The UK Non-Dairy Creamer market was valued at around USD 187.8 million in 2025. The sales are projected to increase at a healthy CAGR of 6.4% attaining market value of USD 347.7 million by 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 187.8 million |

| Projected Global Value in 2035 | USD 347.7 million |

| Value-based CAGR from 2025 to 2035 | 6.4% |

The UK non-dairy creamer sector has been on an upward trajectory thanks to the incorporation of healthier and more sustainable diets and the rise of lactose intolerance cases among consumers. Non-dairy creamers are lactose-free and stable at room temperature, and they're alternatives to milk and cream, which are used in beverages like tea and coffee.

They are offered in different formats, including powder, liquid, and concentrated, and powered creamers dominate the market because they are more practical and have a longer shelf life than other types of creamers.

The beverage sector, especially the coffee chains, offices, and households are the key areas where the solutions are mainly adopted. The creamers are such that they mimic the texture and the taste of milk which makes them highly practical without needing refrigeration. The leading players in the UK market, such as Nestlé, Alpro (Danone), and Coffee-Mate, have been introducing more products to meet the need for plant-based and allergen-free alternatives.

Major factors that drive the market are the rising popularity of vegan foods, the expansion of the coffee market to outside the home, and research and development of plant-based formulations.

Manufacturing companies are working on product quality improvement, for example, by utilizing coconut oil, almond milk, and oat milk to better the taste and the texture of the creamers. Furthermore, the emergence of the “clean label” phenomenon has contributed to the increase of creamers without artificial additives and hydrogenated oils.

The UK market is constantly in progress due to the focus on including healthier and sustainable options. The implementation of innovations in packaging, including single-serve sachets, has also contributed to the market growth by addressing the needs of busy, on-the-go consumers.

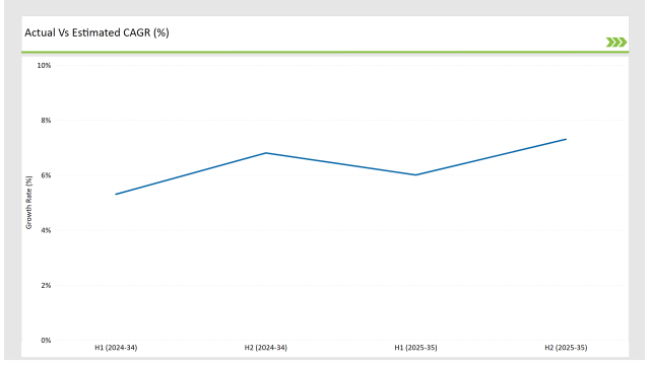

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2023) and the current year (2024) specifically for the UK Non-Dairy Creamer market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| October 29, 2024 | Rude Health, a prominent UK plant-based milk brand, was acquired by Finland's Oddlygood , a company spun out of dairy giant Valio. This acquisition aims to strengthen Oddlygood's presence in the UK market and expand Rude Health's product offerings. |

| October 26, 2024 | A report highlighted that while plant-based milk alternatives are popular in the UK, they may lack essential nutrients found in cow's milk, such as protein, calcium, and vitamin B12. This has implications for consumers choosing non-dairy creamers, emphasizing the need for fortified products. |

| September 2024 | Nestlé's brand, Coffee Mate, launched plant-based creamers in French Vanilla and Caramel flavors, catering to the growing demand for non-dairy alternatives in the UK market. |

| August 2024 | Danone introduced new plant-based creamers under its Silk and So Delicious brands, expanding its non-dairy product line in the UK to meet increasing consumer demand for vegan options. |

| July 2024 | Starbucks, in collaboration with Nestlé, released two flavors of non-dairy creamers: Caramel and Hazelnut, aiming to attract younger coffee drinkers who prioritize sustainable and transparent ingredient sourcing. |

The Office Coffee Sector's Rise in Powdered Creamers

The traditional powdered non-dairy creamers are one of the products that have done very well in office and workplace coffee due to their long-lasting shelf life, simple storage, and affordability. To stay away from extra costs and save space, many workplaces lean towards powdered creamers which require no refrigeration and are hassle-free to dispense, thus making them the best option for high-consumption environments.

The Coffee-Mate brand under Nestlé is a leading player in this sector as it provides packaging that is tailored for coffee stations set up in workplaces.

Unflavored Creamers as a Clean-Label Preference

Unflavored non-dairy creamers have seen a steady surge in demand given the consumer rising interest towards clean-label alternatives. These creamers are not incorporated with any artificial flavorings, thereby attracting individuals who are looking for a taste that does not overshadow their coffee or tea.

Alpro's unsweetened powdered creamer, which can easily accommodate health properties and streamline the ingredient list has been popular especially among harsh beverage customers.

Plant-Based Ingredient Use has Increased

The addition of plant-based ingredients like almond, coconut, and oat in non-dairy creamers is creating a shift in the market. The manufacturers are concentrating on recipes to create a creamier product without the negative connotations of using additives.

Coconut-based powdered creamers have particularly seen increasing interest for their advantages in both texture and nutritional value. Alpro and small niche brands are using this trend for promotion by making environmental claims and mentioning vegan certification for their products.

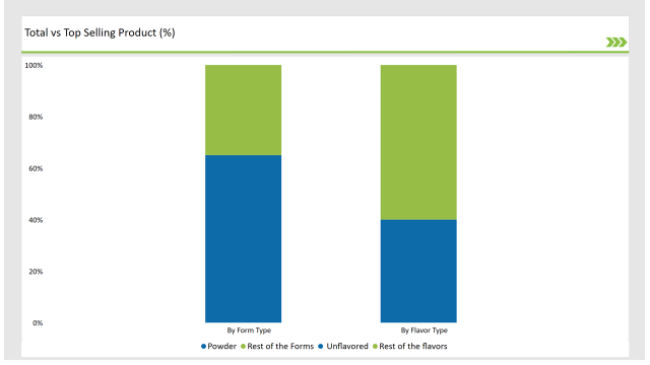

% share of Individual categories by Product Type and Applications in 2025

Powdered non-dairy creamers are the most widely consumed products in the UK thanks to their easy use and long life. In households and foodservice outlets, this format is highly preferred where logistical and handling issues are paramount. Such a type of creamers dissolves easily in hot beverages and is offered in both types of packages, i.e. single-serve sachets and bulk, thus catering to many customers.

Nestlé’s Coffee-Mate, to mention one, is a front-runner in the market, but it has also come up with specialty introductions like the hot drink or anti-foam mix types, which are creamers that keep their original consistency when added to hot drinks or frothy beverages like cappuccinos. These products are stored and transported under different conditions so that the existence of temperature variances has an additional positive effect on them.

Unflavored non-dairy creamers have found their place as a main category nourished by the quest of consumers for simplicity and flexibility. These creamers are very suitable in that they give the drinks a creamy texture instead of a different taste and so they are liked by many tea and coffee fans.

The company Alpro, which is among the major market players, has introduced unflavored powdered creamers free of artificial additives to people who are concerned about their food being clean label. The ever-growing trend in unflavored creamers results from their usage in both food-type and drink-type applications, as they are good for both.

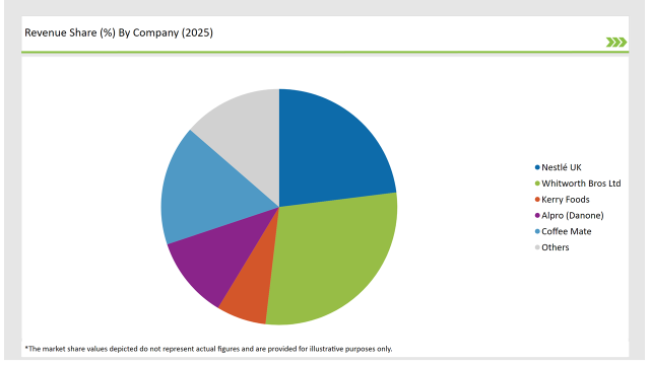

The UK non-dairy creamer market's main players are Nestlé, Alpro (Danone), and Coffee-Mate. These companies are keeping their place on the playing field by striving for innovation and relatedfully, primarily on the plant-based option and the clean-label one. Concurrently, Nestlé has also improved its powdered creamer line with a more customer-tailored choice associated to retail and foodservice alike.

Alpro with the launch of vegan-certified and allergen-free flavors has been catering to health-conscious patrons. Additionally, the introduction of coconut and almond-based creamers by niches is catering to customers interested in sustainability. Deepening their market roots is facilitated by strategic brands collaboration with coffee vendors and through launching single serve sachets.

2025 Market share of UK Non-Dairy Creamer suppliers

Key Sources like Coconut, Almond, Soy, Corn, and Others are included in the report.

Powder / Granules and Liquid.

Packaging types like Sachets / Pouches, Bags, Canisters, and Bottles are considered.

Food Service Channels, Hypermarkets / Supermarkets, Convenience Stores, Grocery Stores, Specialty Stores, and Online Retail.

By 2025, the UK Non-Dairy Creamer market is expected to grow at a CAGR of 6.4%.

By 2035, the sales value of the UK Non-Dairy Creamer market is expected to reach USD 347.7 million.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA