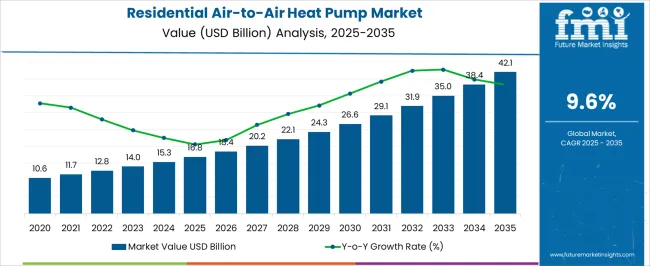

The residential air-to-air heat pump market is expected to grow from USD 16.8 billion in 2025 to USD 42.1 billion by 2035, registering a 9.6% CAGR and creating an absolute dollar opportunity of USD 25.3 billion. Growth is driven by increasing adoption of energy-efficient heating and cooling solutions, rising electricity costs, and supportive government incentives for low-emission residential HVAC systems. Technological improvements in inverter-based compressors, smart thermostats, and enhanced energy efficiency are further boosting market uptake across global regions.

A 10-year growth comparison highlights differences in market expansion between the first and second halves of the forecast period. From 2025 to 2030, growth is steady but slightly moderate, with cumulative revenue reaching approximately USD 25 billion, driven primarily by adoption in North America and Europe, where early regulations, incentives, and retrofit projects support market penetration. Between 2031 and 2035, growth accelerates sharply as Asia Pacific and Latin America adopt air-to-air heat pumps on a larger scale, fueled by rising urbanization, new residential construction, and increased consumer awareness of energy-efficient solutions.

Technological innovation during this period, including improved efficiency and smart control integration, further enhances adoption. Overall, the 10-year comparison demonstrates that the latter half of the decade contributes more substantially to market expansion, reflecting a combination of emerging market growth, technological enhancements, and increasing regulatory support, culminating in the USD 42.1 billion market by 2035.

| Metric | Value |

|---|---|

| Residential Air-to-Air Heat Pump Market Estimated Value in (2025 E) | USD 16.8 billion |

| Residential Air-to-Air Heat Pump Market Forecast Value in (2035 F) | USD 42.1 billion |

| Forecast CAGR (2025 to 2035) | 9.6% |

The residential air-to-air heat pump market is primarily driven by the residential heating and cooling sector, which accounts for approximately 47% of the market share, as homeowners seek energy-efficient systems for space conditioning. The new construction and building integration segment contributes about 23%, incorporating heat pumps in modern homes to meet energy performance standards. The retrofitting and renovation sector represents close to 15%, where older homes are upgraded with advanced HVAC solutions. The renewable energy integration segment accounts for roughly 10%, combining heat pumps with solar and other clean energy sources. The remaining 5% comes from small-scale commercial and multi-family residential projects seeking compact, efficient, and low-maintenance heating and cooling solutions. The residential air-to-air heat pump market is evolving with advancements in efficiency, smart controls, and eco-friendly refrigerants. High Seasonal Energy Efficiency Ratio (SEER) and Heating Seasonal Performance Factor (HSPF) units are gaining adoption to lower energy consumption and operational costs.

Wi-Fi-enabled smart thermostats and integrated home automation platforms allow remote monitoring and optimized climate control. Low Global Warming Potential (GWP) refrigerants are being increasingly used to reduce environmental impact. Compact, inverter-driven models are enhancing adaptability for homes of varying sizes. Manufacturers are focusing on noise reduction, durability, and seasonal performance optimization. Rising consumer interest in energy-efficient and environmentally conscious heating solutions continues to drive market growth globally.

The Residential Air to Air Heat Pump market is witnessing rapid expansion, driven by increasing demand for energy-efficient residential heating and cooling solutions. Current adoption reflects growing consumer awareness of sustainable technologies and government incentives supporting low-carbon residential energy systems. The market is shaped by rising electricity prices, heightened focus on reducing greenhouse gas emissions, and the transition from conventional heating and cooling systems to heat pump technology.

Technological advancements, such as inverter-driven compressors and improved refrigerants, have enhanced efficiency and performance, increasing consumer acceptance. The integration of smart home systems and IoT-enabled controls is further enabling energy optimization, providing homeowners with better control over comfort and operational costs.

Urbanization and growing construction of single-family and multi-family homes are creating additional opportunities for residential installations The market is poised for long-term growth, with future opportunities arising from continued improvements in system efficiency, government subsidies, and rising environmental awareness among residential consumers.

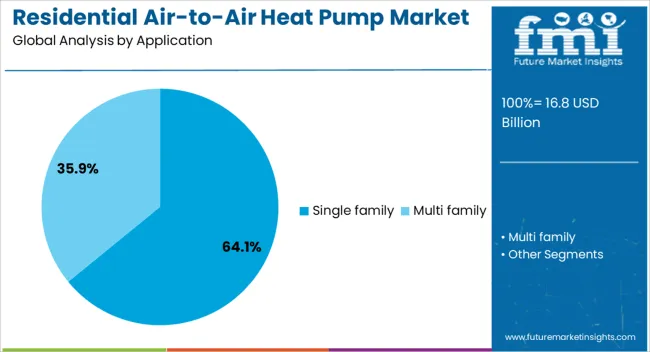

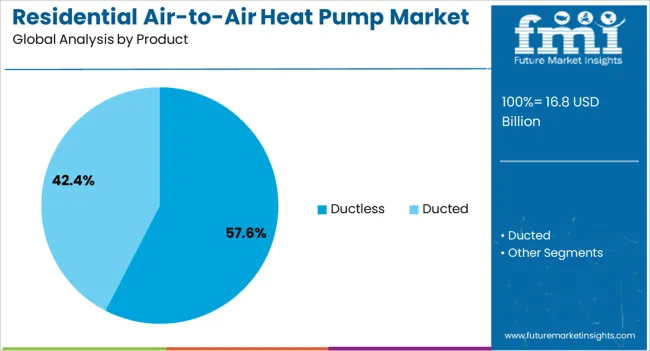

The residential air-to-air heat pump market is segmented by application, product, and geographic regions. By application, residential air-to-air heat pump market is divided into Single family and Multi family. In terms of product, residential air-to-air heat pump market is classified into Ductless and Ducted. Regionally, the residential air-to-air heat pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Single Family application segment is projected to hold 64.1% of the Residential Air to Air Heat Pump market revenue in 2025, positioning it as the dominant application. This leadership is being driven by the rapid adoption of heat pumps in standalone residential properties, where the need for consistent year-round heating and cooling is highest. Single-family homes benefit from scalable installation flexibility, allowing homeowners to implement both ducted and ductless systems depending on property layout and energy requirements.

The growth of this segment has been reinforced by government initiatives promoting energy-efficient residential solutions and incentives for replacing conventional HVAC systems. Consumers are increasingly opting for heat pumps due to reduced electricity consumption, lower operational costs, and environmentally friendly refrigerants.

In addition, the ability to integrate heat pumps with smart home and energy management systems has enhanced appeal, enabling optimized performance, remote monitoring, and predictive maintenance This combination of cost-effectiveness, energy efficiency, and convenience has solidified the Single Family segment as the leading application in the market.

The Ductless product segment is expected to account for 57.6% of the Residential Air to Air Heat Pump market revenue in 2025, establishing it as the leading product category. This segment has grown due to the ease of installation and adaptability in residential spaces where conventional ductwork is either impractical or costly to implement. Ductless systems allow for zonal control, offering energy efficiency and precise temperature management across individual rooms, which has increased their attractiveness to homeowners.

The growth has also been supported by aesthetic considerations, with compact indoor units reducing intrusion into living spaces while maintaining performance. As inverter technology and smart controls have improved, ductless heat pumps now deliver enhanced efficiency, quieter operation, and seamless integration with smart home systems.

The segment’s expansion is further facilitated by favorable government incentives, increasing consumer focus on sustainable and low-carbon solutions, and rising urbanization where retrofitting traditional systems is challenging These factors collectively have reinforced the ductless product’s leading position in the residential heat pump market.

The residential air-to-air heat pump market is witnessing strong adoption supported by rising household energy efficiency upgrades and demand for low-emission heating systems. Asia Pacific leads with USD 14.5 billion in 2024, with China (USD 7.5 billion), Japan (USD 4.2 billion), and South Korea (USD 2.8 billion). Europe accounts for USD 12.3 billion, with Germany (USD 4.6 billion), France (USD 3.8 billion), and UK (USD 3.9 billion). North America holds USD 9.6 billion, led by the USA, while other regions contribute USD 2.2 billion. Applications include single-family homes (65%) and multi-family residences (35%).

Adoption is driven by increasing energy-efficient retrofitting programs, stricter emission targets, and growing residential electricity demand. In 2024, single-family homes accounted for 65% of installations, while multi-family units represented 35%. Asia Pacific leads at USD 14.5 billion, Europe at USD 12.3 billion, and North America at USD 9.6 billion. Over 25 million households in China and Japan installed air-to-air heat pumps in the past three years. Europe added over 3 million units in 2023, mainly in Germany, France, and the UK Growing awareness of cost savings, with households reducing annual heating expenses by USD 500–1,200, fuels continued adoption.

Smart connectivity, variable-speed compressors, and hybrid systems are reshaping adoption patterns. Nearly 30% of new installations in 2024 include IoT-enabled control systems, offering remote monitoring and load optimization. Variable-speed inverter compressors, present in 40% of units, enhance efficiency by 15–20% compared to fixed-speed models. Hybrid heat pump systems integrating electric and natural gas options are being deployed in colder climates, representing 12% of installations across North America and Northern Europe. Compact ductless mini-split systems are gaining traction in multi-family housing, accounting for 25% of recent installations, reducing space requirements and enhancing flexibility in retrofitted buildings.

Opportunities arise from government-backed incentives, growing electrification of heating, and large-scale housing construction. Asia Pacific is projected to reach USD 17.5 billion by 2027, Europe USD 14.5 billion, and North America USD 11.2 billion. Programs in China and India to upgrade 10 million homes annually to energy-efficient systems are accelerating adoption. In Europe, subsidies covering 20–40% of upfront installation costs drive installation rates, while in the USA, tax credits of up to USD 2,000 per unit strengthen household interest. Expanding smart home integration and utility-driven demand response programs are creating further opportunities for advanced heat pump solutions.

High upfront costs, installation challenges, and performance variations in extreme climates remain barriers. A typical residential air-to-air heat pump costs USD 4,000–12,000 per unit, with installation adding USD 1,500–3,000 depending on property type. Retrofitting older homes with ductless systems can increase costs by 20–25%. Units show reduced efficiency below –10 °C, requiring backup systems in colder regions. Annual maintenance costs range between USD 200–400 per household, which can affect affordability. Supply chain disruptions for compressors and refrigerants add 3–6 weeks to delivery timelines. Regional differences in building codes and electrical standards further slow down uniform adoption.

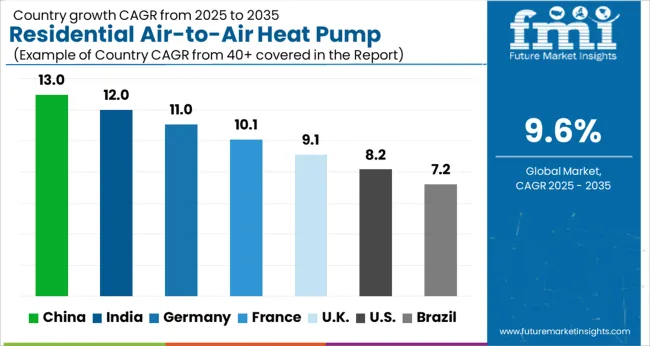

| Country | CAGR |

|---|---|

| China | 13.0% |

| India | 12.0% |

| Germany | 11.0% |

| France | 10.1% |

| UK | 9.1% |

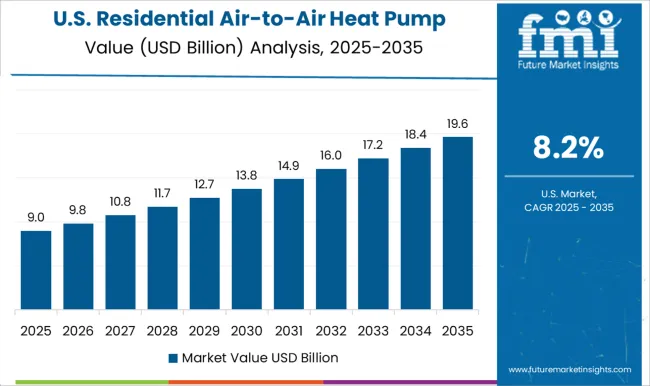

| USA | 8.2% |

| Brazil | 7.2% |

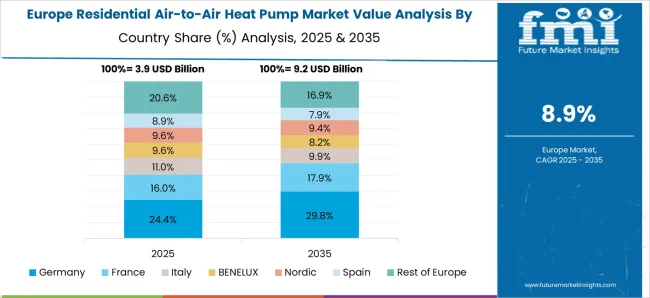

The residential air-to-air heat pump market is projected to grow at a global CAGR of 9.6% through 2035, driven by increasing adoption of energy-efficient heating and cooling solutions, government incentives, and rising urban residential demand. China leads at 13.0%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion in residential construction, renewable integration, and energy-efficient home systems. India follows at 12.0%, a 1.25× multiple of the global rate, reflecting growing urban housing, adoption of efficient HVAC solutions, and increasing awareness of energy savings. Germany records 11.0%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in heat pump technology, premium residential installations, and sustainable housing initiatives. The United Kingdom posts 9.1%, 0.95× the global rate, with adoption concentrated in retrofit projects, new residential developments, and energy-efficient housing programs. The United States stands at 8.2%, 0.85× the benchmark, with steady uptake in residential HVAC upgrades, new housing, and energy-efficient building solutions. BRICS economies drive the bulk of market volume, OECD countries emphasize technological advancement and efficiency, while ASEAN nations contribute through expanding residential construction and energy-efficient HVAC adoption.

The residential air-to-air heat pump market in China is projected to grow at a CAGR of 13.0%, supported by increasing adoption in urban apartments, energy-efficient residential buildings, and government incentives for low-emission heating solutions. Domestic manufacturers such as Gree Electric and Midea supply high-efficiency, inverter-based heat pumps for residential applications. Technological improvements focus on variable-speed compressors, improved COP (coefficient of performance), and smart thermostat integration. Adoption is driven by rising energy costs, urban housing developments, and promotion of cleaner heating alternatives in northern and southern cities.

The residential air-to-air heat pump market in India is expected to grow at a CAGR of 12.0%, supported by rising urbanization, increasing electricity prices, and the government’s energy efficiency initiatives. Manufacturers such as Blue Star and Voltas provide inverter-driven, energy-efficient residential heat pumps. Demand is concentrated in metropolitan areas with high-rise apartment buildings, while adoption in Tier 2 cities is increasing due to awareness campaigns. Technological advancements emphasize low power consumption, noise reduction, and integration with smart home systems.

Germany’s residential air-to-air heat pump market is projected to grow at a CAGR of 11.0%, influenced by strong government incentives, energy-efficient housing programs, and increasing demand for low-carbon residential heating. Companies such as Bosch Thermotechnology and Viessmann supply high-efficiency, low-noise heat pumps optimized for northern European climates. Demand is driven by new residential construction as well as retrofits of existing homes. Technological focus includes high COP, eco-friendly refrigerants, and integration with solar PV and smart control systems.

The residential air-to-air heat pump market in the United Kingdom is expected to grow at a CAGR of 9.1%, driven by government incentives for low-carbon heating, energy efficiency standards, and growing consumer awareness. Suppliers provide inverter-based, quiet, and energy-efficient residential heat pumps suitable for urban homes and retrofitting projects. Adoption is influenced by increasing energy costs and a growing interest in smart, connected home solutions. Technological developments emphasize low noise, rapid heating performance, and integration with renewable energy sources.

The residential air-to-air heat pump market in the United States is projected to grow at a CAGR of 8.2%, supported by rising residential electrification, energy efficiency initiatives, and adoption in new constructions and retrofits. Key manufacturers such as Trane, Carrier, and Lennox provide high-efficiency, inverter-driven heat pumps. Technological improvements focus on variable-speed compressors, smart control integration, and low-noise operation. Growth is concentrated in regions with moderate climates, while northern states increasingly adopt hybrid systems to supplement heating.

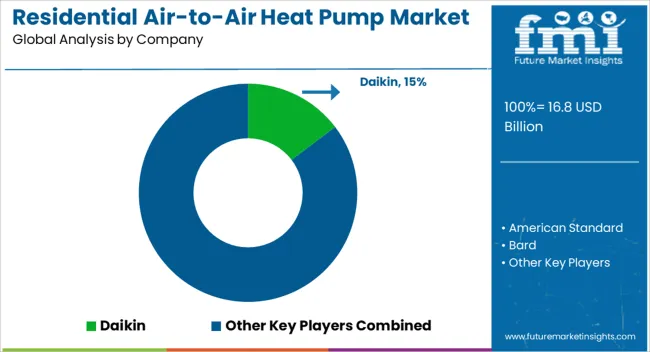

Competition in the residential air-to-air heat pump market is being shaped by energy efficiency, quiet operation, and system reliability for single-family homes and multi-residential buildings. Market positions are being reinforced through advanced inverter technology, smart controls, and global service networks that ensure consistent performance and ease of installation. Daikin and American Standard are being represented with high-efficiency heat pumps engineered for stable temperature control and low energy consumption. Bard and Blue Star are being promoted with compact and durable systems structured for residential and light commercial applications. Bosch and Carrier are being applied with solutions optimized for climate adaptability, quiet operation, and long-term durability. Fujitsu and Gree are being showcased with units designed for residential energy savings and user-friendly operation. Klimaire and LG supply heat pumps engineered for smart connectivity, remote monitoring, and easy integration with home automation systems. Lennox and MrCool are being advanced with modular systems structured for flexible installation and enhanced seasonal performance. Napoleon, Panasonic, Rheem, Samsung, Stiebel Eltron, and Trane are being represented with high-performance residential heat pumps designed for quiet operation, efficiency, and robust climate control. Strategies in the market are being centered on inverter technology, energy-efficient performance, and smart system integration. Research and development are being allocated to improve coefficient of performance, refrigerant management, noise reduction, and connectivity with digital thermostats and energy management systems. Product brochures are being structured with specifications covering heating and cooling capacity, energy efficiency ratings, compressor type, airflow, and installation requirements. Features such as inverter-driven compressors, quiet operation, remote monitoring, and climate adaptability are being emphasized to guide procurement and installation decisions. Each brochure is being arranged to present technical performance, compliance with international energy standards, and maintenance support. Information is being provided in a clear, evaluation-ready format to assist homeowners, installers, and procurement teams in selecting residential air-to-air heat pumps that meet efficiency, reliability, and comfort requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.8 Billion |

| Application | Single family and Multi family |

| Product | Ductless and Ducted |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin, American Standard, Bard, Blue Star, Bosch, Carrier, Fujitsu, Gree, Klimaire, LG, Lennox, MrCool, Napoleon, Panasonic, Rheem, Samsung, Stiebel Eltron, and Trane |

| Additional Attributes | Dollar sales by heat pump type and residential application, demand dynamics across new constructions and retrofits, regional trends in energy-efficient heating and cooling adoption, innovation in COP, inverter technology, and smart controls, environmental impact of refrigerants and energy use, and emerging use cases in hybrid HVAC and smart homes. |

The global residential air-to-air heat pump market is estimated to be valued at USD 16.8 billion in 2025.

The market size for the residential air-to-air heat pump market is projected to reach USD 42.1 billion by 2035.

The residential air-to-air heat pump market is expected to grow at a 9.6% CAGR between 2025 and 2035.

The key product types in residential air-to-air heat pump market are single family and multi family.

In terms of product, ductless segment to command 57.6% share in the residential air-to-air heat pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Generator Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy-Efficient Technologies Market Size and Share Forecast Outlook 2025 to 2035

Residential Interior Wood Doors Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Residential AMI Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential Vacuum Circuit Breaker Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Carpet Roll Market Size and Share Forecast Outlook 2025 to 2035

Residential Air Insulated Power Distribution Component Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy Efficient Windows Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar PV Inverter Market Size and Share Forecast Outlook 2025 to 2035

Residential Water Treatment Devices Market Size and Share Forecast Outlook 2025 to 2035

Residential Electric Boiler Market Size and Share Forecast Outlook 2025 to 2035

Residential Smart Gas Meter Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Energy as a Service (EaaS) Market Size and Share Forecast Outlook 2025 to 2035

Residential Solar Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA