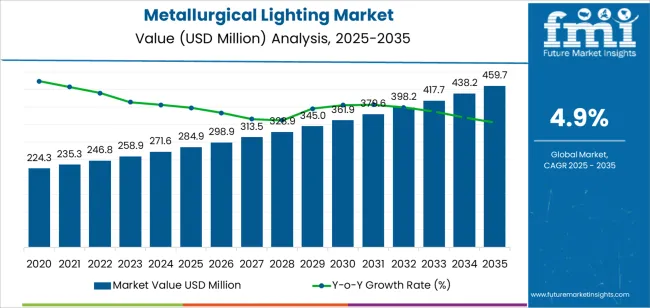

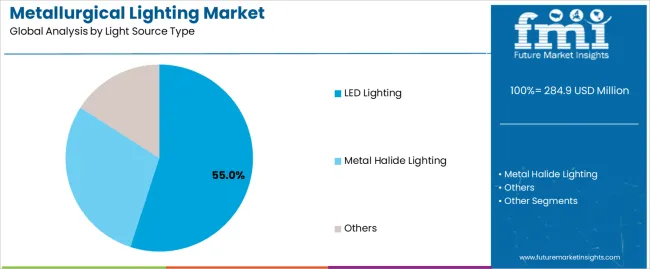

The metallurgical lighting market is forecast to grow from USD 284.9 million in 2025 to USD 459.7 million by 2035 at a CAGR of 4.9%. Demand for rugged, high intensity lighting designed to tolerate extreme heat, dust, vibration and corrosive conditions is being driven by modernization and capacity expansion across steel, aluminum, casting and forging operations. LED systems, which account for approximately 55% of installations, are preferred because longer service life and reduced energy consumption lower maintenance burden and operating expense in large industrial plants. Smart lighting platforms that enable adaptive control, remote monitoring and integration with factory automation are gaining traction where visibility and process control are critical. Retrofit projects in mature markets are being pursued to replace older metal halide fixtures, while new plant construction in emerging economies is fueling greenfield demand.

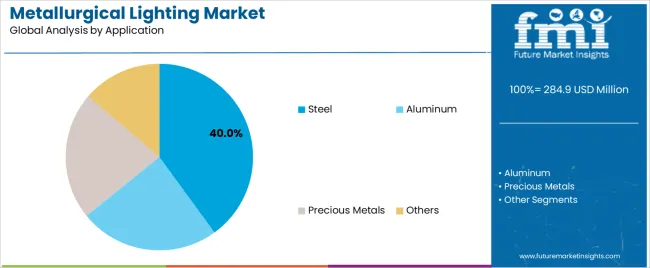

Safety and quality control considerations continue to prioritise high lumen output, thermal resistance and robust ingress protection for fixtures located near furnaces and heavy machinery. Suppliers are emphasising modularity, ease of installation and durable optics that maintain beam performance under contaminant exposure. Sectoral adoption is strongest in steelmaking, which represents roughly 40% of application demand, followed by aluminum and specialty metal processing. Price sensitivity and installation downtime remain constraints for fast replacement cycles, yet total cost of ownership arguments and regulatory emphasis on energy efficiency encourage specification of modern luminaires.

In addition, advancements in lighting technologies, including LED-based and smart lighting systems, are reshaping the metallurgical lighting market. LEDs offer benefits such as lower energy use, reduced maintenance requirements, longer service lifespans, and improved lighting quality in challenging industrial settings. The integration of smart monitoring and control systems allows lighting conditions to be adjusted automatically, improving energy management and productivity.

Growth in industrial development across emerging economies is further supporting market expansion, as increasing investments in large-scale metallurgical plants increase the need for specialized lighting equipment. Government regulations promoting worker safety and energy conservation are also encouraging broader adoption of modern lighting solutions. As industries continue upgrading outdated lighting to more efficient, heat-resistant, and reliable systems, the metallurgical lighting market is expected to experience steady long-term demand.

From 2025 to 2030, the metallurgical lighting market is expected to grow from USD 284.9 million to USD 361.9 million, representing an increase of USD 77 million. This growth will be driven by rising infrastructure development and industrial modernization efforts, particularly in regions focused on expanding metal and steel production capacity. During this phase, many facilities will replace traditional lighting systems with LED and enhanced high-temperature-resistant lighting solutions to improve reliability and reduce maintenance costs.

The need to reduce downtime and operational risk is encouraging industries to adopt lighting that maintains consistent output under demanding conditions. Furthermore, heightened safety protocols and government workplace lighting standards will push manufacturers to implement better illumination systems that support visual accuracy and protect workers in complex industrial settings.

Between 2030 and 2035, the market is expected to expand from USD 361.9 million to USD 459.7 million, adding USD 97.8 million in value. Growth during this period will be supported by the continued adoption of smart, automated lighting systems integrated with digital monitoring platforms. The increasing use of data-driven industrial operations will encourage integration of lighting systems capable of adjusting brightness, beam direction, and efficiency in real time.

The ongoing move toward sustainability will also influence market trends, with companies adopting energy-efficient lighting to meet emissions reduction targets and lower long-term operating expenses. As metallurgical production capacity rises globally and industries place greater emphasis on efficiency, safety, and environmental responsibility, demand for advanced metallurgical lighting systems will maintain a steady upward trajectory through 2035.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 379 million |

| Market Forecast Value (2035) | USD 666 million |

| Forecast CAGR (2025-2035) | 5.8% |

The metallurgical lighting market is experiencing steady growth, driven by the increasing demand for high-performance lighting solutions in industries such as steel production, aluminum manufacturing, and precious metals. The transition towards energy-efficient lighting technologies, such as LEDs, is a significant driver of growth, as these solutions offer longer lifespans and reduced energy consumption compared to traditional lighting. Additionally, the growing emphasis on sustainability and cost optimization within industrial facilities is further propelling the demand for advanced lighting solutions. The steel industry is one of the largest applications for metallurgical lighting, contributing to the market’s growth, especially in regions with robust industrial production, such as China, India, and Germany.

Technological advancements in LED lighting are also contributing to market growth. These lights provide superior brightness, high efficiency, and better resistance to high temperatures, making them ideal for industrial environments like smelting, casting, and refining operations. As industries around the world focus on automation and smart manufacturing to improve productivity, the need for optimized lighting solutions that enhance visibility and safety in metallurgical and manufacturing plants continues to increase. With the ongoing development in lighting technology, particularly in smart lighting systems, the metallurgical lighting market is expected to grow steadily over the next decade.

The metallurgical lighting market is segmented by light source type and application, both of which reflect distinct industrial requirements across global regions. By light source type, the market includes LED lighting, metal halide lighting, and other lighting technologies, with the LED lighting segment leading at approximately 55% share. By application, the market is divided into steel, aluminum, precious metals and others, with the steel segment accounting for about 40% share. Growth is especially strong in Asia Pacific regions such as China and India, while Europe and North America continue to rely on modernization and replacement of existing systems.

The LED lighting segment dominates the metallurgical lighting market, capturing roughly 55% of the total share. This leadership is largely due to the superior performance characteristics of LED technology in demanding industrial environments such as steel mills and aluminum smelters. LEDs offer significant advantages over traditional lighting options including metal halide lamps - they consume less power, have longer lifespans, reduce maintenance costs and perform better under high ambient temperatures and harsh conditions. In metallurgical operations where environments can include molten metal, extreme heat, glare and vibration, LED systems provide enhanced durability and reliability.

Furthermore, the global push toward energy efficiency and carbon reduction in industrial facilities is accelerating LED adoption. Regions such as China, India and Germany are investing heavily in upgrading their steel and aluminum plant lighting systems to LED, driving volume. Additionally, LED lighting systems can integrate with smart controls and automation systems, delivering further operational benefits in smart factories and Industry 4.0 environments. As the demand for modernized infrastructure grows and industries prioritize cost optimization, energy savings, and automation integration, the LED segment is well positioned to retain dominance in the metallurgical lighting market over the forecast period.

The steel segment holds the largest application share in the metallurgical lighting market, at approximately 40%. Steel production plants require extensive and robust lighting systems, given that operations span large furnaces, casting lines, rolling mills, and heavy duty processing zones that demand high intensity, reliable illumination. In addition to safety concerns, good lighting supports quality control, automation systems and productivity in such high temperature and harsh environments. Metal halide and LED lighting both serve this sector, but LEDs are increasingly preferred due to their longevity and energy efficiency.

Much of the growth is occurring in major steel producing nations such as China, India and Brazil, where new plant construction and modernization of older facilities are underway. The need to retrofit existing mills to improve energy performance, comply with environmental regulations, and reduce operating costs further pushes demand for advanced lighting solutions in steel. Given steel’s volume in industrial output globally and its critical reliance on lighting, the steel sector continues to represent the largest share of the metallurgical lighting market.

The metallurgical lighting market is advancing due to escalating demand for energy efficient lighting solutions in heavy industry sectors such as steel, aluminum and precious metals. With rising industrial automation, eye toward operational safety and surge in smart manufacturing, facilities are migrating from traditional high intensity lamps to LED lighting systems that deliver longer lifespans and lower energy consumption. Emerging markets in Asia Pacific, especially China and India, are modernizing infrastructure, which further fuels adoption of advanced industrial lighting. Regulatory emphasis on sustainability and carbon emission reduction in manufacturing also underpin steady market growth.

Key drivers for the metallurgical lighting market include the shift to LED lighting technologies offering improved durability in high temperature, harsh metallurgical environments, and substantial cost savings from lower energy consumption and maintenance. Furthermore, growth in the steel and aluminum industries is driving the need for robust, high intensity lighting in production areas like smelting, casting and rolling mills. The push for smart factory implementation and integration of lighting systems with automation platforms and IoT controls is another driver, enhancing operational efficiency and safety across metallurgical applications.

Despite promising growth, the metallurgical lighting market faces restraints, such as the high initial investment required to install advanced LED or smart lighting systems in large industrial facilities. Some older plants, especially in developing regions, may delay upgrades due to budgetary constraints or operational downtime risks. Additionally, resistance to change and the long lifetime of existing lighting installations can slow replacement cycles. Compatibility with existing control systems and harsh environmental conditions in metallurgical settings like high heat, dust and vibration may also pose application challenges for lighting suppliers and end users alike.

Emerging trends in the metallurgical lighting market include increased deployment of smart lighting systems that integrate sensors, remote monitoring and adaptive brightness controls to optimize energy usage in industrial plants. Miniaturization and modularity of lighting fixtures designed for heavy industry applications are gaining traction, enabling easier installation and maintenance. Sustainability is becoming central, with lighting providers offering recycled materials and more efficient optics to align with green manufacturing goals. Lastly, retrofitting of legacy metallurgical plants in regions such as Europe and North America is gaining momentum, driving demand for upgrade kits and flexible lighting solutions tailored to demanding environments.

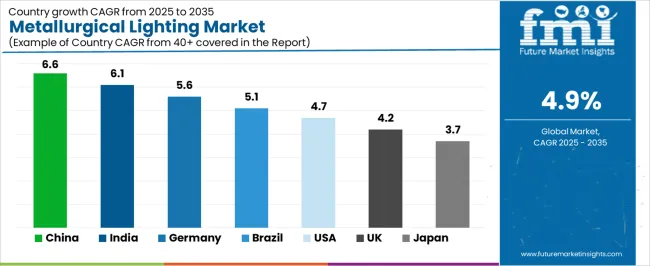

The metallurgical lighting market is experiencing growth across various global regions, driven by industrialization, modernization of manufacturing facilities, and a shift towards energy-efficient lighting solutions like LED. Emerging economies such as China and India are witnessing strong growth, fueled by increasing steel and aluminum production and ongoing infrastructure projects. Meanwhile, developed regions such as Germany, the USA, and Japan are experiencing more steady growth, driven by upgrades of existing facilities and the push toward sustainable and smart manufacturing. Overall, the market reflects the unique demands and maturity levels of each region, with ongoing industrial advancements and environmental regulations shaping market dynamics.

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| Brazil | 5.1% |

| USA | 4.7% |

| UK | 4.2% |

| Japan | 3.7% |

China is projected to grow at a CAGR of 6.6% in the metallurgical lighting market. As the world’s largest producer of steel and aluminum, China plays a pivotal role in the global market. The country is rapidly modernizing its industrial base, focusing on upgrading its aging steel plants and aluminum refineries with more energy-efficient lighting systems. The strong demand for LED lighting, driven by the government’s emphasis on sustainability and energy savings, is replacing traditional high-intensity lamps such as metal halide lights.

LEDs are favored for their ability to operate under high temperatures, offer longer lifespans, and reduce maintenance costs, which is particularly beneficial for large-scale operations like smelting and casting in the metallurgical sector. China’s investment in smart manufacturing further supports the adoption of advanced lighting systems integrated with automation and IoT solutions, improving both safety and operational efficiency. As the country continues to ramp up its green energy initiatives and industrial upgrades, China remains the largest market for metallurgical lighting, providing numerous growth opportunities for lighting manufacturers.

India is expected to grow at a CAGR of 6.1% in the metallurgical lighting market, driven by the country’s strong industrial base and increasing steel and aluminum production. India is undergoing a large-scale transformation in its industrial infrastructure, with significant investments in new steel plants, aluminum refineries, and precious metals processing. As India strives to meet global standards in sustainability and energy efficiency, LED lighting has become the preferred choice for modernizing its manufacturing facilities.

LEDs offer energy efficiency, longer operational lifespans, and superior performance in high-temperature environments, making them ideal for metallurgical plants. In addition to energy savings, there is a growing focus on smart manufacturing in India, with lighting systems becoming integrated into automated control systems that optimize factory operations. The ongoing industrialization in emerging regions, combined with the government’s Make in India initiative, drives further demand for advanced lighting technologies. As India’s steel and aluminum sectors continue to expand to meet domestic and global demand, energy-efficient lighting solutions will remain essential for supporting production processes and ensuring worker safety.

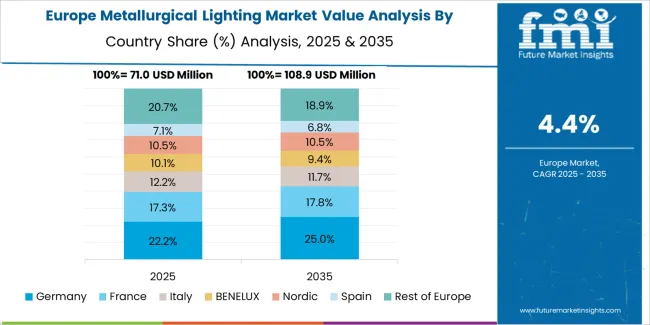

Germany is projected to grow at a CAGR of 5.6% in the metallurgical lighting market, driven by its strong manufacturing base and commitment to energy efficiency and sustainability. The country is home to a number of high-tech steel plants and aluminum refineries, where lighting systems are crucial to maintaining operational efficiency, worker safety, and process optimization. Germany’s advanced industrial landscape means that its demand for lighting solutions is often driven by the need for high-performance lighting that can operate reliably in harsh environments such as casting, smelting, and forging.

Germany has been at the forefront of adopting LED lighting, driven by the country’s regulatory frameworks aimed at carbon reduction and energy conservation. Furthermore, smart lighting solutions, which integrate lighting systems with factory automation and control systems, are gaining traction. This technology allows for real-time monitoring and adjustment of lighting levels, improving energy consumption and reducing operational costs. As Germany’s manufacturing sector continues to innovate and modernize, the adoption of LED lighting and advanced lighting solutions in metallurgical applications will remain a key growth driver in the region.

Brazil is projected to grow at a CAGR of 5.1% in the metallurgical lighting market. As one of the leading producers of steel and aluminum in Latin America, Brazil’s market for metallurgical lighting is driven by the need for high-quality, durable lighting solutions that can withstand the extreme conditions of metal production plants. LED lighting is rapidly replacing traditional metal halide lamps due to its energy efficiency and ability to perform under high heat, which is essential in steel mills and aluminum smelting facilities.

Moreover, Brazil’s infrastructure expansion and industrial modernization efforts in the metallurgical sector contribute significantly to the adoption of energy-efficient lighting. The country is also focusing on sustainability, with government policies aimed at reducing carbon footprints and improving energy usage in industrial facilities. This shift aligns with global trends toward smart manufacturing, where advanced lighting systems are integrated into the automation and control systems of industrial plants. As Brazil’s mining and manufacturing industries continue to expand, the demand for advanced metallurgical lighting solutions will continue to grow, creating opportunities for both local and international lighting manufacturers to cater to the market.

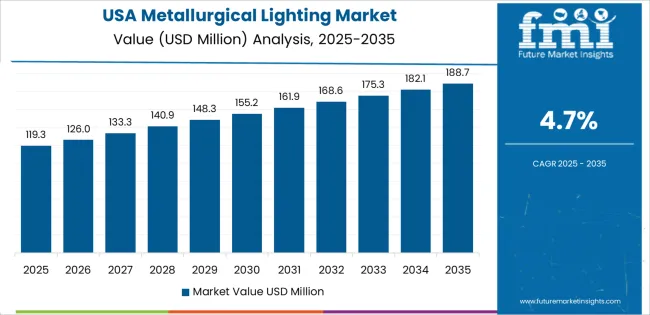

The USA is projected to grow at a CAGR of 4.7% in the metallurgical lighting market. The country’s industrial landscape is well-developed, with an emphasis on high-efficiency and advanced lighting systems to support steel, aluminum, and precious metals production. USA manufacturers are increasingly replacing traditional metal halide lamps with LED lighting solutions, driven by government regulations aimed at reducing energy consumption and improving safety in high-temperature environments.

LEDs offer lower operating costs, longer service lives, and better heat resistance, making them ideal for use in harsh conditions typical of smelting and casting. Additionally, the USA market is witnessing increased adoption of smart lighting integrated with automation systems for better energy management and enhanced operational efficiency. As the USA manufacturing sector modernizes its plants and focuses on energy sustainability, the demand for smart, high-performance lighting systems is expected to rise, driving market growth in the region.

The UK is projected to grow at a CAGR of 4.2% in the metallurgical lighting market. Although growth is more modest due to market maturity, the country remains a key player in the adoption of advanced lighting systems in steel and aluminum industries. The UK has increasingly adopted LED lighting in its industrial plants, driven by a combination of sustainability goals and the desire to reduce energy consumption and maintenance costs.

The country’s commitment to energy efficiency and green manufacturing practices supports the demand for smart lighting systems that can integrate with factory automation technologies, providing enhanced monitoring, control, and energy management capabilities. As the UK continues to prioritize advanced manufacturing and environmentally responsible production, the demand for high-performance, energy-efficient lighting solutions in metallurgical plants will remain stable, fueling gradual market expansion.

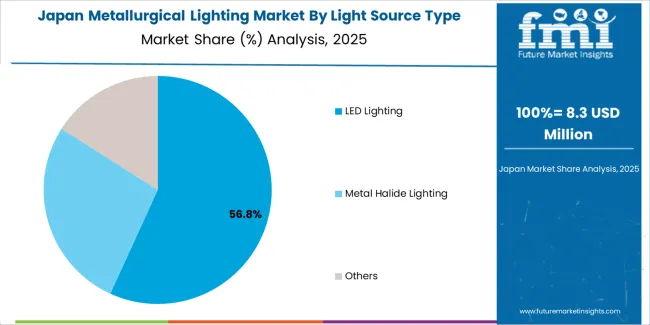

Japan is projected to grow at a CAGR of 3.7% in the metallurgical lighting market. Known for its advanced industrial sectors, Japan continues to invest in high-performance lighting systems to support its steel and aluminum industries. Japanese manufacturers, particularly those in the automotive and electronics sectors, demand lighting systems that can operate efficiently under extreme heat and challenging conditions.

LED lighting is favored due to its energy efficiency and ability to provide consistent, high-intensity lighting while reducing maintenance costs. Japan is also a leader in smart manufacturing, and as more facilities adopt automation and real-time monitoring systems, the need for integrated lighting solutions will continue to grow. Although Japan’s market is more mature than emerging markets, the country remains an essential market for high-quality, durable lighting systems in metallurgical applications.

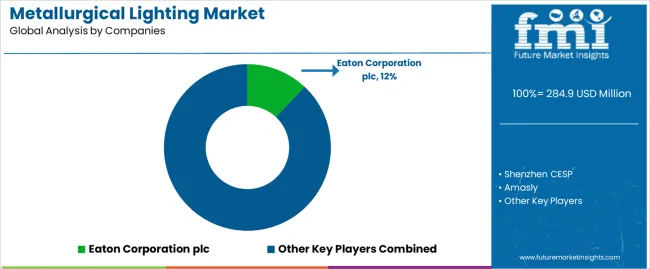

The metallurgical lighting market is characterized by a mix of established multinational players and regional specialists. Key companies such as Eaton Corporation, Shenzhen CESP, and AGC Lighting dominate the market due to their extensive product portfolios, strong distribution channels, and robust research and development capabilities. Eaton Corporation, with its broad market share of approximately 12%, stands out for its innovative LED lighting solutions that cater specifically to the demanding environments of steel plants, aluminum refineries, and mining operations. These companies leverage their technological expertise and sustainability-focused solutions to meet the growing demand for energy-efficient and high-performance lighting systems. Their ability to offer customized solutions, integrated with smart lighting controls and automation systems, has enabled them to secure key positions in both developed and emerging markets.

In addition to large players, smaller, specialized companies like Luxo Corporation, Burton Medical Lighting, and Warom Lighting are gaining traction, particularly in specific regions or niches within the metallurgical lighting market. These companies focus on offering cost-effective solutions that meet the needs of regional markets, often catering to smaller industrial plants or specialized manufacturing sectors. The competitive landscape is also marked by regional partnerships and mergers that help companies expand their product reach and strengthen market presence in emerging economies like India, Brazil, and China, where demand for advanced lighting solutions in heavy industries is rising rapidly. As the market continues to evolve, innovation and adaptability to local market conditions will remain essential for maintaining competitive advantage.

| Items | Details |

|---|---|

| Quantitative Units | USD Million |

| Regions Covered | China, India, Germany, Brazil, USA, UK, Japan |

| Light Source Type | LED Lighting, Metal Halide Lighting, Others |

| Application | Steel, Aluminum, Precious Metals, Others |

| Key Companies Profiled | Eaton Corporation plc, Shenzhen CESP, Amasly, OKTECH, Eaton, AGC Lighting, Luxo Corporation, Larson Electronics, Burton Medical Lighting, Warom Lighting, Dialight |

| Additional Attributes | The market analysis includes dollar sales by light source type and application categories. It also covers regional adoption trends across major markets like China, India, Germany, and the USA. The competitive landscape features key players in the metallurgical lighting industry, focusing on innovations in LED and metal halide lighting systems. Trends in the demand for industrial lighting in steel, aluminum, and precious metals industries are also explored, along with energy efficiency and regulatory factors influencing market growth. |

The global metallurgical lighting market is estimated to be valued at USD 284.9 million in 2025.

The market size for the metallurgical lighting market is projected to reach USD 459.7 million by 2035.

The metallurgical lighting market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in metallurgical lighting market are led lighting, metal halide lighting and others.

In terms of application, steel segment to command 40.0% share in the metallurgical lighting market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Metallurgical Microscopes Market

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Lighting Contactor Market Growth – Trends & Forecast 2024-2034

Lighting Fixture Market

EV Lighting Market Growth - Trends & Forecast 2025 to 2035

LED Lighting Controllers Market

Strobe Lighting Market Size and Share Forecast Outlook 2025 to 2035

Runway Lighting Market Trends, Outlook & Forecast 2025 to 2035

Marine Lighting Market

Runway Lighting System Market

Plasma Lighting Market

Stadium Lighting Market Size and Share Forecast Outlook 2025 to 2035

Outdoor Lighting Market Growth – Trends & Forecast 2025 to 2035

Airport Lighting Market

Aircraft Lighting Market Size and Share Forecast Outlook 2025 to 2035

High End Lighting Market Size and Share Forecast Outlook 2025 to 2035

Hospital Lighting Market Size and Share Forecast Outlook 2025 to 2035

Military Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA