UK Chitin sales will reach approximately USD 150.8 million by the end of 2025. Forecasts suggest the market will achieve a 7.2% compound annual growth rate (CAGR) and exceed USD 324 million in value by 2035

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 150.8 million |

| Industry Value (2035F) | USD 324 million |

| CAGR (2025 to 2035) | 7.2% |

The UK chitin market is flourishing with a steady growth rate due to its increasing utilization in healthcare, food and beverages, water treatment, agriculture, and pharmaceuticals. Chitin is a biopolymer that occurs naturally and is mainly derived from the shells of shrimp and crabs as well as from fungal sources. It is recognized for being biodegradable, non-toxic, and antimicrobial. As the reality of companies dealing with climate change urges them to adopt sustainability and environmental solutions, the need for derivatives of chitin such as chitosan and glucosamine is also going up.

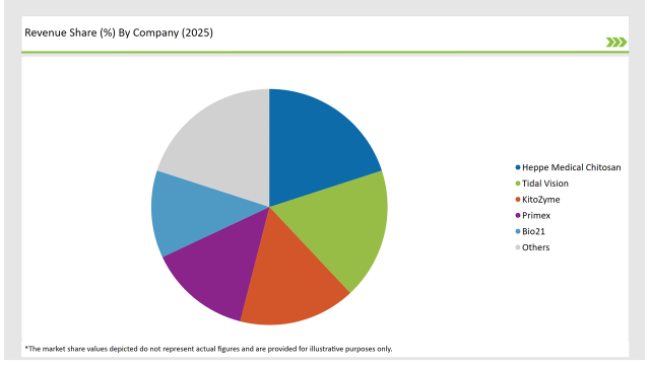

Some prominent chitin traders such as Heppe Medical Chitosan, KitoZyme, Tidal Vision, Primex, and Bio21 are the main drivers of the UK market, making investments in biodegradable formulations, medical-grade chitin production, and introducing new applications based on bioproducts. As the market is fed with natural and bio-based ingredients, the use of chitin in pharmaceuticals and functional food applications is also growing.

The UK Food Standards Agency (FSA) and the European Food Safety Authority (EFSA), which are the regulatory bodies, are imposing strict regulations on chitin-based ingredients in healthcare and food products. In addition, the progress of technologies in biopolymer extraction and the valorization of waste from seafood processing which are equally important, both contribute to market growth.

In the face of challenges like high processing costs, the seafood-based chitin allergen controversy, and regulatory complexities, the market is still expected to surge owing to its multifunctional properties, increased cellular implant applications, and the enhancement of plant-based alternatives in chitin production.

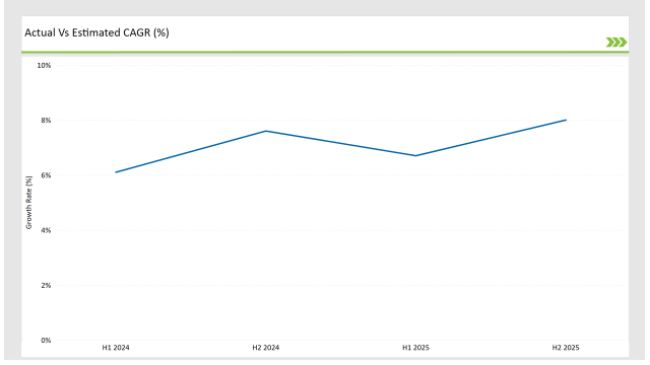

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Chitin market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Heppe Medical Chitosan introduced a medical-grade chitin-based wound healing solution. The product aims to accelerate tissue regeneration and improve antimicrobial resistance in patients. |

| Oct 2024 | KitoZyme expanded its fungal-derived chitin production in the UK to reduce dependency on marine-based sources. This aligns with the increasing demand for vegan and allergen-free chitin. |

| Sep 2024 | Tidal Vision launched a biodegradable chitin-based agricultural bio-stimulant to enhance soil fertility and crop yield. The innovation supports sustainable farming practices. |

| Aug 2024 | Primex partnered with UK nutraceutical brands to develop glucosamine-enriched dietary supplements. These formulations target joint health and anti-inflammatory benefits. |

| Jul 2024 | Bio21 collaborated with leading research institutes to explore chitin’s role in tissue engineering and drug delivery systems. This development aims to expand chitin's applications in regenerative medicine. |

The Healthcare and Pharmaceutical Sectors Are Now the Largest Demand for Chitin Within the UK Healthcare Industry

Chitin and its derivatives are gaining more popularity in the UK healthcare sector due to their biocompatibility, non-toxicity, and antimicrobial properties. For example, they are present in the composition of the adhesive bandages, sutures, and drug delivery systems.

Studies have indicated that biodegradable chitin not only promotes healing but also diminishes inflammation and improves immunity. Demand for chitin in the area of implants and regenerative medicine is also projected to increase owing to a higher incidence of chronic wounds and orthopedic conditions. In addition, chitin's new move, substituting non-biodegradable with biodegradable bioactive, consequently leads to the enlargement of chitin's territory in the medical field.

Increase in the Use of Innovative Chitin Extraction and Processing Processes

The conventional chitin extraction methods are based on chemical treatments which are associated with environmental pollution and are not very effective. But the new technologies that are gradually gaining ground include enzyme-assisted extraction, fermentation-based processing, and microwave-assisted deacetylation which are all good for the environment.

These methods help cut waste disposal costs, refine the product, and also decrease the expense of manufacturing. Companies are putting more money into waste valorization projects, and with this, they are producing high-value chitin derivatives by utilizing seafood processing by-products while causing minimal impact on the environment.

A New Era in Chitin as Functional Food and Nutraceutical

Interest in health issues like gut health, joint support, and weight management has led to an increase in the use of chitin as a nutraceutical component. Glucosamine, which is one of the main derivatives of chitin, is included in a lot of joint health supplements and in treatment systems for anti-inflammatory diseases.

As of now, functional foods are used with chitin-based prebiotics and dietary fibers which contribute to a healthy digestive system. In addition, chitin's fat-binding characteristics have been studied to provide a solution for the problem of weight loss, thus it becomes a precious ingredient in the nutraceutical market.

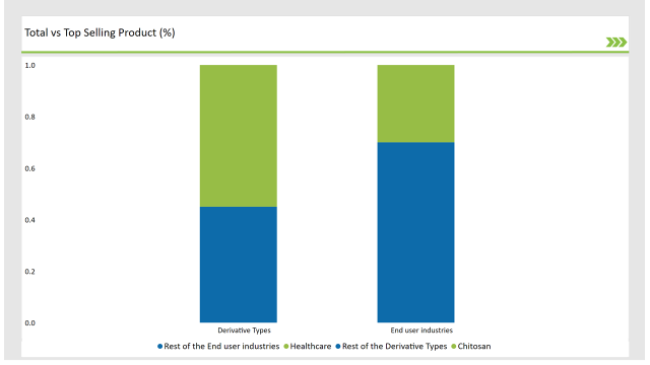

% share of Individual categories by Derivative Type and Applications in 2025

Chitosan is the main part of the 50% value of the market which it wins thanks to the common use of the bioactive polymer in food preservation, biomedical research, and sustainable management. Its antibacterial and film-forming benefits made it a popular choice for using it in food packages and coatings that are edible. Chitosan's part in green packaging and food coatings is flourishing due to the UK government promoting less plastic usage and sustainability.

With naturally occurring polysaccharide, chitin witnessing a tremendous boom in its utilizations within healthcare industries for fighting a vast category of medical difficulties, this unique biocompatibility and biodegradable material also finds application with increasing popularity, especially in cases of wound healing, tissue engineering, and the delivery of medications. Due to its antimicrobial properties, this biopolymer is very essential in the fabrication of advanced medical devices and antimicrobial dressings in the treatment of healthcare-associated infections.

Moreover, chitin is applied to dental and ophthalmological treatments where it will be used as a solution in innovative applications related to tooth filling, contact lenses, and artificial corneas. The versatility of this biopolymer is turning the healthcare sector around, which promises to allow for more efficient and patient-specific treatments.

Note: above chart is indicative in nature

The chitin market of the United Kingdom is characterized by moderate competition, with manufacturers concentrating on their goals as biotechnological progress, alternative chitin sources, and eco-friendly applications. Famous companies like Heppe Medical Chitosan, KitoZyme, Tidal Vision, Primex, and Bio21 are investing actively in fermentation-based chitin production, medical-grade formulations, and biodegradable applications.

With more frequent observation by the regulatory agency, manufacturers are purifying the chitin products from any contamination with the help of state-of-the-art purification techniques. The field is also exhibiting joint ventures between research institutes and biotech companies directed toward the study of chitin in biomedicine, bioengineering, and sustainable agriculture.

The continuous acceptance of chitin in the life sciences, nutraceutical sectors, and bio packaging for environmental protection is believed to be the factor that promotes the turning out of greatest innovations and market expansion in the near future.

Glucosamine, Chitosan, Others

Food and Beverages, Agrochemical, Healthcare, Cosmetics and Toiletries, Waste and Water Treatment, Others.

Within the Forecast Period, the UK Chitin market is expected to grow at a CAGR of 7.2%.

By 2035, the sales value of the UK Chitin industry is expected to reach USD 324 million.

Key factors propelling the UK Chitin market include Increasing demand in healthcare, pharmaceuticals, biodegradable packaging, and functional foods is boosting the market.

Prominent players in the UK Chitin manufacturing include Heppe Medical Chitosan, KitoZyme, Tidal Vision, Primex, and Bio21, focusing on sustainable chitin extraction and product innovation.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA