The global metal evaporation boat market is projected to reach USD 714.8 million by 2035, reflecting an absolute increase of USD 276.0 million over the forecast period. The market is valued at USD 438.8 million in 2025 and is expected to grow at a CAGR of 5.0%. This growth is driven by the increasing demand for metal evaporation boats in industries such as semiconductor manufacturing, thin-film coatings, solar panels, and optics, where high-performance metal deposition is essential. Metal evaporation boats are widely used in vacuum deposition processes to deposit thin metallic films onto substrates, critical for applications requiring precise, high-quality coatings for electronic components, optical coatings, and photovoltaic cells.

Metal evaporation boats are favored for their high resistance to temperature and oxidation, making them ideal for high-vacuum processes that require the deposition of materials like gold, silver, copper, and aluminum. As industries continue to push for miniaturization of electronic devices and enhanced performance in components such as semiconductors, sensors, and thin-film solar cells, the demand for these evaporation boats is expected to increase. Additionally, the growing adoption of photovoltaic technologies for renewable energy generation, where metal coatings are crucial for efficiency, is further propelling the market.

The market growth is also supported by technological advancements in deposition techniques, particularly the use of metal evaporation boats in advanced manufacturing processes. These boats offer precise control over the thickness and uniformity of deposited films, which is crucial for applications in the semiconductor industry, where even minute variations can impact performance. Furthermore, the rise of new materials and technologies in the optics and aerospace sectors, where specialized coatings are required for lenses, mirrors, and spacecraft components, is contributing to the expanding market for metal evaporation boats.

Between 2025 and 2030, the metal evaporation boat market is projected to grow from USD 438.8 million to approximately USD 554.6 million, adding USD 115.8 million, which accounts for about 42% of the total forecast growth for the decade. This period will be characterized by continued growth in semiconductor manufacturing, electronics, and the expansion of photovoltaic applications, all of which require efficient metal deposition technologies.

From 2030 to 2035, the market is expected to expand from approximately USD 554.6 million to USD 714.8 million, adding USD 160.2 million, which constitutes about 58% of the overall growth. This phase will see further advancements in metal deposition technologies, with an increasing focus on renewable energy applications, particularly thin-film solar panels, and the continued evolution of miniaturized electronic devices, driving greater demand for metal evaporation boats.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 438.8 million |

| Market Forecast Value (2035) | USD 714.8 million |

| Forecast CAGR (2025-2035) | 5.0% |

The metal evaporation boat market is growing due to its critical role in the vacuum deposition process, widely used in industries such as electronics, optics, and materials science. Metal evaporation boats are essential for depositing thin metal films onto substrates in applications such as semiconductor manufacturing, solar panel production, and optical coatings. These coatings are vital for enhancing the performance of electronic components, energy-efficient devices, and advanced optical systems.

The growth of the electronics industry, especially in the production of semiconductors, flat-panel displays, and advanced sensors, is a significant driver for the market. Metal evaporation boats are used to deposit metals like gold, silver, aluminum, and copper, which are crucial for creating the conductive layers in electronic devices. As the demand for smaller, faster, and more efficient electronic devices increases, the need for precise and high-quality metal deposition techniques continues to rise.

The increasing focus on renewable energy is driving demand for metal evaporation boats in the production of thin-film solar cells, where uniform and controlled deposition of metal films is essential for improving efficiency. Challenges such as the high cost of raw materials and the complexity of the evaporation process may limit growth in cost-sensitive markets, though continued advancements in deposition technologies and manufacturing capabilities are expected to support sustained market growth.

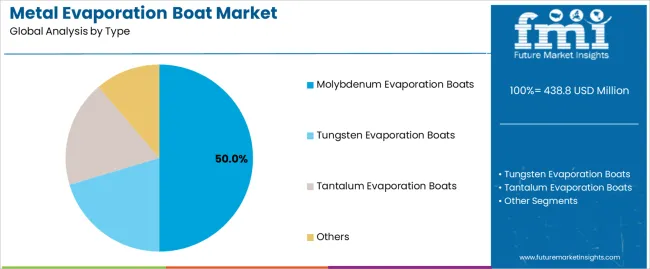

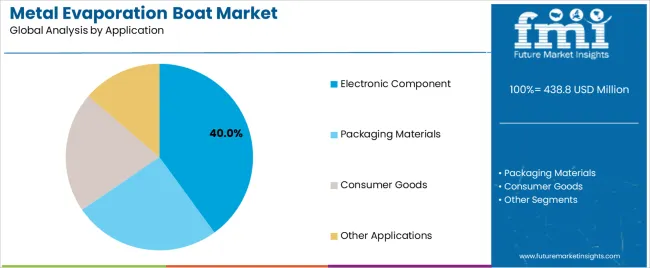

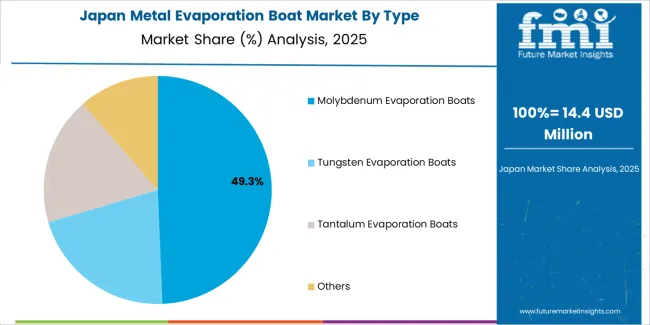

The market is segmented by type, application, and region. By type, the market is divided into molybdenum evaporation boats, tungsten evaporation boats, tantalum evaporation boats, and other types. Based on application, the market is categorized into electronic components, packaging materials, consumer goods, and other applications. Regionally, the market is divided into Asia Pacific, Europe, North America, and other key regions.

The molybdenum evaporation boats segment leads the metal evaporation boat market, capturing 50.0% of the total market share. Molybdenum boats are favored for their exceptional thermal stability and resistance to high temperatures, which makes them ideal for vacuum deposition processes used in various industries. These boats are particularly effective in thin-film deposition for electronic devices, including semiconductors and photovoltaic cells. Their consistent performance in high-temperature environments and ability to produce uniform, high-quality coatings are key factors contributing to their market leadership. Molybdenum boats also offer a cost-effective solution compared to other metal options, which further drives their widespread adoption.

While tungsten evaporation boats, tantalum evaporation boats, and other types are used in more specialized applications, they hold smaller market shares. Tungsten boats are suitable for extreme high-temperature environments, and tantalum boats excel in corrosion resistance. However, molybdenum evaporation boats dominate due to their balance of performance, durability, and cost-effectiveness.

The electronic component application dominates the metal evaporation boat market, accounting for approximately 40.0% of the total market share. Metal evaporation boats are crucial in the production of electronic components, where they are used in thin-film deposition processes for semiconductors, sensors, and other devices. The growing demand for advanced electronic products, such as smartphones, laptops, and solar panels, has driven significant growth in this sector. These products rely on high-quality thin-film coatings, which are produced using metal evaporation boats, making the electronic component sector the largest application segment.

What sets the electronic component application apart is the continuous innovation in electronics, which requires high-precision deposition techniques for efficient device performance. Although other applications, such as packaging materials and consumer goods, contribute to the market, the demand for metal evaporation boats in the electronic component industry remains the largest, driven by ongoing technological advancements and increasing production of high-performance electronic devices.

The market is expanding due to the increasing demand for advanced evaporation boats in thin film deposition across electronics, optics and renewable energy sectors. These boats offer features like high‑temperature resilience, uniform metal evaporation and precision deposition capability. Key drivers include the growth in semiconductor fabrication and solar cell manufacturing, while restraints stem from high material and manufacturing costs and competition from alternative deposition technologies.

Metal evaporation boats are gaining popularity because they enable consistent, high‑purity thin film coatings using metals like tungsten, molybdenum and tantalum—essential for applications in semiconductors, display panels and optical components. These boats withstand extreme temperatures and provide reliable thermal and mechanical performance, making them ideal for precision vacuum deposition workflows. As industries demand finer geometries, higher throughput and improved film uniformity, the role of metal evaporation boats becomes increasingly critical. The growth of connected devices, 5G infrastructure and advanced solar cells further drives adoption of these components in manufacturing lines.

Material and process innovations are driving growth in the evaporation boat sector by enabling improved designs, better thermal stability and longer service life. Advances in manufacturing techniques such as fine‑grain alloy control, surface treatments and optimized geometries are enhancing boat performance under severe vacuum and high‑power conditions. Process improvements in evaporation systems, automation of deposition lines and integration of diagnostics are making metal boats more efficient and scalable. These factors are expanding the range of applications, including beyond traditional electronics into aerospace, automotive and specialized coatings.

Several challenges are limiting broader adoption of metal evaporation boats. One major challenge is the high cost of materials (like tungsten and tantalum) and the precision fabrication required for defect‑free performance. Quality control and consistency across batches are critical and can be difficult to maintain, especially for high‑volume applications. Integration into existing deposition systems may require significant re‑qualification and investment, which can deter smaller manufacturers. Moreover, alternative technologies (such as sputtering or CVD) present competitive pressure, and supply‑chain uncertainties for critical and specialty metals can further impact availability and cost.

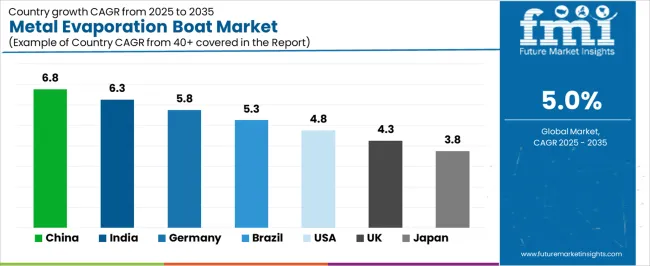

| Country | CAGR (%) |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

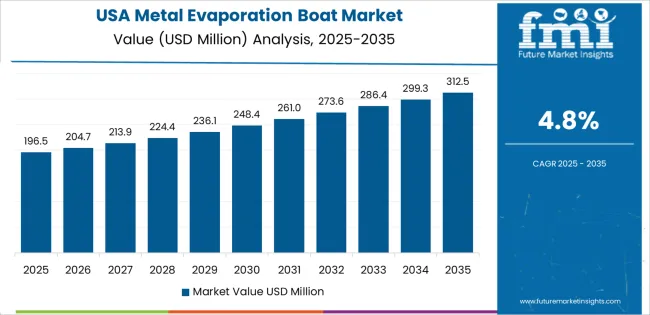

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

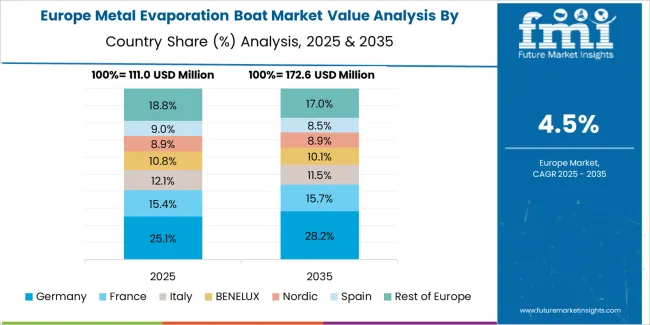

The global metal evaporation boat market is witnessing steady growth, with China leading at a 6.8% CAGR, driven by industrial expansion, increased demand for electronic devices, and a growing focus on semiconductor and thin-film technologies. India follows with a 6.3% CAGR, supported by the country’s expanding electronics sector and focus on renewable energy. Germany records a 5.8% CAGR, propelled by the country’s manufacturing strength, particularly in the automotive, aerospace, and energy industries, where metal evaporation boats play a key role in deposition processes. Brazil experiences a 5.3% CAGR, driven by infrastructure development and an increasing need for coating solutions in energy and manufacturing sectors.

The USA grows at a 4.8% CAGR, influenced by its technological advancements in semiconductor fabrication, automotive, and aerospace industries. The UK grows at a 4.3% CAGR, supported by its demand for metal coatings in electronics and aerospace. Japan’s market, growing at a 3.8% CAGR, reflects steady demand from its electronics and manufacturing sectors, particularly in high-performance applications. As industries worldwide continue to rely on thin-film deposition technologies, the metal evaporation boat market is poised for continued expansion across these regions.

China is leading the metal evaporation boat market with a 6.8% CAGR, driven by its rapidly expanding electronics, semiconductor, and solar industries. As the world’s largest manufacturing hub, China’s electronics and display sectors heavily rely on vacuum deposition processes that require high-performance components like metal evaporation boats. These boats are crucial for the vaporization of metals used in thin-film deposition, which is essential for manufacturing displays, solar panels, and semiconductor components. As China continues to grow its manufacturing capacity and adopt more advanced technology, the demand for metal evaporation boats is expected to remain strong.

The Chinese government’s support for renewable energy projects, especially solar power, further boosts the market. Metal evaporation boats play a critical role in the production of thin-film solar panels, which are a key component of China’s energy transition. With China’s growing focus on smart manufacturing, automation, and reducing reliance on imports, the country is also expected to expand its domestic production of evaporation boats. As more industries adopt thin-film technology for various applications, from electronics to energy, China’s leadership in this market is set to continue.

India is experiencing significant growth in the metal evaporation boat market, with a 6.3% CAGR, driven by its expanding electronics and renewable energy sectors. As India increases its domestic electronics manufacturing, particularly for displays, solar panels, and semiconductors, the need for vacuum deposition systems and their components, such as metal evaporation boats, has surged. These boats are crucial for creating thin films in applications ranging from consumer electronics to energy storage devices. The government’s push for local manufacturing under the "Make in India" initiative further accelerates demand for advanced manufacturing technologies, including vacuum deposition.

India’s growing renewable energy sector, particularly solar power, has also spurred the demand for metal evaporation boats. With a focus on solar energy expansion, India requires reliable and efficient thin-film deposition solutions for solar panels, where metal evaporation boats are indispensable. As India continues to expand its industrial base and invest in high-tech manufacturing, the market for metal evaporation boats is expected to grow steadily. In addition, India’s focus on energy efficiency, combined with the rise of local manufacturing capabilities, positions the country to be a significant player in the metal evaporation boat market in the coming years.

Germany is experiencing steady growth in the metal evaporation boat market, with a 5.8% CAGR, supported by its advanced manufacturing sectors such as automotive, aerospace, and precision engineering. These industries rely heavily on vacuum deposition technologies for coating and thin-film production, where metal evaporation boats are essential. The country’s commitment to high-quality manufacturing and precision engineering makes it a significant player in the global market. Furthermore, Germany’s leadership in semiconductor fabrication and high-tech equipment development creates consistent demand for advanced metal evaporation sources used in PVD (physical vapor deposition) systems.

Germany’s increasing focus on renewable energy, particularly solar power, contributes to the market’s growth as well. Thin-film solar panels, which rely on metal evaporation boats for the deposition of materials, are increasingly in demand in the country’s transition to cleaner energy sources. As Germany works to integrate more renewable energy into its grid, the need for efficient and reliable deposition systems will rise. With strong investments in green technologies and energy-efficient systems, Germany’s industrial demand for metal evaporation boats is expected to remain robust, ensuring steady market growth in the coming years.

Brazil is witnessing moderate growth in the metal evaporation boat market, with a 5.3% CAGR, fueled by its expanding industrial base and growing demand for renewable energy solutions. Brazil’s key sectors, such as oil and gas, petrochemicals, and power generation, rely on vacuum deposition technologies for coatings and surface treatments. These sectors require metal evaporation boats to achieve high-performance results in thin-film production. As Brazil continues to industrialize and modernize its infrastructure, the demand for reliable, high-temperature components like metal evaporation boats will continue to grow.

In addition to its industrial expansion, Brazil’s focus on renewable energy, especially solar power, is further driving the need for metal evaporation boats. With increased investments in solar panel manufacturing and the adoption of thin-film technology, the demand for vacuum deposition equipment rises. Metal evaporation boats are key components in the production of thin-film solar panels, which are integral to Brazil’s renewable energy plans. As Brazil continues to invest in energy efficiency, advanced manufacturing, and green technologies, the market for metal evaporation boats will likely expand, supporting the country’s industrial development and clean energy transition.

The USA is experiencing steady growth in the metal evaporation boat market with a 4.8% CAGR, supported by the increasing demand for vacuum deposition technologies in industries such as semiconductors, aerospace, and electronics. As one of the largest global markets for electronics and precision instruments, the USA relies heavily on metal evaporation boats for the production of thin-film components used in devices like displays, sensors, and semiconductors. The country’s focus on advancing technologies in manufacturing and materials science ensures continued demand for high-quality, durable evaporation boats.

The growing adoption of renewable energy technologies, especially solar power, further contributes to the USA’s demand for metal evaporation boats. Thin-film solar panels, which require efficient deposition systems, are an essential part of the country’s clean energy infrastructure. As the USA continues to transition to renewable energy and adopt more energy-efficient solutions, the demand for metal evaporation boats used in solar panel production and other high-tech applications will continue to rise. With continuous innovation in manufacturing processes and renewable energy systems, the USA’s market for metal evaporation boats is expected to remain strong in the future.

The UK is experiencing steady growth in the metal evaporation boat market, with a 4.3% CAGR, driven by its advanced manufacturing industries and ongoing investment in renewable energy technologies. Key sectors such as electronics, aerospace, and automotive rely on vacuum deposition technologies, where metal evaporation boats play a critical role. These industries require thin-film deposition processes for the production of components like sensors, coatings, and displays, all of which require metal evaporation boats for efficient and high-quality results. The UK’s focus on high-tech, precision manufacturing ensures steady demand for these components.

The UK’s commitment to renewable energy, especially solar power, further contributes to the market’s growth. As the country increases its solar energy capacity and transitions to more sustainable energy solutions, the demand for metal evaporation boats in thin-film solar panel manufacturing grows. With a focus on energy efficiency and carbon reduction, the UK is positioning itself as a leader in renewable energy technologies, which in turn supports the continued demand for metal evaporation boats. As industries continue to prioritize innovation and sustainable energy, the market for metal evaporation boats in the UK is expected to experience steady, long-term growth.

Japan is experiencing steady growth in the metal evaporation boat market with a 3.8% CAGR, driven by its advanced electronics, automotive, and materials manufacturing sectors. The country is a leader in high-tech manufacturing, including semiconductor production, solar technology, and precision instrumentation, all of which require vacuum deposition systems. Metal evaporation boats are key components in these systems, where they are used to deposit thin films onto various substrates. Japan’s commitment to innovation in manufacturing processes and materials science supports the demand for high-quality, reliable evaporation boats.

Japan’s increasing focus on renewable energy, particularly solar power, also contributes to the steady growth of the market. As the country adopts more renewable energy sources and expands its solar power generation, the need for thin-film technologies increases. Metal evaporation boats are crucial for producing thin-film solar panels, which are a core part of Japan’s renewable energy strategy. As the country continues to invest in advanced technologies and green energy solutions, the demand for metal evaporation boats will continue to grow, ensuring Japan’s role in the global market remains significant.

The metal evaporation boat market is characterized by a competitive landscape with key players offering high-quality evaporation boats used in thin film deposition, electronics, and coating applications. Plansee SE leads the market with a 12% share, known for its expertise in producing tungsten and other metal-based products. Plansee’s reputation for precision, high-performance materials, and advanced manufacturing capabilities makes it a leading supplier in this market.

Other major players include Kennametal, 3M, and PENSC, all of which bring decades of experience in materials technology. Kennametal is known for its tungsten and metal product offerings, which are highly regarded for their durability and reliability in high-performance applications. 3M offers a broad range of materials, including metal evaporation boats, as part of its advanced coatings and materials solutions. PENSC competes by focusing on the production of high-quality metal evaporation boats designed for specific coating and deposition applications.

Regional players such as Orient Special Ceramics, Zibo Peida, and Qingzhou Dongshan provide cost-effective, high-quality solutions, catering to customers looking for affordable and reliable metal evaporation boats. Companies like Achemetal, Jonye Ceramics, and ATTL focus on specialized metal products and custom solutions for niche industries. The competitive landscape is driven by product quality, innovation, customization, and the increasing demand for metal evaporation boats in semiconductor manufacturing, electronics, and thin-film coating industries.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD million |

| Classification | Free-standing, Combined |

| Application | Industrial, Commercial, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Countries Covered | China, Japan, South Korea, India, Australia & New Zealand, ASEAN, Rest of Asia Pacific, Germany, United Kingdom, France, Italy, Spain, Nordic, BENELUX, Rest of Europe, United States, Canada, Mexico, Brazil, Chile, Rest of Latin America, Kingdom of Saudi Arabia, Other GCC Countries, Turkey, South Africa, Other African Union, Rest of Middle East & Africa |

| Key Companies Profiled | Ebara Corporation, Adva Tech, Cooling Tower Systems, Classik Cooling Towers, Composite Cooling Solutions, EVAPCO, GS Cooling Towers, KOBELCO ECO SOLUTIONS, Kelvion Holding, Midwest Cooling Towers, NSCTPL, PERFECT Cooling Towers, Paharpur Cooling Towers, WATCO, Baltimore Aircoil, BAHOP, SPX Cooling Tech, Yuanheng Technology, Teling Energy Saving Air Conditioning Equipment, Feixue Refrigeration Equipment, Liangchi Group, King Sun Industry, Liangyan Cooling and Heating Equipment |

| Additional Attributes | Dollar sales by classification and application categories, market growth trends, market adoption by classification and application segments, regional adoption trends, competitive landscape, technological advancements in square cross flow side outlet cooling tower design, integration with industrial cooling systems. |

The global metal evaporation boat market is estimated to be valued at USD 438.8 million in 2025.

The market size for the metal evaporation boat market is projected to reach USD 714.8 million by 2035.

The metal evaporation boat market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in metal evaporation boat market are molybdenum evaporation boats, tungsten evaporation boats, tantalum evaporation boats and others.

In terms of application, electronic component segment to command 40.0% share in the metal evaporation boat market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metal Miniature Bone Plates Market Size and Share Forecast Outlook 2025 to 2035

Metal Locking Plate and Screw System Market Size and Share Forecast Outlook 2025 to 2035

Metal Pallet Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Varistor (MOV) Surge Arresters Market Size and Share Forecast Outlook 2025 to 2035

Metal Straw Market Size and Share Forecast Outlook 2025 to 2035

Metal Can Market Size and Share Forecast Outlook 2025 to 2035

Metal IBC Market Forecast and Outlook 2025 to 2035

Metalized Barrier Film Market Forecast and Outlook 2025 to 2035

Metal Packaging Market Size and Share Forecast Outlook 2025 to 2035

Metal Bellow Market Size and Share Forecast Outlook 2025 to 2035

Metal based Safety Gratings Market Size and Share Forecast Outlook 2025 to 2035

Metal Modifiers Market Size and Share Forecast Outlook 2025 to 2035

Metallic Stearate Market Size and Share Forecast Outlook 2025 to 2035

Metallic Labels Market Size and Share Forecast Outlook 2025 to 2035

Metal Recycling Market Size and Share Forecast Outlook 2025 to 2035

Metal Forming Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Removal Fluids Market Size and Share Forecast Outlook 2025 to 2035

Metal Deactivators Market Size and Share Forecast Outlook 2025 to 2035

Metal Film Analog Potentiometers Market Size and Share Forecast Outlook 2025 to 2035

Metal Oxide Film Fixed Resistor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA