The UK Fish Oil market is expected to reach USD 509.1 million in 2025 and is projected to reach a total value of USD 800.4 million by 2035. This represents a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 509.1 million |

| Industry Value (2035F) | USD 800.4 million |

| CAGR (2025 to 2035) | 4.2% |

The UK fish oil market is currently in a phase of sustained expansion primarily due to the rising number of applications in nutraceuticals, pharmaceuticals, animal feed, and aquaculture.

Fish oil is the most known source of omega-3 fatty acids (EPA and DHA) and are proven to have health-promoting effects, which include the ability to support cardiovascular health, improve cognitive function, and possess anti-inflammatory properties. The popularity and consumers' demand for high-quality, purified salmon oil that is scientifically proven to provide health benefits are quite growing these days.

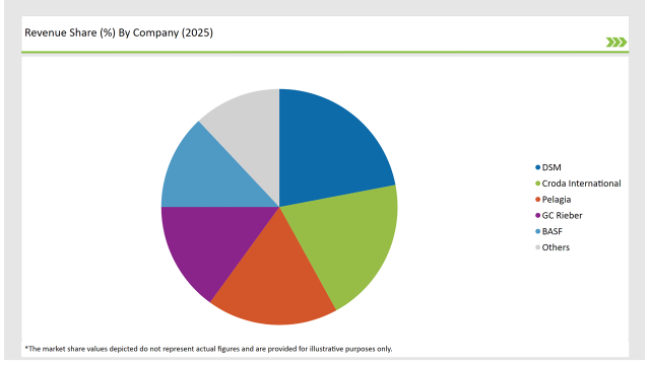

Top players such as DSM, Croda International, Pelagia, GC Rieber, and BASF are dominating the UK fish oil market by investing in cutting-edge purification technologies alongside ensuring sustainability fish oil sourcing and product formulations.

The recently increased interest in plant-based and algae-derived omega-3 alternatives is another factor that collaboratively supports the development of the industry through the expansion of companies' product lines to meet the needs of vegetarian and vegan customers.

The UK Food Standards Agency (FSA) and the European Food Safety Authority (EFSA) have taken steps to ensure sustainability and traceability. They have mandated the mercury-free processing and eco-friendly sourcing of fish oil products.

The UK government's strong focus on marine sustainability is motivating the responsible management of fisheries and generating transparency in the fish oil production process.

The sector is sustaining its growth despite some hurdles that include changes in raw material prices, competition from other omega-3 suppliers, and very strict government rules because consumers are becoming more and more conscious of health issues, there are more product innovations, and fish oils are now included in a wider range of functional foods, dietary supplements, and pharmaceuticals.

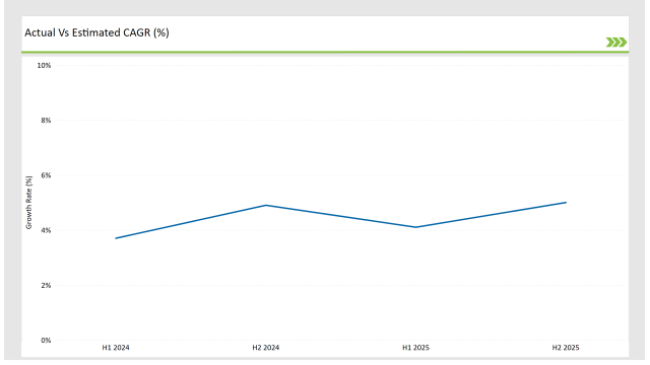

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Fish Oil market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | DSM launched a new ultra-refined fish oil supplement with enhanced bioavailability. The product is designed for improved absorption and higher omega-3 concentration. |

| Oct 2024 | Croda International expanded its UK-based fish oil purification facility to meet growing demand for pharmaceutical-grade omega-3 products. The facility incorporates state-of-the-art molecular distillation techniques. |

| Sep 2024 | Pelagia introduced a sustainable fish oil extraction process using low-impact fishing techniques. This initiative aligns with global marine conservation efforts. |

| Aug 2024 | GC Rieber partnered with UK nutraceutical brands to develop premium fish oil formulations with added antioxidants. These products target cognitive health and immune support. |

| Jul 2024 | BASF launched a vegan-friendly omega-3 supplement derived from algae, aiming to reduce dependency on traditional fish oil sources. |

Increased Requirement for Fish Oil with Formulation-Grades

The UK market has seen the rise in demand for highly purified, pharmaceutical-grade fish oil due to its clinically proven value in handling cardiovascular diseases, inflammation, and neurological conditions.

Manufacturers are concentrating on the purification of by-products routes which involve molecular distillation and supercritical fluid extraction to assure their products are free from contamination and to have higher strength formulations. Regulatory authorities are also stimulating Clinical trials along with evidence-based justifications that have led to fish oils being included in some drugs and therapies.

Sustainable Sourcing and Ethical Marine Stewardship

The lack of knowledge about the rapid changes of overfishing and marine ecology makes the UK fish oil industry put an emphasis on sourcing responsibly and good fisheries management.

Manufacturers get certifications from bodies like the Marine Stewardship Council (MSC) and Friends of the Sea (FOS) that ensure the fish oil is from non-endangered fish species and also benefits in by-product application. Furthermore, companies are instigating the use of by-catch technology and close-loop processing systems that will act in a better way for the environment.

Encapsulation and Delivery Systems: The Technology of Tomorrow

The innovations that were made in the delivery and encapsulation of fish oil have gone far in introducing the supply of these products in a more efficient way. Employed technologies include liposomal encapsulation, microencapsulation, and soft gel techniques; they have been utilized to prevent oxidation as well as accelerate the absorption rate of omega-3 fatty acids. This innovation is most valuable in functional foods and medical-grade fish oil supplements applications, where stability and efficacy are very important.

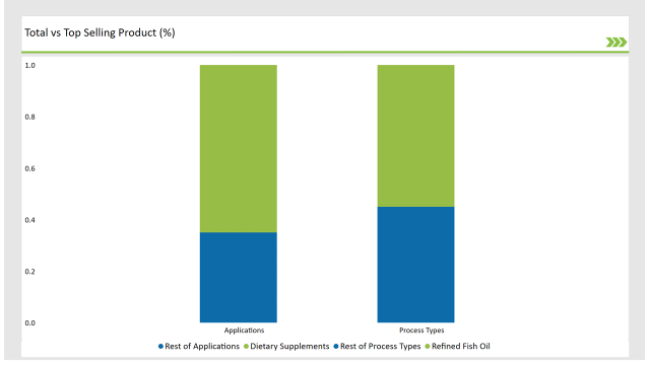

% share of Individual categories by Process and End User in 2025

As refined fish oil is subjected to thorough purification and thus heavy metals, contaminants, and oxidation by-products are removed, it constitutes 55% of the UK market. The process adopted ensures the high-quality, pharmaceutical, and nutraceutical-grade fish oil, thus making it the go-to choice for dietary supplements and medical formulations. Companies strive to enhance the refining process, which results in higher purity, better stability, and improved sensory properties.

Fish oil holds 65% of the market in the UK thanks to its leading role in nutritional supplements and functional foods. Omega-3-enriched goods which are available as capsules, gummies, and fortified beverages are massively advertised for their heart health, brain function, and anti-inflammatory benefits.

The increase of the senior population and the shift towards preventive medicine are together contributing to the soaring demand for high-concentration omega-3 products.

Note: above chart is indicative in nature

The UK fish oil market is moderately consolidated, with leading manufacturers focusing on high-purity processing, sustainability initiatives, and omega-3 innovation. Major players such as DSM, Croda International, Pelagia, GC Rieber, and BASF are growing their production capacity, integrating new research partnerships, and promoting certification programs, which all help them maintain their market-leading position.

Manufacturers are also turning to the exploration of the other sources of omega-3 found in microalgae such as EPA/DHA, to address the strong concern of a growing customer base that is vegetarian and vegan. Collaboration with academia, pharmaceutical companies, and nutraceutical brands is a big driver of innovative new products and seed applications.

The UK gradually capturing the high-purity, scientifically documented fish oil supplementation market increases due to the research, production technology, and sustainable sourcing development of the field.

Feed Grade, Food Grade, Pharma Grade.

Salmon Oil, Tuna Oil, Cod Liver Oil, Sardine Oil, Squalene Oil, Krill Oil, Anchovy Oil, Menhaden Oil, Others.

Crude Fish Oil, Refined Fish Oil, Modified Fish Oil.

Aqua-Feed, Food and Beverages, Dietary Supplements, Cosmetic and Beauty Products.

Within the Forecast Period, the UK Fish Oil market is expected to grow at a CAGR of 4.2%.

By 2035, the sales value of the UK Fish Oil industry is expected to reach USD 800.4 million.

Key factors propelling the UK Fish Oil market include increasing demand for omega-3 supplements, pharmaceutical applications, and sustainable marine-derived products.

Prominent players in the UK Fish Oil manufacturing include DSM, Croda International, Pelagia, GC Rieber, and BASF. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA