The UK Allergen Free Food market is estimated to be worth USD 2,169.2 million by 2024 and is projected to reach a value of USD 4,090 million by 2035, growing at a CAGR of 5.8% over the assessment period 2025 to 2035

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,327.4 million |

| Industry Value (2035F) | USD 4,090 million |

| CAGR (2025 to 2035) | 5.8% |

The UK allergen-free food market is experiencing rapid growth due to the heightened awareness of the consumers toward the food allergies, intolerances, and diets with sensitivities. With the rising number of people suffering from the health disorders related to foods like gluten intolerance, lactose intolerance, and nut allergies, the demand for allergen-free food options has increased significantly.

Furthermore, the market is amid rapid expansion, thanks to the growing trend of clean-label, health-conscious, and plant-based diets among consumers, who even have no diagnosed allergies The one of the main reason for the market to expand is the increased desire for free-from products among not just allergy patients but also those who want to be healthy.

Not a few people choose Allergen-free foods as a part of a wellness-focused lifestyle, often linking them to better digestion, weight control, and overall health. The shift in consumption patterns has persuaded food manufacturers to bring a wider range of products free of allergens in many categories from bakery and snacks to dairy-free drinks and confectionery.

An equally important reason is the part played by the regulatory bodies to ensure transparency in allergen labeling. The UK Food Standards Agency (FSA) has strict rules that require clear labeling of allergens thus facilitating the assurance consumer confidence in free-from products. Since retailers and manufacturers have been prioritizing adherence to these guidelines, the number of certified allergen-free food products has increased in supermarkets, specialty shops, and online platforms.

With sustained innovation funding, the relationship with health organizations, and increased availability in retail, the UK allergen-free food market will continue to experience strong growth. The interplay of consumer-led demand, regulatory backing, and food industry developments is turning allergen-free food into a standard option instead of a necessity for people with specific allergies only.

Personalization is the trending branch of the allergen-free food market. Personalized nutrition is coming out as the major trend in the allergen-free food market. The shift is adding the credibility and efficiency factor in the process of allergen-free food production.

Consumers are more and more interested in these tailored solutions which correlate with their dietary needs and health objectives. Many companies are transitioning to green manufacturing and are opting for clean-label strategies to cater to this need.

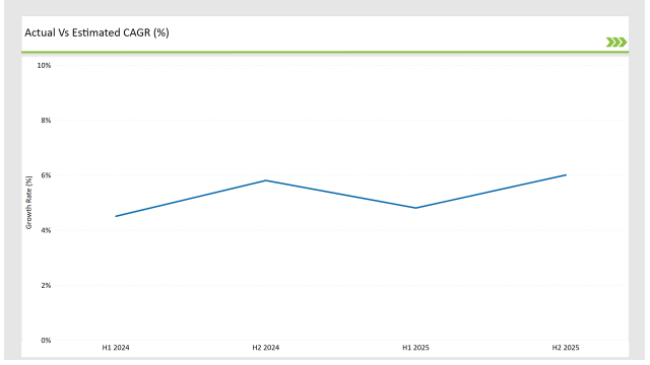

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Allergen Free Food market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Nestlé introduced a new range of nut-free and gluten-free chocolates to expand its allergen-free confectionery segment. The launch aims to provide safe indulgence for individuals with severe nut allergies. |

| April 2024 | Alpro expanded its plant-based allergen-free milk lineup with a fortified oat-based alternative free from nuts, soy, and dairy. The product is enriched with vitamins and minerals for additional nutritional benefits. |

| June 2024 | Genius Foods launched a new high-protein gluten-free bread targeting fitness-conscious consumers with dietary restrictions. This innovation caters to the growing demand for functional allergen-free foods. |

| August 2024 | Nairn’s collaborated with major UK supermarket chains to introduce a wider range of sugar-free, gluten-free oat biscuits. The expansion aligns with increasing consumer preference for healthier snack alternatives. |

| October 2024 | Kinnerton Confectionery partnered with online retailers to strengthen e-commerce sales for its nut-free chocolate bars, responding to rising demand for convenient allergen-free product accessibility. |

Premiumization of the “Free-From” Products

Gone are the days when allergen-free options consisted only of standard replacements; now, premium alternatives are trending. Shoppers are on an upward curve of buying high-priced, gourmet allergen-free foods that come with augmented taste and texture. Enterprises are resorting to small-batch, high-protein, and organic allergen-free product lines to meet the demands stemming from this premiumization trend.

The improvement of allergen detection technology in food production is being driven by food technology. The production lines for allergen-free food are becoming more efficient, inputs are being utilized better, and the environmental impact is being reduced with the help of new technologies such as AI-based quality management systems and block chain solutions that ensure food safety.

Allergy-Free Foods Find Personalized Nutrition as the New Trend

The allergen-free food segment is now faced with the rapid emergence of the personalized nutrition trend. As a result of the health and dietary needs, more and more clients prefer to pick individualized solutions. To keep up, food brands are introducing allergen-free meal kits that can be customized, as well as snacks that are functional for specific requirements, and they include a range of dietary-specific supplements.

Digitally Automated Allergen Detection in Food Manufacturing

The rate of advancements in the food sector is increasing due to the visible results of food technology, which also leads to the higher detection of allergens and the lower amount of contamination in the production line.

To a greater extent, manufacturers implement the use of artificial intelligence for quality control management and block chain networks that will make food traceability a safer practice in the allergen-free food sector. Consequently, consumer confidence rises, and food safety is maintained via effective allergen-free food production.

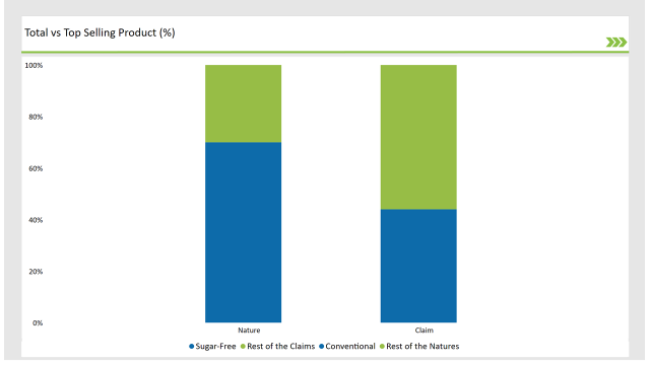

% share of Individual categories by Claim and Nature in 2025

Sugar-free allergen-free foods are the most sought after choice, boasting a market share of 44% as the growing preference of consumers for healthier alternatives becomes clearer. These goods are widely exploited by people dealing with diabetes, weight loss, and sugar problems. The principal categories are sugar-free snacks, dairy-free products, and bakery items, with brands like Nairn's and Genius Foods increasing their ways of participation in this section.

Traditional allergen-free foods are the main market players in the UK, accounting for 70% of the market, while the leading food companies keep modifying their own product lines to fulfill allergen-free requests. The food retail chains and top brands are pouring money into allergy-free versions of regular products to facilitate more people in buying them.

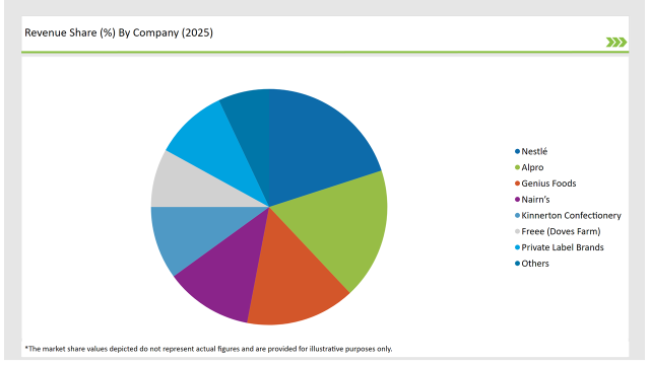

2025 Market share of UK Allergen Free Food suppliers

Note: above chart is indicative in nature

The UK allergen-free food market is moderately fragmented with most of the market being covered by prominent food manufacturers and specialist brands, fighting to catch up with rising consumer demand. The market giants such as Nestlé, Alpro, Genius Foods, and Nairn's are leading the sector owing to their broad product lines and retail relationships.

The brands in Tier 2 and the start-up brands are engaged in niche formulations, where they offer organic allergen-free and functional free-from foods. In a bid to remain in the race, producers are innovating with fortified allergen-free foods, expanding e-commerce distribution, and increasing retail partnerships.

Associations with online retailers and supermarket will remain a primary focus of strategy to improve extent. Also, supermarket-owned free-from brands are overcoming the established players by offering cheaper goods. With the rise in consumer demand for free-from, health-focused, and functional foods, there will be solid growth in the UK market led by continuous innovation and wider product accessibility.

Within the Forecast Period, the UK Allergen Free Food market is expected to grow at a CAGR of 5.8%.

By 2035, the sales value of the UK Allergen Free Food industry is expected to reach USD 4,090 million.

Key factors propelling the UK Allergen Free Food market include the rising demand for free-from products, with continued investment in innovation, partnerships with health organizations, and expanding retail availability, the UK allergen-free food market is set for sustained growth.

Prominent players in the UK Allergen Free Food manufacturing include Nestlé, Alpro, Genius Foods, Nairn’s, Kinnerton Confectionery, Free (Doves Farm). These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

UK Shrimp Market Insights – Growth, Demand & Forecast 2025-2035

UK Hostel Market Trends – Demand, Growth & Forecast 2025-2035

UK Mezcal Market Growth – Innovations, Trends & Forecast 2025-2035

UK Omega 3 Market Analysis – Size, Demand & Forecast 2025-2035

UK Lactose Market Report – Demand, Trends & Outlook 2025-2035

UK Lactase Market Growth – Innovations, Trends & Forecast 2025-2035

UK Car Wax Market Analysis – Size, Share & Forecast 2025-2035

UK Aerogel Market Insights – Growth, Demand & Forecast 2025-2035

UK Catalase Market Report – Trends, Demand & Industry Forecast 2025–2035

UK Fish Oil Market Trends – Growth, Demand & Forecast 2025–2035

UK Chitosan Market Outlook – Size, Share & Forecast 2025–2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

UK Fish Meal Market Insights – Demand, Size & Industry Trends 2025–2035

UK Sourdough Market Analysis – Size, Demand & Forecast 2025-2035

UK X-by-Wire Market Report – Trends, Demand & Industry Forecast 2025-2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

UK Bubble Tea Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA