The UK Bakery Mixes market is currently valued at around USD 432.2 million, and is anticipated to progress at a CAGR of 3.7% to reach USD 619.4 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 432.2 million |

| Industry Value (2035F) | USD 619.4 million |

| CAGR (2025 to 2035) | 3.7% |

The UK bakery mixes market is experiencing stable development, which is mainly supported by the growing needs for convenience, home baking culture, and the rise of artisanal and specialty baked goods. As busy consumers turn to quick and easy cooking methods, pre-mixes have flourished as a viable option. With bakery mixes, only one ingredient is needed instead of multiple, therefore it becomes a highly favorable option among households as well as commercial bakers.

One of the main factors that impacted the market is the substantial power of health-oriented customers who ask for pastry products made from natural, preservative-free, and premium ingredients. Consequently, the figure of gluten-free, wholegrain and protein-enriched bakery mixes surged. Furthermore, producers are reacting to the consumers' preferences and are increasing the organic and clean-label range of mixes based on the trend of food production transparency.

Social media, recipe-sharing platforms, and the popularity of baking shows have led to the rise of consumer interest in the baking experiments. Companies are riding this trend by the introduction of easy-use, high-quality bakery mixes that are suitable to a variety of diets and skill levels.

The UK bakery mixes market is projected to preserve a stable growth path, despite the constantly changing promotion in cleaner, innovative, and premium product levels. The convenience factor, which is fully aligned with the evolving consumer expectations for healthier and more diverse baking options, still leads the drive of market expansion.

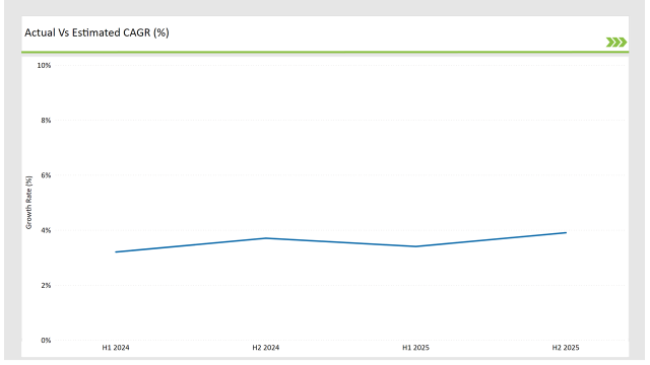

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Bakery Mixes market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Dawn Foods UK introduced a new range of high-protein bread and cake mixes for health-conscious consumers. |

| April 2024 | Puratos UK expanded its clean-label bakery mix portfolio, eliminating artificial preservatives and additives. |

| June 2024 | Tesco Private Label launched an exclusive gluten-free bakery mix range catering to the free-from category. |

| August 2024 | A report from UK Baking Insights highlighted a 15% rise in demand for home baking mixes, reflecting consumer preferences for DIY baking solutions. |

| October 2024 | AB Mauri partnered with leading UK bakeries to supply customized bakery mixes for commercial use, supporting large-scale production. |

The Movement Towards Health-Conscious Bakery Mixes

The increasing presence of consumers who are looking for alternatives with their dietary preference has determined the market of bakery mixes. Also, manufacturers are offering gluten-free, high-fiber, and low-sugar products instead of regular mixtures. Along the same lines, fortified flour mixes with additional vitamins and minerals, and plant protein are also on the rise in health-conscious circles.

With the acknowledgement of more people going with plant-based and functional diets, bakery mix brands are embarking on superfood trends with ingredients like chia seeds, flaxseeds, and almond flour. These superfood ingredients make the goods more nutritious. Companies are also utilizing sugar reduction technologies, eliminating refined sugar with natural sweeteners such as honey, coconut sugar, and monk fruit extract to accommodate diabetic and weight-conscious consumers.

The Shift to Artisanal and Specialty Baking Mixes

The increase in the popularity of artisanal-style baked goods has triggered the demand for specialty bakery mixes. The brands are providing premium solutions that contain high-quality ingredients, e.g., sourdough starters, heritage grains, and natural flavor enhancers. This turns caters both for professionals and home bakers, who want the baked products to look and feel as if they were made by hand.

Some producers are also extending their product lines to include organic, non-GMO, and preservative-free choices, thus meeting the demand of customers who are increasingly concerned about food quality and environmental sustainability. Also, the popularity of DIY baking kits, which have specialty mixes, pre-measured ingredients, and instructions, has made this market segment even stronger, attracting people who want a quick but artisanal baking experience.

Retail and E-Commerce Growth in Bakery Mix Sales

More retailers are adding bakery mix products to their lineup, and supermarkets are unveiling exclusive private-label brands. E-commerce channels have also been an integral part of the increase in sales by making specialty bakery mixes more accessible to customers. New business idea-distribution subscription services for home bakers where pre-measured, high-quality mixes make regular deliveries are presented as an avenue for further market expansion success.

Online baking communities and social media influencers are prominently driving product discovery, given that brands and popular content creators team up in the promotion of new bakery mix variants. Besides, direct-to-consumer (DTC) channels for brands which comprise personalized and small-batch bakery mixes are reshaping the market, introducing customers with greater choice and ability to buy niche products.

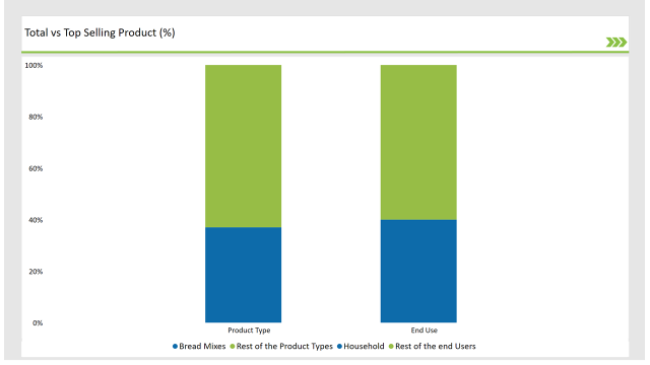

Bread mixes are the most popular product type in the UK, accounting for 37% of the market share in bakery mixes, mainly due to the enormous demand from consumers for homemade bread, especially types like sourdough, wholegrain, and seeded. The introduction of easy-to-use bread mixes that simplify the entire process of making bread has also contributed to their popularity, both in the sector of home baking and commercial bakeries.

What is more, brands are going beyond the standard with specialty bread by launching new products with gluten-free and protein enhancements. Furthermore, increased consumer interest in slow fermentation benefits and the use of natural leavening agents has resulted in the demand for sourdough-based bread mixes. A lot of firms are presenting bread mixes that have functional ingredients, such as ancient grains and probiotics, that are in demand among health-conscious individuals.

Household usage is a significant portion of the bakery mix market, accounting for 40% of the total share, with the growing trend of home baking by consumers. The market's demand for simple, effective, and high-standard baking mixes has jumped significantly, as more people have taken up baking as a hobby or the activity of convenience.

The brands with small batch, recyclable packaging and recipe ideas are pointing household consumers out which in turn will drive frequent use. Also, the development of online baking tutorials as well as digital recipe-sharing platforms has empowered consumers, who can now explore different baking techniques, thus increasing reliance on high-quality baking mixes.

In search of more high-end and individualized solutions, brands are also starting to create personalized bakery mix kits that allow consumers to tailor flavors, textures, and nutritional content to their preferences.

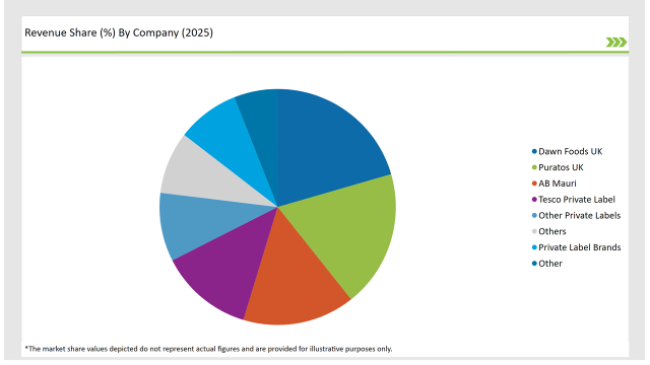

2025 Market share of UK Bakery Mixes suppliers

Note: above chart is indicative in nature

The UK bakery mixes market is characterized by moderate competition, with the major players emphasizing clean-label innovation, premium product offerings, and entry into the e-commerce field. The major players in the market like Dawn Foods UK, Puratos UK, AB Mauri, and Tesco Private Label dominate with remarkable market shares, which they channel through strong retail partnerships and product differentiation.

To remain competitive, manufacturers are making investments in the sustainable sourcing of raw materials, developing innovative packaging solutions, and making functional baking mixes. The rise of DIY home baking kits, subscription models that are practical, and the launch of specialty mixes that are premium are anticipated to be further factors for market growth in the years ahead.

The advancement on the dimensions of convenience, health orientated formulations, and digital retail positions, the UK bakery mixes market for uninterrupted expansion.

Cake Mixes, Bread Mixes, Pastry Mixes, Cookie Mixes, Others

Household, Commercial, Food Service Providers, Retail Chains, Others.

Within the Forecast Period, the UK Bakery Mixes market is expected to grow at a CAGR of 3.7%.

By 2035, the sales value of the UK Bakery Mixes industry is expected to reach USD 619.4 million.

Key factors propelling the UK Bakery Mixes market include the rising vegan trend, increasing consumer preference for clean label products, and heightened awareness about the health benefits associated with natural food additives.

Prominent players in the UK Bakery Mixes Manufacturing Dawn Foods UK, Puratos UK, AB Mauri, and Tesco. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA