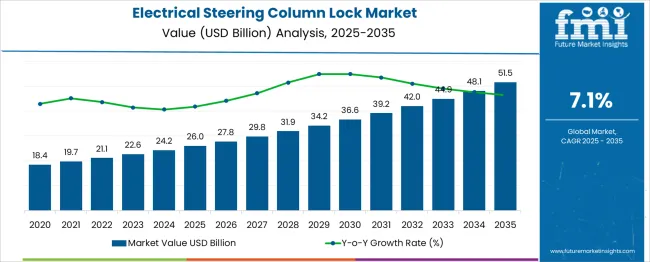

The Electrical Steering Column Lock Market is estimated to be valued at USD 26.0 billion in 2025 and is projected to reach USD 51.5 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period. A growth momentum analysis reveals steady acceleration followed by sustained growth. Between 2025 and 2030, the market grows from USD 26.0 billion to USD 36.6 billion, contributing USD 10.6 billion in incremental growth. This period demonstrates a CAGR of 6.7%, driven by increasing demand for advanced safety features in vehicles, particularly in the automotive sector, where electric and autonomous vehicles are becoming more prevalent. The market shows strong momentum during this phase, fueled by technological advancements in vehicle security systems, regulatory pressure for enhanced anti-theft features, and rising consumer awareness of vehicle safety.

From 2030 to 2035, the market continues to grow at a slightly higher rate, moving from USD 36.6 billion to USD 51.5 billion, contributing USD 14.9 billion. This phase reflects a CAGR of 8.2%, as continued innovation in electrical steering column locks, coupled with the proliferation of electric vehicles (EVs) and smart automotive technologies, drives further demand. The growth momentum analysis indicates a strong market performance with accelerating growth in the latter half of the forecast, underpinned by advancements in automotive technology and rising global adoption of connected and autonomous vehicles.

| Metric | Value |

|---|---|

| Electrical Steering Column Lock Market Estimated Value in (2025 E) | USD 26.0 billion |

| Electrical Steering Column Lock Market Forecast Value in (2035 F) | USD 51.5 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The electrical steering column lock (ESCL) market is expanding steadily due to rising automotive security standards, electronic integration in steering systems, and growing production of passenger vehicles with embedded safety features. These systems prevent unauthorized steering wheel movement and are essential components in modern vehicle anti-theft architectures.

As vehicle manufacturers shift toward drive-by-wire technologies and centralized electronic control units, the adoption of ESCL systems is becoming standard. Increasing focus on insurance compliance, immobilizer regulation, and improved theft deterrence is supporting adoption, particularly in developing economies.

OEM investments in compact, integrated steering modules and enhanced reliability of lock actuators are driving continued innovation. With electrification trends and increasing electronic content per vehicle, ESCL integration is expected to become more prevalent across entry-level and premium vehicle segments.

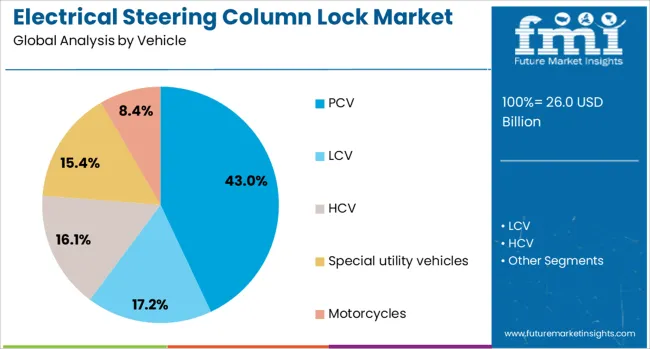

The electrical steering column lock market is segmented by vehicle, distribution channel, and geographic regions. The electrical steering column lock market is divided into PCV, LCV, HCV, Special utility vehicles, and Motorcycles. In terms of distribution channel, the electrical steering column lock market is classified into OEM and market. Regionally, the electrical steering column lock industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Passenger cars (PCVs) are expected to dominate the electrical steering column lock market with a 43.0% share in 2025. This leadership is driven by rising volumes of passenger vehicle production globally and increasing consumer demand for vehicles with advanced security systems.

ESCL units offer reliable anti-theft locking solutions integrated with the ignition and start-stop systems. Automakers are standardizing ESCL across mid-size and compact cars, particularly in regions with high vehicle theft incidents.

Additionally, increased production of electric and hybrid passenger vehicles is further promoting ESCL installations due to the shift toward electronic ignition systems.

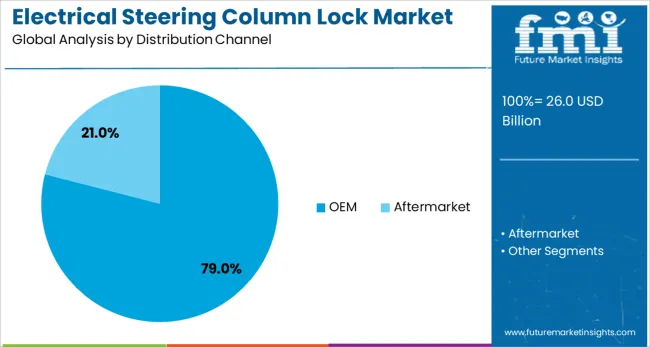

The OEM segment is projected to account for 79.0% of the market share in 2025, making it the dominant distribution channel. Original equipment manufacturers are integrating ESCL systems directly into the steering column during assembly, ensuring compatibility with other vehicle control modules and reducing aftermarket dependency.

OEMs also benefit from system-level testing, longer product warranties, and smoother vehicle assembly line integration.

As automakers strive for higher security compliance and simplified design, OEM-sourced ESCL units remain the preferred choice across most vehicle platforms, including ICE and EV architectures.

Increasing vehicle security concerns have led to the rising adoption of electrical steering column locks, which enhance vehicle protection by electronically immobilizing the steering system. These locks offer added security by preventing unauthorized vehicle use, a crucial factor as automotive theft remains a significant issue. The demand for such systems is heightened by the rise of advanced security features in vehicles, particularly in the electric vehicle (EV) and autonomous vehicle sectors. While challenges like high production costs and integration complexities exist, ongoing technological advancements offer growth opportunities, particularly as manufacturers aim to meet rising security standards in modern vehicles.

The increasing focus on vehicle security systems is significantly contributing to the demand for electrical steering column locks. These locks are crucial in modern vehicles, especially as anti-theft solutions become a priority for both consumers and manufacturers. As the automotive industry embraces electric and autonomous vehicles, there is a heightened need for advanced, electronic-based security systems that can be seamlessly integrated into digital platforms. Technological advancements in sensors, digital encryption, and remote access control systems further enhance the efficiency and cost-effectiveness of electrical steering column locks. As these innovations align with consumer demands for safer, smarter vehicles, the adoption of electrical steering column locks is growing. These systems not only prevent theft but also ensure higher security levels for autonomous and electric vehicles, where traditional security methods are less effective.

A significant challenge in the adoption of electrical steering column locks is the high cost associated with both development and installation. The need for specialized components, along with the advanced technology involved in these systems, contributes to increased production expenses. The complexity of integrating these locks into existing vehicle architectures, particularly in older models, presents another barrier. Retrofitting legacy systems requires extensive modifications and can lead to higher costs and extended development timelines. Ensuring long-term reliability is critical, as any failure in the system could compromise vehicle security. Compatibility with other security systems, like keyless entry and immobilizers, adds another layer of complexity. Manufacturers must invest heavily in R&D to guarantee smooth integration across various vehicle platforms, which may slow down widespread adoption and increase costs for manufacturers and consumers.

The rise of electric and autonomous vehicles presents a unique growth opportunity for the electrical steering column lock market. These vehicles require advanced security measures to ensure safety and prevent theft, making electronic steering column locks a key component in vehicle security systems. As autonomous vehicles rely on digital systems for navigation and control, the need for integrated, sophisticated security features becomes essential. The global expansion of electric vehicles (EVs) offers a substantial market for these security solutions, especially as automakers focus on making EVs more secure. The adoption of electrical steering column locks in next-generation vehicles, driven by increased automation and vehicle electrification, provides opportunities for manufacturers to enhance security while aligning with evolving automotive trends focused on enhanced performance and digital control systems.

An emerging trend in the automotive industry is the growing integration of electrical steering column locks with broader automotive security systems. These locks are being incorporated into a more extensive security infrastructure that includes keyless entry, real-time vehicle tracking, and remote monitoring, helping to enhance overall vehicle protection. The integration of smart technologies, such as mobile app control and biometric access, is gaining popularity, providing more convenience and security for vehicle owners. Furthermore, the increasing adoption of autonomous vehicles accelerates the need for robust and automated security measures to ensure safe and reliable operation. As these vehicles require more complex security solutions, the market for electrical steering column locks is evolving, with manufacturers focusing on creating smarter, more interconnected systems that contribute to enhanced vehicle security.

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

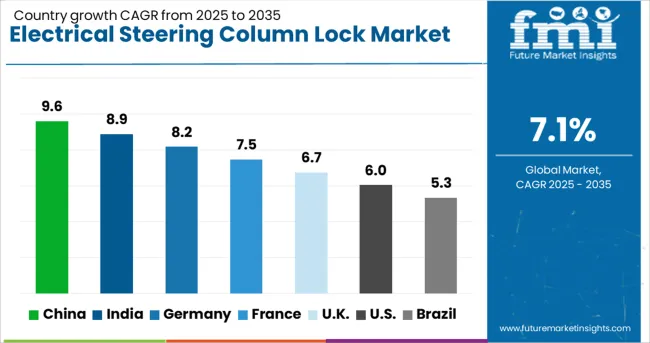

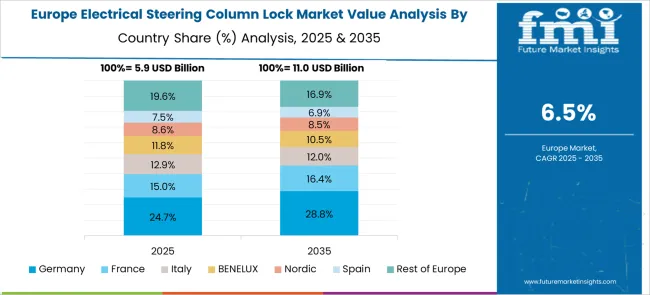

The electrical steering column lock market is projected to grow at a CAGR of 7.1% from 2025 to 2035. China leads at 9.6%, followed by India at 8.9%, and Germany at 8.2%. The United Kingdom records 6.7%, while the United States stands at 6.0%. Growth in BRICS countries such as China and India is attributed to the rapid expansion of the automotive sector, increased demand for electric vehicles, and advancements in automotive security systems. Developed markets like Germany, the UK, and the USA show steady growth driven by innovations in vehicle safety and security technologies. The analysis spans over 40+ countries, with the top countries shown below.

China is projected to grow at a CAGR of 9.6% through 2035, with its booming automotive industry playing a significant role in driving demand for electrical steering column locks. As China transitions towards electric vehicles (EVs), the demand for advanced vehicle safety systems has increased. Electrical steering column locks are becoming essential components in enhancing vehicle security, particularly as EV adoption rises in urban areas. Government regulations aimed at improving the security and intelligence of vehicles contribute to the growth of the electrical steering column lock market in China. The automotive sector in China is rapidly adopting smart technologies, and steering column locks are becoming integral in modern vehicles.

India is projected to grow at a CAGR of 8.9% through 2035, primarily driven by the rapid expansion of its automotive sector. The rise in electric vehicle (EV) production and sales in India has increased the need for enhanced vehicle security systems, including electrical steering column locks. The government’s initiatives to modernize the automotive industry and promote the adoption of advanced technologies further drive the market for steering column locks. As the country focuses on securing vehicles, the demand for these advanced locking systems continues to rise. The increased rate of vehicle theft in India has also heightened the need for robust security solutions.

Germany is projected to grow at a CAGR of 8.2% through 2035, driven by the rise in electric vehicle (EV) production and increasing focus on vehicle security. As Germany remains a leader in the automotive industry, particularly in the electric vehicle sector, there is a growing demand for advanced security features like electrical steering column locks. These locks are essential for enhancing vehicle safety and preventing theft. Germany’s push for higher security standards in electric vehicles has contributed significantly to the adoption of steering column locks. The strong regulatory framework, encouraging the use of secure technologies in vehicles, plays a crucial role in expanding the market. As more automotive manufacturers focus on electric and hybrid vehicles, the demand for advanced safety features will continue to increase in Germany.

The United Kingdom is projected to grow at a CAGR of 6.7% through 2035, supported by the increasing need for vehicle security technologies. The rise of electric vehicles (EVs) and the demand for higher security standards in modern vehicles are driving the adoption of electrical steering column locks in the UK. As the country moves towards greener mobility solutions, there is a growing emphasis on enhancing vehicle security systems. UK manufacturers are integrating advanced safety features, such as electrical steering column locks, to improve vehicle security and reduce theft. Government incentives promoting the adoption of electric vehicles and stringent safety regulations have contributed to the growing market demand.

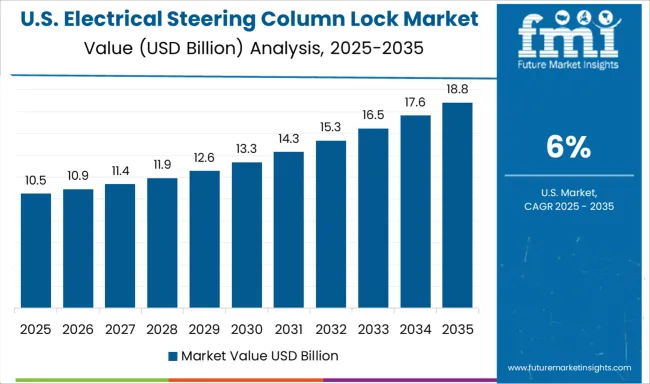

The United States is expected to grow at a CAGR of 6.0% through 2035, driven by the increasing need for advanced vehicle security systems. As the automotive market shifts towards electric vehicles (EVs), the demand for electrical steering column locks continues to rise. These locks are essential for ensuring the safety of vehicles, especially with the growing adoption of smart and connected vehicles. USA consumers and manufacturers are increasingly concerned about vehicle theft, which further drives the market for enhanced security features. The USA government’s stringent vehicle safety regulations and focus on minimizing vehicle theft contribute to the growing use of electrical steering column locks. As vehicle security becomes a higher priority, adoption rates of these systems will continue to rise, supporting the market’s expansion in the USA.

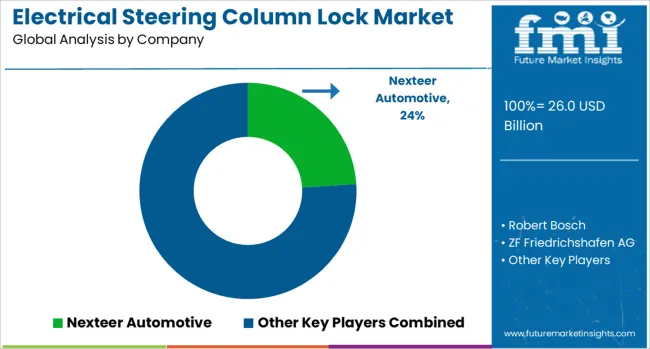

The electrical steering column lock market is driven by key players specializing in automotive security and advanced steering technologies. Nexteer Automotive leads with its high-performance electronic steering systems and column locks that enhance vehicle security while supporting driver assistance features. Robert Bosch and ZF Friedrichshafen AG are significant players, offering integrated solutions for steering and locking systems, prioritizing safety, reliability, and seamless integration with modern vehicle architectures. NSK Ltd. focuses on steering systems and column locks, emphasizing weight reduction, durability, and enhanced safety. Nissan also plays a vital role, producing electronic steering column locks as part of their commitment to advancing vehicle security and integrating advanced driver assistance systems (ADAS).

The market is further influenced by the increasing demand for keyless entry systems and advancements in electric vehicles (EVs). Competitive differentiation is driven by factors such as product reliability, integration capabilities, ease of installation, and adherence to automotive safety standards. Players in the market must overcome barriers such as high R&D costs, regulatory compliance, and the need for technical expertise in security systems. To stay competitive, companies are focusing on improving the efficiency of locking mechanisms, enhancing vehicle security features, and ensuring compatibility with electric and autonomous vehicles. As the automotive industry continues to innovate, companies are prioritizing the development of next-generation steering column locks with integrated connectivity and advanced security systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 26.0 Billion |

| Vehicle | PCV, LCV, HCV, Special utility vehicles, and Motorcycles |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nexteer Automotive, Robert Bosch, ZF Friedrichshafen AG, NSK Ltd., and Nissan |

| Additional Attributes | Dollar sales by product type (electronic steering column locks, mechanical/electromechanical locks) and end-use segments (passenger vehicles, commercial vehicles, electric vehicles). Demand dynamics are driven by increasing adoption of electronic and keyless entry systems, growing automotive security concerns, and rising production of electric vehicles (EVs). Regional trends show North America and Europe leading the adoption of advanced steering and locking technologies, while Asia-Pacific is emerging due to increased production of vehicles with integrated electronic security systems. |

The global electrical steering column lock market is estimated to be valued at USD 26.0 billion in 2025.

The market size for the electrical steering column lock market is projected to reach USD 51.5 billion by 2035.

The electrical steering column lock market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in electrical steering column lock market are pcv, lcv, hcv, special utility vehicles and motorcycles.

In terms of distribution channel, oem segment to command 79.0% share in the electrical steering column lock market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electrically-Driven Heavy-Duty Aerial Work Platforms Market Size and Share Forecast Outlook 2025 to 2035

Electrically Actuated Micro Robots Market Size and Share Forecast Outlook 2025 to 2035

Electrically Conductive Coating Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Safety Personal Protection Equipment (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Electrical Steel Market Growth - Trends & Forecast 2025 to 2035.

Electrical Coil Tester Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electrical Fuses Market Analysis – Growth & Forecast 2025 to 2035

Electrical Digital Twin Market Growth – Trends & Forecast 2025 to 2035

Electrical Bushings Market Trends – Growth & Forecast 2025 to 2035

Electrical Steel Coatings Market 2025-2035

Electrical Service Market Growth – Trends & Forecast 2024-2034

Electrical Safety Analyzers Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA