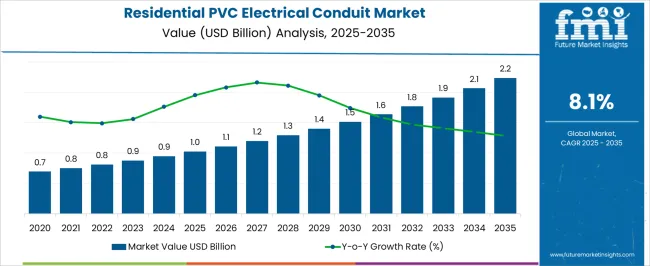

The Residential PVC Electrical Conduit Market is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 8.1% over the forecast period. This steady expansion reflects the increasing demand for safe, durable, and cost-effective electrical wiring solutions in residential construction projects globally. From 2020 to 2024, the market experienced early adoption, growing from USD 0.7 billion to 1.0 billion as modern housing projects and urbanization trends drove demand for standardized electrical infrastructure.

During the scaling phase from 2025 to 2030, the market is expected to gain momentum, increasing from USD 1.0 billion to around USD 1.5 billion. This growth is fueled by rising residential construction activities, government initiatives promoting electrical safety standards, and growing consumer preference for PVC conduits due to their corrosion resistance and ease of installation. From 2030 to 2035, the market enters a consolidation stage, reaching USD 2.2 billion as adoption saturates in mature markets and competition intensifies among leading manufacturers. YoY growth remains strong, though marginally tapering as penetration deepens. The market trajectory underscores a combination of sustained infrastructure development, regulatory support, and technological improvements in conduit manufacturing, ensuring continued expansion across the residential electrical segment.

| Metric | Value |

|---|---|

| Residential PVC Electrical Conduit Market Estimated Value in (2025 E) | USD 1.0 billion |

| Residential PVC Electrical Conduit Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

The Residential PVC Electrical Conduit market is experiencing steady expansion, fueled by the rising demand for cost-effective and corrosion-resistant wiring systems across residential construction projects. This growth has been supported by increasing urbanization, rising residential construction permits, and growing awareness of electrical safety standards. PVC conduits have gained wide adoption due to their lightweight properties, ease of installation, and long-term durability in indoor environments.

Press releases from construction technology firms and statements from electrical regulatory bodies have highlighted a growing shift toward non-metallic solutions for safer and more efficient electrical routing. Additionally, the market is expected to benefit from policy-driven housing programs and energy-efficient building codes, especially in developing regions.

Future growth is being enabled by the focus on sustainable materials and the integration of modular construction techniques, which favor pre-fabricated and easy-to-install conduit systems These factors are collectively reinforcing the market’s forward trajectory, positioning PVC conduit systems as a preferred solution within residential electrical infrastructure.

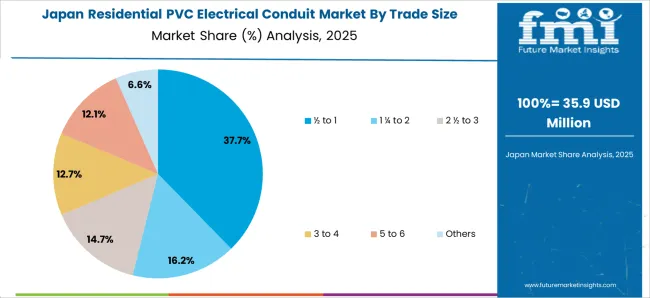

The residential PVC electrical conduit market is segmented by trade size and geographic regions. By trade size, the residential PVC electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. Regionally, the residential PVC electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is projected to account for 36.8% of the Residential PVC Electrical Conduit market revenue share in 2025, making it the leading segment within this category. This prominence is being driven by its suitability for standard residential wiring applications, which require moderate conduit dimensions for efficient cable management. Electrical installation guidelines and building safety codes have contributed to the segment's dominance by recommending these sizes for indoor circuits, including lighting and outlet wiring.

It has been observed in contractor-focused publications and electrical engineering bulletins that this range offers optimal flexibility, ease of installation, and compatibility with existing junction boxes and fittings. Furthermore, distributors have consistently reported high turnover for this size category due to its alignment with the majority of household electrical layouts.

The segment's accessibility, lower cost per unit, and broad availability through hardware and retail channels have further solidified its position These factors have made the ½ to 1 trade size conduit a preferred choice among installers and residential contractors.

The residential PVC electrical conduit market is expanding due to rising construction of homes, apartments, and urban housing projects. PVC conduits provide cost-effective, corrosion-resistant, and easy-to-install solutions for safe electrical wiring. Growing demand for reliable electrical infrastructure, safety compliance, and organized wiring systems drives adoption. Manufacturers are focusing on lightweight materials, fire-retardant designs, and flexible installation options. North America and Asia-Pacific lead growth due to increased residential construction and updated building codes emphasizing electrical safety standards.

PVC conduits offer an efficient method for protecting electrical cables in residential projects. They prevent exposure to moisture, physical damage, and rodents, ensuring long-term safety and uninterrupted electrical flow. Easy handling, cutting, and joining make installation faster and reduce labor costs. Builders and electricians prefer PVC conduits for their flexibility, lightweight nature, and resistance to corrosion compared to metal alternatives. With increasing household electrification and smart home adoption, reliable conduit systems become essential. Manufacturers providing pre-marked, standardized, and easy-to-install PVC conduit solutions gain favor in residential construction projects.

Adherence to electrical safety codes and standards is critical in residential construction. PVC conduits must meet fire-retardant, mechanical strength, and insulation requirements defined by local authorities. Manufacturers investing in high-quality raw materials and rigorous testing ensure compliance with international and regional electrical codes. Products certified under recognized standards improve contractor confidence and minimize legal risks. Building inspectors and developers prefer certified conduits to ensure long-term safety, especially in multi-unit housing projects. Meeting regulatory requirements enhances market credibility and drives adoption among safety-conscious residential construction projects.

PVC conduits offer adaptability for various wiring layouts in apartments, single-family homes, and mixed-use buildings. Lightweight and bendable options simplify routing around walls, ceilings, and floors. Modular connectors and fittings provide seamless integration, reducing on-site adjustments. Custom-sized conduits enable installers to meet space constraints without compromising safety. Manufacturers providing a range of diameters, colors, and accessories allow builders to standardize installations while maintaining design flexibility. Ease of installation, reduced labor, and minimal maintenance make PVC conduits a preferred choice for modern residential projects.

The market is competitive, with both global and regional manufacturers offering diverse PVC conduit solutions. Differentiation arises from product quality, cost efficiency, installation ease, and after-sales support. Strategic partnerships with construction companies, electricians, and distributors accelerate adoption. Expansion into high-growth residential regions, including Asia-Pacific and Latin America, offers significant opportunities. Companies emphasizing lightweight, durable, and certified PVC conduits with efficient supply chains strengthen market positioning. Brand recognition, consistent quality, and regional distribution networks remain key factors for long-term growth in the residential PVC electrical conduit market.

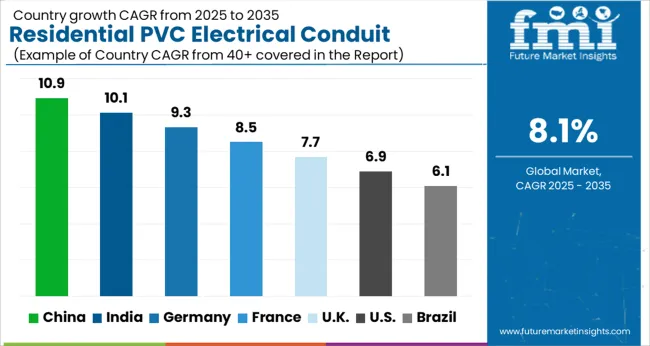

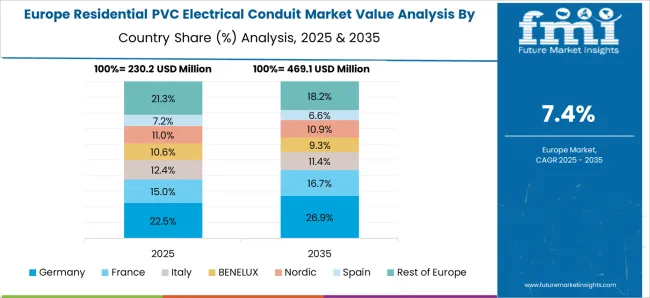

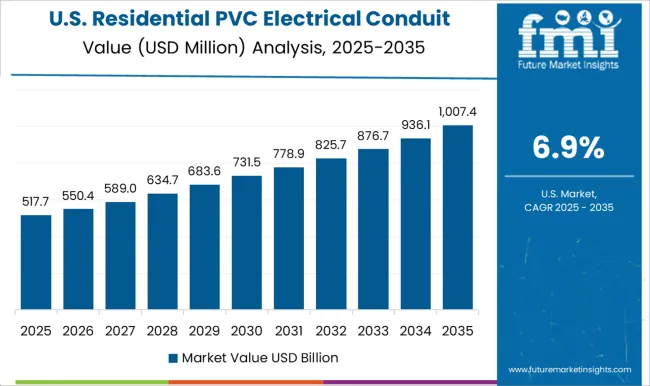

The global residential PVC electrical conduit market is projected to grow at a CAGR of 8.1%, driven by increasing demand in residential, commercial, and infrastructure construction projects. China leads with a growth rate of 10.9%, supported by large-scale urban development and modernization initiatives. India follows at 10.1%, fueled by expanding residential construction and electrical distribution networks. Germany shows steady growth at 9.3%, leveraging advanced manufacturing technologies and robust infrastructure development. The UK and USA record moderate growth rates of 7.7% and 6.9%, respectively, reflecting consistent demand in residential and commercial sectors. This report includes insights on 40+ countries; the top countries are shown here for reference.

The residential PVC electrical conduit market in China is growing at 10.9%, driven by rapid urbanization, expansion of residential construction projects, and increasing demand for reliable electrical infrastructure. PVC conduits are preferred due to their corrosion resistance, ease of installation, and cost-effectiveness, making them ideal for new housing developments and renovation projects. The government’s initiatives to modernize urban housing and improve electrical safety standards further support market growth. Manufacturers are focusing on high-quality, durable materials and innovative designs that cater to complex building layouts. Additionally, rising awareness of fire safety and electrical efficiency in residential projects contributes to the increased adoption of PVC conduits. With ongoing investments in residential infrastructure, China presents a substantial growth opportunity for the residential PVC electrical conduit market.

The residential PVC electrical conduit market in India is projected to grow at 10.1%, fueled by the country’s booming housing sector and rising focus on electrical safety standards. PVC conduits are widely adopted in residential projects due to their ease of installation, durability, and affordability. Government programs promoting affordable housing, smart cities, and modern infrastructure are driving demand for standardized electrical solutions. Manufacturers are investing in high-quality materials, fire-resistant conduits, and customizable designs to meet the requirements of developers and homeowners. Additionally, growing awareness of electrical safety, sustainable materials, and efficient installation practices supports market expansion. With the continuous growth of urban and semi-urban housing projects, India’s residential PVC electrical conduit market is expected to witness steady adoption in the coming years.

Residential PVC electrical conduit market in Germany is advancing at 9.3%, supported by stringent electrical safety standards and the adoption of modern construction practices. PVC conduits are preferred in residential projects due to their corrosion resistance, reliability, and ease of installation, ensuring long-term safety and compliance with regulatory requirements. Manufacturers are focusing on high-quality materials, fire-resistant solutions, and innovative designs tailored to multi-family and high-rise residential developments. The country’s emphasis on energy efficiency, green construction, and sustainable infrastructure further promotes the adoption of PVC electrical conduits. With ongoing urban housing projects and renovations of older buildings, Germany continues to represent a stable and high-potential market for residential PVC electrical conduit manufacturers.

The residential PVC electrical conduit market in the United Kingdom is growing at 7.7%, driven by urban housing developments, renovations, and the increasing adoption of modern electrical systems. PVC conduits offer benefits such as durability, corrosion resistance, and cost efficiency, making them ideal for residential applications. Government programs promoting safety standards, sustainable construction, and energy-efficient homes support increased adoption of PVC electrical conduits. Manufacturers focus on innovative materials, easy-to-install solutions, and designs suitable for complex building layouts. Rising awareness of electrical safety and fire prevention further enhances market demand. The combination of residential construction growth, modernization of housing infrastructure, and preference for standardized electrical solutions positions the UK market for continued growth.

The residential PVC electrical conduit market in the United States is expanding at 6.9%, fueled by rising residential construction, renovation projects, and the growing emphasis on electrical safety and reliability. PVC conduits are widely used due to their corrosion resistance, durability, and ease of installation, making them ideal for single-family homes, multi-family units, and commercial-residential projects. Government initiatives promoting energy-efficient and safe electrical installations support market growth. Manufacturers are innovating with fire-resistant materials, modular conduit systems, and customizable solutions to cater to diverse residential projects. With increasing investments in housing infrastructure and renovation of older buildings, the demand for PVC electrical conduits in the USA is expected to grow steadily, driven by efficiency, safety, and compliance requirements.

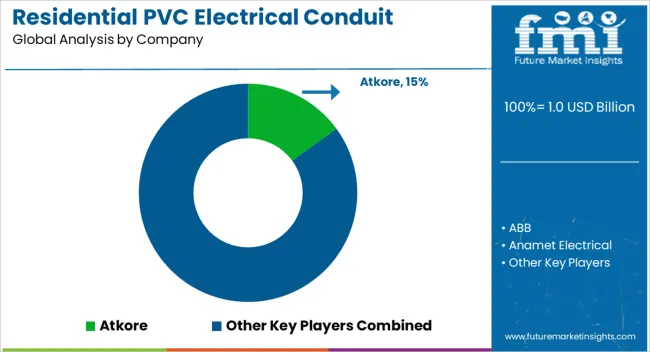

The residential PVC electrical conduit market is experiencing steady growth, driven by rapid urbanization, increasing residential construction, and the demand for safer, cost-effective electrical infrastructure. PVC conduits are widely preferred for residential wiring due to their durability, corrosion resistance, lightweight nature, and ease of installation. They provide robust protection for electrical cables against mechanical damage, moisture, and chemical exposure, making them essential for modern residential projects. Leading players such as Atkore and ABB offer a range of high-quality PVC conduit solutions tailored for residential and commercial applications. Anamet Electrical, ASTRAL, and Bahra Electric focus on innovative designs, ensuring compliance with global safety standards and local electrical codes. Champion Fiberglass, CANTEX, and Electri-Flex provide specialized conduit solutions for both indoor and outdoor residential installations, enhancing long-term reliability. Guangdong Ctube Industry, Hubbell, and HellermannTyton contribute with technologically advanced products that improve installation efficiency and ensure superior electrical insulation. Iplex Pipelines, Legrand, and Schneider Electric offer integrated solutions combining conduits with fittings and accessories for streamlined residential wiring. Sundeep Electricals, TOYO INDUSTRY LAO FACTORY, Vinidex, and Wienerberger further strengthen the market with durable, cost-effective, and eco-friendly PVC conduit offerings suitable for diverse residential construction environments. With rising construction activities in emerging economies and the growing need for organized electrical infrastructure in smart homes, the market for residential PVC electrical conduits is expected to expand rapidly. Continuous innovation, regulatory compliance, and enhanced product reliability are driving adoption, positioning PVC conduits as a critical component of safe and efficient residential electrical systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.0 Billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore, ABB, Anamet Electrical, ASTRAL, Bahra Electric, Champion Fiberglass, CANTEX, Electri-Flex, Guangdong Ctube Industry, Hubbell, HellermannTyton, Iplex Pipelines, Legrand, Schneider Electric, Sundeep Electricals, TOYO INDUSTRY LAO FACTORY, Vinidex, and Wienerberger |

| Additional Attributes | Dollar sales by type including rigid PVC, flexible PVC, and corrugated conduits, application across residential construction, renovation projects, and commercial housing, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising residential construction activities, demand for safe and durable electrical wiring solutions, and increasing adoption of standardized building codes. |

The global residential PVC electrical conduit market is estimated to be valued at USD 1.0 billion in 2025.

The market size for the residential PVC electrical conduit market is projected to reach USD 2.2 billion by 2035.

The residential PVC electrical conduit market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in residential PVC electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of , segment to command 0.0% share in the residential PVC electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA