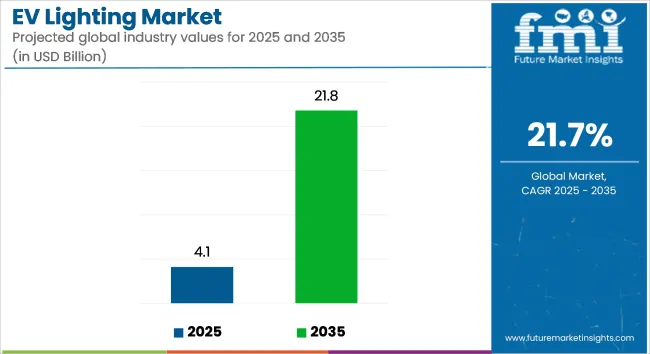

The global EV lighting market is estimated at USD 4.1 billion in 2025 and further projected to reach USD 21.8 billion by 2035, reflecting a compound annual growth rate (CAGR) of 21.7% over the forecast period. Market expansion is being supported by the growing integration of intelligent lighting systems as a core feature of next-generation electric vehicles.

Lighting technologies have been embedded into EV platforms to elevate both vehicle identity and safety. The “Parametric Pixel” LED lighting used in the Hyundai IONIQ 5 has been positioned as a visual signature, helping define the IONIQ brand’s futuristic appeal. Such lighting modules have been adopted to reinforce styling continuity across electric model lineups.

Deployments of adaptive matrix LED systems, programmable front and rear signature lighting, and ambient interior illumination have been observed in premium and mid-tier EV offerings. These systems have been engineered to improve road visibility, enhance driver awareness, and elevate user experience within the cabin.

Technical whitepapers from sources such as American Bright and EEWorld have noted that LED-based lighting infrastructure at EV charging stations has been implemented to improve nighttime usability and energy savings. Integration with smart control systems has enabled automated brightness regulation and motion-triggered illumination in outdoor environments.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4.1 billion |

| Industry Value (2035F) | USD 21.8 billion |

| CAGR (2025 to 2035) | 21.7% |

Smart lighting innovations introduced between 2023 and 2024 have featured dynamic beam adjustment, automatic glare suppression, and ambient LEDs calibrated to daylight tones. These technologies have been developed in alignment with emerging safety mandates and consumer expectations for personalized in-cabin experiences.

Suppliers have expanded EV lighting portfolios to support integration with advanced driver-assistance systems (ADAS), digital body control units, and infotainment platforms. This has enabled features such as intelligent beam switching, sequential turn signals, and power-optimized LED performance.

As EV volumes increase, lighting is being treated as a critical system rather than an accessory-designed to merge aesthetics, energy efficiency, and safety in a single architecture.

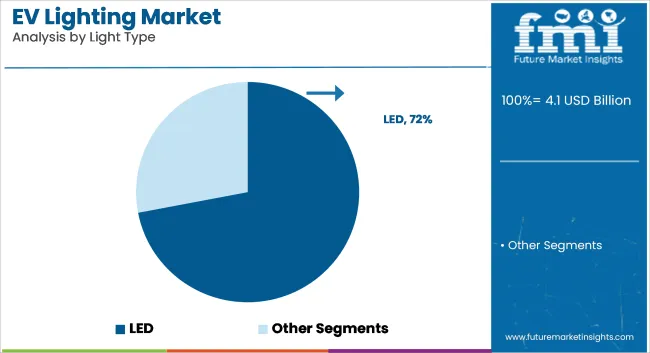

LED lights are estimated to account for approximately 72% of the global EV lighting market share in 2025 and are projected to grow at a CAGR of 22.0% through 2035. Their low energy consumption, compact design, and superior illumination make them ideal for electric vehicles where battery efficiency is critical.

Automakers continue to favor LED systems for headlamps, DRLs, brake lights, and ambient interior lighting due to their extended lifespan and lower heat output. Advancements in adaptive LED matrices, intelligent beam shaping, and connected lighting technologies further support the widespread use of LEDs across premium and mid-range electric models. Manufacturers are also enhancing integration with vehicle electronics and exterior styling, making LED lighting a central feature in EV design evolution.

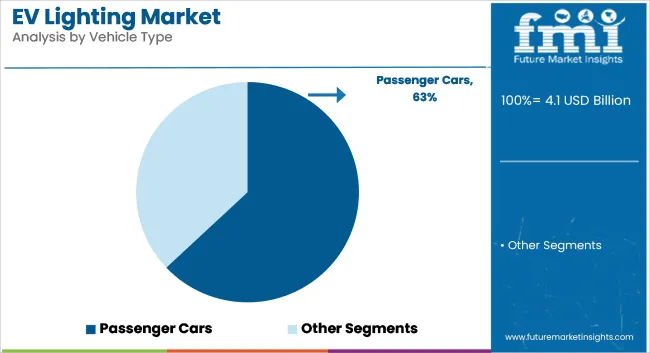

Electric passenger cars are projected to account for approximately 63% of the global EV lighting market share in 2025 and are expected to grow at a CAGR of 21.9% through 2035. This dominance is driven by high production volumes, diverse model availability, and regulatory support for zero-emission vehicles in key markets such as China, Europe, and North America.

EV manufacturers prioritize advanced lighting systems to improve vehicle aesthetics, safety, and energy management. LED-based lighting solutions are now standard across most electric passenger cars, including hatchbacks, sedans, and crossovers, offering features like adaptive high beams, sequential indicators, and customizable interior illumination. As global EV adoption accelerates, lighting remains a key area of innovation contributing to brand differentiation and enhanced driver experience.

OEMs and customers also rate energy efficiency as important, as there is increasing emphasis on minimizing power consumption while providing bright, reliable lighting. OEMs score high on durability/impact resistance and must ensure that lighting components can endure being part of the end product; aftermarket suppliers and retailers rate that moderately.

Design innovation is of high importance to OEMs, suggesting that they are likely integrating advanced, flashy solutions into vehicles, but it ranks medium in importance for others groups. For aftermarket suppliers, cost/value is rated high and for retailers and consumers, moderately important. Regulatory compliance is crucial for OEMs, scoring highly, but not so much for retailers and consumers. Thus, the table shows the trade-off between performance, cost, and design factors which drive the EV lighting segment.

With over 78% penetration of LED technology, the EV lighting market is crucial for global supply chains but can be at risk given reliance on foreign products. Global chip shortages have hit LED drivers and components since they are related to chips, prompting price increases and delaying production.

Moreover, there are additional regulatory supply risks, including tariffs on Chinese imports of LEDs as well as logistical disruptions that suppliers now must navigate and mitigate for their production sustainability.

Suppliers who become obsolete through non-innovation will lose OEM contracts to competitive suppliers who can provide cost-effective and efficient solutions. As such, the market does become reliant on the rates of EV adoption, which can increase the risk of volatility; the demand for complex lighting solutions can be affected by economic downturns, changes in consumer preferences or shifts in vehicle design trends.

Regulatory risks also factor heavily into the equation, as inconsistency in safety standards between regions has a direct impact on product design and timelines for approval.

The sluggishness in the adoption of matrix LED technology in the USA, versus in Europe, shows how regulatory variation can curtail market potential. However, there are various solutions, such as OLED and fiber-optic lighting that pose threats of substitution to traditional LED modules, but LED technology will dominate the coming years.

They're having to be agile from a supplier perspective continue investing in R&D while keeping a lid on cost in a competitive environment.

Premium and Budget Price Segments in EV Lighting Market Moreover, high-end EVs utilize complex lighting schemes, including dynamic LED projector assist lights and ambient lighting effects, which adopt a value-based pricing strategy. These features still create room for improving safety, aesthetics, and personalization while allowing automakers to charge more for advanced lighting packages.

In contrast, budget EVs aim to maximize cost efficiency, utilizing basic LED modules with price points based on budget constraints for cost-effective assembly. Value-added pricing works for new technologies, like AI-controlled headlights and custom lighting animations, where consumers will accept a higher price if the added safety/luxury is perceived.

Bundling strategies are the norm, and with the trim packages already including all manner of premium features. It locks in better margins and fits automakers’ pricing strategies. New suppliers, especially from Asia, use penetration pricing to gain ground, upending longstanding Western manufacturers.

Factors affecting pricing include dropping LED component prices, consumer acceptance of paying for lighting improvements and sustainability issues. A standard LED price segment continues to drop but, amid pricing pressures, makers are using upsell opportunities via customizable lighting features to stay profitable.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 7.6% |

| The UK | 7.2% |

| EU | 7.8% |

| Japan | 7.5% |

| South Korea | 7.9% |

The USA market is also showing strong growth through increasing demand for electric vehicles (EVs), OLED and LED light technology, and government regulation of energy-efficient vehicle parts. Safety, car design, and energy efficiency are driving next-generation light solution growth demand among automobile manufacturers.

United States electric vehicle (EV) sales increased more than 40% in 2023, and growth is expected to continue, the USA Department of Energy's data show. Inflation Reduction Act (IRA) and other similar federal tax credits are driving demand and penetration.

Major automobile companies such as Tesla, Ford, and General Motors utilize high-intensity LED and adaptive light technology to enhance battery life and battery visibility. Tesla Matrix LED headlights of newer vehicles use smart high-beam control technology that reduces energy consumption. FMI predicts the USA market to mirror 7.6% CAGR during the research period.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| EV Adoption Surge | Over 1.2 million EVs sold in 2023, supported by federal incentives. |

| Technological Advancements | Use of OLED, laser, and matrix LED lighting for improved energy efficiency. |

| Government Policies | IRA tax credits and USD 7.5 billion allocated for EV infrastructure. |

| Safety and Aesthetics Focus | Automakers integrating adaptive and ambient lighting to enhance visibility. |

The UK market is growing at a rate that grows with growing acceptance of EVs, greater energy regulation, and greater consumer demand for smart light technology. The government's move to phase out new petrol and diesel car sales by 2035 is taking EV production up, thus boosting demand for smart light technology.

Luxury vehicle companies such as Jaguar Land Rover and Bentley are investing in sophisticated lighting technology such as adaptive matrix LED technology for use in security and efficiency improvement in vehicles. Bentley Flying Spur's electronic lighting adapts brightness according to road conditions to enhance driving experience. The UK market is expected to see a 7.2% CAGR growth rate over the forecast period, says FMI.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| EV Growth | 370,000+ new EVs registered in 2023, up 18% YoY. |

| Strict Energy Regulations | Government mandates on carbon neutrality by 2050 driving LED/OLED adoption. |

| Premium Vehicle Market | High demand for luxury cars with customizable lighting systems. |

| Technological Advancements | Increased use of matrix LED and laser lighting for enhanced safety. |

The EU market is opening up with robust green regulation, technology innovation, and increasing EV sales attracting demand for affordable vehicle lights. France, Germany, and the Netherlands are at the forefront, with over 1 million new EVs registered in Germany alone in 2023.

EU Green Deal to reduce greenhouse gases by 55% by 2030 needs energy-efficient automotive lighting, and therefore the firms have adopted laser and OLED light technology. Volkswagen and BMW introduced OLED rear lights and adaptive laser headlights that reduce power consumption and enhance lighting.

Growth Factors in the EU

| Key Drivers | Details |

|---|---|

| Environmental Regulations | EU Green Deal targets 55% CO₂ reduction by 2030, promoting LED/OLED use. |

| EV Market Growth | Over 2.1 million EVs sold in 2023 across EU nations. |

| Technological Advancements | Volkswagen, BMW leading OLED and laser lighting innovation. |

| Cost-Efficiency Focus | High demand for energy-saving and long-lasting lighting systems. |

The Japanese market is expanding as the automobile sector increasingly uses the most recent high-efficiency light technologies to increase safety and save energy. Japan's vision of becoming carbon neutral by 2050 has been among the key drivers for the higher adoption of cutting-edge EV light solutions.

Toyota, Honda, and Nissan use adaptive lighting and OLED technology as a step to increase vision while conserving energy. Toyota bZ4X electric SUV has a high-end matrix LED system that minimizes glare and improves nighttime driving safety.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| National Carbon Neutral Plan | Commitment to net-zero emissions by 2050. |

| Smart Lighting Adoption | OLED, matrix LED, and adaptive lighting in mainstream EVs. |

| Growing EV Market | EV registrations up 25% YoY, increasing demand for efficient lighting. |

| Government Incentives | Subsidies and tax benefits for EV component manufacturers. |

South Korea paces high speed in the luxury vehicle lighting segment with EV manufacturing expansion, government initiatives, and widespread adoption of AI-based adaptive light technology. South Korea also targets 33% of new cars sold as electric vehicles by the year 2030, further propelling demand for energy-efficient light systems.

Automobile manufacturers like Hyundai and Kia are also introducing smart, AI-controlled lights that adapt based on weather and traffic. Hyundai Ioniq 6 has a smart pixel lighting system via an LED array for better appearance and efficiency.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| EV Industry Expansion | Targeting 33% of new vehicle sales as EVs by 2030. |

| Smart City Integration | Adoption of AI-powered adaptive lighting for urban mobility. |

| Government Support | Financial incentives for EV lighting tech R&D. |

| Technological Innovations | Hyundai’s Pixel LED lighting enhancing efficiency and safety. |

The advancements in LED, OLED, and adaptive lighting technologies have continuously transformed the global EV lighting market to enhance energy efficiency, safety, and beauty. As the market for electric vehicles (EVs) continues to grow, more of these intelligent lighting solutions as well as dynamic illumination will emerge, and many will adopt an AI-driven adaptive system to facilitate better visibility, conserve energy, and make the driver experience more enjoyable.

The tier-1 automotive lighting suppliers, technology developers and manufacturers of EVs are building a world filled with innovations in next-generation lighting and are shaping this market.

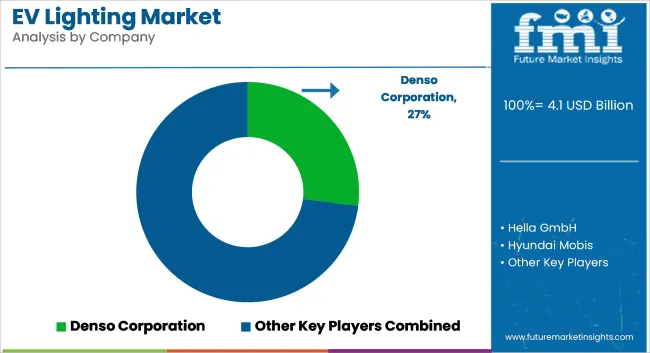

The leading players, including Hella, Valeo, Koito Manufacturing, Stanley Electric, and Marelli, are equipped with innovative and cutting-edge technologies with respect to LED and laser lighting systems, adaptive headlamps, and customizable interior ambient lighting. These companies are enhancing the competitive stand through their strong OEM collaborations, proprietary optical technology, and advanced digital lighting solutions.

On the other hand, new entrants and technology start-ups are crossing the limits in AI-enabled lighting controls, ultra-thin OLED panels, and matrix LED technology to meet the growing need for energy-efficient and intelligent lighting systems.

The all-dominating high-performance and innovative sustainable solutions in EV lighting will define the future leaders as automakers come to highlight the futuristic designs, compatibility with autonomous driving, and greener, energy-efficient components.

The EV lighting market includes halogen, xenon (HID), LED, and others, with LED leading due to its energy efficiency, durability, and superior illumination.

Lighting solutions are used in electric passenger cars, electric commercial vehicles, electric two-wheelers (E2W), and others, with passenger cars holding the largest share due to high production volumes.

EV lighting is distributed through original equipment manufacturers (OEMs), the aftermarket, and other channels, with OEMs driving demand due to factory-installed lighting systems.

The market spans North America, Latin America, Europe, East Asia, South Asia and Pacific, and the Middle East and Africa (MEA), with Asia-Pacific leading due to high EV adoption and strong automotive manufacturing.

A revenue of USD 4.1 billion is expected to be generated from manufacturing EV lighting in 2025.

The market is predicted to reach a size of USD 21.8 billion by 2035, growing at a CAGR of 21.7% from 2025 to 2035.

Key manufacturers in the market include Denso Corporation, Hella GmbH, Hyundai Mobis, Koito Manufacturing, Koninklijke Philips N.V., Osram GmbH, Robert Bosch GmbH, Stanley Electric Co., Valeo, and ZKW.

Asia-Pacific is expected to be a prominent hub for EV lighting manufacturers, driven by the rapid expansion of the electric vehicle industry and advancements in automotive lighting technology.

LED-based lighting solutions are the most widely used product segment in the EV lighting market due to their energy efficiency, durability, and superior illumination.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Light Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Light Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Light Type, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Light Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Light Type, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Light Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Light Type, 2018 to 2033

Table 28: Europe Market Volume (Units) Forecast by Light Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 30: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Light Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Units) Forecast by Light Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 38: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Light Type, 2018 to 2033

Table 44: MEA Market Volume (Units) Forecast by Light Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Light Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Light Type, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Light Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Light Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Light Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Light Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Light Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Light Type, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Light Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Light Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Light Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Light Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Light Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Light Type, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Light Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Light Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Light Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Light Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Light Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Light Type, 2018 to 2033

Figure 82: Europe Market Volume (Units) Analysis by Light Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Light Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Light Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 86: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Europe Market Attractiveness by Light Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 95: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Light Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Light Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Units) Analysis by Light Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Light Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Light Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Light Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Light Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Light Type, 2018 to 2033

Figure 130: MEA Market Volume (Units) Analysis by Light Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Light Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Light Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 134: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: MEA Market Attractiveness by Light Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 143: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

EV Charger Converter Module Market Forecast Outlook 2025 to 2035

EV Charging Panelboard Market Forecast Outlook 2025 to 2035

Evacuated Miniature Crystal Oscillator (EMXO) Market Forecast and Outlook 2025 to 2035

EV Charging Tester Market Size and Share Forecast Outlook 2025 to 2035

Evaporative Air Cooler Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Cable Market Size and Share Forecast Outlook 2025 to 2035

EVOH Encapsulation Film Market Size and Share Forecast Outlook 2025 to 2035

eVTOL Charging Facilities Market Size and Share Forecast Outlook 2025 to 2035

Event Tourism Market Size and Share Forecast Outlook 2025 to 2035

EV Telematics Control Systems Market Size and Share Forecast Outlook 2025 to 2035

Evidence Collection Tubes Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Recycling and Black Mass Processing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EVA Coated Film Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Management Software Platform Market Size and Share Forecast Outlook 2025 to 2035

EV EMC Battery Filter Market Size and Share Forecast Outlook 2025 to 2035

EV Traction Inverter Market Size and Share Forecast Outlook 2025 to 2035

EV Plant Construction Market Size and Share Forecast Outlook 2025 to 2035

EV Battery Heating System Market Size and Share Forecast Outlook 2025 to 2035

EV Charging Station Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Event Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA