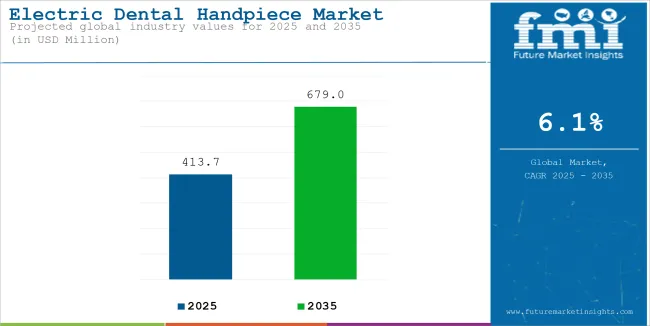

The global sales of electric dental handpiece are estimated to be worth USD 413.7 million in 2025 and are anticipated to reach a value of USD 679.0 million by 2035. Sales are projected to rise at a CAGR of 6.1% over the forecast period between 2025 and 2035. The revenue generated by electric dental handpiece in 2024 was USD 395.8 million.

Growing concerns regarding sustainability are making a significant impact on the dental handpiece market, where manufacturers are making sustainable tools. The product development focuses on the reusability of parts, saving energy, and the material should be recyclable. It fits the efforts by the healthcare sector across the world to minimize the carbon footprint in terms of their operations.

This leads to versatile handpieces, and a dentist requires them for different procedures with minimal change in the tools. The interchangeable attachments in electric dental handpieces for scaling, polishing, and drilling tasks are becoming more favored. For instance, Bien-Air's electric handpieces offer modularity, which is a multi-functional dental equipment.

Global Electric Dental Handpiece Industry Analysis

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 395.8 million |

| Estimated Size, 2025 | USD 413.7 million |

| Projected Size, 2035 | USD 679.0 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

Minimally invasive dental procedures are increasingly more popular among patients because of reduced recovery times and lower levels of pain compared to the conventional methods, with better aesthetic outcomes. Electric dental handpieces allow such procedures by providing greater and more accurate control than their air-driven counterparts.

For example, restorative procedures such as crown preparation and veneers require high-speed consistent torque for efficiently executing the procedures. As awareness of minimally invasive options grows among patients and practitioners, the demand for high-performance tools like electric dental handpieces is rising. The driver is also supported by the increasing investments in advanced dental technologies across North America, Europe, and Asia.

Electric dental handpieces are used to minimize strain by dentists by providing ergonomic superiority over conventional systems. With musculoskeletal disorders on the increase among dental professionals, there is increased interest in moving towards ergonomic tools to facilitate long-term sustainable careers.

Over 60% of dentists report work-related musculoskeletal pain, thereby increasing interest in tools that are less stressful to use, a study published in the Journal of Dental Research. In turn, the response has come in electric handpieces, whose designs are lightweight and which have variable grip sizes.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the electric dental handpiece industry outlook between 2024 and 2025 on a six-month basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year.

January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global electric dental handpiece industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics. H1 covers January to June, while H2 spans July to December. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 6.8%, followed by a slightly lower growth rate of 6.5% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 6.8% (2024 to 2034) |

| H2 | 6.5% (2024 to 2034) |

| H1 | 6.1% (2025 to 2035) |

| H2 | 5.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 6.1% in the first half and projected to lower at 5.6% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

Rising Prevalence of Oral Health Disorders Globally Boosting the Market for Electric Dental Handpieces

Oral health disorders, including cavities, periodontal diseases, and tooth loss, are becoming increasingly prevalent worldwide. According to the World Health Organization (WHO), nearly 3.5 billion people suffer from oral diseases, with untreated dental caries being the most widespread condition. This alarming statistic highlights the growing need for effective and precise dental tools to address complex dental health issues.

Electric dental handpieces have emerged as indispensable in modern dentistry due to their consistent torque, precision, and ability to handle intricate procedures efficiently. For instance, in cases of severe decay, these tools provide the reliability required for accurate tissue removal and preparation for restorative treatments.

Furthermore, the rise in geriatric populations globally has intensified the demand for advanced dental care. Older adults often require specialized treatments, such as prosthodontics or periodontics, where electric dental handpieces excel due to their durability and control. Institutions like the World Dental Federation have advocated for incorporating these tools to combat the increasing burden of oral diseases.

By reducing procedural time and enhancing patient outcomes, electric dental handpieces are becoming a cornerstone in addressing the oral health crisis, driving their adoption among dental professionals worldwide.

Emergence of Wireless and Battery-Operated Dental Handpieces Revolutionizing Dental Practices

Wireless and battery-powered electric dental handpieces are revolutionizing the dental world by offering increased mobility and convenience. The new devices are free from the constraints of the traditional corded models, thus allowing practitioners to carry out procedures with greater ease.

Advanced wireless handpieces from top manufacturers like Dentsply Sirona and NSK are now equipped with long-lasting lithium-ion batteries and rapid charging capabilities. These innovations ensure uninterrupted operation, even during lengthy procedures, making them highly desirable in both private clinics and mobile dental units.

Portability allows the wireless handpieces to be used in underserved or remote areas, hence enhancing access to dental care. Mobile dental clinics are an example, and these are used to give treatment in rural areas where dental disparities exist. Additionally, their ergonomic design reduces practitioner fatigue and increases the efficiency of procedures, keeping in line with the increasing trend of practitioner wellness.

With the modernization of clinics, the adoption of cordless and battery-operated technologies is expected to increase in the future. These will find a permanent place in the future dental care practice. The advancements are not only making the workflow easier but also more patient-centric by providing a smooth experience during procedures.

Partnerships with Dental Schools for Training and Awareness Enhancing Market Penetration

Partnering with dental schools and training institutes is an effective way to foster the adoption of electric dental handpieces. Students would, therefore, acquire hands-on knowledge of the sophisticated tools and handle them well as they begin practice.It eliminates several misconceptions existing in the realm of electric handpieces, especially in terms of being difficult to use or more expensive, for instance, proving the long-run advantages in everyday life.

Dental schools act as channels through which recent advances in the dental technology could be spread in the most potent manner, resulting in early adopters among them. Training programmes aimed at targeting can give the much-needed confidence to use electric handpieces as integral parts of practice. These developments showcase electric handpieces not just as state-of-the-art tools in dentistry but also as the most improved and modern tool, leading to long-term growth of the market.

Complexity in Maintenance and Repairs Hindering Adoption of Electric Dental Handpieces

Though these electric dental handpieces have a lot of benefits, their maintenance and repair complexities make them a challenge to be adopted. As compared to the air-driven model, which is relatively simple in servicing, the electric handpieces require specialized service for motor calibration, electronic failures, and software updates. In most cases, this results in increased downtime and higher maintenance costs for dental practices.

For instance, electric handpieces tend to degrade the internal bearings or motors to the point that they need complete replacement. Repeated costs on tight budgets become unaffordable for some clinics, and it deters them from adopting electric models. Procuring replacement parts can also cause long delays that further disrupt operations in the clinics.

Another challenge that arises is the lack of standard repair protocols among manufacturers, making practitioners unwilling to switch. To overcome these barriers, manufacturers must focus on improving the durability of their products and providing accessible, cost-effective repair services to foster broader adoption of electric handpieces.

The global electric dental handpiece industry recorded a CAGR of 5.3% during the historical period between 2020 and 2024. The growth of the electric dental handpiece industry was positive as it reached a value of USD 395.8 million in 2024 from USD 311.2 million in 2020.

Electric dental handpiece over the past two to three years has experienced massive change in character, largely being driven by innovation and the growing preference of dentists for electricity. A noticeable trend in electric handpieces replacing air-driven types is because electric handpieces give better torque and precision than the air-driven varieties.

The adoption was highly marked in developed areas, which are characterized by higher investments in superior dental care facilities. To respond to the ever-increasing rate of musculoskeletal disorders among dentists, manufacturers focused on ergonomic design, and this resulted in light and easy-to-handle models.

Another trend from history is the growing interest in digital dentistry, which led to the demand for integration-friendly tools with high-tech diagnostic and treatment systems. Electric handpieces made their entrance with IoT features like real-time feedback and automatic adjustments. Additionally, in the wake of the pandemic, infection control awareness led to handpieces with enhanced sterilization capabilities and disposable components.

Looking ahead, the electric dental handpiece market is poised to witness transformative trends driven by advancements in digital healthcare and the increasing focus on patient-centered care. One key futuristic trend is the integration of artificial intelligence (AI) for optimizing procedural performance. AI-enabled handpieces are expected to assist dentists by learning user preferences, automating torque adjustments, and providing real-time procedural insights, improving precision and patient outcomes.

Portability and versatility are also becoming the key factors, with manufacturers designing compact, multifunctional handpieces to cater to mobile clinics and resource-limited settings. Wireless and cordless technologies will dominate in the market, due to its innovations in battery life and fast-charging capabilities. These features are likely to appeal to modern dental practices seeking operational flexibility.

Additionally, the emphasis on patient comfort will drive the development of noise-reduction and vibration-dampening technologies, enhancing the overall dental experience. Customizable handpieces tailored to specific procedures or user ergonomics will further align with personalized healthcare trends.

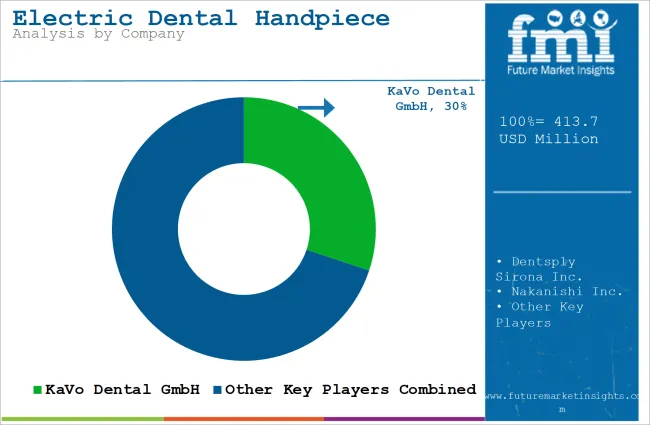

Tier 1 companies are the major companies as they hold a 41.1% share worldwide. Tier 1 companies are the largest and most influential players in the electric dental handpiece market. They have a significant global presence, often operating across multiple continents and serving a wide array of customers in both developed and emerging markets. These companies offer a broad range of dental handpieces with advanced features, catering to various specialties within dentistry.

Their products are typically known for their reliability, precision, and cutting-edge technology. Prominent tier 1 players include KaVo Dental GmbH, Dentsply Sirona Inc., Bien-Air Medical Technologies and W&H Dentalwerk Bürmoos GmbH

The tier 2 companies hold a share of 29.6% worldwide. Tier 2 companies tend to have a strong presence in specific regions or countries rather than a global footprint. They may not have the same level of worldwide distribution as Tier 1 companies but are still highly regarded within their market segments.

Companies in this tier often focus on providing cost-effective solutions without sacrificing quality. They may be known for offering good value products with solid performance, which appeals to dental professionals looking for reliable and affordable options. Key Companies under this category include Nakanishi Inc., A-dec Inc., SciCan Ltd., DentalEZ Group, and Brasseler USA

The section below covers the industry analysis for electric dental handpiece sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 3.5% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 11.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 3.5% |

| Germany | 3.1% |

| Italy | 3.9% |

| China | 10.3% |

| India | 11.1% |

| Japan | 6.1% |

The United States dominates the global market with a high share in 2024. The United States is expected to exhibit a CAGR of 3.5% throughout the forecast period (2025 to 2035).

The United States is the global leader in electric dental handpieces, mainly due to its vast network of educational and training institutions. The country houses some of the world's finest dental schools that are affiliated with Harvard University and the University of Michigan, both of which put a lot of emphasis on embracing advanced technologies in dental practice. These institutes not only produce very qualified dental professionals but also implement innovative tools, such as electric dental handpieces, into their curriculum.

This early exposure ensures that practitioners entering the workforce are already adept at using electric handpieces, creating sustained demand within the market. Additionally, continuous professional development programs and certifications in the USA prioritize precision and efficiency in dental care, further driving the preference for electric handpieces. By cultivating a workforce trained in advanced tools and techniques, the USA establishes a strong foundation for technological adoption, maintaining its market dominance.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.1%.

Germany is leading the electric dental handpiece market, coupled with strength in precision engineering and manufacturing excellence. The country is known worldwide for its state-of-the-art engineering capabilities, hosting many of the world's most innovative companies in dental equipment manufacturing, including industry leaders KaVo and Dentsply Sirona, who continuously advance the quality and performance standards within the industry.

The country's engineering capabilities ensure that electric dental handpieces manufactured in Germany are unmatched in terms of precision, durability, and efficiency, making them highly sought after both domestically and globally. Moreover, the stringent regulatory framework of medical devices in Germany, combined with high manufacturing standards, instills confidence in the reliability of its dental products.

This reputation for precision and quality is what encourages wider adoption among German dentists who prefer technologically advanced tools that meet the expectation of patients towards high-quality care. Germany achieves its leadership in the market through the combination of engineering innovation and stringent quality standards.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 11.1% during the forecasted period.

India is becoming an emerging player in the electric dental handpiece market as its dental tourism sector grows. India offers good quality at an affordable cost to patients who want to avail themselves of dental treatment, thus annually attracting thousands of international patients to the country from the Middle East, Africa, and Europe. With this increasing flow of patients, Indian dental clinics have begun using advanced tools like electric dental handpieces to keep up with global standards and make procedures more precise and efficient.

The competitive nature of dental tourism forces clinics to innovate and invest more in the technological advancement of a dental handpiece to ensure better and improved patient results and satisfaction leading to repeat visits with positive referrals to others.

Demand for premium, high-quality instruments has grown remarkably in cities as Mumbai, Delhi, and Chennai, which can be termed 'dental tourist destinations'. Consequently, India also emerges as the fastest-growing electrical dental hand-piece market.

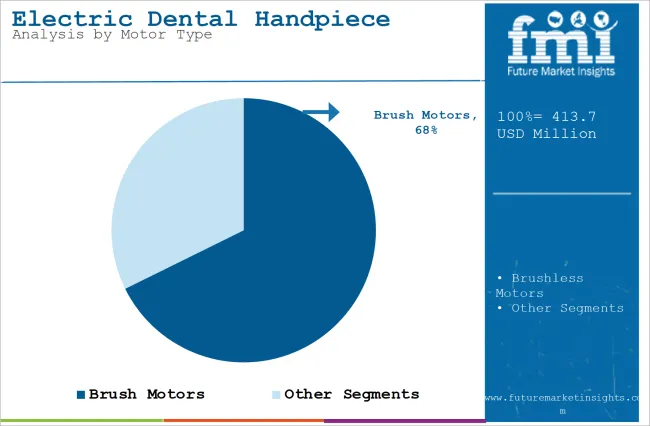

The section contains information about the leading segments in the industry. Based on motor type, brush motors are expected to account 67.7% of the global share in 2025.

| Motor Type | Value Share (2025) |

|---|---|

| Brush Motors | 67.7% |

Brush motors dominate the electric dental handpiece market. This is due to their low cost and ease of design. They are significantly less expensive to produce than brushless motors, and thus, are widely used by dental practitioners, especially in regions that are sensitive to cost. This allows the dental clinic to embrace high-performance electric handpieces without any financial strain.

Moreover, the simpler design of brush motors facilitates easier maintenance and repairs. With a straightforward mechanism involving brushes and a commutator, repairs are less complex and do not require specialized expertise. This simplicity is especially appealing for smaller dental practices that may not have immediate access to advanced repair services.

Another contributing factor is the compatibility of brush motors with a wide range of existing dental systems. Their adaptability to different power sources and handpiece configurations ensures that they remain a practical choice for practitioners globally, reinforcing their market leadership.

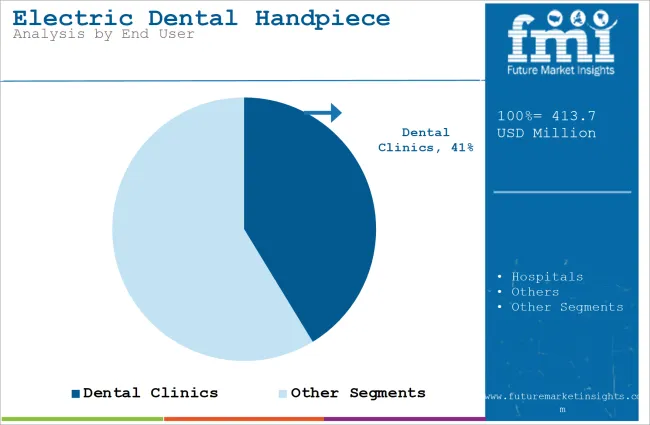

| By End User | Value Share (2025) |

|---|---|

| Dental Clinics | 41.3% |

Dental clinics will account for 41.3% of the end user segment in 2025, and exhibit the highest CAGR in the forecast period.

With dental clinics, more patient volume can be treated under a specialty care scope. They can have more electrical dental handpiece purchases since patients of such clinics demand highly specialized treatments that require excellent equipment.

There are no cases in hospitals where electric dental handpieces would only be used and nothing else would be treated except by electric tools. This will vary based on the variety of procedures; it may involve cleanings up to complex restorative treatments for which precision and efficiency are always key.

The trend of private dental practices is on the rise, which further strengthens this dominance. In addition, the increase in cosmetic dentistry, an area that has been largely provided by dental clinics, has increased demand for high technology equipment. This focus on patient-centered, specialized services ensures that dental clinics remain leaders in the market.

Key players in the electric dental handpiece market are focusing on continuous product innovations to maintain competitiveness. Companies are introducing new models with improved durability, ergonomic designs, and diverse options to meet the varying needs of dental professionals. Additionally, frequent product launches are aimed at enhancing performance, user comfort, and overall efficiency to appeal to a broader market and adapt to changing dental practice requirements.

Recent Industry Developments in Electric Dental Handpiece Market

In terms of motor type, the industry is divided into non-complaint brush motors and brushless motors.

In terms of end user, the industry is segregated into hospitals, dental clinics and others.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global electric dental handpiece industry is projected to witness CAGR of 6.1% between 2025 and 2035.

The global electric dental handpiece industry stood at USD 395.8 million in 2024.

The global electric dental handpiece industry is anticipated to reach USD 679.0 million by 2035 end.

China is expected to show a CAGR of 10.3% in the assessment period.

The key players operating in the global electric dental handpiece industry include KaVo Dental GmbH, Dentsply Sirona Inc., Nakanishi Inc., A-dec Inc., Bien-Air Medical Technologies, SciCan Ltd., DentalEZ Group, Brasseler USA, W&H Dentalwerk Bürmoos GmbH, NSK Ltd., Keystone Dental, Inc., DENTFLEX

Table 01: Global Market Pricing Analysis (US$) By Region, 2021

Table 02: North America Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Country

Table 03: North America Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 04: North America Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 05: North America Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 06: Latin America Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Country

Table 07: Latin America Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 08: Latin America Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 09: Latin America Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 10: Western Europe Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Country

Table 11: Western Europe Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 12: Western Europe Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 13: Western Europe Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 14: Eastern Europe Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Country

Table 15: Eastern Europe Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 16: Eastern Europe Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 17: Eastern Europe Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 18: APEJ Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Country

Table 19: APEJ Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 20: APEJ Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 21: APEJ Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 22: Japan Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 23: Japan Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 24: Japan Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 25: MEA Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Country

Table 26: MEA Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By Motor Type

Table 27: MEA Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 28: MEA Market Size (US$ Mn) Analysis 2013–2021 and Forecast 2022–2028, By End User

Table 29: Global Market Size (US$ Mn) 2013–2021 and Forecast 2022-2025 By Region

Table 30: Global Market Size (US$ Mn) 2013–2021 and Forecast 2022-2025 By Motor Type

Table 31: Global Market Volume (Units) Analysis-2013–2021 and Forecast 2022–2028, By Motor Type

Table 32: Global Market Size (US$ Mn) 2013–2021 and Forecast 2022-2025 By End User

Figure 01: Market Revenue Share By Motor Type 2022E & 2028F

Figure 02: Market Revenue Share By End User, 2022E & 2028F

Figure 03: Market Revenue Share By Region, 2022E & 2028F

Figure 04: Dental caries experience (DMFT) of 12-year old children

Figure 05: Market, Price (US$) Difference (U.S Vs. Japan), 2021

Figure 06: Global Market Brush Motors, Price Difference (US$) By Region, 2017A

Figure 07: Global Market Brush Motors, Price Difference (US$) By Region, 2028

Figure 08: Global Market Brushless Motors, Price Difference (US$) By Region, 2017A

Figure 09: Global Market Brushless Motors, Price Difference (US$) By Region, 2028

Figure 10: North America Market Value Share (2017E)

Figure 11: North America Market Value Share Analysis (%) By Country, 2022 & 2028

Figure 12: North America Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 13: North America Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 14: U.S. Historical Market Size (US$ Mn), 2013–2021

Figure 15: U.S. Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 16: Canada Historical Market Size (US$ Mn), 2013–2021

Figure 17: Canada Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 18: North America Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 19: North America Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 20: North America Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 21: North America Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 22: North America Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 23: North America Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 24: North America Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 25: North America Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 26: North America Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 27: North America Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 28: North America Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 29: North America Market Attractiveness Analysis By End User, 2022–2028

Figure 30: North America Market Attractiveness Analysis By Country, 2022–2028

Figure 31: Latin America Market Value Share (2017E)

Figure 32: Latin America Market Value Share Analysis (%) By Country, 2022 & 2028

Figure 33: Latin America Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 34: Latin America Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 35: Brazil Historical Market Size (US$ Mn), 2013–2021

Figure 36: Brazil Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 37: Mexico Historical Market Size (US$ Mn), 2013–2021

Figure 38: Mexico Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 39: Rest of Latin America Historical Market Size (US$ Mn), 2013–2021

Figure 40: Rest of Latin America Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 41: Latin America Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 42: Latin America Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 43: Latin America Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 44: Latin America Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 45: Latin America Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 46: Latin America Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 47: Latin America Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 48: Latin America Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 49: Latin America Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 50: Latin America Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 51: Latin America Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 52: Latin America Market Attractiveness Analysis By End User, 2022–2028

Figure 53: Latin America Market Attractiveness Analysis By Country, 2022–2028

Figure 54: Western Europe Market Value Share (2017E)

Figure 55: Western Europe Market Value Share Analysis (%) By Country, 2022 & 2028

Figure 56: Western Europe Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 57: Western Europe Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 58: U.K. Historical Market Size (US$ Mn), 2013–2021

Figure 59: U.K. Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 60: Germany Historical Market Size (US$ Mn), 2013–2021

Figure 61: Germany Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 62: France Historical Market Size (US$ Mn), 2013–2021

Figure 63: France Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 64: Italy Historical Market Size (US$ Mn), 2013–2021

Figure 65: Italy Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 66: Spain Historical Market Size (US$ Mn), 2013–2021

Figure 67: Spain Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 68: Nordic Countries Historical Market Size (US$ Mn), 2013–2021

Figure 69: Nordic Countries Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 70: Rest of Western Europe Historical Market Size (US$ Mn), 2013–2021

Figure 71: Rest of Western Europe Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 72: Western Europe Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 73: Western Europe Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 74: Western Europe Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 75: Western Europe Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 76: Western Europe Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 77: Western Europe Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 78: Western Europe Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 79: Western Europe Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 80: Western Europe Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 81: Western Europe Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 82: Western Europe Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 83: Western Europe Market Attractiveness Analysis By End User, 2022–2028

Figure 84: Western Europe Market Attractiveness Analysis By Country, 2022–2028

Figure 85: Eastern Europe Market Value Share (2017E)

Figure 86: Eastern Europe Market Value Share Analysis (%) By Country, 2022 & 2028

Figure 87: Eastern Europe Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 88: Eastern Europe Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 89: Russia Historical Market Size (US$ Mn), 2013–2021

Figure 90: Russia Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 91: Poland Historical Market Size (US$ Mn), 2013–2021

Figure 92: Poland Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 93: Rest of Eastern Europe Historical Market Size (US$ Mn), 2013–2021

Figure 94: Rest of Eastern Europe Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 95: Eastern Europe Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 96: Eastern Europe Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 97: Eastern Europe Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 98: Eastern Europe Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 99: Eastern Europe Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 100: Eastern Europe Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 101: Eastern Europe Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 102: Eastern Europe Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 103: Eastern Europe Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 104: Eastern Europe Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 105: Eastern Europe Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 106: Eastern Europe Market Attractiveness Analysis By End User, 2022–2028

Figure 107: Eastern Europe Market Attractiveness Analysis By Country, 2022–2028

Figure 108: APEJ Market Value Share (2017E)

Figure 109: APEJ Market Value Share Analysis (%) By Country, 2022 & 2028

Figure 110: APEJ Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 111: APEJ Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 112: China Historical Market Size (US$ Mn), 2013–2021

Figure 113: China Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 114: Australia & New Zealand Historical Market Size (US$ Mn), 2013–2021

Figure 115: Australia & New Zealand Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 116: India Historical Market Size (US$ Mn), 2013–2021

Figure 117: India Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 118: ASEAN Historical Market Size (US$ Mn), 2013–2021

Figure 119: ASEAN Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 120: Rest of APEJ Historical Market Size (US$ Mn), 2013–2021

Figure 121: Rest of APEJ Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 122: APEJ Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 123: APEJ Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 124: APEJ Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 125: APEJ Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 126: APEJ Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 127: APEJ Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 128: APEJ Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 129: APEJ Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 130: APEJ Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 131: APEJ Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 132: APEJ Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 133: APEJ Market Attractiveness Analysis By End User, 2022–2028

Figure 134: APEJ Market Attractiveness Analysis By Country, 2022–2028

Figure 135: Japan Market Value Share Analysis (%) By Motor Type, 2022 & 2028

Figure 136: Japan Market Value Share Analysis (%) By End User, 2022 & 2028

Figure 137: Japan Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 138: Japan Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 139: Japan Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 140: Japan Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 141: Japan Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 142: Japan Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 143: Japan Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 144: Japan Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 145: Japan Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 146: Japan Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 147: Japan Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 148: Japan Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 149: Japan Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 150: Japan Market Attractiveness Analysis By End User, 2022–2028

Figure 151: MEA Market Value Share (2017E)

Figure 152: MEA Market Value Share Analysis (%) By Country, 2022 & 2028

Figure 153: MEA Historical Market Size (US$ Mn) Analysis, 2013–2021

Figure 154: MEA Market Size (US$ Mn) & Y-o-Y Growth (%), 2022-2028

Figure 155: GCC Countries Historical Market Size (US$ Mn), 2013–2021

Figure 156: GCC Countries Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 157: South Africa Historical Market Size (US$ Mn), 2013–2021

Figure 158: South Africa Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 159: Rest of Middle East & Africa Historical Market Size (US$ Mn), 2013–2021

Figure 160: Rest of Middle East & Africa Market Size (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 161: MEA Brush Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 162: MEA Brush Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 163: MEA Brushless Motors Market Size (US$ Mn) Analysis, 2013–2021

Figure 164: MEA Brushless Motors Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 165: MEA Dental Clinics Market Size (US$ Mn) Analysis, 2013–2021

Figure 166: MEA Dental Clinics Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 167: MEA Hospitals Market Size (US$ Mn) Analysis, 2013–2021

Figure 168: MEA Hospitals Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 169: MEA Others Market Size (US$ Mn) Analysis, 2013–2021

Figure 170: MEA Others Market Value (US$ Mn) & Y-o-Y Growth (%), 2022–2028

Figure 171: MEA Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 172: MEA Market Attractiveness Analysis By End User, 2022–2028

Figure 173: MEA Market Attractiveness Analysis By Country, 2022–2028

Figure 174: Global Market Share Analysis (%) By Region, 2022 & 2028

Figure 175: Global Market Y-o-Y Growth (%) 2022–2028, By Region

Figure 176: Global Market Attractiveness Analysis By Region, 2022–2028

Figure 177: Global Market Share Analysis (%) By Motor Type, 2022 & 2028

Figure 178: Global Market Y-o-Y Growth (%) 2022–2028, By Motor Type

Figure 179: Global Market Attractiveness Analysis By Motor Type, 2022–2028

Figure 180: Global Market Share Analysis (%) By End User, 2022 & 2028

Figure 181: Global Market Y-o-Y Growth (%) 2022–2028, By End User

Figure 182: Global Market Attractiveness Analysis By End User, 2022–2028

Figure 183: Global Market Value Analysis and Forecast, 2021–2028 (US$ Mn)

Figure 184: Global Market Absolute $ Opportunity (US$ Mn), 2013–2021

Figure 185: Global Market Absolute $ Opportunity (US$ Mn), 2021–2028

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Electric Bicycle Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Transmission Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA