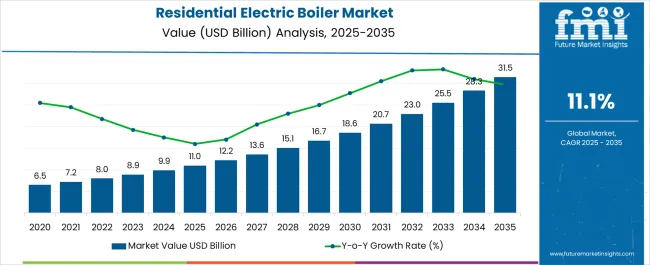

The residential electric boiler market is estimated to be valued at USD 11.0 billion in 2025 and is projected to reach USD 31.5 billion by 2035, registering a compound annual growth rate (CAGR) of 11.1% over the forecast period. This surge is driven by rising demand for energy-efficient and environmentally friendly heating solutions in residential sectors, as electric boilers offer advantages such as reduced carbon emissions, lower maintenance costs, and seamless integration with renewable energy sources. Additionally, increasing government initiatives and subsidies promoting electrification of heating systems are further accelerating adoption. Technological advancements in smart and IoT-enabled electric boilers are enhancing operational efficiency and convenience, making them an attractive option for modern households. The market’s growth also mirrors the global trend toward sustainable energy consumption and decarbonization of residential infrastructure, positioning electric boilers as a key solution in the transition to greener energy systems.

| Metric | Value |

|---|---|

| Residential Electric Boiler Market Estimated Value in (2025 E) | USD 11.0 billion |

| Residential Electric Boiler Market Forecast Value in (2035 F) | USD 31.5 billion |

| Forecast CAGR (2025 to 2035) | 11.1% |

The rising focus on decarbonizing residential heating systems is encouraging the replacement of traditional fuel-based boilers with electric variants. Government incentives promoting low-emission home heating technologies are further contributing to market momentum. Improvements in electric grid infrastructure and growing adoption of smart home systems have paved the way for seamless integration of electric boilers in modern residences.

Increasing construction of energy-efficient housing, along with rising awareness of environmental sustainability, is creating favorable conditions for electric boiler deployment. As electricity becomes a more cost-competitive and cleaner energy source, residential consumers are expected to continue moving toward electric solutions for space and water heating, ensuring sustained market growth over the coming years.

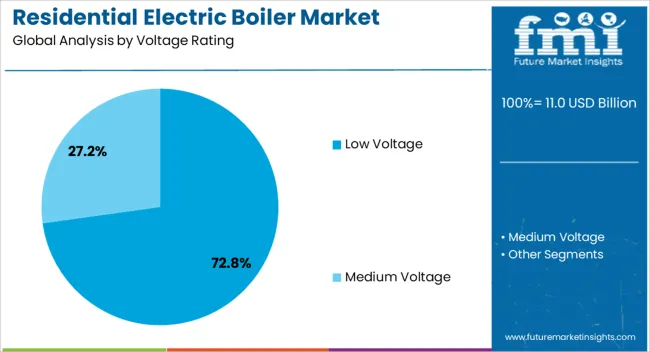

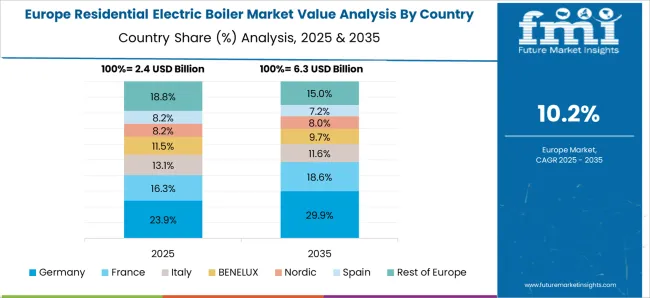

The residential electric boiler market is segmented by voltage rating and geographic regions. By voltage rating, the residential electric boiler market is divided into low-voltage and medium-voltage. Regionally, the residential electric boiler industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The low voltage segment is projected to hold 72.8% of the Residential Electric Boiler market revenue in 2025, making it the leading voltage category. This dominance is being driven by its suitability for residential settings where compact, efficient, and low-power systems are preferred.

Low voltage boilers are typically easier to install, require less specialized infrastructure, and are compatible with standard household electrical systems, which has increased their adoption in both new constructions and retrofit projects. Their lower installation cost, reduced operational complexity, and compatibility with smart thermostats and home automation systems have further reinforced their market position.

The ability to provide adequate heating for small to medium-sized residences without the need for high-capacity electrical configurations has made low-voltage electric boilers a practical and attractive choice. As consumer preferences continue to shift toward energy-efficient and low-maintenance heating technologies, the low-voltage segment is expected to maintain its leadership within the market.

The residential electric boiler market is driven by energy-efficient heating demands, government incentives, and consumer preferences for cleaner alternatives. Developments in product features further propel growth, positioning electric boilers as a leading choice for modern residential heating solutions.

The residential electric boiler market is driven by a rising preference for energy-efficient heating solutions. With increasing concerns about air quality and reducing reliance on fossil fuels, electric boilers offer a cleaner and more efficient alternative to traditional gas-powered systems. Homeowners and builders are prioritizing energy-saving heating technologies due to their lower operational costs and simpler maintenance requirements. Growing awareness about reducing carbon footprints and complying with stricter environmental regulations are pushing the demand for electric heating systems. Electric boilers are becoming a popular choice in both new residential projects and as replacements for outdated heating systems in existing homes.

Government policies are playing a significant role in the growth of the residential electric boiler market. Many governments are offering financial incentives and rebates to encourage the installation of energy-efficient heating systems. In some regions, building codes are increasingly mandating energy-efficient technologies in new homes, which has led to a rise in electric boiler adoption. These regulatory pressures are particularly strong in areas with ambitious emission reduction targets. Manufacturers are focusing on compliance with these regulations to take advantage of subsidies and incentives. This growing governmental focus on improving energy efficiency in residential buildings is positively impacting electric boiler demand.

There is a growing consumer demand for clean, safe, and efficient heating solutions for residential spaces. Electric boilers are considered a safer option compared to traditional gas-powered boilers due to their absence of combustion-related risks. Homeowners are looking for alternatives that do not contribute to indoor air pollution, making electric heating systems more attractive. As electric grids become greener with the integration of renewable energy sources, electric boilers are becoming more appealing due to their alignment with cleaner energy. As health-conscious and environmentally aware consumers seek low-emission products, electric boilers are gaining market traction.

Recent developments in electric boiler design are contributing to the market’s growth. Modern electric boilers are now more compact, efficient, and equipped with advanced control systems. These improvements enable homeowners to manage their heating systems more effectively, optimizing energy consumption and enhancing comfort. Manufacturers are also introducing smart-home compatibility, allowing users to control their heating remotely. With continued progress in electric heating products, including higher thermal efficiency and integrated smart technology, the market is witnessing greater demand for these solutions in residential settings. Enhanced product features are making electric boilers an increasingly popular choice for new builds and upgrades.

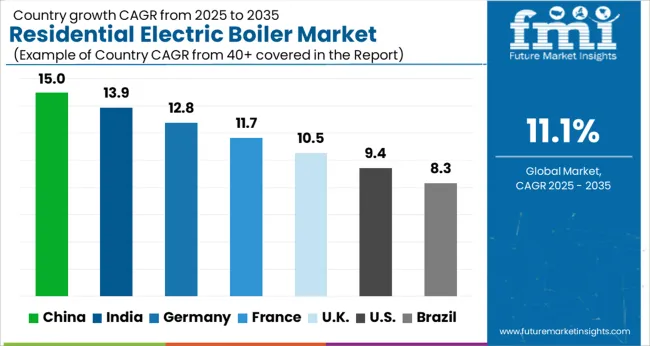

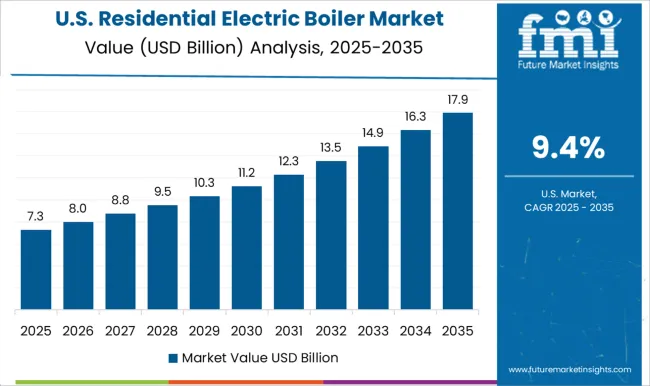

The residential electric boiler market is projected to expand at a global CAGR of 11.1% from 2025 to 2035, driven by rising consumer demand for energy-efficient, eco-friendly heating solutions. China leads with a CAGR of 15.0%, fueled by robust government policies promoting energy efficiency and cleaner heating technologies in residential buildings. India follows at 13.9%, supported by growing urbanization, increasing disposable incomes, and an expanding middle class seeking efficient and cost-effective heating systems. France achieves a CAGR of 11.7%, benefiting from the strong focus on reducing emissions in residential sectors. The United Kingdom shows a growth rate of 10.5%, driven by demand for sustainable heating alternatives in new housing projects and renovation of existing properties. The United States posts a CAGR of 9.4%, reflecting a steady increase in the adoption of electric heating solutions, particularly in regions where grid electrification is prioritized. The analysis spans over 40 countries, with these markets serving as core benchmarks for market penetration, regulatory adaptation, and strategic investment in the global residential electric boiler sector.

China is projected to record a CAGR of 15.0% from 2025 to 2035, outpacing the global average of 11.1%, due to government incentives, increasing demand for clean energy solutions, and growing urbanization. From 2020–2024, the CAGR was around 13.0%, driven by the shift toward more efficient, eco-friendly residential heating systems. The rise in demand can be attributed to China’s push toward energy-efficient buildings and the transition from coal and gas to electric heating systems. The upcoming phase is expected to be characterized by continued policy support for energy-efficient housing and stronger adoption in new residential projects. Manufacturers are prioritizing the development of smart-home compatible boilers and energy management systems to cater to evolving consumer preferences.

India is expected to achieve a CAGR of 13.9% from 2025 to 2035, higher than the global 11.1%, supported by increased disposable incomes, urbanization, and the growing middle-class population. During 2020–2024, the CAGR was 12.0%, with demand primarily driven by the rise of energy-efficient technologies and government initiatives promoting green energy solutions. As the demand for cleaner, safer heating solutions rises, especially in urban areas, the market is poised for further growth. The focus on renewable energy, incentives for adopting energy-efficient systems, and growing awareness of sustainable living are all contributing factors to the market’s expansion. Manufacturers are introducing electric boilers with improved energy efficiency and affordability.

France is forecast to experience a CAGR of 11.7% from 2025 to 2035, driven by stringent environmental regulations, a focus on energy efficiency, and the growing preference for sustainable living. From 2020–2024, the market saw a CAGR of 10.5%, bolstered by the country’s commitment to reducing fossil fuel usage in residential heating. The growth is expected to accelerate as the French government continues to incentivize eco-friendly solutions and energy-efficient heating systems. The increasing adoption of electric boilers in new builds and renovations reflects the demand for low-emission heating alternatives. Manufacturers are focusing on enhancing product offerings, such as integration with renewable energy sources, to meet these rising expectations.

The United Kingdom is projected to achieve a CAGR of 10.5% from 2025 to 2035, supported by the government’s focus on reducing carbon emissions and expanding the use of energy-efficient systems. During 2020–2024, the UK posted a CAGR of 8.0%, reflecting gradual adoption driven by favorable regulatory frameworks and growing environmental awareness. The market’s growth is being propelled by government incentives for eco-friendly home solutions, with electric boilers emerging as a leading choice for residential heating. The increased focus on low-carbon homes, along with stricter energy regulations, is expected to drive higher demand for electric boilers. Manufacturers are adapting by introducing more compact and efficient units with enhanced smart features.

The United States is expected to record a CAGR of 9.4% from 2025 to 2035, supported by increasing awareness of clean heating systems and regulatory support for energy-efficient products. From 2020–2024, the USA market posted a CAGR of 7.0%, reflecting growing consumer demand for alternative heating solutions and rising electricity grid integration. The market is expected to accelerate due to federal and state incentives for residential energy-efficient systems, along with higher adoption rates in areas with restricted natural gas availability. Manufacturers are increasingly focusing on improving boiler efficiency, lowering installation costs, and offering systems compatible with renewable energy sources.

Viessmann remains a dominant player, offering a diverse range of high-efficiency electric boilers designed for both residential and commercial applications, with a focus on advanced control systems and energy-saving features. ACV specializes in compact, wall-mounted units with an emphasis on fast installation and low maintenance. Acme Engineering Products delivers customized solutions with a strong focus on energy performance, while Argo provides user-friendly electric heating systems with modern features.

Atlantic Boilers is well-known for its large-scale electric heating solutions and custom installations. Bosch Industriekessel offers robust, high-performance boilers suited for both residential and industrial applications. Bradford White Corporation focuses on quality manufacturing and energy-efficient designs. Chromalox specializes in electric heating elements, offering solutions for residential, commercial, and industrial applications. Cleaver-Brooks stands out with advanced product configurations for energy efficiency and smart technologies. Cochrane Engineering provides tailored electric boiler systems with strong after-sales support. Danstoker manufactures high-performance boilers, providing cost-effective and eco-friendly solutions. Electro Industries offers electric heating systems for both residential and industrial needs, while Ferroli is recognized for affordable yet efficient models. Flexiheat UK provides advanced, space-saving electric boilers for residential use, while Fulton’s products cater to both residential and commercial markets. LAARS Heating Systems focuses on innovative, energy-efficient heating systems, while Lacaze Energies offers eco-friendly heating solutions for residential properties.

Thermolec provides highly efficient electric boilers for residential heating, while Thermon offers solutions for specialized industrial and residential applications. Varmebaronen is known for its innovative approach to energy-efficient electric heating systems, offering user-friendly solutions for residential and commercial use. Competitive strategies focus on improving energy efficiency, adopting smart technology, offering customizable solutions, and ensuring compliance with local energy regulations. These players maintain strong market positions by providing high-quality, reliable products tailored to meet consumer needs for eco-friendly and cost-effective heating systems.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.0 Billion |

| Voltage Rating | Low Voltage and Medium Voltage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Viessmann, ACV, Acme Engineering Products, Argo, Atlantic Boilers, Bosch Industriekessel, Bradford White Corporation, Chromalox, Cleaver-Brooks, Cochrane Engineering, Danstoker, Electro Industries, Ferroli, Flexiheat UK, Fulton, LAARS Heating Systems, Lacaze Energies, Thermolec, Thermon, and Varmebaronen |

| Additional Attributes | Dollar sales projections, market share by region, growth trends, key competitors, pricing strategies, consumer preferences, and regulatory impacts. |

The global residential electric boiler market is estimated to be valued at USD 11.0 billion in 2025.

The market size for the residential electric boiler market is projected to reach USD 31.5 billion by 2035.

The residential electric boiler market is expected to grow at a 11.1% CAGR between 2025 and 2035.

The key product types in residential electric boiler market are low voltage and medium voltage.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA