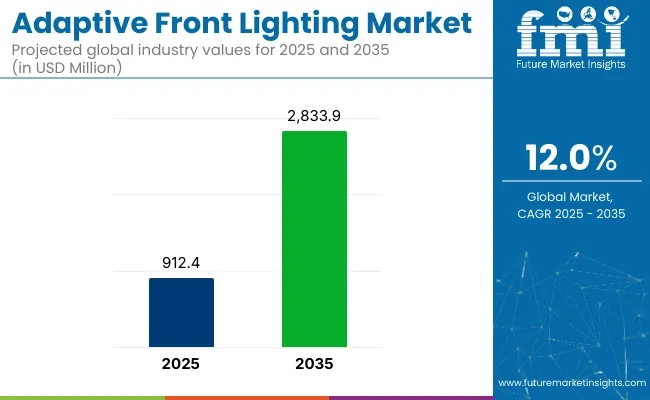

The global adaptive front lighting market is projected to be valued at USD 912.4 million in 2025 and is expected to surge to USD 2,833.9 million by 2035. This reflects a strong compound annual growth rate (CAGR) of 12% over the forecast period. The growth is being supported by the rapid advancement of automotive lighting technologies, tighter safety regulations, and increased integration of driver-assistance features in mid- and high-segment vehicles.

In 2024, ams OSRAM unveiled its Eviyos® 2.0 smart LED designed specifically for adaptive driving beam (ADB) applications. This LED matrix contains over 25,000 individually controllable pixels. As per the official announcement, the module enables precise, real-time illumination without glare for oncoming drivers. “With Eviyos 2.0, we’re enabling safer night driving through highly adaptable forward lighting,” said an ams OSRAM spokesperson in the press release.

DENSO Corporation, in its 2024 update, confirmed the development of a new electronic control unit (ECU) for adaptive front lighting systems. This ECU was engineered to support high-speed data processing and control for beam pattern customization based on vehicle speed, steering angle, and real-time camera inputs. According to DENSO, the new controller is being deployed in advanced driver-assistance systems (ADAS) in next-generation EVs and premium sedans.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 912.4 Million |

| Market Value (2035F) | USD 2833.9 Million |

| CAGR (2025 to 2035) | 12% |

User feedback from Tesla vehicle owners, as shared in early 2025 via Tesla Motors Club, highlighted ongoing software-level improvements in adaptive lighting performance. Enhanced responsiveness and wider beam coverage were reported following firmware updates in Model S and Model 3 variants equipped with matrix LED systems.

The adoption of AFS is being accelerated by Euro NCAP safety ratings and regional mandates that reward glare-free high-beam technologies. With the move toward autonomous driving and sensor-rich vehicle platforms, adaptive lighting is expected to play a critical role in enhancing nighttime visibility and pedestrian safety.

As optical precision, ECU integration, and regulatory support evolve, the AFS market is anticipated to remain a central innovation cluster within the automotive lighting segment through 2035.

Camera sensors accounted for 34% of the global market in 2025 and are projected to grow at a CAGR of 12.8% through 2035. Their continued adoption was driven by the expanding deployment of advanced driver assistance systems (ADAS), including lane-keeping assist, traffic sign recognition, and pedestrian detection.

In 2025, OEMs integrated multi-camera setups in both premium and mid-segment vehicles to support 360-degree vision, blind-spot monitoring, and parking assistance. Automakers in North America, Europe, and South Korea scaled up camera-based perception systems as part of Level 2 and Level 3 automation rollouts.

Advancements in image processing, low-light visibility, and real-time data fusion with radar and lidar contributed to the technology’s relevance in both urban and highway driving environments. Regulatory pressures mandating safety features such as automatic emergency braking also supported broader implementation.

Passenger vehicles contributed 66% of the total sensor demand by vehicle type in 2025 and are expected to expand at a CAGR of 12.5% through 2035. Growth was supported by the steady rise in sensor content per vehicle, driven by safety regulations, consumer demand for convenience features, and electrification.

In 2025, mass-market models incorporated a combination of ultrasonic, camera, and radar sensors to meet both regional mandates and brand differentiation strategies. Vehicle manufacturers in China, Germany, and the USA led sensor integration across compact SUVs, sedans, and electric vehicles.

The expansion of Level 1 and Level 2 ADAS functions across entry-level trims increased sensor installation rates. Sensor supply chains were optimized through Tier 1–Tier 2 collaboration, with packaging, calibration, and software alignment tailored for platform-level scalability.

High Costs and Regulatory Barriers

One of the key obstacles facing the Adaptive Front Lighting sector relates to the steep initial expenses connected to sophisticated illumination innovations. Integrating LED grids, laser headlamps, and intelligence-guided adaptable management modules substantially inflates automobile construction prices, restricting acceptance in medium-priced and budget-friendly automobiles.

Rules and standards that differ between international locations additionally pose a hindrance for producers aiming to configure front lights that meet worldwide benchmarks. Another issue is consumer uncertainty regarding these progressive systems along with lingering issues concerning information protection and cybersecurity as vehicles become more interlinked.

Advancements in AI, IoT, and Sustainable Lighting

Despite the many roadblocks, the Adaptive Front Lighting Market is not without prospects. AI-controlled adaptive lighting control technologies combined with real-time traffic monitoring and road condition examination are reworking the automotive lighting industry. Adaptive headlamp technology is constantly developing as cars become more advanced. Advanced sensors, LiDAR implementation, and vehicle-to-vehicle communication are making headlight functionality more than just lighting.

Simultaneously, energy-efficient and eco-friendly illumination technologies such as OLED and micro-LED are on the verge of opening new possibilities. The surging need for electric and autonomous vehicles is driving automakers to heavily invest in future-generation smart headlights with improved light distribution, lower energy consumption, and improved collision avoidance.

Innovative collaborations between car lighting manufacturers, chip makers, and AI creators are nurturing innovative solutions. Through collaboration, adaptive front lighting is becoming more optimized, cost-effective, and widespread. Looking ahead, deepening cooperation between automakers and lighting innovators will further proliferate intelligent lighting choices. This will likely lead to pervasive adoption and considerable market development.

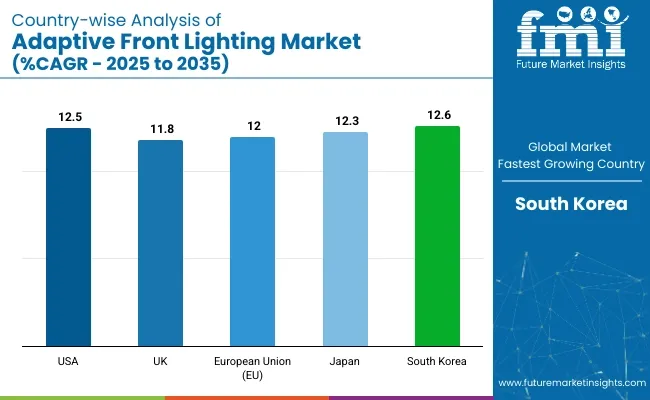

The surging Adaptive Front Lighting Market in the United States continues to exponentially burgeon, propelled by heightening safety standards, groundbreaking technological progressions in automotive illumination, and ubiquitous acknowledgement of sophisticated driver assistance solutions. The National Highway Traffic Safety Administration vigorously champions adaptive lighting innovations to maximize nighttime visibility and minimize crash danger.

With some longer sentences and others kept shorter to vary the structure, their goal is ensuring drivers can safely navigate evening roads seeing clearly in the dark. High-end vehicles resolutely pave the path of progress, as innovators including Tesla, Ford, and General Motors outfit their latest automobiles with state-of-the-art, laser-guided headlights controlled by LEDs. Their advanced adaptive lighting helps illuminate the way forward.

Furthermore, mass adoption of electric and autonomous drives further accelerates the need for smart lighting solutions. The emergence of intelligent and networked lighting systems combined with AI-directed adaptive beam steering and modulation will define the future form and function of the marketplace in the United States. Adaptive systems promise to revolutionize visibility and safety through computational adjustments.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.5% |

The rapidly evolving adaptive lighting industry within the United Kingdom continues to thrive due to various motivating elements. Strict Euro NCAP safety standards have prompted carmakers to focus on incorporating advanced high-tech attributes into their vehicle lines.

At the same time, consumer interest in the newest collision prevention and night vision technologies remains increasing. Moreover, the lightning-fast rise in electric automobile adoption is spurring significant financial commitment into next-generation adaptive LED and matrix headlights capable of improving safety and the driving experience for riders.

The UK administration's ambitious objective of transitioning into a totally zero-emissions new car marketplace within the following fifteen years is delivering a strong impetus for integrating state-of-the-art adaptive lighting technologies into approaching electric automobile designs.

As a result, auto giants like Jaguar Land Rover and Rolls Royce are funneling assets into cultivating cutting-edge AI-powered remedies for their luxury nameplates. Furthermore, adaptive lighting is playing an increasingly vital part in ongoing smart urban transportation initiatives, with both passenger automobiles and commercial fleets functioning as test subjects for the pioneering systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 11.8% |

The Adaptive Front Lighting Market in the European Union continues to steadily advance due to stringent vehicle protection rules across the area as well as increasing require for luxurious vehicles using the latest technologies innovations. The EU's Vision Absolutely zero tactic, which aims to decrease website traffic deaths, is really encouraging key auto producers to incorporate cutting-edge adaptive lighting alternatives that enhance visibility and pedestrian recognition in night driving circumstances.

In Tuscany, The capital of scotland- Paris, and Italy, adaptive illumination adoption is very highest as high-conclude makes like Mercedes-Benz, BMW, and Volkswagen roll out new high-conclude automobile types using edge-cutting laser light and OLED-driven adaptive headlight technological know-how capable of rapidly altering beam habits based upon quickly switching road circumstances.

Meanwhile, the large-scale changeover to electrified and autonomous travelling is really prompting even more progression of synthetic intelligence-powered adaptive lighting techniques that take advantage of real-time natural environment investigation to dynamically optimize illumination for increased basic safety and comfort at the fringe of perspective.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.0% |

Japan's Adaptive Front Lighting Market expands due to proliferating intelligent lighting technologies and rigorous road safety protocols, the flourishing electric vehicle sector also propels growth. The Ministry of Land, Infrastructure, Transport and Tourism's strict headlamp provisions push OEMs toward integrating adaptive LED and laser systems.

Toyota, Honda and Nissan prioritize artificial-intelligence-optimized adaptive illumination answering to visibility while preventing glare. Their solutions dynamically adjust beam position according to driving conditions.

At the forefront of autonomous vehicle development, Japan correspondingly sees demand heighten for sensor-driven adaptive headlights fundamental to nighttime autonomy by self-operated automobiles. As vehicles engineer navigating independence from human guidance through darkness, such illumination evolves ever more vital to their safe prowess.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.3% |

The Adaptive Front Lighting industry in South Korea has truly boomed in recent years, propelled forward by tremendous leaps in technology, amplified investments into automotive research and progress, and a surging requirement for luxurious cars equipped with sophisticated protection systems.

The national government is proactively cultivating intelligent transportation infrastructures and self-governing cars, spurring extensive acceptance of adaptive headlights which assist machines to see evidently and humans to stay conspicuous. Meanwhile, consumers have enthusiastically embraced these advanced safety features, popularizing vehicles with options like cornering lights, high-beam assist, and glare-free beams tailored for country roads.

Hyundai, Kia, and tech powerhouse Samsung Electronics are pioneering complicated development of AI-powered dynamic headlight technologies. Their sophisticated systems rapidly modify beam patterns in real time based on evolving traffic conditions, intricate road designs, and ever changing driving situations. This helps spotlight hazards and enhances clarity for the vehicle and other drivers.

Moreover, the spreading utilization of 5G connectivity in vehicles nationally has intricately linked adaptive lighting with vehicle-to-everything (V2X) communication answers. This brings together lighting, positioning, and network data to give supplementary safety benefits like early warning mechanisms and location aids that guide drivers on the road.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

The Adaptive Front Lighting Market is experiencing dynamic change propelled by escalating interest for progressed wellbeing highlights, enhanced night-time perceivability, and administrative orders for vehicle lighting wellbeing. Automakers and lighting framework producers zero in on LED-and laser-based flexible lighting, AI-incorporated lighting controls, and energy-proficient arrangements to upgrade driving wellbeing.

The market incorporates worldwide auto lighting pioneers, semiconductor innovation suppliers, and particular framework consolidators, every one contributing developments identified with adaptive shaft control, sensor joining, and keen illumination advances.

In addition, specialized progressions have permitted headlights to self-adjust, recognizing vehicles and pedestrians to avoid dazzling and improve perceivability consistently. As innovation propels, its capacity to react rapidly to changing street conditions will enhance wellbeing considerably more.

The overall market size for the Adaptive Front Lighting Market was USD 912.4 Million in 2025.

The Adaptive Front Lighting Market is expected to reach USD 2833.9 Million in 2035.

Rising vehicle safety regulations, increasing adoption of advanced driver assistance systems (ADAS), and growing demand for high-performance lighting solutions will fuel market growth.

The USA, Germany, China, Japan, and South Korea are key contributors.

LED-based adaptive front lighting is expected to dominate due to energy efficiency and enhanced visibility.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 20: Latin America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 25: Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 27: Europe Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 28: Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 29: Europe Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 30: Europe Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 31: Europe Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 32: Europe Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 33: Asia Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 35: Asia Pacific Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 36: Asia Pacific Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 37: Asia Pacific Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 38: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 39: Asia Pacific Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 40: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 41: MEA Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: MEA Market Volume (Units) Forecast by Country, 2020 to 2035

Table 43: MEA Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 44: MEA Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 45: MEA Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 46: MEA Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 47: MEA Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 48: MEA Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Technology, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 5: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 6: Global Market Volume (Units) Analysis by Region, 2020 to 2035

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 9: Global Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 10: Global Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 13: Global Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 17: Global Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 18: Global Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 21: Global Market Attractiveness by Technology, 2025 to 2035

Figure 22: Global Market Attractiveness by Sales Channel, 2025 to 2035

Figure 23: Global Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 24: Global Market Attractiveness by Region, 2025 to 2035

Figure 25: North America Market Value (USD Million) by Technology, 2025 to 2035

Figure 26: North America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 27: North America Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 28: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 29: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 30: North America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 33: North America Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 34: North America Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 41: North America Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 42: North America Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 43: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 44: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 45: North America Market Attractiveness by Technology, 2025 to 2035

Figure 46: North America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 47: North America Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 48: North America Market Attractiveness by Country, 2025 to 2035

Figure 49: Latin America Market Value (USD Million) by Technology, 2025 to 2035

Figure 50: Latin America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 52: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 53: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 57: Latin America Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 58: Latin America Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 66: Latin America Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 69: Latin America Market Attractiveness by Technology, 2025 to 2035

Figure 70: Latin America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 71: Latin America Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 72: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 73: Europe Market Value (USD Million) by Technology, 2025 to 2035

Figure 74: Europe Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 75: Europe Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 76: Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 77: Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 78: Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 81: Europe Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 82: Europe Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 83: Europe Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 85: Europe Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 86: Europe Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 87: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 89: Europe Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 90: Europe Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 91: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 93: Europe Market Attractiveness by Technology, 2025 to 2035

Figure 94: Europe Market Attractiveness by Sales Channel, 2025 to 2035

Figure 95: Europe Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 96: Europe Market Attractiveness by Country, 2025 to 2035

Figure 97: Asia Pacific Market Value (USD Million) by Technology, 2025 to 2035

Figure 98: Asia Pacific Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 99: Asia Pacific Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 100: Asia Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 101: Asia Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 105: Asia Pacific Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 106: Asia Pacific Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 109: Asia Pacific Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 110: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 113: Asia Pacific Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 114: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 117: Asia Pacific Market Attractiveness by Technology, 2025 to 2035

Figure 118: Asia Pacific Market Attractiveness by Sales Channel, 2025 to 2035

Figure 119: Asia Pacific Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 120: Asia Pacific Market Attractiveness by Country, 2025 to 2035

Figure 121: MEA Market Value (USD Million) by Technology, 2025 to 2035

Figure 122: MEA Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 123: MEA Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 124: MEA Market Value (USD Million) by Country, 2025 to 2035

Figure 125: MEA Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 126: MEA Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 129: MEA Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 130: MEA Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 131: MEA Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 133: MEA Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 134: MEA Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 135: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 137: MEA Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 138: MEA Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 139: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 141: MEA Market Attractiveness by Technology, 2025 to 2035

Figure 142: MEA Market Attractiveness by Sales Channel, 2025 to 2035

Figure 143: MEA Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 144: MEA Market Attractiveness by Country, 2025 to 2035

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Adaptive Lighting Market

Front Office BPO Services Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Front Desk Uniforms Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lighting As A Service Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Lighting as a Service (LaaS) Market Size and Share Forecast Outlook 2025 to 2035

Lighting Product Market Size and Share Forecast Outlook 2025 to 2035

Frontotemporal Disorders Treatment Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Frontotemporal Dementia (FTD) Management Market – Trends & Future Outlook 2025 to 2035

Adaptive Cruise Control Market - Size, Share, and Forecast 2025 to 2035

Front Collision Warning Market Growth – Trends & Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA