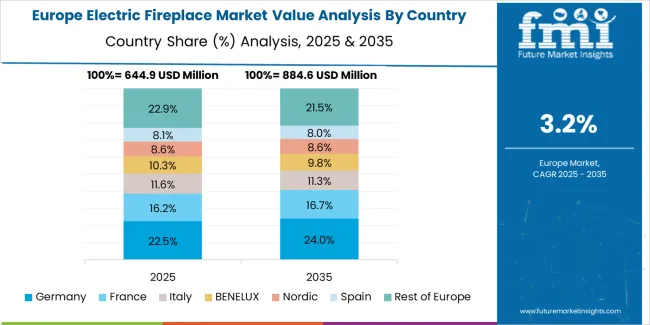

The electric fireplace market in Europe is projected to grow from approximately USD 0.6 billion in 2025 to USD 0.9 billion by 2035, registering a CAGR of approximately 3.8% over the forecast period. Germany is expected to maintain leadership with approximately 22% market share in 2025, supported by residential energy efficiency retrofit programs, emission regulations favoring electric alternatives, and premium product preferences.

The United Kingdom follows with approximately 18% market share in 2025, driven by urban apartment construction activity, building code restrictions on flue installations, and new-build residential developments. France holds approximately 16% market share in 2025, supported by home renovation activities and supplemental heating adoption. Italy commands approximately 12% in 2025, driven by residential modernization and interior design trends.

Spain accounts for approximately 10% in 2025, supported by tourism accommodation upgrades and apartment renovations. The Nordic region maintains approximately 12% in 2025, reflecting premium product adoption and supplemental heating preferences in cold climates. The Benelux region accounts for approximately 6% in 2025, supported by compact urban housing and energy-efficient heating preferences. The Rest of Europe region holds approximately 4% in 2025, reflecting emerging adoption in Central and Eastern European markets with growing home improvement activities.

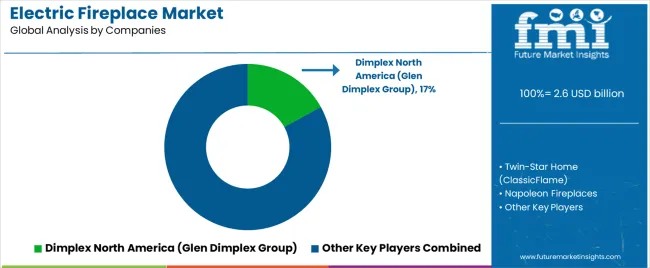

The electric fireplace market is characterized by competition among established home comfort brands, specialized fireplace manufacturers, and emerging smart home appliance companies. Companies are investing in flame effect technology development, smart connectivity integration, product design innovation, and distribution channel expansion to deliver realistic, convenient, and aesthetically appealing electric fireplace solutions. Innovation in LED flame simulation systems, voice-controlled operation features, and customizable aesthetic options is central to strengthening market position and competitive advantage.

Dimplex North America, part of Glen Dimplex Group, leads the market with a 17% share, offering comprehensive electric fireplace solutions with a focus on realistic flame technologies, diverse product configurations, and smart home integration capabilities across residential and light commercial applications. The company launched its Revillusion 2 series featuring enhanced flame effect technology and smart home integration capabilities in May 2024, demonstrating continued commitment to visual realism advancement and connected home compatibility. Twin-Star Home provides innovative electric fireplace products under the ClassicFlame brand with emphasis on contemporary designs and media console integration solutions.

Napoleon Fireplaces delivers comprehensive electric and gas fireplace products with focus on premium quality and design versatility, having announced construction of a new manufacturing facility in Mexico to serve North American markets with targeted operational commencement in 2025. Real Flame offers traditional and contemporary electric fireplace designs with emphasis on realistic flame effects and furniture-quality construction. Duraflame Inc. specializes in accessible electric fireplace products with strong retail distribution and consumer brand recognition. GHP Group Inc. provides diverse home comfort products including electric fireplace offerings. Modern Flames focuses on contemporary linear electric fireplace designs with advanced flame technology. Amantii Electric Fireplaces emphasizes modern architectural designs and commercial-grade installations. BFM Europe Ltd. offers European market electric fireplace solutions. Montigo provides premium electric and gas fireplace products. Touchstone Home Products specializes in wall-mounted electric fireplaces, having introduced the Sideline Infinity three-sided wall-mount line with adjustable heating and smart control features in January 2024.

Electric fireplaces represent a growing home comfort and design segment within residential and light commercial applications, projected to grow from USD 2.6 billion in 2025 to USD 3.7 billion by 2035 at a 3.7% CAGR. These versatile heating and aesthetic products-primarily wall-mounted, built-in, insert, and freestanding configurations-serve as supplemental heating sources and interior design focal points in apartments, single-family homes, condominiums, and boutique commercial spaces where installation flexibility, operational safety, and visual appeal are essential. Market expansion is driven by increasing urban housing density favoring vent-free solutions, growing smart home technology adoption, expanding residential renovation activities, and rising preference for low-maintenance heating alternatives across residential and hospitality sectors.

How Building Code Authorities and Safety Regulators Could Strengthen Product Standards and Installation Guidelines?

How Industry Associations and Retail Organizations Could Advance Product Education and Market Development?

How Electric Fireplace Manufacturers Could Drive Innovation and Market Leadership?

How Homeowners and Commercial Property Operators Could Optimize Product Selection and Utilization?

How Interior Designers and Building Professionals Could Enable Market Expansion?

How Retailers and Distribution Partners Could Strengthen Market Presence?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 2.6 Billion |

| Product Type | Wall-mounted, Built-in, Fireplace Inserts, Freestanding |

| Installation | Indoor, Outdoor |

| End-user | Residential, Commercial |

| Sales Channel | Indirect, Direct |

| Size | 45-60 inches, 30-45 inches, Greater than 60 inches, 30 inches or less |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, Germany, United Kingdom, Japan, Canada, Spain, and 40+ countries |

| Key Companies Profiled | Dimplex North America, Twin-Star Home, Napoleon Fireplaces, Real Flame, Duraflame Inc., Modern Flames |

| Additional Attributes | Dollar sales by product type, installation, end-user, and sales channel categories, regional demand trends, competitive landscape, technological advancements in flame simulation, smart home integration, design innovation, and energy efficiency optimization |

The global electric fireplace market is estimated to be valued at USD 2.6 billion in 2025.

The market size for the electric fireplace market is projected to reach USD 3.7 billion by 2035.

The electric fireplace market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in electric fireplace market are wall-mounted, built-in, fireplace inserts and freestanding.

In terms of end-user, residential segment to command 82.0% share in the electric fireplace market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electric Light Commercial Vehicle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Fluid Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle E-Axle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle On-Board Charger Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA