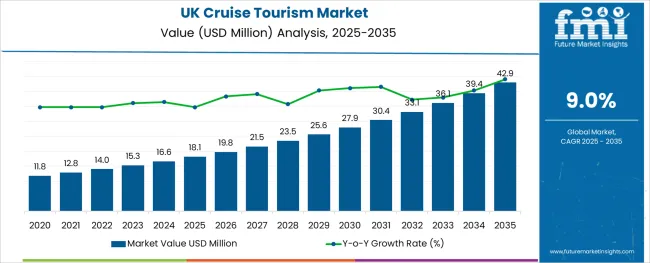

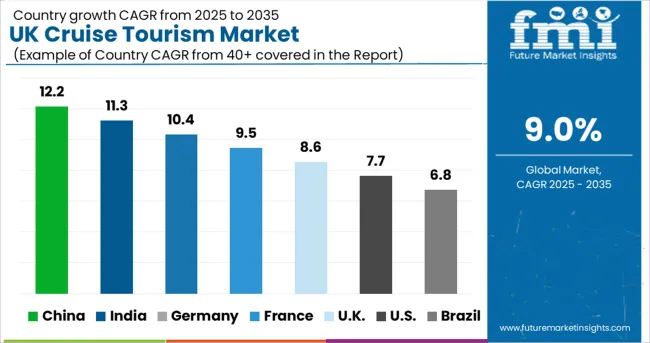

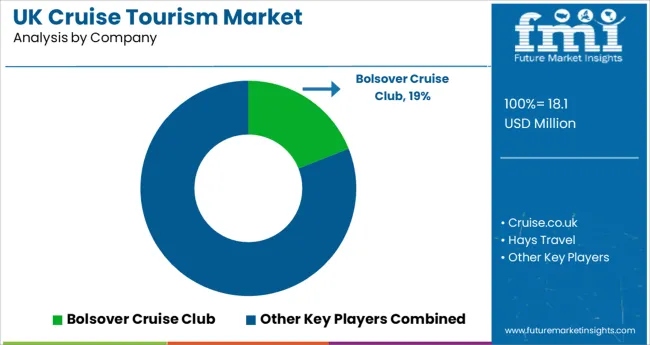

The UK Cruise Tourism Market is estimated to be valued at USD 18.1 million in 2025 and is projected to reach USD 42.9 million by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

The UK cruise tourism market is experiencing steady recovery and transformation, backed by evolving consumer travel behavior, enhanced cruise infrastructure, and expanded itinerary offerings. Growth is being shaped by increasing domestic cruise uptake, digital booking adoption, and rising interest in cultural and climate-resilient destinations.

Cruise operators have introduced shorter regional routes, targeted pricing, and loyalty programs to attract a wider traveler base, including multigenerational families and first-time cruisers. Technological investments in hybrid ships, contactless services, and onboard experience personalization are further supporting market competitiveness.

Policy support for port expansion and cleaner maritime practices, especially in Scotland and the South Coast, is enhancing regional accessibility. Future demand is expected to be reinforced by demand for luxury, themed, and expedition-style cruises, along with rising environmental consciousness driving selection of sustainable cruise lines.

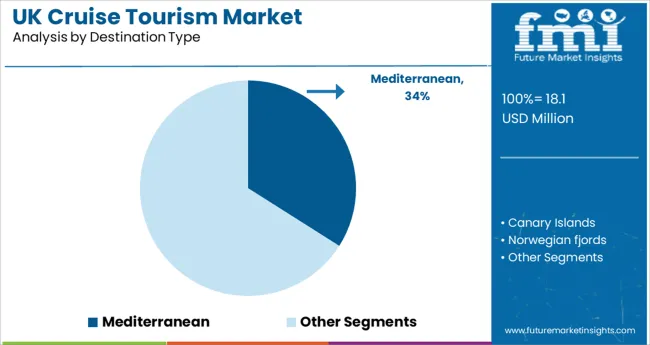

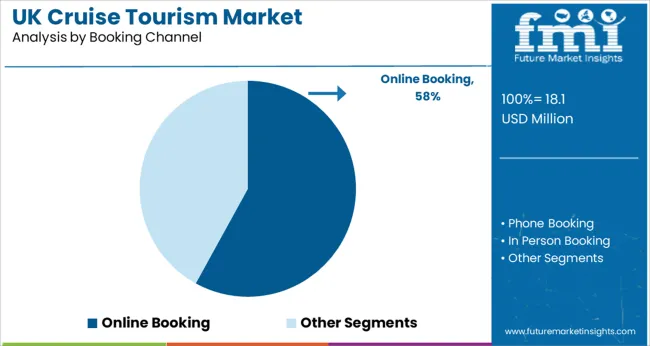

The market is segmented by Destination Type, Booking Channel, Tourist Type, and Age Group and region. By Destination Type, the market is divided into Mediterranean, Canary Islands, Norwegian fjords, Scandinavia, and Baltic. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and In Person Booking.

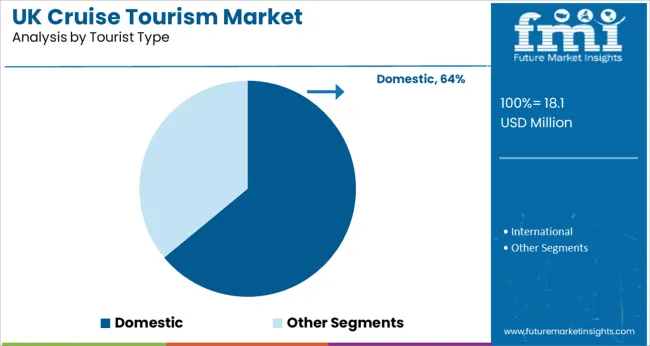

Based on Tourist Type, the market is segmented into Domestic and International. By Age Group, the market is divided into 46-55 Years, 15-25 Years, 26-35 Years, 36-45 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Mediterranean region is projected to account for 34.0% of the UK cruise tourism market revenue in 2025, making it the leading destination segment. This preference has been shaped by the region’s favorable climate, port-rich coastlines, and diverse cultural heritage-all within accessible reach of UK ports.

The popularity of seven- to fourteen-night itineraries, often departing from Southampton and other major terminals, has strengthened demand for Mediterranean circuits. The availability of all-inclusive packages, seamless visa-free travel across EU countries, and partnerships with local excursion providers have made this region a preferred choice among UK travelers.

As cruise operators expand their fleets and optimize seasonal routes, the Mediterranean continues to benefit from a well-established cruise network and year-round appeal.

Online booking is expected to contribute 58.0% of the UK cruise market revenue in 2025, reinforcing its dominance as the primary reservation channel. This growth is being supported by widespread internet accessibility, the rise of mobile-first travel planning, and increasing consumer trust in digital platforms.

Travel aggregators, cruise line portals, and mobile apps are offering flexible payment options, instant booking confirmations, and immersive virtual tour content, all of which are influencing purchase decisions. Personalized marketing, AI-driven recommendations, and influencer-led campaigns are also contributing to digital engagement.

The convenience of 24/7 access, bundled deals, and dynamic pricing has led UK travelers-particularly younger and tech-savvy demographics-to favor online platforms over traditional travel agencies..

Domestic tourists are anticipated to hold 64.0% of the total UK cruise tourism revenue in 2025, highlighting their dominant contribution to the market. This leadership is being driven by rising demand for staycations, economic uncertainty impacting international travel, and greater awareness of home-port cruising benefits.

UK-based cruises offer simplified boarding procedures, minimized travel time, and reduced logistical burdens, making them especially attractive to families and senior travelers. Government travel advisories and health safety considerations during global disruptions have further strengthened the appeal of domestic cruising.

The development of regional cruise terminals and tailored UK coastal itineraries has also broadened the domestic market base, supporting sustained passenger volume growth.

Tourism is crucially significant to the UK cruise economy. Cruises from the UK are always been popular who are not like to fly on their next holidays.

Nowadays consumers have become extra open to experiencing new adventures and cruise excursion gives some things distinct and special, which provides appeal and gives maximum ability cruisers have now no longer been skilled in this form of excursion before, manufacturers presenting expertise and recommendation have excellent possibility to interact with their audience.

Mostly cruise tourism market is preferred by young people and more likely to be interested in the seas. The cruise tourism market is growing faster than the mainstream holidays market, with the count of holiday forecast to grow faster than the total number of overseas holidays.

Before social media cruise market relied on television, radio, and print advertising to promote their brands. But now the growth of the social media market is increasingly being used by the traveling market as a marketing tool.

The cruise market industry now hires travel bloggers to promote their cruises on social media and record their experience and post on their social media accounts. Bloggers focused on promotions in different ways posting pictures, and videos and telling about the features present in the cruise and also writing tips on how to get discounts and book the cruise for holidays.

Cruise operators use various social media sites like Instagram, Facebook, and Twitter, for example, have made it possible to connect and bridge gaps between family and friends, empowered content creators to distribute information via digital media and expanded the reach of promotional marketing through online adverts.

There are several investments done by companies in new and innovative ships and great amenities and broad several varieties of excursions and included great packages for travelers to attract them towards their cruise.

Marketing segmentation has become a useful tool for planning relevant marketing strategies dividing market segmentation such as market segments, marketing sectors like holiday travels, or marketing objectives. The social media market is the new platform for promotions and increases to help in collecting revenue and it helps fasten the growth of the market.

Government Initiatives Expected to Boost the Tourism Market in the UK Cruise market

As per FMI, sales in the UK Cruise market are expected to grow at a CAGR of 9% over the forecast period. CLIA and its contributors are fully devoted to preserving the accountable boom trajectory for the cruise enterprise. Sustainability lies at the coronary heart of all we do, and no enterprise has a more potent hobby in protecting oceans and destinations.

Each day, throughout the cruise enterprise, personal cruise traces are running to improve upon this document via strategic partnerships, new technologies, and ambitious sustainability commitments.

The Cruise Lines International Association told the Transport Committee in December 2024 that the cruise industry is going to contribute around £10 billion to the UK economy each year and give more than 88,000 jobs. These figures include direct and indirect economic output and employment. For example, it includes port services and supply chains such as food manufactured for consumption on cruise ships.

The demand for cruise holidays, praises the value of inclusive packages talking transport, food, and entertainment, help them in budget-friendly experience with different destinations experience and also now cruise atmosphere is more updated.

Cruises now provide quicker Wi-Fi, unfastened onboard texting networks, and RFID wristbands so cruisers can with no trouble manipulate purchases, tune luggage, notify stewards, and get admission to cabins. Celebrity cruises give passengers in-room iPad to order on board and shore activities, at the same time as Royal Caribbean’s Quantum of the Seas cruise delivery has a living room with robot bartenders.

Social media helped to boost the confidence of travelers who can read about everything on the internet about recommendation itineraries, now it’s easy to get access to who is your fellow guests online. Moreover, Journalists are also reflecting on growing consumer interest in cruises.

Millennials are more open to cruise holidays and young travelers are more interested in activities like kayaking and scuba diving and the chance to see more of the world without any hassle of booking transport and the itineraries and the bag packer experience.

Leading players operating in the UK Cruise tourism market are focusing on improving their offerings by providing tour package discounts, new tour locations, and new adventurous activities like water activities in order to gain a competitive edge in the market. For instance:

Due to the growing tourism industry in the country Bolsover Cruise Club, Cruise.co.uk, Hays Travel, Cruise1st.co.uk, Dawson & Sanderson ltd, Luxury Cruise Company, Mundy Cruising, Fred. Olsen Travel. High-end luxury, honeymooners and families, special interest, group tourism, and meeting and incentive events.

UK market has officially launched a new cruise line, Ambassador Cruise Line. The exciting announcement will be welcomed by the UK travel industry. The first British cruise line since 2010 will commence sales in June 2024 with the first cruises beginning operation in the Spring of 2025.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Million for Value |

| Key Region Covered | South Asia |

| Key Countries Covered | UK |

| Key Segments Covered | Destination type, Cruise Type, Booking Channel, Tourist Type, Tour Type, Age Group, and Region. |

| Key Companies Profiled | www.cruisedirect.co.uk; CruiseDeals.co.uk; Hays Travel; Bolsover Cruise Club; The Cruise Specialists; www.cruise1st.co.uk; Barrhead Travel Service Ltd |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global uk cruise tourism market is estimated to be valued at USD 18.1 USD million in 2025.

It is projected to reach USD 42.9 USD million by 2035.

The market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types are mediterranean, canary islands, norwegian fjords, scandinavia and baltic.

online booking segment is expected to dominate with a 58.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA