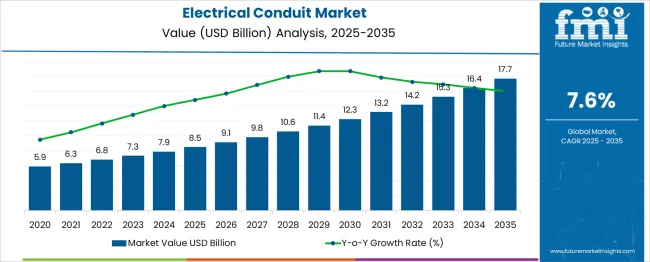

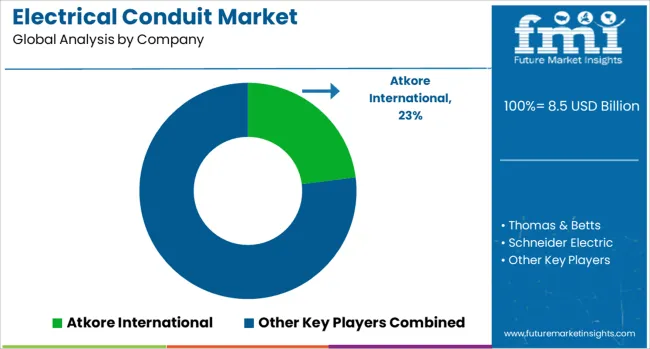

The global electrical conduit market is set to grow from USD 8.5 billion in 2025 to approximately USD 17.7 billion by 2035, recording an absolute increase of USD 9.2 billion over the forecast period. This translates into a total growth of 108.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.6% between 2025 and 2035. The overall market size is expected to grow by nearly 2.08X during the same period, supported by increasing infrastructure development, rising demand for electrical safety solutions, and growing focus on industrial automation and energy distribution systems.

Between 2025 and 2030, the electrical conduit market is projected to expand from USD 8.5 billion to USD 12.3 billion, resulting in a value increase of USD 3.8 billion, which represents 41.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising construction activities, increasing demand for electrical infrastructure modernization, and growing penetration of renewable energy projects in emerging markets. Electrical equipment manufacturers are expanding their conduit product portfolios to address the growing demand for versatile and durable electrical protection solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 8.5 billion |

| Forecast Value in (2035F) | USD 17.7 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

Modern construction projects are increasingly focused on safety compliance and long-term durability that can protect electrical wiring from physical damage, moisture, and environmental hazards. Electrical conduits' proven efficacy in preventing electrical fires and ensuring system integrity makes them essential components in residential, commercial, and industrial installations.

The growing emphasis on sustainable construction and energy efficiency is driving demand for conduit systems that support renewable energy installations and smart building technologies. Industrial automation and the expansion of manufacturing facilities are creating opportunities for specialized conduit solutions that can withstand harsh operating conditions. The rising influence of safety regulations and building codes is also contributing to increased product adoption across different construction segments and geographical regions.

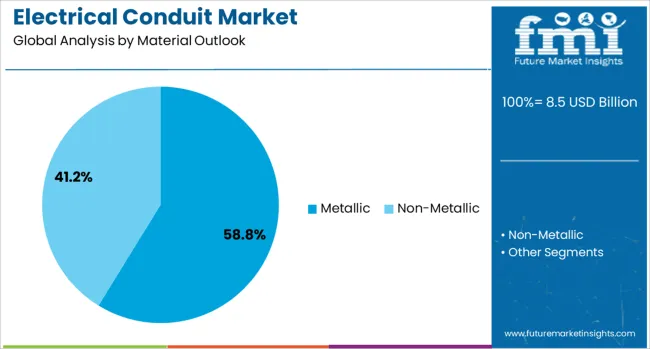

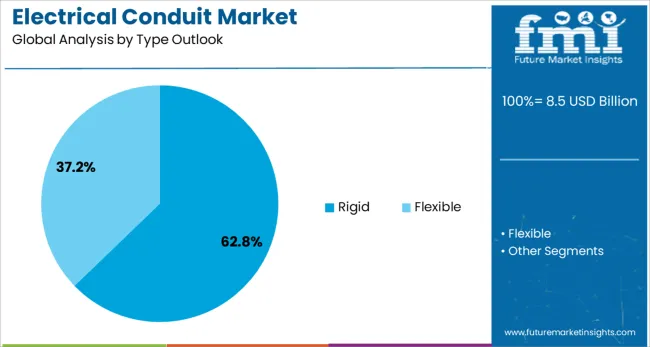

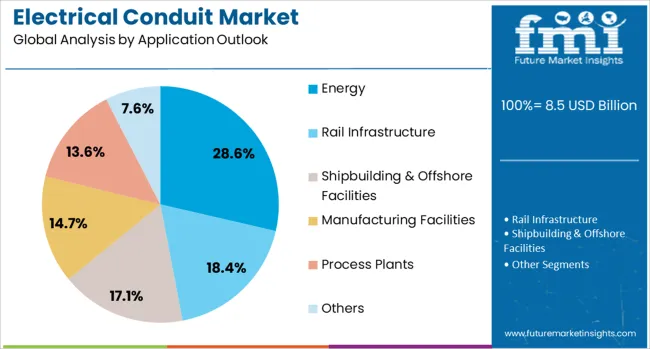

The market is segmented by material outlook, type outlook, application outlook, and region. By material outlook, the market is divided into metallic and non-metallic conduits. Based on type outlook, the market is categorized into rigid and flexible conduits. In terms of application outlook, the market is segmented into energy, rail infrastructure, shipbuilding & offshore facilities, manufacturing facilities, process plants, and others. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The metallic conduit segment is projected to account for 58.8% of the electrical conduit market in 2025, reaffirming its position as the preferred material choice for heavy-duty applications. Industries increasingly rely on metallic conduits for their superior mechanical strength, electromagnetic interference shielding, and fire resistance properties. These conduits directly address critical safety concerns in industrial and commercial installations where cable protection against physical damage and environmental factors is paramount.

This material type forms the foundation of most industrial electrical installations, as it represents the most reliable and code-compliant solution for demanding environments. Engineering specifications and safety standards continue to strengthen trust in metallic conduit systems. With industrial facilities requiring robust electrical infrastructure that can withstand harsh operating conditions, metallic conduits align with both safety requirements and long-term durability goals. Their broad application across heavy industries ensures sustained dominance, making them the central growth driver of electrical conduit demand in critical infrastructure projects.

Rigid conduits are projected to represent 62.8% of electrical conduit demand in 2025, underscoring their role as the preferred type for permanent installations requiring maximum protection. Construction projects gravitate toward rigid conduits for their structural integrity, superior crush resistance, and ability to provide comprehensive protection in exposed or underground applications. Positioned as essential components in code-compliant installations, rigid conduits offer both mechanical protection and environmental sealing capabilities.

The segment is supported by stringent building codes and safety regulations that mandate rigid conduit use in specific applications such as hazardous locations, underground installations, and exposed outdoor environments. Additionally, manufacturers are increasingly developing corrosion-resistant coatings and advanced materials that enhance durability and extend service life in challenging conditions. As infrastructure projects prioritize long-term reliability and safety compliance, rigid conduits will continue to dominate demand, reinforcing their critical positioning within the electrical conduit market.

The energy application is forecasted to contribute 28.6% of the electrical conduit market in 2025, reflecting the growing investments in power generation, transmission, and distribution infrastructure. Energy sector projects are increasingly demanding high-performance conduit systems that can protect critical electrical components in power plants, substations, and renewable energy installations. This aligns with global energy transition initiatives that emphasize grid modernization, renewable integration, and electrical infrastructure resilience.

Power generation facilities and utility companies prioritize conduit systems that meet stringent safety standards while providing long-term reliability in harsh operating environments. The segment also benefits from expanding renewable energy projects, including solar farms and wind installations, which require specialized conduit solutions for both power and control cabling. With global energy demand continuing to rise and infrastructure modernization accelerating, the energy sector serves as a critical driver of innovation and growth in the electrical conduit category.

The electrical conduit market is advancing steadily due to increasing infrastructure development and growing emphasis on electrical safety standards. However, the market faces challenges including raw material price volatility, competition from alternative cable management systems, and varying regional standards and regulations. Innovation in materials technology and sustainable manufacturing practices continue to influence product development and market expansion patterns.

The growing adoption of smart city initiatives and Industry 4.0 technologies is creating demand for advanced electrical conduit systems that support complex wiring infrastructure. Data centers, automated manufacturing facilities, and intelligent building systems require sophisticated cable management solutions that ensure reliable power and data transmission. This trend is driving innovation in conduit design to accommodate higher cable densities and provide enhanced protection for sensitive communication cables.

Modern conduit manufacturers are incorporating advanced materials such as high-performance polymers, composite materials, and corrosion-resistant alloys to enhance product durability and application versatility. These technologies improve conduit performance in extreme temperatures, corrosive environments, and high-stress applications. Advanced manufacturing techniques including automated production lines and quality control systems ensure consistent product quality while reducing manufacturing costs and environmental impact.

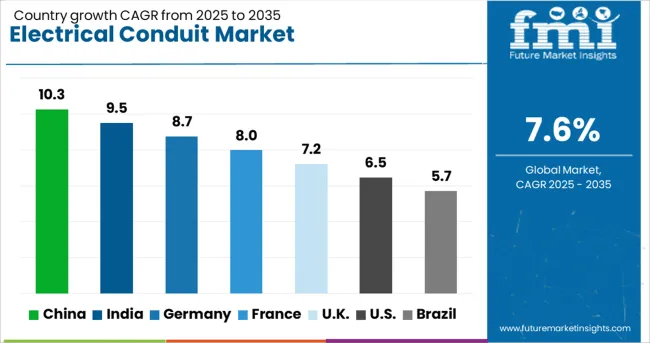

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 10.3% |

| India | 9.5% |

| Germany | 8.7% |

| France | 8% |

| UK | 7.2% |

| USA | 6.5% |

| Brazil | 5.7% |

The electrical conduit market is experiencing robust growth globally, with China leading at a 10.3% CAGR through 2035, driven by massive infrastructure development, industrial expansion, and urbanization initiatives. India follows at 9.5%, supported by government infrastructure programs, growing manufacturing sector, and increasing focus on electrical safety standards. Germany shows steady growth at 8.7%, emphasizing quality standards and industrial automation requirements. France records 8%, focusing on energy infrastructure modernization and nuclear sector maintenance. The UK demonstrates 7.2% growth, prioritizing renewable energy projects and building renovation programs.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from electrical conduits in China is projected to exhibit strong growth with a CAGR of 10.3% through 2035, driven by unprecedented infrastructure development and rapid industrialization across tier-1 and tier-2 cities. The country's Belt and Road Initiative and domestic construction boom are creating significant demand for electrical conduit systems. Major international and domestic manufacturers are establishing comprehensive production and distribution networks to serve the growing construction and industrial sectors.

Revenue from electrical conduits in India is expanding at a CAGR of 9.5%, supported by government infrastructure initiatives, growing manufacturing sector, and increasing emphasis on electrical safety compliance. The country's Make in India program and smart cities mission are driving demand for quality electrical infrastructure solutions. International electrical equipment manufacturers and domestic producers are establishing manufacturing facilities to serve the rapidly growing construction and industrial markets.

Revenue from electrical conduits in Germany is projected to grow at a CAGR of 8.7% through 2035, driven by the country's strong manufacturing base, Industry 4.0 initiatives, and stringent safety standards. German industries consistently demand high-quality conduit systems that meet exacting specifications for durability, safety, and performance in demanding industrial applications.

Demand for electrical conduits in France is projected to grow at a CAGR of 8%, supported by extensive energy infrastructure modernization programs and nuclear power plant maintenance requirements. French industries prioritize high-specification conduit systems that ensure reliable performance in critical applications while meeting stringent European safety standards.

Revenue from electrical conduits in the UK is projected to grow at a CAGR of 7.2% through 2035, supported by significant investments in renewable energy infrastructure and commercial construction projects. British contractors and installers value quality, compliance, and sustainability, positioning electrical conduits as essential components in modern electrical installations.

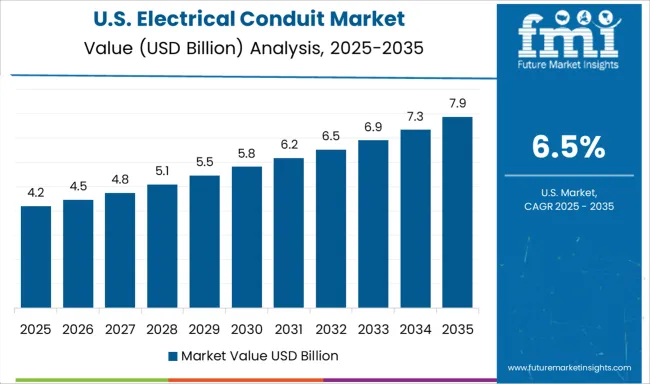

Revenue from electrical conduits in the USA is projected to grow at a CAGR of 6.5%, supported by infrastructure modernization initiatives and industrial facility upgrades. American industries are increasingly focused on safety compliance, system reliability, and long-term performance. The market is characterized by strong demand for innovative conduit solutions that address specific application requirements while meeting national electrical codes.

Revenue from electrical conduits in Brazil is projected to grow at a CAGR of 5.7% through 2035, supported by industrial development initiatives and infrastructure improvement programs. Brazilian industries are increasingly adopting international safety standards and quality specifications, driving demand for reliable conduit systems in industrial and commercial applications.

The electrical conduit market is characterized by competition among established electrical equipment manufacturers, specialized conduit producers, and regional players. Companies are investing in advanced manufacturing technologies, material innovations, global distribution networks, and technical support services to deliver reliable, compliant, and cost-effective cable protection solutions. Product quality, technical expertise, and customer service are central to strengthening market position and customer relationships.

Atkore International leads the market with 23.0% global value share, offering comprehensive conduit solutions with focus on innovation and application-specific products. Thomas & Betts provides extensive electrical raceway systems with emphasis on quality and code compliance. Schneider Electric delivers integrated electrical infrastructure solutions combining conduits with broader electrical systems. Legrand focuses on cable management innovations with premium positioning in commercial applications. Siemens and General Electric, operating globally, provide industrial-grade conduit systems integrated with their broader electrical equipment portfolios. Eaton Corporation emphasizes safety and reliability with comprehensive conduit ranges for diverse applications. Southwire Company and Cooper Industries offer value-engineered solutions with strong distribution networks. Hubbell provides specialized conduit systems for demanding industrial and hazardous location applications.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 8.5 Billion |

| Material Outlook | Metallic, Non-Metallic |

| Type Outlook | Rigid, Flexible |

| Application Outlook | Energy, Rail Infrastructure, Shipbuilding & Offshore Facilities, Manufacturing Facilities, Process Plants, Others |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Atkore International, Thomas & Betts, Schneider Electric, Legrand, Siemens, General Electric, Eaton Corporation, Southwire Company, Cooper Industries, Hubbell, and others |

| Additional Attributes | Dollar sales by conduit material and diameter specifications, regional demand trends, competitive landscape, buyer preferences for metallic versus non-metallic solutions, integration with fire-rated and explosion-proof certifications, innovations in corrosion resistance, quick-connect systems, and sustainable manufacturing practices |

The global electrical conduit market is estimated to be valued at USD 8.5 billion in 2025.

The market size for the electrical conduit market is projected to reach USD 17.7 billion by 2035.

The electrical conduit market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in electrical conduit market are metallic and non-metallic.

In terms of type outlook, rigid segment to command 62.8% share in the electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Label Market Size and Share Forecast Outlook 2025 to 2035

Electrical Insulation Materials Market Size and Share Forecast Outlook 2025 to 2035

Electrical Enclosure Market Size and Share Forecast Outlook 2025 to 2035

Electrical Sub Panels Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Services Market Size and Share Forecast Outlook 2025 to 2035

Electrical Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA