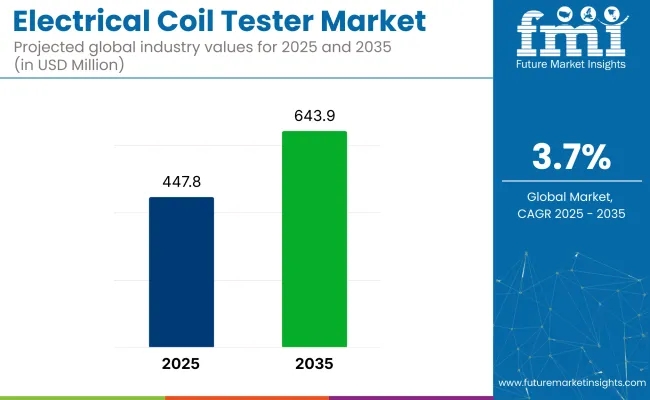

The electrical coil tester market is estimated to be valued at USD 447.8 million, and it is projected to reach approximately USD 643.9 million by 2035. This represents a CAGR of 3.7% over the forecast period from 2025 to 2035.

The growth can be attributed to the increasing need for reliable and efficient testing equipment used in the maintenance and manufacturing of electric motors, transformers, generators, and other coil-based equipment. Electrical coil testers play a vital role in ensuring the performance and longevity of these components, especially in sectors where equipment downtime can result in significant operational costs.

The industry is characterized by its essential role in quality assurance and predictive maintenance strategies. As industrial automation and electrification increase globally, so does the emphasis on routine equipment testing and diagnostics. According to the USA EIA, utilities spent USD 320 billion in 2023 to produce electricity, up from USD 287 billion in 2003.

Electrical coil testers are used to evaluate the integrity, insulation resistance, and functionality of coil windings in motors and transformers, critical tasks that prevent electrical failures and extend asset life. Emerging economies are rapidly adopting testing technologies as they expand their power infrastructure, manufacturing capabilities, and electric mobility systems.

This trend is particularly notable in Asia-Pacific, where urbanization and industrialization are creating sustained demand for electrical testing tools. Moreover, developed industries in North America and Europe are investing heavily in grid modernization and smart manufacturing, further contributing to industry growth.

One of the major driving forces behind the expansion of the industry is the growing focus on predictive maintenance and energy efficiency. Organizations across industries are increasingly prioritizing early fault detection to avoid unplanned downtime and reduce energy losses due to equipment inefficiencies.

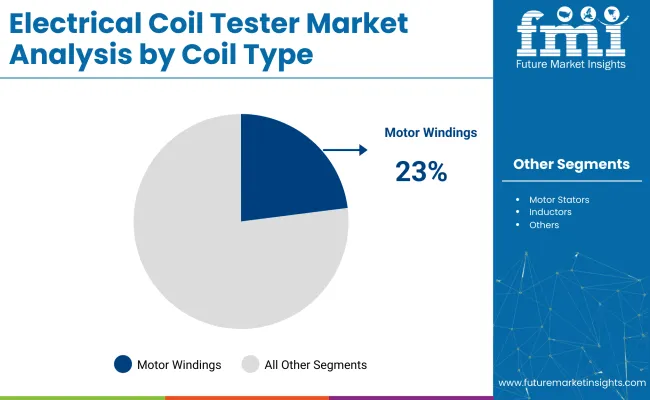

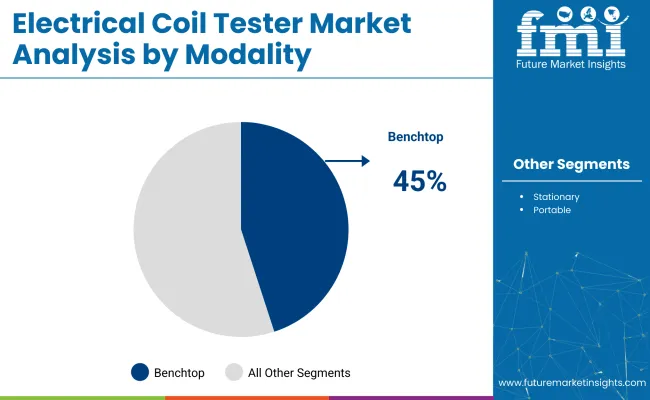

The industry is led by the motor windings segment, driven by the critical role of motors in industrial and automotive systems. Benchtop testers dominate by modality due to their precision and reliability in controlled environments. The “up to 2,500 V” voltage range is most preferred for its balance of safety and performance, while the electrical and heavy machinery sector leads end-use due to its dependence on high-maintenance equipment and growing automation demands.

Motor Windings are projected to dominate the industry in 2025, accounting for 23% of the industry share.

The benchtop segment is projected to hold over 45% of the industry share in 2025 in the industry, making it the dominant modality.

The up to 2,500 V segment is expected to dominate the industry, capturing an industry share of over 35% in 2025. This segment is widely favored due to its versatility and suitability for testing a broad range of electrical equipment, including motors, transformers, and coils used in industrial and commercial applications.

Electrical & heavy machinery is projected to account for 19% of the industry share in 2025.

The industry is driven by the growing adoption of predictive maintenance to enhance equipment reliability and reduce downtime. Additionally, rapid industrial automation and electrification, including electric vehicles and renewable energy, increase demand for accurate and reliable coil testing solutions.

Growing Emphasis on Predictive Maintenance and Equipment Reliability

One of the key dynamics driving the industry is the rising adoption of predictive maintenance practices across various industries. Organizations are increasingly shifting from reactive to proactive maintenance strategies to minimize unexpected equipment failures, extend asset life, and reduce operational downtime. Electrical coil testers play a vital role in this transformation by enabling early detection of insulation breakdowns, winding faults, and other electrical anomalies in critical equipment like motors, transformers, and generators.

Expansion of Industrial Automation and Electrification

Another significant industry driver is the rapid expansion of industrial automation and the global push toward electrification. As factories and industrial facilities adopt advanced automated systems and integrate electric motors in various applications, the need for consistent and accurate coil testing becomes more essential. This trend is further fueled by the growth of electric vehicles, renewable energy systems, and smart grid infrastructure, all of which rely heavily on coil-based components.

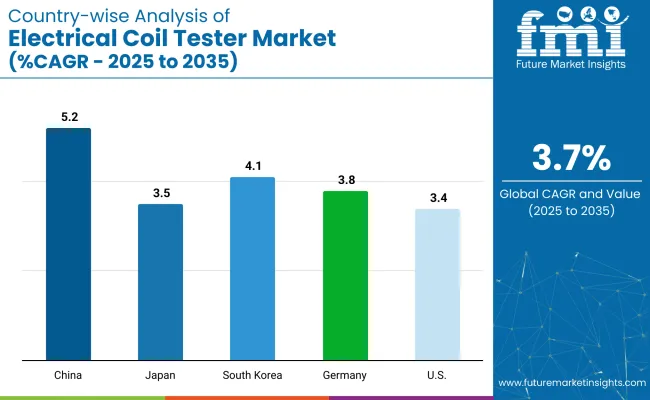

The industry is driven by the rising adoption of predictive maintenance and the growing demand for equipment reliability. Rapid expansion in China and South Korea is fueled by manufacturing and infrastructure growth. The USA and Germany lead in innovation and automation for enhanced testing precision.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 5.2% |

| Japan | 3.5% |

| South Korea | 4.1% |

| Germany | 3.8% |

| United States | 3.4% |

The United States industry is estimated to grow at a 3.4% CAGR during the study period.

The industry in China is projected to grow at a CAGR of 5.2% during the study period.

The industry in Japan is expected to grow at a CAGR of 3.5% during the study period.

The industry in South Korea is anticipated to grow at a CAGR of 4.1% during the study period.

The industry in Germany is forecasted to grow at a CAGR of 3.8% during the study period.

Dominant players like Qingdao AIP Intelligent Instrument Co., Ltd., JTEKT Electronics Corporation, and Kikusui Electronics Corp. lead the industry with cutting-edge diagnostic technologies, high-precision testing capabilities, and robust global distribution networks across automotive, industrial, and power sectors.

Key players such as Soken Electric Co., Ltd., Infantron, and Hioki provide specialized testing solutions for specific applications and cater to regional industries. Emerging players, including smaller manufacturers like Wenzhou Joie, offer cost-effective and tailored testing equipment for local industries and niche segments.

Recent Electrical Coil Tester Industry News

| Report Attributes | Details |

|---|---|

| Current Total Industry Size (2025) | USD 447.8 million |

| Projected Industry Size (2035) | USD 643.9 million |

| CAGR (2025 to 2035) | 3.7% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and units |

| Coil Type Analyzed (Segment 1) | Automotive Ignition Coils, Motor Windings, Transformer Windings, Motor Stators, Inductors, And Relays. |

| Modality Covered (Segment 2) | Benchtop, Stationary, And Portable. |

| Input Voltage Covered (Segment 3) | Up to 500 V, Up to 2,500 V, Up to 5,000 V, and above 5,000 V |

| End Use Analyzed (Segment 4) | Automotive OEMs, Aerospace, Electrical & Heavy Machinery, Semiconductor, Electronics & Appliances, Research & Certification Labs, Energy & Power, And Others |

| Regions Covered | North America, Western Europe, East Asia, South Asia |

| Countries Covered | United States; Canada; United Kingdom; Germany; France; Italy; Spain; Netherlands; China; Japan; South Korea; India; Pakistan; Bangladesh |

| Key Players Influencing the Industry | Qingdao AIP Intelligent Instrument Co., Ltd., JTEKT ELECTRONICS CORPORATION, Soken Electric Co., Ltd., Infantron, Kikusui Electronics Corp., Hioki |

| Additional Attributes | Dollar sales, industry share, regional demand trends, growth drivers, competitive landscape, end-user preferences, pricing benchmarks, technology trends, and future forecasts by modality and voltage range. |

The industry is segmented into automotive ignition coils, motor windings, transformer windings, motor stators, inductors, and relays.

The industry covers benchtop, stationary, and portable.

The industry is categorized into Up to 500 V, Up to 2,500 V, Up to 5,000 V, and above 5,000 V.

The industry is divided into automotive OEMs, aerospace, electrical & heavy machinery, semiconductor, electronics & appliances, research & certification labs, energy & power, and others

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, the Middle East and Africa (MEA) have been covered in the report.

The industry is expected to reach USD 447.8 million by 2025.

The industry size is projected to be USD 643.9 million in 2035.

The industry is expected to grow at a CAGR of 3.7% from 2025 to 2035.

China is expected to be the fastest-growing with a CAGR of 5.2%.

Qingdao AIP Intelligent Instrument Co., Ltd holds the highest market share, 20%, in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steering Column Lock Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Fuses Market Analysis – Growth & Forecast 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Electrical Service Market Growth – Trends & Forecast 2024-2034

Electrical Safety Analyzers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA