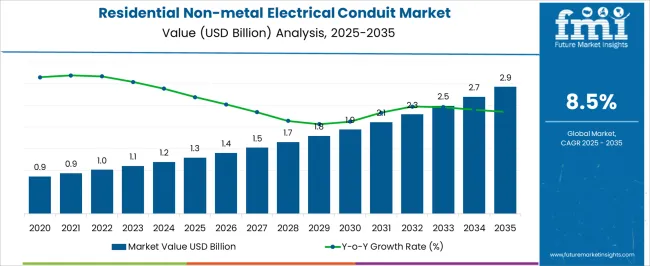

The residential non-metal electrical conduit market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. As electrical systems become more complex and integrated into residential spaces, the need for durable, non-metallic conduits that can effectively shield wiring from external elements while ensuring safe energy distribution has become a key factor in driving growth. These conduits offer several advantages, such as corrosion resistance, flexibility, and ease of installation, all of which contribute to their growing adoption in residential building projects.

As construction and renovation activities continue to rise globally, the market for residential non-metal electrical conduits is expected to see accelerated demand. The need for compliance with stricter electrical safety standards and the rising awareness around minimizing the risk of electrical fires further intensifies the adoption of non-metallic conduits in residential wiring.

Non-metallic conduits offer added safety benefits in comparison to traditional materials, making them a preferred choice in home construction and upgrades. With an increasing focus on cost-effective solutions, non-metal electrical conduits are anticipated to see rising application across various residential projects, positioning the market for substantial growth in the coming years.

| Metric | Value |

|---|---|

| Residential Non-metal Electrical Conduit Market Estimated Value in (2025 E) | USD 1.3 billion |

| Residential Non-metal Electrical Conduit Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The residential non-metal electrical conduit market is estimated to hold a notable proportion within its parent markets, representing approximately 6-8% of the electrical conduit market, around 5-6% of the residential electrical systems market, close to 9-10% of the construction materials market, about 7-8% of the wiring and cabling market, and roughly 3-4% of the electrical components market. Collectively, the cumulative share across these parent segments is observed in the range of 30-36%, reflecting the increasing demand for reliable, cost-effective, and non-corrosive conduit solutions in residential electrical installations. The market has been driven by the growing need for efficient and safe wiring solutions, where durability, fire resistance, and ease of installation are prioritized.

Adoption is influenced by procurement decisions focusing on the long-term benefits of non-metallic materials over traditional metal conduits, particularly for homes that require flexible, lightweight, and corrosion-resistant electrical systems. Market participants have concentrated on enhancing the performance and cost-effectiveness of non-metallic conduits, expanding their application in modern residential electrical networks. As a result, the residential non-metal electrical conduit market has not only captured a significant share within the electrical conduit and wiring markets but has also influenced construction materials and electrical components sectors, underlining its role in improving the safety, efficiency, and durability of residential electrical infrastructure.

The residential non-metal electrical conduit market is gaining steady traction due to increasing demand for flexible, corrosion-resistant, and cost-effective wiring solutions in modern housing developments. Growth is being influenced by rising investments in residential construction, urban housing projects, and the growing adoption of advanced electrical infrastructure in both new and retrofit installations. Non-metallic conduits are being favored in residential settings for their superior insulation properties, ease of installation, and resistance to moisture, chemicals, and environmental degradation.

As homeowners and contractors prioritize safer and more durable materials, demand is shifting toward PVC and similar non-metallic solutions that offer longevity and lower maintenance costs. Additionally, updates in building codes and regulations promoting non-metallic electrical conduit for interior applications are supporting wider market penetration. The increased use of smart electrical systems, home automation, and integrated wiring solutions in modern homes is further reinforcing the market’s outlook With a focus on safety, flexibility, and cost efficiency, the residential non-metal conduit market is expected to experience continued growth, driven by innovation in materials and rising consumer awareness of long-term benefits.

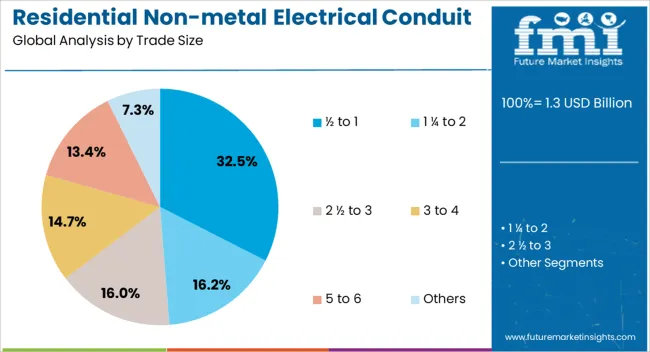

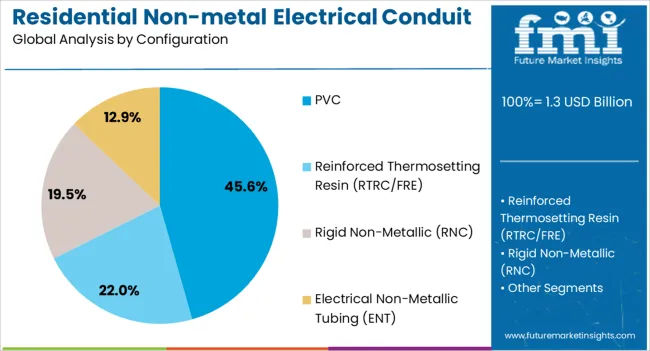

The residential non-metal electrical conduit market is segmented by trade size, configuration, and geographic regions. By trade size, residential non-metal electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of configuration, residential non-metal electrical conduit market is classified into PVC, Reinforced Thermosetting Resin (RTRC/FRE), Rigid Non-Metallic (RNC), and Electrical Non-Metallic Tubing (ENT). Regionally, the residential non-metal electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ½ to 1 trade size segment is expected to hold 32.5% of the residential non-metal electrical conduit market revenue share in 2025, emerging as the leading size category. Its prominence is being driven by suitability for the majority of residential wiring installations, particularly for light-duty and standard electrical applications. This size range offers an ideal balance between ease of handling, sufficient internal capacity, and compatibility with commonly used electrical cables and fittings.

Its lightweight nature and flexibility simplify the installation process, reducing labor time and associated costs for electricians and contractors. This segment is also widely supported by suppliers and building codes, which specify this trade size as optimal for interior residential use in walls, ceilings, and crawl spaces.

The growing emphasis on quick, safe, and cost-effective wiring solutions in both single-family homes and multi-unit housing projects is encouraging adoption of this size category As residential development continues to expand and electrical load requirements increase with modern appliances and smart home systems, the ½ to 1 trade size segment is well positioned to maintain its leadership in the market.

The PVC configuration segment is projected to account for 45.6% of the residential non-metal electrical conduit market revenue share in 2025, solidifying its position as the leading material choice. PVC’s dominance is being reinforced by its affordability, ease of use, and exceptional resistance to corrosion, moisture, and a wide range of environmental stressors. Its flame-retardant and non-conductive properties make it a preferred option for residential electrical systems where safety is a critical concern.

Additionally, PVC conduits are compatible with most residential wiring needs and offer excellent performance in both indoor and underground installations. The lightweight and flexible nature of the material simplifies cutting, bending, and fitting, contributing to faster and more efficient installations.

Its compliance with national and regional electrical codes adds to its widespread acceptance among contractors and builders As demand grows for long-lasting, low-maintenance conduit solutions that support modern electrical loads and home automation, the PVC configuration segment is expected to remain at the forefront of the residential non-metal electrical conduit market, supported by continuous innovations in formulation and installation techniques.

The residential non-metal electrical conduit market is poised for growth as demand for safer, more efficient wiring systems in homes increases. Opportunities arise from the rise of green building construction and the growing preference for flexible, modular conduit systems. However, challenges related to cost and material performance may limit market adoption. By addressing these challenges and capitalizing on emerging trends, manufacturers can position themselves for success in this expanding market.

The residential non-metal electrical conduit market is driven by the increasing need for safe and reliable wiring systems in homes. With the rising concerns over electrical hazards, such as fires caused by exposed wiring, there is a growing preference for non-metallic conduits that offer better insulation, resistance to moisture, and protection from physical damage. As homeowners and builders prioritize safety and code compliance in residential projects, the demand for non-metal conduits is expected to rise, supporting market growth.

The rise of green building practices presents significant opportunities for the residential non-metal electrical conduit market. As eco-friendly construction materials and methods become more prominent, the demand for non-metallic conduits, which are lightweight, corrosion-resistant, and environmentally friendly, is increasing. Non-metallic materials are often favored for their durability and ease of installation, making them suitable for eco-conscious construction projects. This trend toward sustainability in homebuilding is anticipated to create new revenue streams for manufacturers of residential electrical conduit products.

A prominent trend in the residential non-metal electrical conduit market is the growing preference for flexible and modular conduit systems. These systems offer ease of installation and flexibility, allowing for easy modifications and adjustments in residential wiring layouts. Non-metal conduits, often made from PVC or HDPE, are becoming the preferred choice due to their versatility and cost-effectiveness. The demand for flexible conduit solutions, which simplify the installation process and reduce labor costs, is expected to fuel market growth.

The residential non-metal electrical conduit market faces challenges related to cost and material performance. While non-metallic conduits are cost-effective in many instances, the initial cost of installation can be higher compared to traditional metal conduits. Additionally, performance concerns, such as the material’s susceptibility to cracking or damage under extreme conditions, may hinder widespread adoption. Manufacturers need to continually enhance the durability and performance of these conduits to address these challenges and compete effectively in the market.

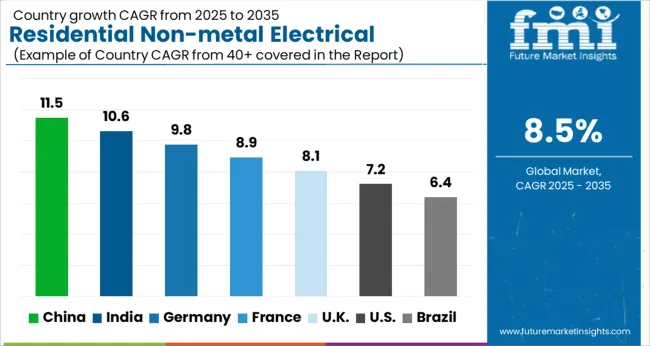

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

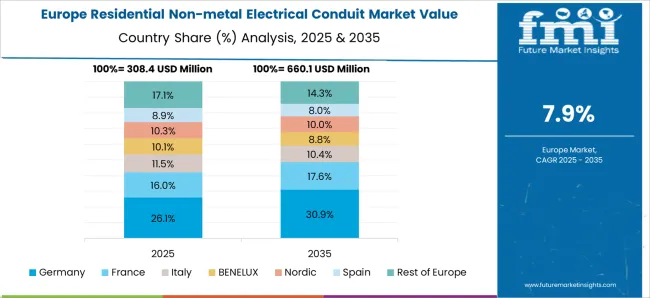

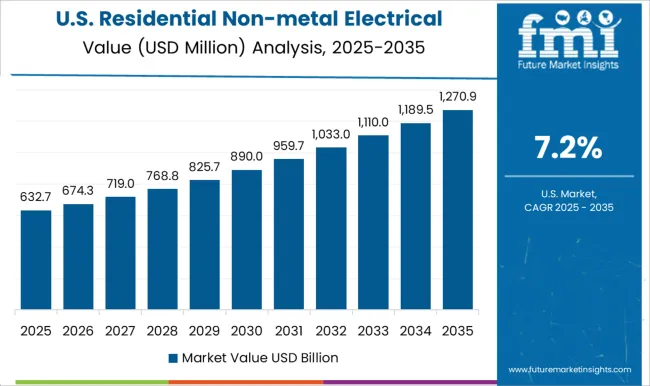

The global residential non-metal electrical conduit market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads with a growth rate of 11.5%, followed by India at 10.6%, and France at 8.9%. The United Kingdom records a growth rate of 8.1%, while the United States shows the slowest growth at 7.2%. The demand for residential non-metal electrical conduits is being driven by increasing construction activities, the shift towards safer electrical installations, and rising awareness of electrical system durability. In emerging markets such as China and India, urbanization and infrastructure development are key contributors to this demand, while in developed regions like the USA and UK, regulations and the push for energy efficiency are boosting the adoption of these conduits. This report includes insights on 40+ countries; the top markets are shown here for reference.

The residential non-metal electrical conduit market in China is experiencing significant growth, with a growth rate of 11.5%. The country’s rapid urbanization and booming construction industry are major drivers behind the demand for non-metal conduits. As China focuses on improving electrical safety and sustainability in residential buildings, non-metallic conduits are gaining popularity due to their cost-effectiveness, durability, and ability to withstand environmental stresses. Additionally, the rise of green building practices and the growing focus on energy-efficient infrastructure are further boosting the demand for these conduits. China's government initiatives aimed at enhancing building safety and promoting environmental sustainability are expected to continue driving market growth.

The residential non-metal electrical conduit market in India is growing at a rate of 10.6%, driven by the country’s urbanization and increasing infrastructure development. With the rise in residential construction, there is a growing need for electrical safety and the adoption of non-metallic conduits, which are considered safer and more durable than traditional materials. India’s government initiatives, such as the Smart Cities Mission and Housing for All, are driving the demand for better electrical infrastructure in residential buildings. Additionally, the rise in awareness regarding fire hazards and environmental concerns is contributing to the growing adoption of non-metal conduits, as they provide enhanced safety and sustainability.

The residential non-metal electrical conduit market in France is growing at a rate of 8.9%, supported by the country’s focus on energy efficiency and sustainable building practices. As part of the European Union’s commitment to reducing carbon emissions, France is emphasizing green building standards, which are driving the adoption of non-metallic conduits in residential projects. These conduits are favored for their fire-resistant properties and low environmental impact. The French residential construction sector is seeing an increased focus on electrical system safety, leading to higher demand for non-metallic conduits. Furthermore, the transition toward smart homes and energy-efficient buildings is also contributing to the growth of this market in France.

The residential non-metal electrical conduit market in the United Kingdom is growing at a rate of 8.1%, driven by the country’s stringent building codes and emphasis on electrical safety. The UK is focusing on modernizing its residential infrastructure, with a particular focus on sustainability and energy efficiency. Non-metallic conduits, which offer superior insulation and fire resistance, are becoming increasingly popular in residential construction projects. The adoption of smart home technologies and the need for improved electrical safety are also boosting the demand for these conduits. Additionally, the UK government’s commitment to reducing carbon emissions and encouraging green building practices is playing a key role in driving the market growth.

The residential non-metal electrical conduit market in the United States is growing at a rate of 7.2%, as the country continues to focus on building safety and energy-efficient infrastructure. As the residential sector increasingly adopts sustainable practices, non-metallic conduits are becoming a preferred choice due to their flexibility, safety features, and cost-effectiveness. The rise of green building initiatives, coupled with stringent electrical codes, is also pushing the demand for non-metallic conduits in residential projects. In addition, the USA government’s energy efficiency programs and focus on reducing carbon footprints are contributing to the adoption of these conduits. The market is also benefiting from the increased focus on fire safety in residential buildings.

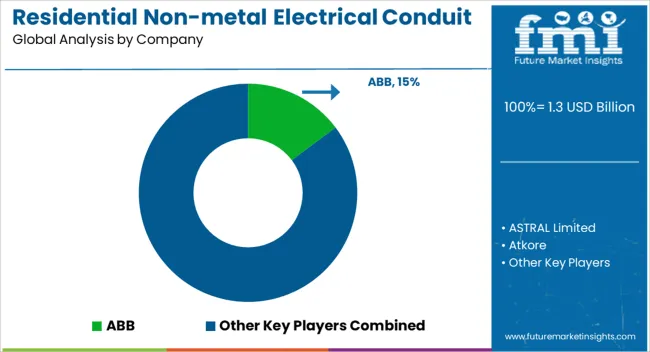

The residential non-metal electrical conduit market is expanding as residential construction projects increasingly focus on safety, durability, and efficient electrical infrastructure. ABB, Schneider Electric, and Legrand are major contributors to this growth by offering reliable and innovative conduit solutions that help in protecting electrical wiring and ensuring safety in residential applications. ABB provides cutting-edge conduit systems that are known for their high performance and fire-resistance, making them suitable for diverse residential environments. Schneider Electric offers advanced solutions such as flexible conduits and accessories that facilitate easy installation and long-term protection. Legrand contributes to the market with flexible and durable electrical conduits designed to meet the growing demand for home automation and sustainable living solutions.

Along with these global leaders, companies like ASTRAL Limited, Atkore, and Hubbell are also pivotal in the market’s growth. ASTRAL Limited focuses on manufacturing environmentally friendly non-metallic conduits, while Atkore specializes in providing a wide range of residential electrical conduit solutions that meet international safety and environmental standards. Hubbell emphasizes innovation in its product offerings, providing reliable conduit systems that are both easy to install and long-lasting. Other notable players, including Wienerberger AG, CANTEX INC., and Electri-Flex Company, are continuously advancing their product lines to enhance the overall performance of non-metal electrical conduits. With increasing construction activities, these companies are poised to meet the growing demand for high-quality, non-metallic electrical conduit systems that provide optimal safety and efficiency in residential buildings.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | PVC, Reinforced Thermosetting Resin (RTRC/FRE), Rigid Non-Metallic (RNC), and Electrical Non-Metallic Tubing (ENT) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ABB, ASTRAL Limited, Atkore, Legrand, Schneider Electric, Hubbell, Wienerberger AG, CANTEX INC., Electri-Flex Company, Anamet Electrical, Inc., HellermannTyton, Champion Fiberglass, Inc., and Guangdong Ctube Industry Co., Ltd. |

| Additional Attributes | Dollar sales by material type (PVC, CPVC, fiberglass, HDPE) and application (wiring protection, cable management, outdoor installations) are key metrics. Trends include rising demand for lightweight, corrosion-resistant conduits, growth in residential construction and DIY projects, and increasing adoption of energy-efficient wiring solutions. Regional adoption, regulatory standards, and technological innovations are driving market growth. |

The global residential non-metal electrical conduit market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the residential non-metal electrical conduit market is projected to reach USD 2.9 billion by 2035.

The residential non-metal electrical conduit market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in residential non-metal electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, pvc segment to command 45.6% share in the residential non-metal electrical conduit market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA