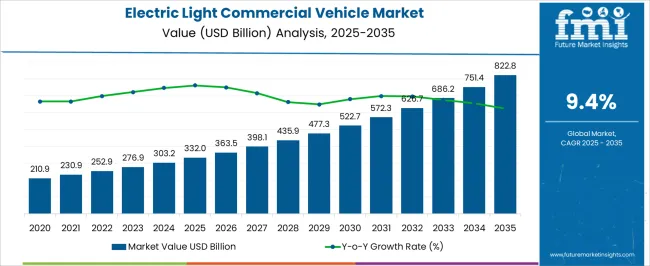

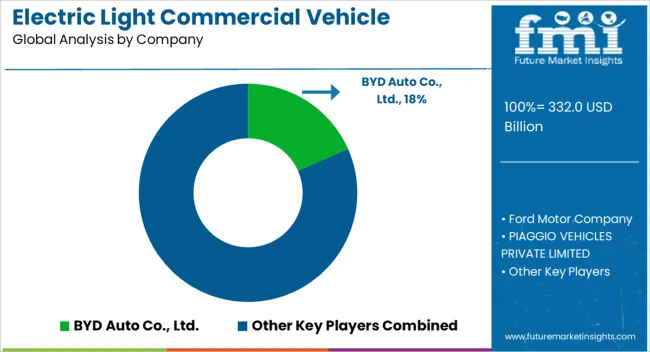

The Electric Light Commercial Vehicle Market is estimated to be valued at USD 332.0 billion in 2025 and is projected to reach USD 822.8 billion by 2035, registering a compound annual growth rate (CAGR) of 9.4% over the forecast period.

| Metric | Value |

|---|---|

| Electric Light Commercial Vehicle Market Estimated Value in (2025 E) | USD 332.0 billion |

| Electric Light Commercial Vehicle Market Forecast Value in (2035 F) | USD 822.8 billion |

| Forecast CAGR (2025 to 2035) | 9.4% |

The electric light commercial vehicle (e-LCV) market is expanding rapidly, supported by the rising demand for sustainable transportation in urban logistics, last-mile delivery, and fleet operations. Regulatory pressures to reduce carbon emissions, combined with growing investments in charging infrastructure, have accelerated adoption.

The current market environment reflects strong participation from automakers introducing multiple e-LCV models with extended range, improved payload capacity, and competitive total cost of ownership. Businesses are increasingly prioritizing electric fleets to meet sustainability goals, further strengthening demand.

Government subsidies and tax incentives are also providing significant momentum. The market outlook remains highly favorable, with e-LCVs projected to play a crucial role in urban freight transport, supported by rapid electrification of logistics and advancements in battery technology.

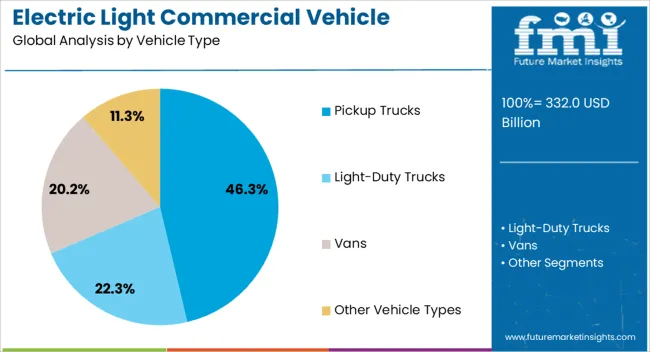

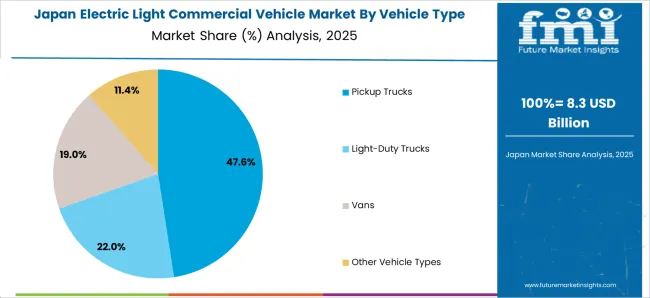

The pickup trucks segment holds approximately 46.30% share of the vehicle type category in the e-LCV market. This dominance is due to the widespread utility of pickups in logistics, construction, and service industries, where load flexibility and versatility are critical.

Electrification of pickup models has been prioritized by automakers to cater to demand for high-performance, emission-free vehicles in both commercial and personal use. The segment benefits from fleet electrification initiatives, particularly in last-mile delivery and municipal services.

Improved battery efficiency and extended driving ranges have reinforced adoption, while ongoing advancements in fast-charging capabilities further support operational viability. With continuous investment in e-pickup models and high adoption rates across developed economies, this segment is expected to retain its strong market share.

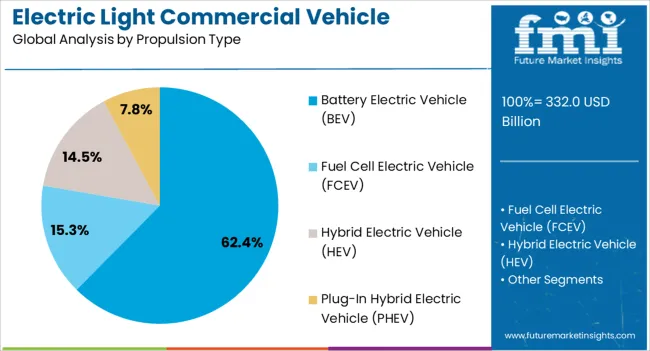

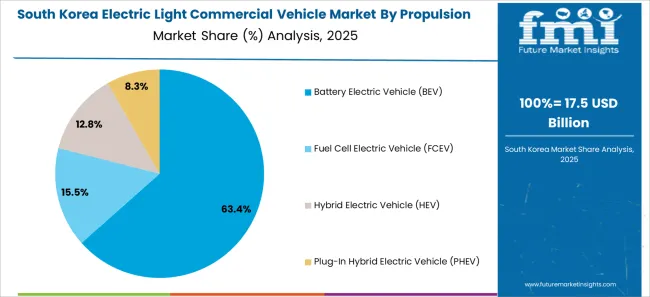

The BEV segment dominates the propulsion type category with approximately 62.40% share, reflecting the industry’s preference for fully electric solutions over hybrid alternatives. The segment’s growth is supported by advancements in lithium-ion and solid-state battery technologies, which enhance driving range and reduce charging times.

Government incentives promoting zero-emission vehicles have further accelerated adoption across commercial fleets. BEVs eliminate reliance on combustion engines, thereby reducing maintenance costs and improving operational efficiency for fleet operators.

With expanding charging networks and continued cost reductions in battery manufacturing, BEVs are expected to remain the preferred propulsion type in the e-LCV market.

.webp)

The below 6,000 lbs segment leads the gross vehicle weight (GVW) category with approximately 58.70% share, owing to its suitability for urban delivery and light transport operations. Vehicles in this range offer optimal payload capacity for last-mile logistics, where frequent stops and high maneuverability are required.

The segment’s dominance is reinforced by favorable regulatory frameworks that support electrification in lighter vehicle classes, alongside lower operational costs. Automakers are focusing on this category to cater to small businesses, courier services, and retail delivery fleets.

With the rise of e-commerce and rapid urbanization, the below 6,000 lbs segment is projected to maintain its leadership, driven by strong demand for efficient, eco-friendly transport solutions.

The net revenue generated from sales of electric light commercial vehicles in 2020 was around USD 210.9 billion. Sales of electric light commercial vehicles grew at a CAGR of 12% from 2020 to 2025. The value of the market was USD 332 billion in 2025.

The reliability and travel range of electric light commercial vehicles or eLCVs improved by continuous developments in battery technology during this period. Companies that used the emerging advancements in battery technology, including higher energy density and quicker charging times, provided customers with competitive and attractive eLCV models.

| Attributes | Details |

|---|---|

| Electric Light Commercial Vehicle Market Size (2020) | USD 210.9 billion |

| Total Market Size (2025) | USD 332 billion |

| Overall Market (CAGR 2020 to 2025) | 12% CAGR |

Logistics services or door-to-door delivery businesses find electric light commercial vehicles to be economically feasible due to their lower running costs, which include frequent halts and maintenance charges. So, EV manufacturers are now trying to draw electric commercial fleet operators and companies looking for efficiency by highlighting cost reductions in their marketing campaigns.

Though this market mostly deals with commercial vehicles, people’s decisions to buy electric vehicles for occasional use have also influenced the market trends to some extent. Manufacturers of electric vehicles can enhance their brand image over the coming decade by emphasizing the advantages of eLCVs to consumers with knowledge of environmental effects and climate change.

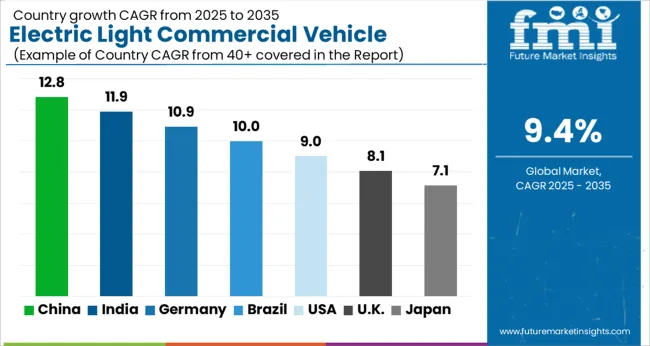

The table below demonstrates the expected growth rates of lucrative markets through 2035.

Sales of eLCVs in the United States are expected to rise at a 9.8% CAGR from 2025 to 2035.

The market in China is expected to rise at a 9.9% CAGR from 2025 to 2035.

The electric light commercial vehicle market in the United Kingdom is expected to advance at a CAGR of 10.7% over the projected period.

Japan’s electric light commercial vehicles market is expected to expand at a 10.9% CAGR through 2035.

The market in South Korea is likely to rise at a CAGR of 11.3% through 2035.

Based on the vehicle type, electric light-duty trucks are expected to lead the market in 2025. The production and sales of electric light-duty trucks are expected to increase at 9.3% CAGR through 2035.

| Attributes | Details |

|---|---|

| Top Vehicle Type | Light-duty Trucks |

| CAGR from 2025 to 2035 | 9.3% |

| CAGR from 2020 to 2025 | 11.8% |

Urban delivery businesses are actively looking to improve their operational efficiency. The creation of integrated fleet management systems, including electric light-duty trucks, is economical. This is propelling the segment’s growth.

Based on the propulsion type, the demand for battery electric vehicles is higher compared to other segments. Sales of BEVs are expected to rise at a CAGR of 9.1% over the projected years.

| Attributes | Details |

|---|---|

| Top Propulsion Type | BEV |

| CAGR from 2025 to 2035 | 9.1% |

| CAGR from 2020 to 2025 | 11.6% |

Battery electric vehicles (BEVs) have become more appealing by the incorporation of remote control technologies and mobile connection capabilities. This is expected to boost the segment’s growth over the forecast period, owing to the integration of intelligent and networked functionalities.

The electric light commercial vehicle market is characterized by the presence of established key players who are focusing on the diversification and modeling eLCVS. The landscape provides enough room for the entry of new players. Startups are focusing on innovation and development to increase their market share. They are emphasizing the development of quicker charging technologies to enhance accessibility, boosting growth in the market.

Recent Developments in the Electric Light Commercial Vehicle Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 303.2 billion |

| Projected Market Size (2035) | USD 750 billion |

| Anticipated CAGR (2025 to 2035) | 9.5% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Vehicle Type, By Application, By Propulsion Type, By Gross Vehicle Weight (GVW), and By Region |

| Key Companies Profiled | Bollinger; Chevrolet; Ford Motor Company; Fuso |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global electric light commercial vehicle market is estimated to be valued at USD 332.0 billion in 2025.

The market size for the electric light commercial vehicle market is projected to reach USD 822.8 billion by 2035.

The electric light commercial vehicle market is expected to grow at a 9.4% CAGR between 2025 and 2035.

The key product types in electric light commercial vehicle market are pickup trucks, light-duty trucks, vans and other vehicle types.

In terms of propulsion type, battery electric vehicle (bev) segment to command 62.4% share in the electric light commercial vehicle market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electric Cargo Bike Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electric Sub-meter Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electric Fabric Shaver Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA