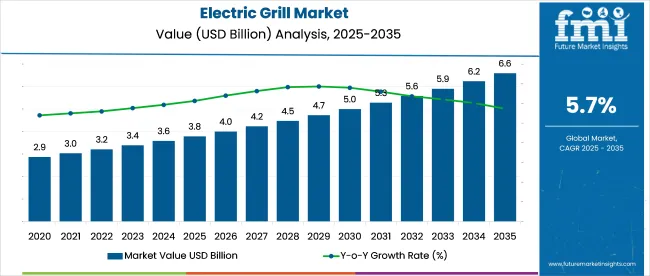

Global electric grill sales are forecast to rise from USD 3.79 billion in 2025 to USD 6.61 billion by 2035, tracking a 5.7% CAGR. North America will contribute nearly 47% of revenue in 2024, but demand shifts are more aggressive in Asia and Western Europe, where indoor cooking appliances are used in over 68% of new urban households.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3.79 billion |

| Industry Value (2035F) | USD 6.61 billion |

| CAGR (2025 to 2035) | 5.7% |

Over 42 million households in ASEAN are projected to adopt plug-in grills by 2030, especially in industries like Indonesia and Vietnam, where gas alternatives are constrained by policy or infrastructure. Production capacity in China and Turkey is being expanded by 18-25% through 2026, with players favoring modular assembly to localize last-mile customization.

In February 2025, SharkNinja, Inc. unveiled the Ninja™ FlexFlame™ Propane Grill & Outdoor Cooking System, entering the outdoor grilling segment with a five-in-one appliance for grilling, smoking, roasting, griddling, and pizza-making. Powered by CyclonicHeat-iQ™ Technology, the unit combines a high-speed convection fan, precision-controlled propane flames, and a wood-pellet smoke box.

It preheats to 600°F in under seven minutes and was developed over two years to meet growing consumer demand for multifunctional outdoor cooking. Priced at USD 999.99, it’s now available on NinjaKitchen.com, Amazon, and through retailers like Home Depot and ACE Hardware.

The electric grill market holds varied shares across its five parent categories due to overlapping applications and distinct consumer spending patterns. Within the home appliances market, electric grills account for approximately 2.3%, driven by their niche position among large and small appliances. In the kitchen appliances segment, their share rises to 4.8%, reflecting stronger alignment with countertop and compact cooking devices.

A 6.1% share is captured within outdoor cooking equipment, where electric models compete alongside gas and charcoal grills. In the electric household products category, the share is estimated at 3.5%, constrained by dominance of non-cooking items. The highest share, around 7.4%, is observed in the smart cooking devices market, supported by rising adoption of IoT-enabled grilling systems and integration with connected home platforms.

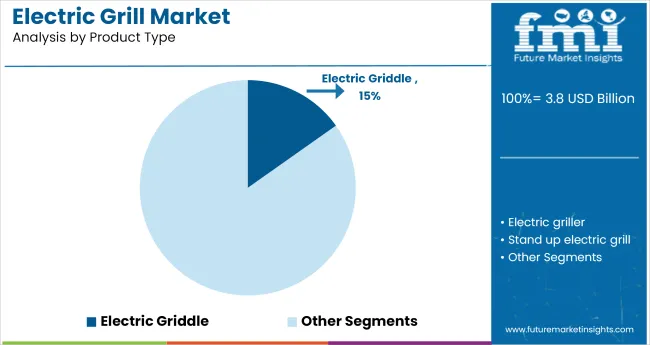

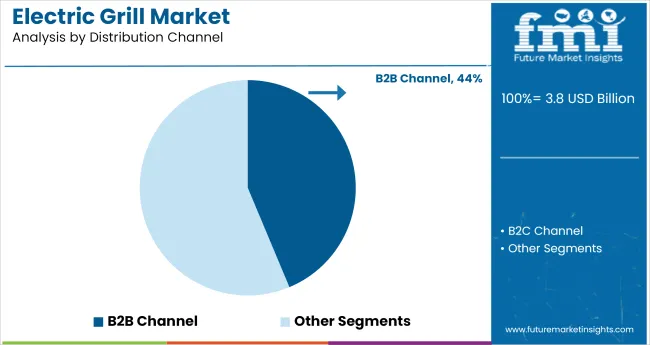

In the electric grill industry, the electric griddle segment is expected to hold a 15.2% share in 2025. The distribution channel segment is dominated by the B2B channel, which holds a 43.7% share. The industry is expanding across regions including North America, Latin America, Europe, Asia, and the Middle East & Africa.

The electric griddle segment is expected to hold a 15.2% share in 2025. Known for its versatility, the electric griddle is popular for preparing a wide range of meals, particularly breakfast foods like pancakes, bacon, and eggs. Its growing appeal is fueled by the demand for multipurpose cooking devices that can efficiently handle different cooking needs.

The electric griddle's compact design makes it ideal for use in small kitchens or apartments where space is limited. This product's ability to cater to various cooking requirements supports its continued growth in the industry.

The B2B channel is projected to capture 43.7% share by 2025. This channel primarily serves businesses such as restaurants, hotels, and cafes, where electric grills are essential for large-scale food preparation. The foodservice industry increasingly demands energy-efficient and easy-to-use cooking appliances, driving growth in the B2B sector.

Commercial kitchens and dining establishments, especially in developed regions, are expected to contribute significantly to the industry expansion. The preference for appliances that can handle high-volume cooking with minimal maintenance is expected to keep the B2B channel dominant in the coming years.

Electric grill usage has increased in regions where outdoor space is constrained and consumers seek cleaner, compact cooking solutions. Changing food habits and rising demand for oil-free meals have positioned these appliances as preferred alternatives. However, product overlap and regional affordability gaps have slowed broader penetration.

Space Limitations and Health Preferences Guide Adoption

Electric grills are now found in over 68% of newly built housing units across OECD and ASEAN countries where balconies or patios are limited. In countries like Japan and Germany, over half of households rely on plug-in cooking due to restricted kitchen ventilation. Demand for appliances with non-stick ceramic surfaces and adjustable heat controls has climbed steadily, with such models accounting for 32% of retail shelf space in Western Europe.

Affordability and Appliance Overlap Impede Expansion

In Latin America, electric grills cost 23-35% more than induction cooktops or gas stoves, narrowing appeal among mid- and lower-income groups. In regions with power instability, such as Indonesia and South Africa, consumers face high risk when investing in electric-only appliances. Simultaneously, multifunctional devices like air fryers and combination cookers continue to erode standalone electric grill sales.

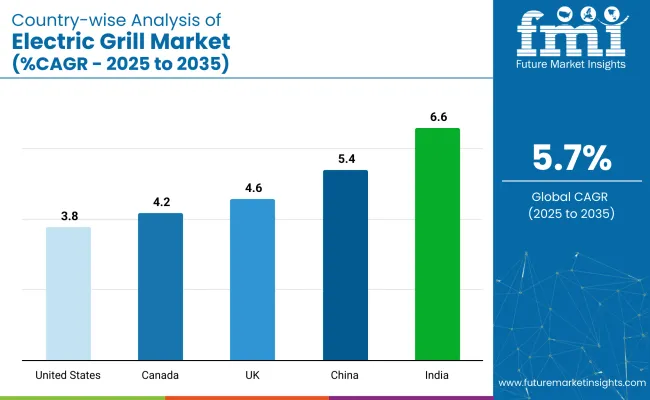

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

| Canada | 4.2% |

| UK | 4.6% |

| China | 5.4% |

| India | 6.6% |

The global electric grill market is projected to grow at a 5.2% CAGR from 2025 to 2035. India leads with 6.6%, outperforming the global average by nearly 1 percentage point. Growth is supported by increased adoption among mid-tier residential buyers and expanding demand in second-tier urban centers. China follows at 5.4%, where BRICS-driven investments in localized production and pricing tiers are helping to capture urban middle-class households and institutional catering demand.

The United Kingdom, an OECD economy, posts a 4.6% CAGR. While growth is steady among health-conscious urban renters, high energy costs and limited category awareness have kept wider adoption in check. Canada records 4.2%, with demand concentrated in affluent households, well below global momentum. The United States shows the lowest rate at 3.8%, reflecting industry saturation and slower replacement cycles. Legacy brands there are pivoting toward exports and connected product lines to offset sluggish domestic volumes.

The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Sale of electric grill in the United States is expected to grow at a 3.8% CAGR from 2025 to 2035. The industry is driven by health trends and the demand for convenient indoor cooking appliances. As consumer preferences shift toward healthier cooking methods, electric grills are becoming increasingly popular due to their ability to reduce fat. Technological innovations such as precise temperature control and enhanced user interfaces are expected to support growth. The market is benefiting from increasing interest in multifunctional kitchen appliances that combine convenience and performance.

Demand for electric grills in the United Kingdom is projected to expand at a 4.6% CAGR through 2035. Consumer interest in home cooking and healthier eating is driving the demand for electric grills. In areas where space constraints limit outdoor grilling, electric grills are becoming more popular. The increasing popularity of compact and energy-efficient cooking appliances is supporting this growth. Technological improvements, such as faster cooking times and better heat distribution, are also contributing to the widespread appeal of electric grills in the UK market.

China is forecasted to grow at a 5.4% CAGR through 2035, driven by increasing adoption of electric grills among middle-class households and rising demand from institutional catering and apartment-based cooking segments. With increasing adoption of Western cooking methods and the rise of health-conscious consumers, electric grills are becoming more popular. Technological advancements, including energy-efficient features and improved cooking performance, are enhancing the attractiveness of electric grills. Additionally, innovations in grill designs are creating a demand for space-saving and easy-to-use appliances.

The electric grill market in India is expanding at a 6.6% CAGR through 2035, the highest among key countries. Rising disposable incomes and rapid growth in cities are driving demand for modern kitchen appliances. Health-conscious trends and a growing preference for convenient cooking solutions are contributing to the adoption of electric grills. With a large population and increasing interest in indoor cooking methods, India is positioned as a key market. Moreover, the country’s price-sensitive nature drives manufacturers to innovate with affordable and efficient electric grill options.

Sales of electric grills in Canada are growing at a 4.2% CAGR from 2025 to 2035. Growth in cities, a rising middle class, and a growing interest in healthier cooking methods are key drivers. Canadians are increasingly turning to electric grills for their convenience, energy efficiency, and the ability to prepare healthier meals with less fat. Technological advancements, such as enhanced heat distribution and precise temperature control, are expected to further boost the market. With a focus on multifunctionality, Canadian consumers are seeking compact, versatile cooking appliances for their kitchens.

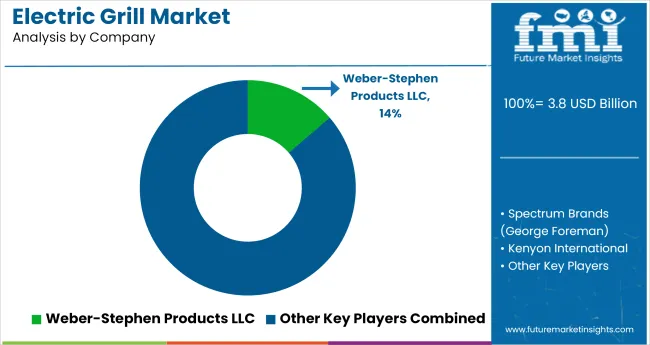

In the electric grill market, leading companies are scaling operations through a mix of smart-tech upgrades, compact designs, and omnichannel placements. Brands like Weber-Stephen, Spectrum Brands (George Foreman), and Kenyon International are capturing household demand by offering precision-controlled grilling systems integrated with app connectivity, energy-efficient heating, and customizable plate options.

Their growth is supported by strong brand equity and a wide-format product range that spans indoor and outdoor categories. OEM vendors and backend suppliers, including Breville and Tristar, support bulk production and component integration, enabling faster rollout of region-specific SKUs across North America, Europe, and Asia.

Competitive intensity has grown as entry-level product lines attract regional manufacturers targeting online-first and modular appliance segments. Market share defense is now linked to IoT enablement, after-sales service ecosystems, and culinary content partnerships. Most suppliers are pursuing three levers: extending smart grill compatibility with home platforms, investing in countertop and balcony-optimized variants, and aligning with D2C platforms to drive recurring accessory and consumables sales.

Leading Company - Weber-Stephen Products LLC

Industry Share - 13.7%

Recent Industry Developments in the Electric Grill Market

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 3.79 billion |

| Projected Industry Size (2035) | USD 6.61 billion |

| CAGR (2025 to 2035) | 5.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Detailed Product Types Analyzed (Segment 1) | Electric Griddle, Electric Griller, Stand Up Electric Grill, Portable/Tabletop Outdoor Electric Grill, Outdoor Electric Griddle, Outdoor Electric Smoker, Outdoor Electric Pizza Grill Oven, Outdoor Pellet Grill, Others |

| Distribution Channels Analyzed (Segment 2) | B2B Channel, B2C Channel |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia, Middle East & Africa, Oceania |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Beiersdorf AG, Shiseido Company, Amway, Unilever PLC, Avon Products Inc., The Estée Lauder Companies Inc., L’Oréal S.A., Kao Corporation, Colgate-Palmolive Company, Procter & Gamble Co., Other Players (As requested) |

| Additional Attributes | Dollar sales, share by product type and channel, consumer shift to portable outdoor formats, expansion in electric smoker adoption, B2C channel dominance, brand penetration trends in North America and Europe |

In terms of detailed product type, the industry is divided into the electric griddle, electric griller, stand up electric grill, portable/tabletop outdoor electric grill, outdoor electric griddle, outdoor electric smoker, outdoor electric pizza grill oven, outdoor pellet grill, and others.

The industry is further divided by distribution channels that are B2B channel, and B2C channel

Key countries of North America, Latin America, Europe, East Asia, South Asia, Middle East and Africa (MEA), and Oceania have been covered in the report.

The industry is projected to reach USD 3.79 billion in 2025.

The industry is expected to grow at a CAGR of 5.7% from 2025 to 2035.

Electric griddles are expected to capture a 15.2% share in 2025.

The Asia region, especially India, is projected to register a CAGR of 6.6% from 2025 to 2035.

The industry is projected to reach USD 6.61 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Electric Grills Companies

Electric Grills Market

Electric Aircraft Onboard Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electric Round Sprinklers Market Size and Share Forecast Outlook 2025 to 2035

Electric Cloth Cutting Scissors Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electric Aircraft Sensors Market Size and Share Forecast Outlook 2025 to 2035

Electric Traction Motor Market Forecast Outlook 2025 to 2035

Electric Vehicle Sensor Market Forecast and Outlook 2025 to 2035

Electric Vehicle Motor Market Forecast and Outlook 2025 to 2035

Electric Off-Road ATVs & UTVs Market Size and Share Forecast Outlook 2025 to 2035

Electric Blind Rivet Gun Market Size and Share Forecast Outlook 2025 to 2035

Electric Fireplace Market Size and Share Forecast Outlook 2025 to 2035

Electric Glider Market Size and Share Forecast Outlook 2025 to 2035

Electric Vehicle Battery Conditioners Market Size and Share Forecast Outlook 2025 to 2035

Electric Power Steering Motors Market Size and Share Forecast Outlook 2025 to 2035

Electric Motor Market Size and Share Forecast Outlook 2025 to 2035

Electric Gripper Market Size and Share Forecast Outlook 2025 to 2035

Electric Boat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA