The UK Non-Alcoholic Malt Beverages market is expected to reach USD 1,788 million in 2025 and is projected to reach a total value of USD 3,262.9 million by 2035. This represents a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,788 million |

| Industry Value (2035F) | USD 3,262.9 million |

| CAGR (2025 to 2035) | 6.2% |

The UK market for non-alcoholic malt beverages is experiencing an unprecedented gain in profit as a result of changing consumption patterns towards healthier drinks, a growing popularity of functional drinks, and the effect of international drink trends.

With the increasing understanding of the advantages of malt drinks, people have been choosing them more often as alternatives to traditional sodas and alcohol-free beers. The naturally sweet malt profile, which is free of artificial sweeteners, is the reason for their acceptance in various age groups.

The most important reason for this growth rate is product variety. Together with old brands, new players are also presenting unique flavor options, formulations that are beneficial to health, and reduced sugar variants that target wider audiences.

Along with that, the beverages are also classified under the functional drinks segment, with fortified versions that are loaded with vitamins, minerals, probiotics, and botanical extracts that are sought after by health-centric patrons.

A notable sign is the transformation of the retail landscape. Supermarkets, online channels, and specialty health shops are anchoring more and more of non-alcoholic malt beverages, thus ensuring better customer access.

E-commerce sites, especially the direct-to-consumer models, are pivotal in product discovery and sales growth. Many brands sell subscription systems to attract regular customers through these portals.

With the intensification of rivalry, the strategies of brands are being revised, and branding changes happen. Producers are concentrating on high-end products, thus craft-style, luxury malts are becoming available in the market recently. Artisanal malt beers are often made with organic ingredients, locally sourced malt, and small-batch production, which are produced for exclusive clients who appreciate quality.

The shift is more apparent in the cities, where request for sophisticated alcohol-free alternatives is also increasing.

For the time being, the UK market for non-alcoholic malt beverages is expected to grow at a steady pace, thanks to the innovation, concerted retail expansion, and the changing paradigms of the customer which affect its trajectory.

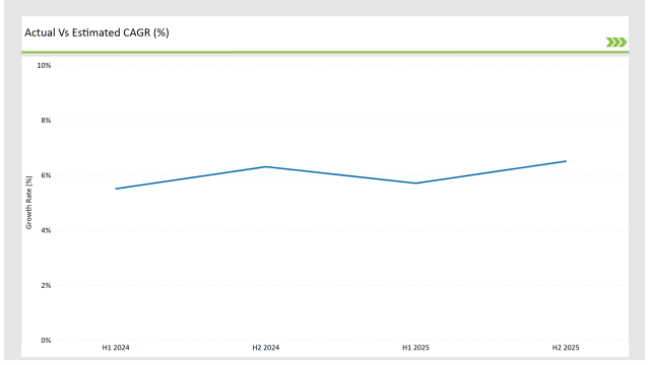

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Non-Alcoholic Malt Beverages market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December.

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Barbican UK launched a new range of naturally flavored malt drinks, reducing sugar content by 20%. |

| April 2024 | Supermalt introduced a fortified malt beverage with added B vitamins and minerals targeting health-conscious consumers. |

| June 2024 | Tesco expanded its private-label malt beverage selection, introducing new tropical flavors to attract younger demographics. |

| August 2024 | A report from UK Beverage Trends indicated a 15% increase in online purchases of non-alcoholic malt drinks. |

| October 2024 | Holland & Barrett began stocking premium malt-based energy drinks, tapping into the functional beverage market. |

Rise in the Popularity of Fortified and Functional Malt Beverages

With the shift in consumer behavior toward drinks that offer additional nutrients; fortified and functional malt beverages are being consumed more and more. Well-known companies, in a move to gain market base, have started to blend in vitamins, metals, and plant-derived extracts into malt drinks, targeting both athletes and health-conscious buyers.

Technologization in beverage formulation has led to innovation in probiotics, fiber, and adaptogens, among others, being perceived as gut-friendly and energy-enhancing beverage options. Besides, the demand for malt drinks, which are natural sources of hydration and endurance support, targeted to athletes and active people, has further increased with the booming of the sports and health & wellness sector.

Development of Premium and Artisanal Malt Drinks

The trend of consumer concerns for the top quality products has a direct impact on the non-alcoholic malt drinks area, it is craft-style beers that are being introduced, that is brands designing these malts. More and more consumers have been purchasing these quality products that are made with unique flavors, organic ingredients, and ethically sourced malt.

Premium malt beverages are usually produced in small batches, incorporating meticulously selected malt extracts, and exotic flavors such as bourbon, Heather flower, and herbal infusions. Furthermore, premium options have also been observed calling for the cooperation of the beverage sector with luxury eateries where the latter are being served malt-based drinks as the refined alcohol-free option to normal soft drinks or non-alcoholic beers.

The Growing Retail Presence of Non-Alcoholic Malt Drinks

Supermarkets, convenience stores, and specialty retailers are increasing shelf space for non-alcoholic malt beverages. Private-label brands are also entering the market, making malt-based drinks more accessible and competitive in terms of pricing. Additionally, supermarkets are diversifying their malt beverage offerings by including multipack options and seasonal flavors, appealing to a broader consumer base.

The growth of direct-to-consumer sales through online grocery platforms and e-commerce has further fueled accessibility, with retailers offering subscription-based delivery models for regular consumers of malt-based drinks. Digital promotions, including limited-time discounts and online-exclusive product launches, are also playing a significant role in expanding the market.

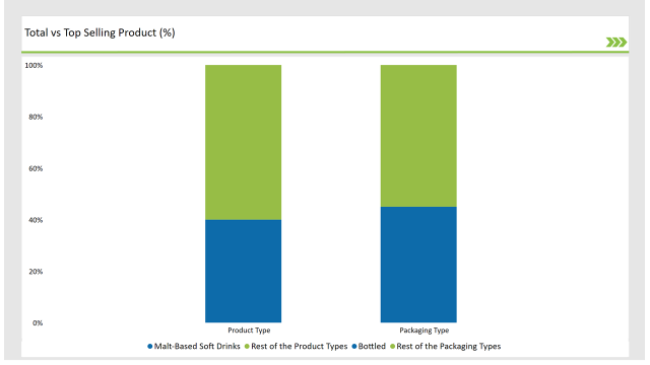

% share of Individual categories by Product Type and Packaging Format in 2025

Malt-based soft drinks take the lead with a 40% share of the total sales in the market. These are the drinks that people like for their naturally sweet taste, are high in antioxidants and are said to be good health-wise like helping digestion and promoting energy levels. The sales of these products were positively impacted by the rising trend of energy drinks made from natural sources, as well as the demand for healthier alternatives to soda.

Apart from that, these drinks also found a niche among alcohol-free consumers who prefer complex and full-bodied flavors instead of the traditional fizzy drinks. The newly launched flavors and the introduction of fun-filled products has been a highlight of the new schemes by the drink makers targeting younger generations like Gen Z, and millennials who have been massively adopted the malt-based soft drinks.

Packaged non-alcoholic malt beverages account for 45% of the market thus they lead the sector, because of their ease of Use and long shelf life. They are the portable choice of soft drinks, thus they are ideal for both home and outdoor quenching. Besides getting good quality and safety assurance, consumers also prefer single-use recyclable or biodegradable packaging by the brands.

The introduction of minimalist, eco-neutral designs in premium bottled malt beverages has produced a rise in the demand for them in upscale grocery stores and the eco-centric chains. In response to changing consumer preferences, some brands have also started to sell smaller, non-alcoholic bottled malt beverages for low-calorie consumption.

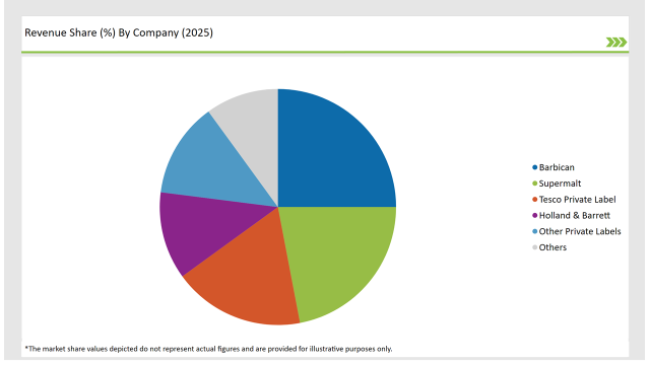

The UK market for non-alcoholic malt beverages is moderately fragmented, with both international and domestic brands competing for market share. Leading players such as Barbican, Supermalt, Tesco Private Label, and Holland & Barrett dominate the sector, leveraging innovation, retail partnerships, and health-focused formulations to gain a competitive edge.

To stay ahead in the competition, brands are now coming out with reduced sugar, functional, and premium malt beverages incorporating new consumer green trends. Online grocery and e-commerce channels are now turning into key distribution routes, launching brands to the mass market. In light of health concerns with fortified drinks, the launch of unique flavors, and the emphasis on sustainable packaging, the UK non-alcoholic malt beverages market is projected to see continued growth in the upcoming years.

2025 Market share of UK Non-Alcoholic Malt Beverages suppliers

Malt Beers, Malt-based Soft Drinks, Malt Extracts, Others

Original/Plain, Flavored (e.g., Fruit, Spices), Herbal

Cans, Bottles, Pouches, Others

B2B (HoReCa), B2C, Hypermarkets/Supermarkets, Convenience Stores, Online Retail, Others.

Within the Forecast Period, the UK Non Alcoholic Malt Beverages market is expected to grow at a CAGR of 6.2%.

By 2035, the sales value of the UK Non Alcoholic Malt Beverages industry is expected to reach USD 3,262.9 million.

Key factors propelling the UK Non Alcoholic Malt Beverages market include shifting consumer preferences toward healthier beverage alternatives, an increasing focus on functional drinks, and the growing influence of global beverage trends.

Prominent players in the UK Non Alcoholic Malt Beverages manufacturing include Barbican, Supermalt, Tesco Private Label, and Holland & Barrett. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA