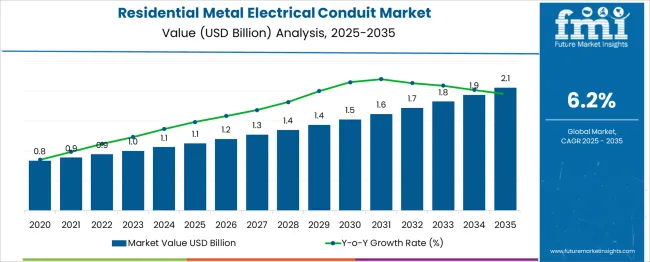

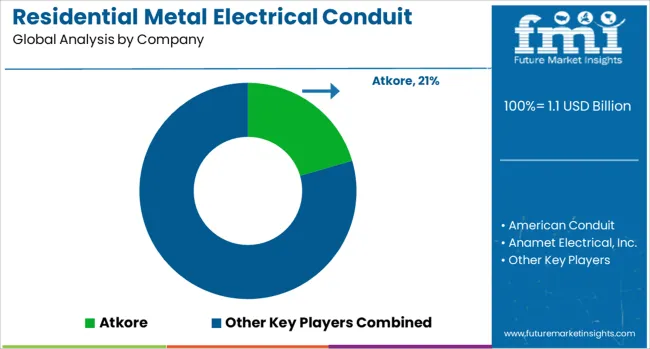

The Residential Metal Electrical Conduit Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.2% over the forecast period. Scenario-based forecasting provides a framework to evaluate potential variations in market growth driven by factors such as construction activity, regulatory mandates, and the adoption of advanced electrical infrastructure. Under the base case scenario, market expansion is expected to follow the projected CAGR, with steady adoption of metal conduits in residential wiring systems to ensure safety, durability, and compliance with electrical codes.

Incremental growth from USD 1.1 billion in 2025 to USD 2.1 billion in 2035 would result from standard residential construction trends and moderate regulatory reinforcement. In an aggressive scenario, accelerated urban development and stricter enforcement of electrical safety regulations could significantly increase demand for metal conduits.

This scenario would push adoption timelines forward, leading to higher penetration rates and potentially exceeding the baseline CAGR, as builders and contractors prioritize certified and compliant conduit systems. Conversely, in a conservative scenario, slower construction activity or substitution with alternative wiring solutions could reduce growth momentum, resulting in a lower trajectory than the projected 6.2% CAGR.

The scenario-based forecasting illustrates that while steady regulatory and construction trends support consistent growth, deviations in policy enforcement, urban residential development, or material substitution could substantially influence the market, highlighting both opportunities and risks within the residential metal electrical conduit sector over the 2025 to 2035 period.

| Metric | Value |

|---|---|

| Residential Metal Electrical Conduit Market Estimated Value in (2025 E) | USD 1.1 billion |

| Residential Metal Electrical Conduit Market Forecast Value in (2035 F) | USD 2.1 billion |

| Forecast CAGR (2025 to 2035) | 6.2% |

Increasing awareness of fire resistance, mechanical protection, and long-term reliability has elevated the preference for metal conduits over plastic alternatives in residential projects.

Advancements in material coatings and manufacturing processes have improved corrosion resistance and ease of installation, making these conduits more attractive to builders and contractors. Growth in urban housing, coupled with stringent electrical codes and sustainability initiatives, is expected to sustain demand during the forecast period.

Emerging trends such as smart home integration and higher electrical loads are creating opportunities for premium and innovative configurations, while collaboration between manufacturers and builders is enabling faster adoption across diverse housing segments.

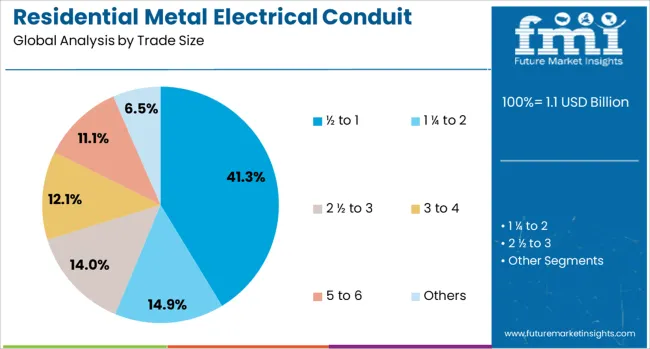

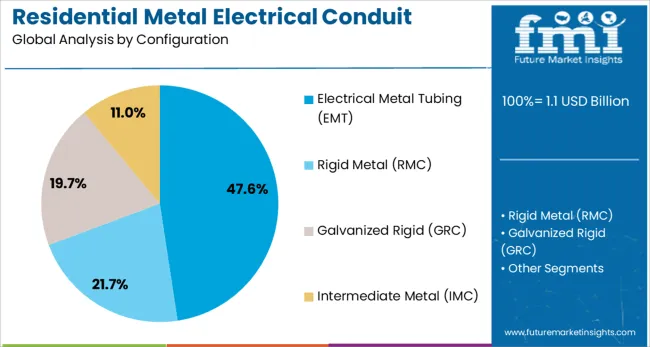

The residential metal electrical conduit market is segmented by trade size, configuration, and geographic regions. By trade size, the residential metal electrical conduit market is divided into ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others. In terms of configuration, the residential metal electrical conduit market is classified into Electrical Metal Tubing (EMT), Rigid Metal Conduit (RMC), Galvanized Rigid Metal Conduit (GRC), and Intermediate Metal Conduit (IMC). Regionally, the residential metal electrical conduit industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by trade size, the ½ to 1 category is expected to hold 41.3% of the total market revenue in 2025, establishing itself as the leading trade size segment. This dominance has been driven by its compatibility with the majority of residential electrical circuits, offering an optimal balance between space efficiency and capacity.

Its smaller diameter has facilitated easier installation within walls and ceilings without compromising safety or accessibility, making it the preferred choice for residential electricians. The lower material and labor costs associated with this trade size have also enhanced its appeal in large-scale housing developments where cost efficiency is critical.

The ability to accommodate standard wiring needs while ensuring compliance with residential building codes has further reinforced the leadership of the ½ to 1 segment within the market.

Segmented by configuration, electrical metal tubing EMT is projected to capture 47.6% of the market revenue in 2025, maintaining its position as the leading configuration segment. This leadership has been supported by its lightweight yet strong construction, which has simplified handling and installation in residential environments.

Its bendability and smooth interior have allowed for efficient wire pulling, reducing installation time and effort. Contractors have preferred EMT due to its balance of protection and cost-effectiveness, especially in projects where both safety and budget constraints are paramount.

Its inherent resistance to physical damage and ability to meet stringent residential electrical codes have made it a standard choice in the industry. The widespread availability of EMT fittings and tools has further facilitated its dominance, enabling seamless integration into varied residential construction layouts while ensuring reliability and durability.

The market has been expanding due to growing demand for safe, durable, and reliable electrical wiring systems in homes. Metal conduits have been widely utilized to protect wiring from mechanical damage, moisture, and fire hazards while ensuring electrical safety compliance. Market growth has been supported by advancements in galvanized, aluminum, and stainless-steel conduit designs, along with increasing residential construction and renovation projects. Rising safety regulations, urban housing expansion, and awareness of fire and electrical hazards have further strengthened the adoption of metal conduits globally.

The growth of new housing developments and residential renovation initiatives has been a key driver for the metal electrical conduit market. Conduits have been utilized to route electrical wiring efficiently while providing protection against mechanical impacts and environmental factors. Rapid urbanization and increasing demand for modern, automated homes have led to a higher requirement for organized and durable electrical distribution systems. Builders and electrical contractors have increasingly preferred metal conduits due to their fire resistance, corrosion protection, and long-term reliability. In addition, retrofitting older homes with modern wiring systems has further fueled demand, as safety codes and energy efficiency standards mandate robust conduit solutions. This combination of new construction, renovations, and regulatory compliance has significantly contributed to the widespread adoption of residential metal electrical conduits globally.

Technological innovations have enhanced the performance, durability, and installation efficiency of residential metal electrical conduits. Modern conduits are manufactured using galvanized steel, aluminum, and stainless steel to offer superior corrosion resistance, mechanical strength, and flexibility in routing electrical wiring. Pre-fabricated fittings, snap-lock systems, and modular components have simplified installation and reduced labor costs. Advances in coating technologies have improved fire resistance, aesthetic finishes, and durability in high-humidity environments. Additionally, lightweight designs and precision-engineered bends have facilitated efficient installation in compact or complex residential layouts. These technological improvements have enabled metal conduits to meet stringent safety standards, comply with electrical codes, and provide long-lasting performance, encouraging their widespread adoption across new and renovated housing projects.

Awareness of electrical safety, fire hazards, and home protection has been a major factor driving demand for residential metal electrical conduits. Metal conduits have been recognized for their ability to prevent electrical faults, minimize risk of short circuits, and contain sparks in case of wire damage. Homeowners, builders, and electricians have increasingly adopted conduits to meet regulatory safety standards and to safeguard expensive appliances and household systems. Fire-resistant coatings, corrosion-resistant materials, and grounding compatibility have made metal conduits suitable for residential environments where safety and reliability are critical. Educational campaigns, updated electrical codes, and insurance requirements have further encouraged adoption, ensuring long-term protection and consistent performance of residential electrical wiring systems.

The expansion of smart homes, automated lighting, and energy-efficient appliances has created opportunities for the residential metal electrical conduit market. Conduits have been deployed to organize complex wiring networks required for smart thermostats, security systems, home automation, and renewable energy integration. Modular and flexible metal conduits allow easy re-routing and future upgrades, supporting dynamic home environments. Rising adoption of energy-efficient and solar-powered residential solutions has further reinforced the need for durable and protective wiring systems. Government incentives promoting energy-efficient housing, coupled with increasing urban residential construction, have opened new avenues for market growth. By combining safety, flexibility, and support for modern home technologies, residential metal electrical conduits are poised for sustained adoption in global housing markets.

| Country | CAGR |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| France | 6.5% |

| UK | 5.9% |

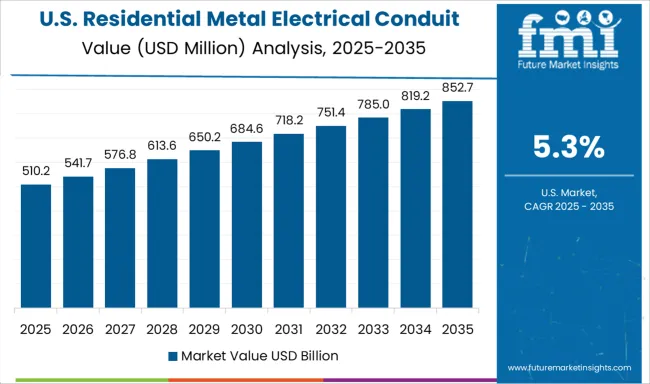

| USA | 5.3% |

| Brazil | 4.7% |

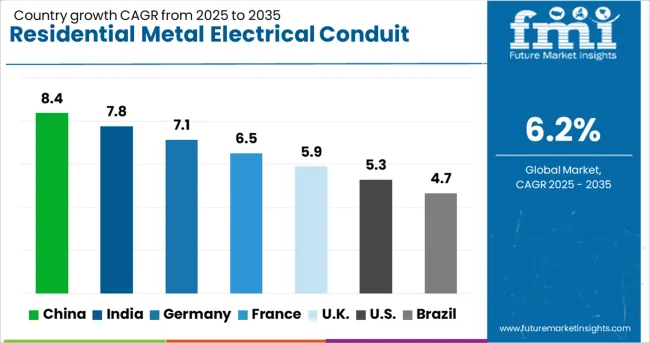

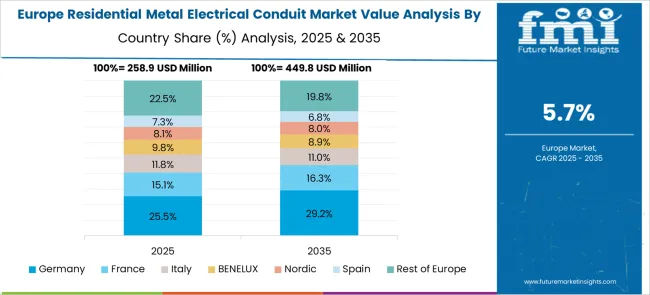

The market is projected to grow at a CAGR of 6.2% between 2025 and 2035, driven by rising demand for safe and durable electrical installations in residential buildings. China leads with an 8.4% CAGR, supported by rapid urban housing development and adoption of standardized electrical safety codes. India follows at 7.8%, with expansion fueled by increasing residential construction and modernization of electrical infrastructure. Germany, at 7.1%, benefits from stringent safety regulations and advanced manufacturing technologies. The UK, growing at 5.9%, focuses on upgrading residential electrical systems, while the USA, at 5.3%, experiences steady adoption due to building code enforcement and residential renovation projects. This report includes insights on 40+ countries; the top markets are shown here for reference.

The Chinese market is projected to grow at a CAGR of 8.4% from 2025 to 2035, driven by rising residential construction and renovation projects. Adoption of metal conduits is supported by increasing demand for durable electrical infrastructure and fire-resistant installations. Domestic manufacturers are introducing advanced galvanized and aluminum conduit solutions to meet safety and compliance standards. Integration of automated manufacturing techniques is enhancing production efficiency. Demand is particularly strong in urban housing projects and multi-unit residential complexes. Strategic collaborations between construction firms and material suppliers are accelerating adoption. Enhanced electrical safety standards are also boosting market growth.

The Indian market is forecast to expand at a CAGR of 7.8%, supported by growing housing developments and modernization of electrical infrastructure. Local manufacturers are focusing on producing high-quality, corrosion-resistant metal conduits for residential applications. Demand is rising in tier 1 and tier 2 cities where construction activity is concentrated. Government regulations for electrical safety are encouraging adoption of certified metal conduits. Partnerships with international material technology providers are helping improve product quality and standards. Increased preference for durable and long-life solutions in apartments and housing complexes is driving steady growth.

Germany is expected to register a CAGR of 7.1%, driven by demand in residential renovation and new construction projects. Manufacturers are focusing on durable and certified metal conduits that meet stringent safety and environmental standards. Adoption in smart homes and energy-efficient housing is rising. Strategic alliances between local producers and construction firms are facilitating project-specific solutions. Demand for galvanized and aluminum conduits is increasing due to enhanced corrosion resistance and installation ease. Regulatory compliance and industry standards are shaping production and quality practices.

The United Kingdom is projected to grow at a CAGR of 5.9%, supported by residential development and modernization programs. Adoption of high-quality metal conduits is being driven by fire safety regulations and electrical standards. Manufacturers are producing corrosion-resistant solutions to address the demands of new housing projects and refurbishment work. Strategic collaborations between builders and conduit suppliers are expanding availability and adoption. The focus on long-lasting and robust electrical infrastructure is boosting market volume.

The United States market is expected to expand at a CAGR of 5.3%, driven by growth in housing projects and demand for durable electrical installations. Adoption of metal conduits is focused on safety, long-term performance, and regulatory compliance. Manufacturers are supplying galvanized and aluminum solutions for new constructions and residential retrofits. Strategic collaborations with homebuilders are facilitating widespread installation in suburban housing projects. Industrially produced conduits are gaining preference for residential applications due to consistent quality and longevity.

The residential metal electrical conduit market is characterized by a mix of global manufacturers and regional fabricators, serving new construction, retrofitting, and renovation projects. Key global players such as Thomas & Betts (ABB), Eaton, and Schneider Electric dominate through comprehensive product portfolios, including EMT, IMC, and rigid steel conduits, combined with integrated fittings, connectors, and installation accessories. Regional leaders in Asia-Pacific, such as Legrand India and Hitachi Metals, focus on mid-sized residential developments, leveraging cost-efficient manufacturing and localized supply chains to meet price-sensitive demand.

Competition is driven by material innovation, corrosion resistance, and ease of installation, as builders and electricians increasingly prefer pre-galvanized or aluminum-alloy conduits that reduce labor costs and improve durability. Manufacturers differentiate through bundled solutions, training programs for electrical contractors, and digital specification tools, enabling faster project approvals and enhanced adoption in large-scale housing projects. The market is also shaped by regulatory compliance, including NEC standards in the U.S., IEC codes in Europe, and BIS specifications in India, which influence design, wall thickness, and fire-resistance requirements.

During the forecast period (2025–2035), players focus on expanding into urban retrofit projects, offering pre-fabricated conduit assemblies, and integrating smart-home compatible conduits that support structured cabling and IoT devices. Companies that combine technical quality, regulatory alignment, and contractor-focused services capture premium positioning while sustaining growth in both mature and emerging residential markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Trade Size | ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6, and Others |

| Configuration | Electrical Metal Tubing (EMT), Rigid Metal (RMC), Galvanized Rigid (GRC), and Intermediate Metal (IMC) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atkore, American Conduit, Anamet Electrical, Inc., Flexa GMbH, Gibson Stainless & Specialty Inc., HellermannTyton, legrand, Nucor Tubular Products, Schneider Electric, Techno Flex, Weifang East Steel Pipe, and Zekelman Industries |

| Additional Attributes | Dollar sales by conduit type and application segment, demand dynamics across residential construction, renovation projects, and smart home installations, regional trends in adoption across North America, Europe, and Asia-Pacific, innovation in corrosion-resistant coatings, flexible designs, and integrated grounding solutions, environmental impact of metal sourcing, manufacturing emissions, and end-of-life recycling, and emerging use cases in energy-efficient home wiring, IoT-enabled electrical systems, and modular residential infrastructure. |

The global residential metal electrical conduit market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the residential metal electrical conduit market is projected to reach USD 2.1 billion by 2035.

The residential metal electrical conduit market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in residential metal electrical conduit market are ½ to 1, 1 ¼ to 2, 2 ½ to 3, 3 to 4, 5 to 6 and others.

In terms of configuration, electrical metal tubing (emt) segment to command 47.6% share in the residential metal electrical conduit market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Residential Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Non-metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Rigid Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Residential PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Scale Non Metal Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Electrical Conduit Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PVC Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Metal Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Utility-Scale Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Metallurgical Lighting Market Size and Share Forecast Outlook 2025 to 2035

Metal Evaporation Boat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA