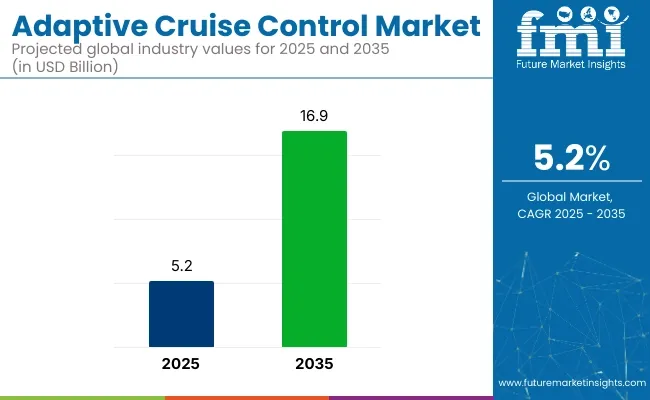

The global adaptive cruise control (ACC) market is projected to grow from USD 5.2 billion in 2025 to USD 16.91 billion by 2035, registering a strong CAGR of 12.5% over the forecast period. This acceleration in growth is being driven by rising integration of advanced driver-assistance systems (ADAS) in both passenger and commercial vehicles, as automakers prioritize safety, automation, and driver comfort.

Audi of America, in a 2024 press release, confirmed enhancements to its Traffic Jam Assist and Adaptive Cruise Control with Stop & Go systems, deployed across its Q5, A6, and e-tron models. These systems were developed to support hands-on lane centering and speed adjustment in congested conditions. Audi stated that “forward-facing cameras and radar units work in harmony to maintain consistent speed and spacing, while allowing for smooth traffic navigation under 40 mph” .

Porsche, through its InnoDrive system, has integrated adaptive cruise capabilities with predictive navigation and camera-based traffic flow recognition. As outlined by Porsche Irvine in 2024, the InnoDrive feature uses real-time GPS data, topographic mapping, and traffic sign recognition to adjust vehicle speed proactively before curves or elevation changes. This system has been offered in the Panamera, Taycan, and select Cayenne variants to enhance long-distance driving and dynamic acceleration control.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 5.2 Billion |

| Market Value (2035F) | USD 16.91 Billion |

| CAGR (2025 to 2035) | 12.5% |

In the premium and near-luxury segment, Acura continues to deploy ACC in its TLX and MDX models. Vehicles have been equipped with Adaptive Cruise Control with Low-Speed Follow, allowing automatic speed adjustments during stop-and-go traffic. As noted in Acura’s 2024 offerings, the system was engineered to work in coordination with lane-keeping assistance and collision mitigation braking systems.

Increased legislative support for mandatory ADAS deployment across Europe, North America, and parts of Asia has further strengthened ACC adoption. OEMs are implementing radar, camera, and lidar-based fusion systems to improve real-time responsiveness and highway automation readiness.

As autonomous driving capabilities advance, adaptive cruise control is expected to serve as a foundational system-bridging driver-assisted and semi-autonomous vehicle technologies through 2035.

Ultrasonic sensors accounted for 28% of the global market share in 2025 and are projected to grow at a CAGR of 12.9% through 2035. Their widespread deployment was supported by their suitability for low-speed maneuvering and obstacle detection tasks in both passenger and commercial vehicles. In 2025, ultrasonic sensors were standard in front and rear bumpers for functions such as parking assistance, automated parking, and low-speed collision mitigation.

Automakers integrated multiple ultrasonic units in compact vehicles, SUVs, and light commercial vans to enhance short-range visibility. The affordability, low power consumption, and compatibility with embedded control systems contributed to sustained adoption. Sensor suppliers optimized unit size and waterproofing features to meet platform-specific requirements in both ICE and EV configurations.

Passenger vehicles represented 67% of total sensor installations by vehicle type in 2025 and are expected to grow at a CAGR of 12.7% through 2035. This growth was driven by increasing incorporation of advanced driver assistance systems (ADAS) such as automated emergency braking, adaptive cruise control, and parking automation.

In 2025, multi-sensor configurations combining ultrasonic, radar, and camera sensors were deployed across mid-range and premium passenger vehicle models. Global safety regulations and consumer demand for enhanced comfort and automation supported higher sensor content per vehicle.

Automakers in China, South Korea, and the European Union expanded sensor-based safety packages across ICE, hybrid, and electric variants. OEM-led innovation programs focused on software-sensor integration and real-time data fusion to support Level 2 and Level 2+ autonomy features.

Expensiveness of ACC Technology: Assembly of radar, LIDAR, AI, and real-time data processing units make adaptive cruise control pricey thus restricting its adoption in low-cost and mid-range vehicles.

Increasing use of AI and Machine Learning in ACC systems: AI-based predictive analytics, real-time decision-making and self-learning algorithms is revolutionizing adaptive cruise control systems and making them more efficient and responsive.

North America dominates the Adaptive Cruise Control (ACC) market, owing to the growing penetration of advanced driver-assistance system (ADAS), coupled with increasing consumer preference toward safer driving technologies. With ACC, automakers have gone a step further to mitigate road deaths and boost driving experience by integrating them with artificial intelligence (AI) electro-optical sensors and radar systems.

Furthermore, strict government regulations requiring vehicle safety features will drive the adoption of ACC in passenger and commercial vehicles. The rising penetration of electric and self-driving vehicles is further aiding the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

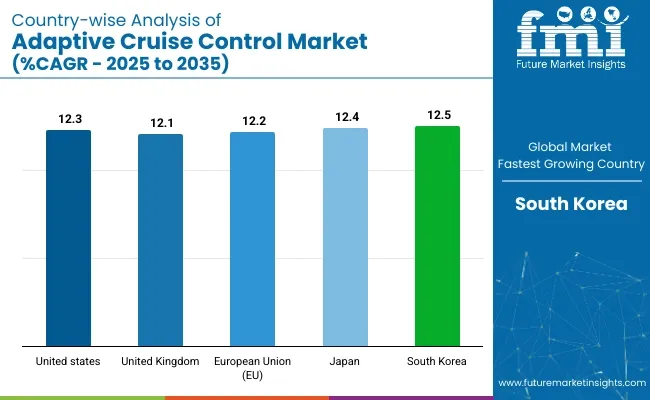

| United States | 12.3% |

As consumers focus on road safety and want convenience and driving comfort, the United Kingdom Adaptive Cruise Control market is roaring. The growth of demand for ACC is primarily due to the increasing adoption of connected car technologies and the presence of primary automotive manufacturers.

Furthermore, government policies promoting ADAS adoption in new vehicles are strengthening the market growth. It allows users to increase the adoption of premium (and mid-range) vehicles through the integration of ACC with AI-based predictive analytics and vehicle-to-everything communication.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.1% |

The ACC market in the European Union is growing rapidly backed by strong regulatory support for vehicle safety standards and high consumer awareness. The Europe market is propelled by countries like Germany, France, and Italy which are making greater investments in ADAS technologies along with smart transportation infrastructure.

The emergence of semi-autonomous and autonomous driving solutions is likely to boost demand for ACC Technologies. The Detroit automotive plants are based on AI-powered adaptive control systems that aim to reduce car accidents while also enhancing fuel efficiency which is expected to lead to the widespread adoption of ACC across various types of vehicles.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.2% |

The adoption of Adaptive Cruise Control in Japan is significant, driven by the country's position as a hub for automotive innovation and ample investments in autonomous vehicle technologies. This more advanced version of ACC uses complex systems that dynamically respond to real-time information such as the position and speed of surrounding traffic, lane keeping assistance, and collision avoidance with this real-time tracking all managed by Artificial Intelligence (AI) technologies.

The government movement toward smart transportation systems and tight safety requirements are also encouraging adoption. Growth in demand for electric and hybrid vehicles equipped with advanced safety features also drives the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.4% |

As South Korea developing smart mobility and automotive electronics, South Korean Adaptive Cruise Control Market is growing by leaps and bounds. Leading carmakers are already combining ACC with their next-generation systems for vehicle safety (AI-enabled vision sensor systems and LIDAR-based navigation).

Also, growing favorable government support for the development of autonomous and connected vehicles is driving market adoption. As electric vehicles and smart driving solutions gain traction, ACC is becoming an increasingly common feature in both high-end and mid-tier models.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.5% |

The Advanced Driver Assistance Systems (ADAS) Market grows with the incorporation of AI-based automation, sensor fusion, and predictive braking by car manufacturers, which aids in boosting vehicle safety.

Data Selection & Preparation: Data is crucial for improved autonomous driving capabilities, and it includes LiDAR based object detection, speed modulation aided by radar, and demand-based traffic data. Innovations in V2X communication, AI-based style of driving analysis, and multi-sensor fusion propel the market competition.

The overall market size for the Adaptive Cruise Control Market was USD 5.2 Billion in 2025.

The Adaptive Cruise Control Market is expected to reach USD 16.9 Billion in 2035.

The demand is driven by rising vehicle automation, increasing safety regulations, growing adoption of advanced driver-assistance systems (ADAS), and consumer preference for enhanced driving comfort.

The top 5 countries driving market growth are USA, UK, Europe, South Korea, and Japan.

Automotive Industry are expected to command a significant share over the assessment period.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Volume (Units) Forecast by Region, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 4: Global Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 6: Global Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 7: Global Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 8: Global Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 10: North America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 12: North America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 13: North America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 14: North America Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 15: North America Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 18: Latin America Market Volume (Units) Forecast by Country, 2020 to 2035

Table 19: Latin America Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 20: Latin America Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 21: Latin America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 22: Latin America Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 23: Latin America Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 24: Latin America Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 25: Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Europe Market Volume (Units) Forecast by Country, 2020 to 2035

Table 27: Europe Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 28: Europe Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 29: Europe Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 30: Europe Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 31: Europe Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 32: Europe Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 33: Asia Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 34: Asia Pacific Market Volume (Units) Forecast by Country, 2020 to 2035

Table 35: Asia Pacific Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 36: Asia Pacific Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 37: Asia Pacific Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 38: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 39: Asia Pacific Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 40: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Table 41: MEA Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 42: MEA Market Volume (Units) Forecast by Country, 2020 to 2035

Table 43: MEA Market Value (USD Million) Forecast by Technology, 2020 to 2035

Table 44: MEA Market Volume (Units) Forecast by Technology, 2020 to 2035

Table 45: MEA Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 46: MEA Market Volume (Units) Forecast by Sales Channel, 2020 to 2035

Table 47: MEA Market Value (USD Million) Forecast by Vehicle Type, 2020 to 2035

Table 48: MEA Market Volume (Units) Forecast by Vehicle Type, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Technology, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 5: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 6: Global Market Volume (Units) Analysis by Region, 2020 to 2035

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 9: Global Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 10: Global Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 13: Global Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 14: Global Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 15: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 16: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 17: Global Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 18: Global Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 19: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 20: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 21: Global Market Attractiveness by Technology, 2025 to 2035

Figure 22: Global Market Attractiveness by Sales Channel, 2025 to 2035

Figure 23: Global Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 24: Global Market Attractiveness by Region, 2025 to 2035

Figure 25: North America Market Value (USD Million) by Technology, 2025 to 2035

Figure 26: North America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 27: North America Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 28: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 29: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 30: North America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 33: North America Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 34: North America Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 35: North America Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 36: North America Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 38: North America Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 39: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 40: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 41: North America Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 42: North America Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 43: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 44: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 45: North America Market Attractiveness by Technology, 2025 to 2035

Figure 46: North America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 47: North America Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 48: North America Market Attractiveness by Country, 2025 to 2035

Figure 49: Latin America Market Value (USD Million) by Technology, 2025 to 2035

Figure 50: Latin America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 51: Latin America Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 52: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 53: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 57: Latin America Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 58: Latin America Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 62: Latin America Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 66: Latin America Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 69: Latin America Market Attractiveness by Technology, 2025 to 2035

Figure 70: Latin America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 71: Latin America Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 72: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 73: Europe Market Value (USD Million) by Technology, 2025 to 2035

Figure 74: Europe Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 75: Europe Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 76: Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 77: Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 78: Europe Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 81: Europe Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 82: Europe Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 83: Europe Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 85: Europe Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 86: Europe Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 87: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 89: Europe Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 90: Europe Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 91: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 93: Europe Market Attractiveness by Technology, 2025 to 2035

Figure 94: Europe Market Attractiveness by Sales Channel, 2025 to 2035

Figure 95: Europe Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 96: Europe Market Attractiveness by Country, 2025 to 2035

Figure 97: Asia Pacific Market Value (USD Million) by Technology, 2025 to 2035

Figure 98: Asia Pacific Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 99: Asia Pacific Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 100: Asia Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 101: Asia Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 102: Asia Pacific Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 105: Asia Pacific Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 106: Asia Pacific Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 109: Asia Pacific Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 110: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 113: Asia Pacific Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 114: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 117: Asia Pacific Market Attractiveness by Technology, 2025 to 2035

Figure 118: Asia Pacific Market Attractiveness by Sales Channel, 2025 to 2035

Figure 119: Asia Pacific Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 120: Asia Pacific Market Attractiveness by Country, 2025 to 2035

Figure 121: MEA Market Value (USD Million) by Technology, 2025 to 2035

Figure 122: MEA Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 123: MEA Market Value (USD Million) by Vehicle Type, 2025 to 2035

Figure 124: MEA Market Value (USD Million) by Country, 2025 to 2035

Figure 125: MEA Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 126: MEA Market Volume (Units) Analysis by Country, 2020 to 2035

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 129: MEA Market Value (USD Million) Analysis by Technology, 2020 to 2035

Figure 130: MEA Market Volume (Units) Analysis by Technology, 2020 to 2035

Figure 131: MEA Market Value Share (%) and BPS Analysis by Technology, 2025 to 2035

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Technology, 2025 to 2035

Figure 133: MEA Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 134: MEA Market Volume (Units) Analysis by Sales Channel, 2020 to 2035

Figure 135: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 137: MEA Market Value (USD Million) Analysis by Vehicle Type, 2020 to 2035

Figure 138: MEA Market Volume (Units) Analysis by Vehicle Type, 2020 to 2035

Figure 139: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2025 to 2035

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2025 to 2035

Figure 141: MEA Market Attractiveness by Technology, 2025 to 2035

Figure 142: MEA Market Attractiveness by Sales Channel, 2025 to 2035

Figure 143: MEA Market Attractiveness by Vehicle Type, 2025 to 2035

Figure 144: MEA Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Adaptive Cruise Control and Blind Spot Detection Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Adaptive Cruise Control System Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Shapewear Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Stroller Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Optics Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Microemulsions Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Adaptive Camouflage Materials Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Steering Market Size and Share Forecast Outlook 2025 to 2035

Adaptive Front Lighting Market Growth - Trends & Forecast 2025 to 2035

Adaptive Authentication Market Insights - Growth & Forecast 2025 to 2035

Adaptive Access Control Market Growth – Trends & Forecast through 2034

Automotive Adaptive Lighting Market

Cruise Safari Market Size and Share Forecast Outlook 2025 to 2035

Assessing Cruise Tourism Market Share & Industry Outlook

Cruise Tourism Industry Analysis By Cruise Type, By Experience Type, By End User (Solo Travelers, Families, Retirees, Business Travelers), By Region – Forecast for 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

River Cruise Market Trends – Growth & Forecast 2024-2034

Europe Cruise Market Forecast and Outlook 2025 to 2035

Glacier Cruises Market Size and Share Forecast Outlook 2025 to 2035

Alaskan Cruises Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA