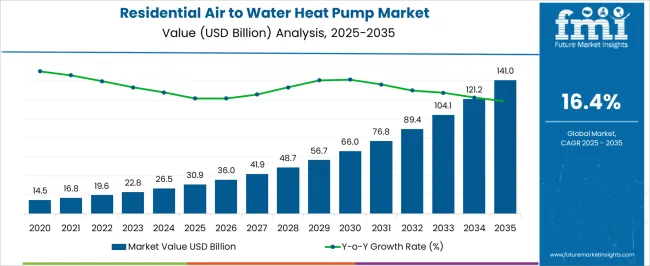

The residential air to water heat pump sector is projected to grow from USD 30.9 billion in 2025 to USD 141 billion by 2035 at a CAGR of 16.4%. The Growth Contribution Index indicates powerful early lifts, with values moving to 36.0 in 2026, 41.9 in 2027, and 48.7 in 2028. Contributions are being generated by replacement of resistance heaters and oil boilers, wider retrofit activity, and new build standards favoring low temperature hydronic space heating.

Demand for monobloc and split systems is being reinforced by inverter compressors, quiet units, and controls. Domestic hot water integration lifts economics and appeal. From 2030 onward, the index steepens as values reach 56.7 in 2030, 66.0 in 2031, and 76.8 in 2032, then 89.4 in 2033, 104.1 in 2034, 121.2 in 2035, closing at 141. Adoption is being strengthened by cold climate performance improvements, SCOP gains, and reliable defrost cycles that stabilize output. Underfloor heating and low temperature radiators support seasonal efficiency. Procurement choices are influenced by installer capacity, warranty terms, and lead times. In a firm read, platforms with dependable compressors, noise control, and interoperable controls will capture share as residential HVAC upgrades favor air to water heat pumps for lasting comfort.

| Metric | Value |

|---|---|

| Residential Air to Water Heat Pump Market Estimated Value in (2025 E) | USD 30.9 billion |

| Residential Air to Water Heat Pump Market Forecast Value in (2035 F) | USD 141.0 billion |

| Forecast CAGR (2025 to 2035) | 16.4% |

The residential air to water heat pump segment is estimated to account for about 24% of the heat pump market, around 20% of the residential heating equipment market, close to 9% of the HVAC market, nearly 27% of the hydronic heating systems market, and roughly 13% of the building energy efficiency solutions market. In aggregate, these proportions total approximately 93% across the listed parent categories. This footprint is regarded as decisive because air to water units serve both space heating and domestic hot water through hydronic loops, buffer tanks, and control logic that deliver steady comfort and predictable running costs.

Adoption has been supported by radiator upgrades, low temperature underfloor circuits, and packaged outdoor modules that simplify installation for contractors. Procurement choices are guided by seasonal performance factor, acoustic profile, cold climate operation, compressor reliability, and service coverage, which favors platforms with proven components and accessible after sales support. Influence extends into installer training, correct sizing, hydraulic separation, and grid aware controls that respond to time of use tariffs.

In multifamily and single family projects, air to water units enable boiler changeouts without flues while minimizing interior disruption. As warranties, refrigerant selections, and design guides improve, air to water systems are expected to secure deeper specification in retrofit and new build programs. The segment therefore acts as a central pillar within its parent markets, shaping procurement standards, comfort strategies, and long term value across residential properties.

The residential air to water heat pump market is experiencing notable expansion, driven by the rising global focus on energy efficiency, carbon reduction, and sustainable home heating solutions. Increasing regulatory support, including incentives and subsidies for renewable energy technologies, is accelerating adoption among homeowners. Advancements in compressor technology, refrigerant systems, and integration with smart home energy management platforms are improving efficiency, lowering operational costs, and enhancing user convenience.

The market is also benefiting from heightened awareness of long-term cost savings and environmental benefits associated with air to water heat pump systems. Growing investments in green building projects and retrofitting of older residential heating systems are further boosting demand.

Seasonal performance improvements and the ability of these systems to provide both space heating and domestic hot water are making them an attractive alternative to conventional boilers As governments continue to strengthen environmental policies and promote electrification in the residential heating sector, the market is positioned for sustained growth over the next decade.

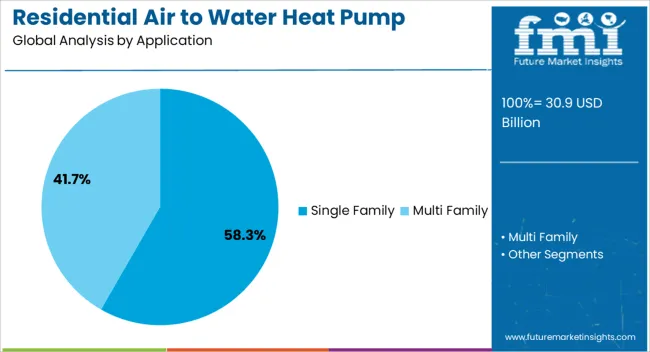

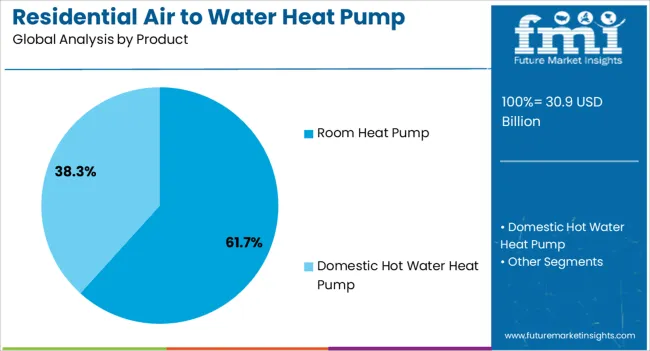

The residential air to water heat pump market is segmented by application, product, and geographic regions. By application, residential air to water heat pump market is divided into Single Family and Multi Family. In terms of product, residential air to water heat pump market is classified into Room Heat Pump and Domestic Hot Water Heat Pump. Regionally, the residential air to water heat pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The single family application segment is projected to hold 58.3% of the residential air to water heat pump market revenue share in 2025, making it the leading application category. Its dominance is being supported by the widespread preference for independent heating systems in detached and semi-detached housing units. The space and layout flexibility in single family homes allows for easier installation of external heat pump units and associated water storage systems.

Growing awareness among homeowners about the long-term cost benefits, lower carbon footprint, and enhanced indoor comfort offered by air to water heat pumps is encouraging adoption in this segment. Government incentive programs targeting single family households, particularly in regions with colder climates, are also reinforcing market growth.

The capability of these systems to serve both heating and domestic hot water requirements with minimal maintenance is further driving demand As urban expansion leads to the development of new residential zones, the single family segment is expected to retain its leadership position due to its compatibility with varied architectural designs and heating requirements.

The room heat pump segment is anticipated to account for 61.7% of the residential air to water heat pump market revenue share in 2025, establishing itself as the leading product type. Its strong position is being driven by its compact design, cost-effectiveness, and suitability for both new installations and retrofitting projects. Room heat pumps are widely favored for their ability to provide targeted heating solutions while maintaining energy efficiency across seasonal temperature variations.

Advancements in inverter-driven compressors and refrigerant technology are improving their performance, making them a reliable choice for homeowners seeking lower energy bills and consistent indoor comfort. The segment is also benefiting from ease of integration with underfloor heating systems and low-temperature radiators, enabling optimal heat distribution.

Manufacturers are focusing on enhancing design aesthetics and operational quietness to align with modern residential preferences With rising consumer demand for affordable and efficient heating solutions, the room heat pump segment is expected to maintain its dominant market share in the years ahead.

The residential air to water heat pump market is projected to grow consistently as households prioritize efficient space heating and reliable domestic hot water using hydronic circuits. Demand is reinforced by boiler replacement programs, rising power-to-gas price spreads, and comfort expectations in modern builds and retrofits. Opportunities are opening in hybrid pairings, smart tariff optimization, and packaged solutions for underfloor systems. Trends favor inverter-driven monoblocs, low-GWP refrigerants, and quieter outdoor units that meet neighborhood noise rules. Challenges persist around upfront cost, installer availability, cold-climate performance certainty, and varied permitting or grid readiness across regions.

Demand has been strengthened by homeowners seeking lower running costs, stable comfort, and dependable domestic hot water through hydronic heating. Air to water systems have been chosen for underfloor loops, fan coils, and modern radiators where steady flow temperatures and weather-compensation controls deliver even warmth. Replacement cycles for oil and gas boilers have motived evaluation of variable-speed heat pumps as electricity tariffs and fuel prices diverge. In an opinionated view, the decisive pull is the combination of proven COP in mild shoulder seasons with year-round DHW production using cylinders and buffer tanks. Cold-climate variants with enhanced vapor injection and smart defrost have expanded suitability in northern zones, while compact indoor hydraulic modules ease integration in urban apartments. As installers bundle commissioning, anti-scald controls, magnetic filtration, and water treatment, perceived risk falls and adoption improves across both retrofit and new build projects.

Opportunities have been created in hybrid configurations that pair an air to water heat pump with an existing boiler to cover peak loads or legacy high-temperature radiators. Smart home integration and time-of-use optimization enable load shifting, PV self-consumption, and tariff-aware DHW scheduling that raise savings. Housing developers are specifying pre-engineered packages with manifolds, prefilled glycol circuits, and app-ready thermostats for rapid installation. In our opinion, the most attractive near-term prize lies in mass retrofit programs where standardized kits, pre-sized cylinders, and straightforward wiring harnesses reduce site time. Utility partnerships for demand response, virtual power plant participation, and controlled backup immersion heating open recurring service revenue. Emerging markets with rising electrification and frequent LPG or oil price spikes are being addressed through leasing, warranty extensions, and installer training that de-risks decisions for cautious homeowners and small property investors.

Trends point to inverter monobloc units that keep refrigerant outdoors and simplify compliance, while split systems remain preferred where long pipe runs or indoor placement is required. Low-GWP choices such as R32 and propane R290 have been adopted to meet refrigerant policies and improve discharge temperatures for medium-high flow radiators. Acoustic performance has improved with larger slow-turning fans and redesigned shrouds to meet dB(A) limits. High-temperature models delivering 65 to 75 °C flow have broadened compatibility with legacy emitters, and legionella control cycles are being automated in DHW tanks. Connectivity is shifting from simple thermostats to home energy management platforms that orchestrate PV, batteries, and EV charging. From our perspective, reliable seasonal performance with clear SCOP figures, transparent sound data, and documented frost protection matters more than headline kW rating when homeowners compare competing proposals.

Challenges arise from upfront equipment and installation cost, particularly where cylinder placement, electrical upgrades, and hydraulic balancing add labor. Real-world seasonal performance in sub-zero weather can vary with emitter sizing, brining of outdoor coils, and defrost strategy, prompting some sites to retain backup heaters. Noise bylaws, planning constraints, and limited outdoor space complicate siting in dense neighborhoods. Installer shortages and uneven training on refrigerant handling, F-gas rules, and hydronics have led to commissioning errors that damage confidence. Grid readiness issues such as service upgrades and breaker availability create friction. Supply variability for compressors, control boards, and propane-rated components extends lead times. In our opinion, vendors that publish full-load and part-load data, offer fixed-price install bundles, and operate regional academies for sizing and balancing will win trust, while price-only offers risk callbacks and underperforming systems.

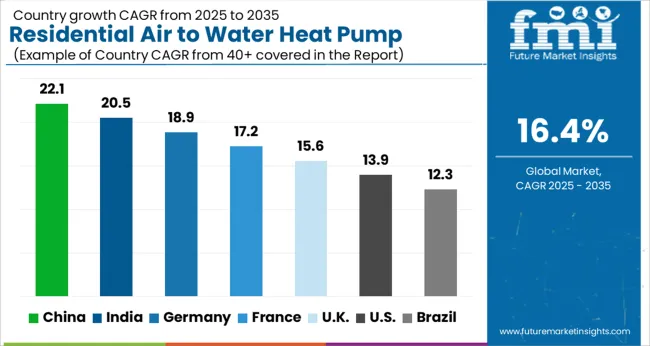

| Country | CAGR |

|---|---|

| China | 22.1% |

| India | 20.5% |

| Germany | 18.9% |

| France | 17.2% |

| UK | 15.6% |

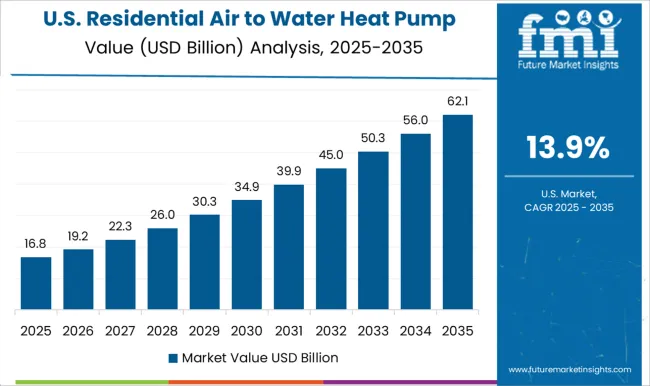

| USA | 13.9% |

| Brazil | 12.3% |

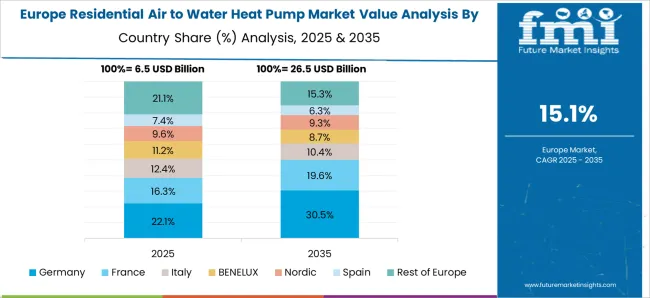

The global residential air-to-water heat pump market is projected to grow at 16.4% from 2025 to 2035. China leads at 22.1%, followed by India 20.5% and Germany 18.9%; the United Kingdom 15.6% and United States 13.9% follow. Momentum is being shaped by electrification of home heating, rebate programs, and demand for efficient domestic hot water. Hybrid systems, monobloc units, and low-temperature radiators are being specified for retrofits, while new builds are being designed around hydronic underfloor loops. Pairing with rooftop solar and thermal storage is gaining favor to flatten evening peaks. Asia is set to outpace on volume deployments and local manufacturing; Europe is expected to emphasize quality standards and quiet operation; the USA outlook appears steady, driven by colder-climate upgrades and builder packages in suburban developments. This report includes insights on 40+ countries; the top markets are shown here for reference.

The residential air to water heat pump market in China is expected to expand at 22.1%. Uptake is being propelled by high-density housing projects, policy-linked rebates, and preference for year-round hydronic comfort. Monobloc units are being specified for apartments to simplify refrigerant handling, while split systems are favored in villas for higher outputs and zoned heating. District-adjacent neighborhoods are adopting heat pumps for shoulder-season flexibility, with domestic hot water tanks sized to evening peaks. Domestic producers have scaled compressors, plate heat exchangers, and controllers, keeping prices competitive and service parts available. Noise limits in tier-one cities are shaping selections toward variable-speed fans and optimized acoustics. It is assessed that China’s vertically integrated supply chain and rapid installer training will sustain durable double-digit growth, with exports reinforcing economies of scale across Asia.

The residential air to water heat pump market in India is forecast to grow at 20.5%. Demand is being led by premium apartments, hill-state homes, and hospitality residences where efficient hot water and mild-season heating are prioritized. Builders are packaging heat pumps with rooftop solar and buffer tanks to deliver quiet operation and predictable bills. In warmer metros, DHW-centric systems dominate; in cooler regions, low-temperature radiators and underfloor loops are being adopted for comfort. Import reliance is easing as local assembly of hydronic modules and controls expands. The installer base is maturing, with commissioning checklists and water-side balancing now common on multi-tower sites. It is expected that India’s mixed-climate profile will favor rapid gains in DHW loads first, followed by steady adoption of full space-heating configurations in northern and elevated geographies.

The residential air to water heat pump market in Germany is projected to rise at 18.9%. Replacement of aging boilers is being prioritized, with attention to radiator delta-T, flow temperatures, and envelope upgrades that unlock higher seasonal efficiency. Ground-floor renovations often include hydronic underfloor circuits, while upper stories retain low-temp panels to control costs. Buyers favor quiet outdoor units, frost-resilient trays, and smart weather-compensation controls. Grid operators encourage thermal storage to smooth evening loads, and homeowners value predictable service schemes with annual checks on glycol concentration and pump curves. It is anticipated that Germany’s insistence on documented performance and careful hydraulic design will keep outcomes consistent, reinforcing long-term confidence in air-to-water systems across detached houses and duplexes.

The residential air to water heat pump market in the UK is expected to expand at 15.6%. Growth is being shaped by grants for off-gas homes, retrofit programs in suburban semis, and interest in quiet monobloc units for tight plots. Installers are standardizing on weather-compensated curves and buffer tanks to stabilize cycling with existing radiators. Planning rules around external noise are being addressed with low-rpm fans and anti-vibration mounts. New-build schemes are designing around underfloor heating and larger DHW cylinders to capture tariff windows. The service ecosystem is widening, with commissioning logs, water-quality checks, and flow balancing now common. It is expected that steady installer training and clear homeowner guidance on set-points and setback strategy will keep satisfaction high, supporting continued market expansion.

The residential air to water heat pump market in the United States is projected to grow at 13.9%. Adoption is being concentrated in the Northeast, Upper Midwest, and mountain states where hydronic baseboards and radiant floors are common. Cold-climate models with vapor-injection compressors are being specified to hold capacity below freezing, while buffer tanks and variable-speed pumps improve comfort at low flow temps. Builders in suburban communities are offering packaged systems with fan-coil air handlers for summer cooling. Incentives and tax credits are assisting replacements of older oil and propane units, and quiet operation with integrated DHW is being valued. It is judged that consistent installer education on hydraulics and controls will unlock broader acceptance, especially in mixed-fuel regions.

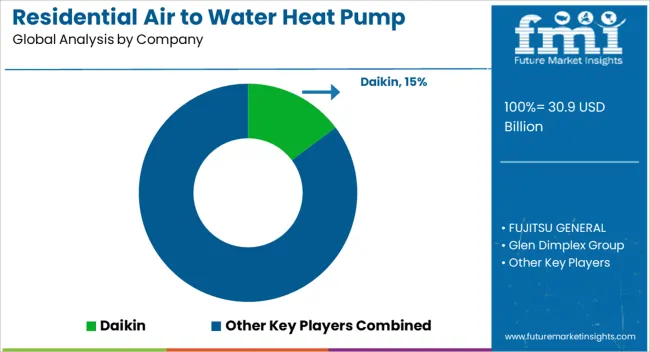

Competition in residential air to water heat pumps has been defined by brochures that turn engineering into simple buying logic. Daikin, Mitsubishi Electric, Panasonic, Fujitsu General, LG Electronics, and Samsung present split and monobloc lines with inverter control, low-ambient heating kits, and smart app supervision. Vaillant Group, STIEBEL ELTRON, WOLF, and Glen Dimplex lean into hydronic depth, pairing units with cylinders, mixing groups, and weather-compensated controls for radiator and underfloor loops. Johnson Controls Hitachi positions quiet operation and space-saving footprints for multifamily sites. Midea and Guangdong PHNIX promote wide model ladders and OEM programs, giving installers portfolio breadth. Lochinvar and Maritime Geothermal focus on cold-climate performance and packaged accessories that shorten commissioning. Across all brands, brochures read like specification maps: SCOP and COP tables, A7/W35 and A-7/W35 operating points, acoustic plots, refrigerant callouts (R32, R290), and wiring diagrams that remove guesswork for designers and contractors.

Strategy has been executed through channel discipline and documentation clarity. Brochures foreground %-based savings calculators, grid-ready controls, and tariff-aware scheduling to frame bill impact. Installation pages show hydraulic schematics, buffer and DHW tank options, anti-legionella cycles, and defrost logic that protects comfort. Compliance badges appear early to smooth incentives and permitting. Quiet modes, vibration isolation, and casing materials are listed to win dense neighborhoods. Service practicality is emphasized through filter access, charge quantities, remote diagnostics, and warranty terms tied to accredited installer training. Brands seek advantage by publishing dual-temperature SCOP at 35 °C and 55 °C, by proving stable capacity at low wet-bulb, and by offering gateway kits that integrate with thermostats and building platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 30.9 Billion |

| Application | Single Family and Multi Family |

| Product | Room Heat Pump and Domestic Hot Water Heat Pump |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin, FUJITSU GENERAL, Glen Dimplex Group, Guangdong PHNIX Eco-energy Solution Ltd., JOHNSON CONTROLS - HITACHI AIR CONDITIONING COMPANY, LG Electronics, Lochinvar, Maritime Geothermal, Midea, Mitsubishi Electric Corporation, Panasonic Corporation, SAMSUNG, STIEBEL ELTRON GmbH & Co. KG, Vaillant Group, and WOLF |

| Additional Attributes | Dollar sales by product type (monobloc, split, hybrid), Dollar sales by capacity (≤10 kW, 10–20 kW, >20 kW), Trends in low temperature performance and natural refrigerants (R290), Role in space heating, DHW, and retrofit replacements, Growth from incentives and building codes, Regional installations across Europe, Asia Pacific, North America. |

The global residential air to water heat pump market is estimated to be valued at USD 30.9 billion in 2025.

The market size for the residential air to water heat pump market is projected to reach USD 141.0 billion by 2035.

The residential air to water heat pump market is expected to grow at a 16.4% CAGR between 2025 and 2035.

The key product types in residential air to water heat pump market are single family and multi family.

In terms of product, room heat pump segment to command 61.7% share in the residential air to water heat pump market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar EPC Market Size and Share Forecast Outlook 2025 to 2035

Residential Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Power Conditioner Market Size and Share Forecast Outlook 2025 to 2035

Residential Filters Market Size and Share Forecast Outlook 2025 to 2035

Residential RF Smart Electric Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Lock Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA