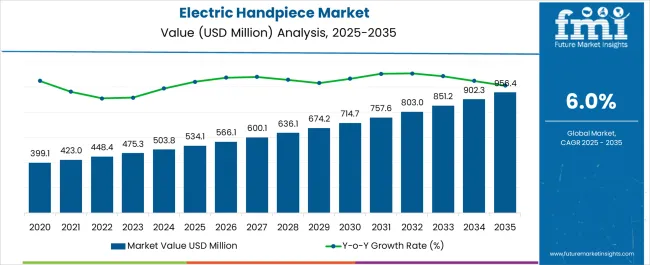

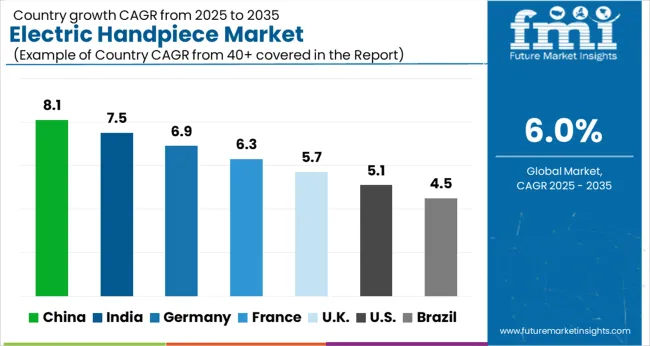

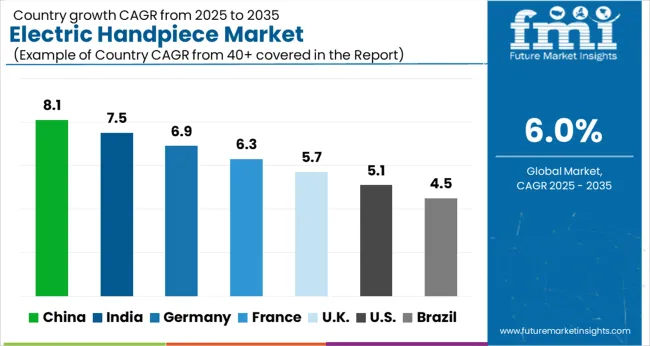

The Electric Handpiece Market is estimated to be valued at USD 534.1 million in 2025 and is projected to reach USD 956.4 million by 2035, registering a compound annual growth rate (CAGR) of 6.0% over the forecast period.

| Metric | Value |

|---|---|

| Electric Handpiece Market Estimated Value in (2025 E) | USD 534.1 million |

| Electric Handpiece Market Forecast Value in (2035 F) | USD 956.4 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The electric handpiece market is experiencing robust growth, supported by advancements in dental technology, increased focus on precision-based procedures, and rising demand for ergonomic and high-performance tools in clinical dentistry. Clinics and dental institutions are transitioning from air-driven to electric handpieces to ensure consistent torque, improved cutting efficiency, and better tactile control during restorative and surgical procedures.

Regulations promoting infection control and the shift toward minimally invasive dentistry are contributing to the market’s expansion. Enhanced patient comfort, reduced noise levels, and compatibility with digital systems have elevated electric handpieces as a standard across developed dental care markets.

Additionally, the rise of cosmetic dentistry, aging population trends, and increased dental awareness in emerging economies are expected to drive demand further. Future market growth will likely be shaped by continued R&D investment in brushless motors, integration of IoT-enabled diagnostics, and compliance with evolving global sterilization standards.

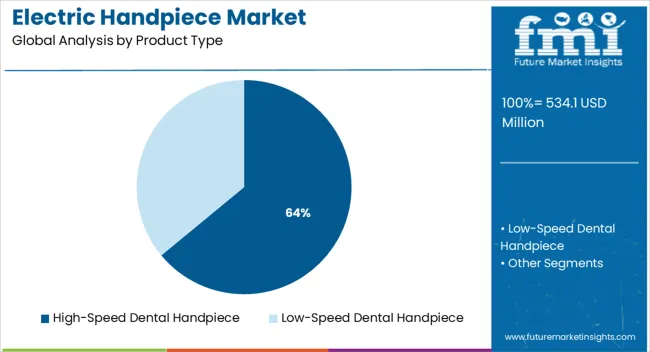

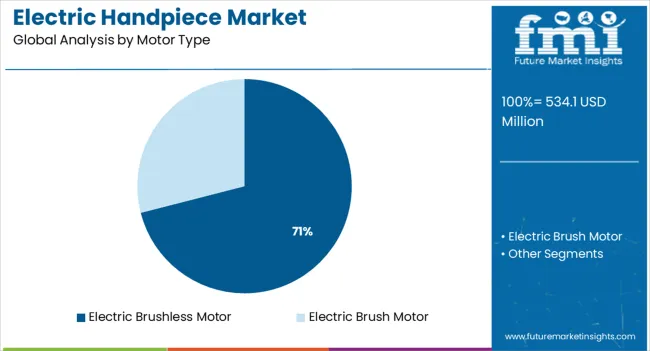

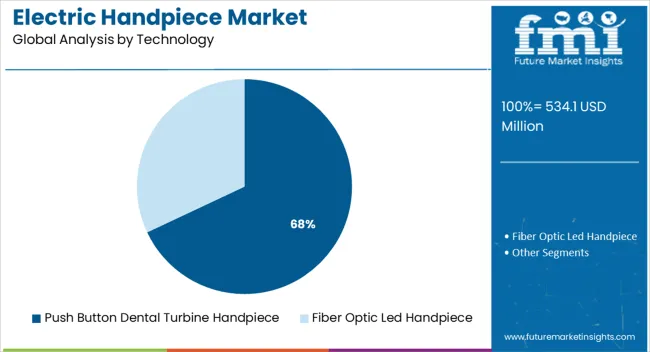

The market is segmented by Product Type, Motor Type, and Technology and region. By Product Type, the market is divided into High-Speed Dental Handpiece and Low-Speed Dental Handpiece. In terms of Motor Type, the market is classified into Electric Brushless Motor and Electric Brush Motor. Based on Technology, the market is segmented into Push Button Dental Turbine Handpiece and Fiber Optic Led Handpiece. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

High-speed dental handpieces are expected to generate 64.0% of the total market revenue in 2025, making them the dominant product type segment. This leading position is being driven by their widespread use in restorative procedures such as cavity preparation and crown fittings, where precision, speed, and minimal patient discomfort are critical.

Their capability to maintain higher RPMs without significant torque loss has made them a clinical standard for efficiency-focused practices. The segment's growth is also being supported by enhanced design ergonomics, improved heat management systems, and push-button chuck mechanisms that allow fast bur exchange, minimizing chair time.

As procedural volume rises in both general and cosmetic dentistry, the preference for high-speed handpieces continues to strengthen, particularly in multi-specialty clinics and academic institutions focused on advanced treatment delivery.

Electric brushless motors are projected to account for 71.0% of the revenue share in 2025, establishing themselves as the leading motor type in the electric handpiece market. This dominance is being attributed to their superior durability, low maintenance requirements, and consistent torque output, all of which are critical for high-precision procedures.

Brushless motors generate less friction and heat, contributing to quieter operation and extended handpiece lifespan. Their compact design allows better integration into lightweight handpiece bodies, improving clinician handling and reducing operator fatigue during long procedures.

Additionally, the reduction of carbon dust generation compared to brushed motors enhances sterilization reliability and performance consistency. As dental practitioners increasingly prioritize smooth operation, long-term cost efficiency, and reduced downtime, brushless motors are expected to remain the preferred choice for both general practice and specialty dentistry settings.

Push button dental turbine handpieces are expected to hold 68.0% of the market share in 2025, leading the technology segment. Their popularity stems from the convenience and speed of bur change functionality, allowing practitioners to switch instruments efficiently without external tools.

This not only improves workflow in high-volume practices but also reduces treatment delays and enhances patient turnaround. The technology supports precise locking mechanisms, contributing to improved clinical safety and reduced vibration during use.

The lightweight construction and ergonomic balance of these handpieces have contributed to their growing adoption across both high-speed and low-speed applications. Continued enhancements in bearing systems and turbine performance are further reinforcing the push button design as the go-to solution in modern dental practices focused on operational efficiency and user comfort.

The market value for electric handpieces was approximately 6.3% of the overall ~USD 503.8 Billion global dental handpiece market in 2024.

The sale of electric handpieces grew at a CAGR of close to 4.3% from 2020 to 2024. The market for electric handpieces is expected to be propelled due to the rising prevalence of oral diseases.

According to FDI World Dental Federation, nearly 3.5 billion people worldwide suffer from oral diseases.

The 2020 study by Global Burden of Disease also estimated the number of children suffering from primary tooth decay issues worldwide to be around 399.1 million, whereas 2 billion adults have tooth decay which is permanent. The need for dentists is growing globally; for example, a WHO factsheet from 2020 states that 93% of its member nations have less than 1 dentist per 1000 people.

People are now more aware of the problems with dental health and how to address them as soon as possible. This is directly related to the forecasted expansion of the electric handpiece market.

Research and development on electric handpiece products have been a consistent part of the enhancement of the dental handpiece industry. Innovations are making the procedure more efficient for dental professionals and comfortable for patients. The different advantages provided by the most recent electric dental handpiece demonstrate the market's innovation and progress. For Instance-

Nakanishi Inc. announced the release of the S-Max M Series on March 12, 2020, which offers the dependability and safety requirements imposed by both industry standards and practitioners.

Other factors such as the rise in the geriatric population with dental and tooth decay problems and increasing demand for cosmetic dentistry would further aid in the growth of the electric handpiece market.

As per the American Association of Oral and Maxillofacial Surgeons 2020 insights, amongst adults aged 35 - 44 years, nearly 69% have lost at least one permanent tooth which causes them to opt for cosmetic dentistry.

Additionally WHO stated that nearly 80 to 85% of dental diseases occur in patients aged greater than 50 years.

The market is set to present an opportunistic outlook, owing to increasing awareness among the rural population. There is a chance to inform and assist the rural population in realizing the value of dental health and oral hygiene.

Such strategies will provide the market an opportunity to expand, even in regions with low market penetration right now. There are many methods that might be used to accomplish this, one of which is communication via telehealth. In addition to supporting patients and meeting their demands, this will offer a chance to advertise cutting-edge items in the electric handpiece industry.

The growth will further be propelled by increasing government healthcare expenditure and awareness programs. For instance, the MHLW created the 8020 Promotion Foundation and the 8020 programs to promote oral health and assist people in saving at least 20 of their own teeth until the age of 80.

The increase in demand for silver-gold-palladium alloys for crowns and other dental prosthesis can be attributed to the expansion of this market. People choose expensive metals because they are better from an aesthetic standpoint and are covered by dental insurance.

Although the electric handpiece market has numerous end-uses, there are certain obstacles that are likely to pose a challenge to market growth. The low reimbursement rate for dental procedures is one of the main reasons restraining the growth of the electric handpiece market.

Dentists are reluctant to accept Medicaid patients due to low reimbursement rates. The Medicaid reimbursement rate is roughly 30% of what dentists typically charge for specific dental procedures. Unfortunately, because of the poor reimbursement rate, dentists are unable to accept these patients.

These propose an adverse consequence on the formative development of the electric handpiece market.

The USA dominates the North American region with a total market share of about 92.4 % in 2024 and is expected to continue the same through the forecast period.

With the vast advancements in the research and development sectors due to high investments, a rise in the aging population, availability of cutting-edge dental devices, and easy access of dentists to these devices, the USA market is expected to hold this position in the forecasted period. According to the Centers for Disease Control and Prevention, more than 40% of individuals reported experiencing oral pain. The USA spends more than USD 124 billion on dental-related expenses.

The UK is expected to show a CAGR growth rate of 6.6% in the European electric handpiece market over the forecast period.

As per the reports by the Oral Health Foundation Statistics in the UK, 39% of adults do not visit dentists and 31% of the population have tooth decay every year.

The market is anticipated to benefit from growing health awareness amongst consumers, the rising number of market players who are investing and producing innovative electric Handpiece, good healthcare reimbursement scenarios, and the high adoption rate of these devices in dental clinics and hospitals.

Germany holds a market share of 18.8% in the whole of Europe and is expected to grow with a CAGR of 7.5% during the forecasted period.

The reason for the rising demand and growth for electric handpiece is the increased awareness among healthcare professionals towards the use of electric handpiece products, along with a growing number of manufacturers in Germany.

Low-speed dental handpiece held a market share of 59.9% in the global market in 2024 and grow with a CAGR of 6.5% by the end of the forecast period.

Low-speed dental handpieces are designed to handle much more air pressure than high-speed handpieces.

They are designed to be more user-friendly and are shorter in design. They usually operate at around 20,000 RPMs. Hence they are preferred more over high-speed dental handpiece as they are easier to handle and causes less damage.

The electric brush motor has shown increased demand with a market share of 56.0% globally in 2024 and is expected to grow with a CAGR of 5.8%.

The electric brush motor is majorly in focus among consumers and healthcare professionals as it helps to maintain a constant speed and torque even when the load increases while performing procedures. Hence, it creates a smoother and more precise cut maintaining greater flexibility in the procedures.

The fiber optic led handpiece held a market share of over 59% globally owing to the fact that it shines light directly on the preparation, which greatly improves sight and helps to perform the operation successfully with less stress. This is why it highly preferred by dentists is.

Dental Clinics held nearly half of the global market share by value during the year 2024.

Dental clinics held the highest market share due to increased insurance company mergers and partnerships. With the aid of dental support organizations, dental clinics are anticipated to change how they give care and take control of the industry in the upcoming years.

With several competitors in the production of electric handpiece, the overall market is highly fragmented. Key Players such as Dentsply Sirona,

KaVo Dental GmbH, NSK/NAKANISHI INC. are adopting new strategies like collaborations with dental organizations, new high-tech product launches, and partnerships to promote their products. These strategies are being followed by upcoming players to increase their business and capture the untapped market.

Similarly, recent developments related to companies manufacturing electric handpiece have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; and Middle East & Africa |

| Key Countries Covered | USA, Canada, Brazil, Mexico, Argentina, UK, Germany, Italy, Russia, Spain, France, BENELUX, India, Thailand, Indonesia, Malaysia, Japan, China, South Korea, Australia, New Zealand, Turkey, GCC Countries, South Africa |

| Key Market Segments Covered | Product, Motor Type, Technology, End User, Region |

| Key Companies Profiled | Dentsply Sirona; KaVo Dental GmbH; NSK/NAKANISHI INC.; Bien-Air Dental SA; A-dec Inc.; W&H Dentalwerk Bürmoos GmbH; Brasseler USA; SciCan Ltd.; Ram Products, Inc; Morita Corporation; DENTALEZ, Inc.; Lares Research; DENTAMERICA INC.; MAI Animal Health (INOVAD-ENT); Medidenta |

| Pricing | Available upon Request |

The global electric handpiece market is estimated to be valued at USD 534.1 million in 2025.

The market size for the electric handpiece market is projected to reach USD 956.4 million by 2035.

The electric handpiece market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in electric handpiece market are high-speed dental handpiece and low-speed dental handpiece.

In terms of motor type, electric brushless motor segment to command 71.0% share in the electric handpiece market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Dental Handpiece Market – Size, Trends & Forecast 2025-2035

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA