The UK sweetener market is expected to reach USD 0.5 billion in 2025 and is projected to experience a steady year-over-year growth of 3.1%, reaching a total value of USD 0.8 billion by 2035. This represents a compound annual growth rate (CAGR) of 3.1% during the forecast period from 2025 to 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 0.5 billion |

| Projected UK Industry Size in 2035 | USD 0.8 billion |

| Value-based CAGR from 2025 to 2035 | 3.1% |

Demand for low-calorie substitutes in food and stored-products is driving the growth of the UK sweetener market. Such high growth is largely driven by rising consumer awareness relating to health, government regulations such as sugar levies, and food manufacturers' reformulation initiatives.

It is not only stevia and monk fruit gaining share among health-conscious consumers but natural sweeteners in general, as artificial variants still dominate large-scale production due to their cost efficiency. Producers of functional food and beverages are turning to sweetener blends to maximize palatability and functional benefit.

Health-driven innovations, clean label positioning and greater availability through e-commerce and specialty health stores also play a role in the growing market. The development of improved taste profiles and reduced aftertaste will continue to widen the acceptance of the components, particularly in reduced-sugar snacks, beverages and baked goods.

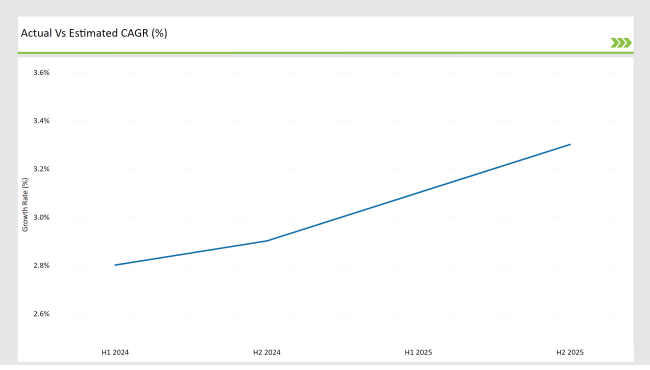

The table below reflects a detailed year-on-year comparison in terms of the change in Compound Annual Growth Rate (CAGR) over the ensuing six months for the respective base year (2024) and the current year (2025) in particular as it applies to the UK sweetener market.

As such, the semi-annual scrutiny caters to significant transitions evidencing market dynamics and revenue confirmation trends, offering participants a more seamless comprehension of balance of power in the landscape within the year. H1 is first half of the year, that is Jan to June, and H2 is second half of the year, from July to December.

H1 signifies period from January to June, H2 signifies period from July to December

The UK sweetener market in 2024 opened up to a CAGR of 2.8% in H1 and even bumped up to a CAGR of 2.9% in H2. (2) In 2025, growth rate reached to 3.1% in H1 and 3.3% in H2 with a total increase for 50 basis points in year-on year.

These numbers exemplify the continuous upward trend of the market, driven by changing dietary habits, government policy mechanisms, and various formulation strategies adopted by key market players. For stakeholders looking to maximize timing, portfolios and investments in the UK sweetener industry, this semi-annual breakdown is an essential source of information.

| Date | Development/Event & Details |

|---|---|

| January 2024 | The UK sweeteners market experienced steady growth, driven by increasing consumer demand for low-calorie and sugar-free alternatives. Health-conscious trends and government initiatives to reduce sugar consumption contributed to the market's expansion. |

| April 2024 | Major food and beverage companies in the UK introduced new products featuring natural sweeteners like stevia and monk fruit. These launches aimed to cater to consumers seeking healthier options without compromising on taste. |

| July 2024 | The market saw a shift towards plant-based sweeteners, with manufacturers investing in research and development to improve the taste and functionality of these alternatives. This trend aligned with the growing popularity of plant-based diets in the UK |

| October 2024 | Consumer awareness campaigns highlighting the health risks associated with excessive sugar intake led to increased adoption of sweeteners in various food products. Retailers reported higher sales of sugar-free and reduced-sugar items. |

| December 2024 | The holiday season saw a surge in demand for sweeteners, as consumers sought healthier options for festive treats. Manufacturers responded by offering a wider range of sweetener-based products, including baking ingredients and confectionery items. |

Switch to All Natural and Low Calorie Sweeteners

The British sweetener industry has undergone major change to meet demand for natural, low-calorie alternatives to regular sugar. They are more than just wanting to cut back on sugar while they watch new health concerns mount, the trend is being driven. Natural sweeteners of plant origin such as stevia and monk fruit - with little or no effect on blood sugar - are trending.

Furthermore, the growing occurrence rate of several health problems such as obesity and diabetes is driving consumers to opt for healthier choices further fueling the demand for sugar substitutes. This is prompting companies to introduce new products, as natural and low-calorie sweeteners become more widely available.

Reducing Service Risks - Regulatory Checklist

Government schemes to curb sugar intake are shaping the sweetener market in the UK. Policies like the Soft Drinks Industry Levy have driven manufacturers to reformulate products to reduce sugar. This regulatory landscape is encouraging innovation in creating new sweeteners that can mimic the taste and properties of sugar without the health risks.

This is leading to investment in R&D to develop sweeteners that satisfy both consumer preferences and regulatory requirements, and is impacting the salt substitution market.

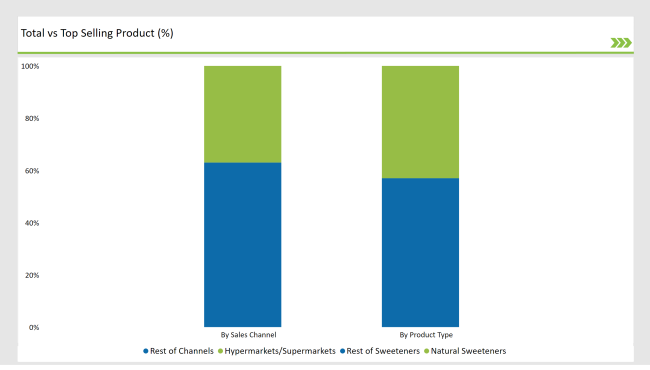

% share of Individual Categories by Product Type and Sales Channel in 2025

Natural sweeteners including stevia, honey, coconut sugar and monk fruit dominate the UK sweetener sector, with a share of the total at 43%. As consumer-driven demand for clean-label products continues to rise across functional food and beverage categories, brands are using more plant-based and naturally sourced sweetening agents.

The Bakery, Dairy & Wellness Beverages Sectors Continued to adopt these Sweeteners: As innovation continued in blenders to further improve taste, stability and glycemic response characteristics, the interest expanded in the bakery, dairy and wellness beverages sectors.

Hypermarkets and supermarkets remain the preferred sales channel, accounting for 37% of total sweetener product sales in the UK They carry a broad assortment of SKUs and conduct aggressive in-store promotions and shelf displays, making them key launch platforms for premium and novel sweeteners. But with rapid growth in online retail, especially in bulk sales of keto-friendly, diabetic-safe and organic sweeteners.

Substantial investments by key industry players, such as Tate & Lyle, Cargill, PureCircle, Ingredion and British Sugar continue to be made in natural and hybrid sweetener portfolios, along with sustainable sourcing methods and plant-based innovations to address changing consumer expectations.

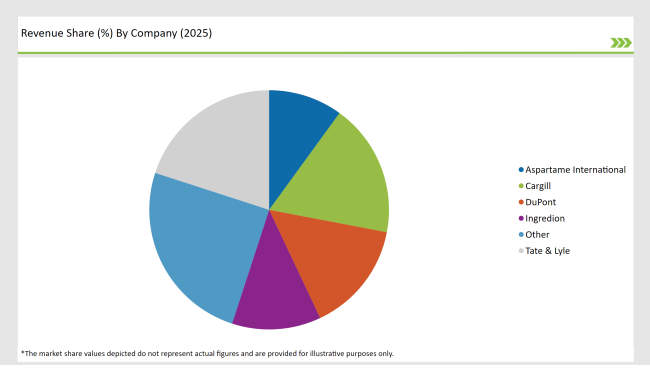

UK Sweeteners Market Recent Developments Top Facts Businesses and suppliers have made several developments in the UK sweeteners market, including some of the following: The UK sweeteners market is moderately consolidated, with a few players including Tate & Lyle, Cargill, DuPont, and Aspartame International.

Such companies hold the leading positions due to their large product range, strong research and development capabilities and extensive distribution network. Besides, some regional and specialty players, primarily targeting the innovative and health-promoting sweeteners segment, which includes plant, organic and other specialty sweeteners that are becoming very prevalent in UK consumer space.

Healthier low-calorie and sugar-free food and beverage options continue to be in high demand, serving as a major growth factor for the market. Natural sweeteners are gaining consumer preference, while the regulatory framework is a key factor in determining the competitive landscape of the sweetener market.

2025 Market Share of UK Sweetener Suppliers

Note: Above chart is indicative in nature.

Growing demand for natural and organic sweeteners products is significantly impacting the competitive dynamics of UK sweetener market. Therefore, firms are heavily investing in R&D to serve the evolving consumer requirements and adhere to the regulatory standards. These companies are expanding product offerings through the use of sustainable and innovative practices. Additionally, market contributors are key to extensive expansion through strategic partnerships and acquisitions and constant innovation to garner reach and solidify market penetration. The sweeteners market in the located kingdom can have a big increase due to growing shift towards use of healthier elements and cleaner label ingredients in food and beverages.

The industry is categorized into Natural Sweeteners (Stevia, Palm Sugar, Coconut Sugar, Honey, Maple Syrup, Monk Fruit Sugar, Agave Syrup, Lucuma Fruit Sugar, Molasses, Other Natural Sweeteners), Artificial Sweeteners (Acesulfame Potassium, Aspartame, Neotame, Advantame, Saccharin, Sucralose, Other Artificial Sweeteners), Sucrose, Novel Sweeteners, and Sugar Alcohols (Erythritol, Xylitol, Sorbitol, etc.).

This segment is further categorized into High Intensity Sweeteners and Low Intensity Sweeteners.

This segment is further categorized into Powder, Liquid, and Crystals.

This segment is further categorized into Organic and Conventional.

This segment is further categorized into Food (Bakery Goods, Sweet Spreads, Confectionery and Chewing Gums, Dairy Products, Others), Beverages (Carbonated Drinks, Fruit Drinks & Juice, Sports & Energy Drinks, Powdered Drinks and Mixes, Others), Pharmaceuticals, Personal Care, and Other Applications.

This segment is further categorized into Hypermarkets/Supermarkets, Convenience Stores, Specialty Retail Stores, Traditional Grocery Retailers, Online Retailers, and Other Channels.

The UK Sweeteners market is estimated to be worth USD 0.5 billion in 2025.

By 2035, the market is expected to reach USD 0.8 billion.

The UK Sweeteners market is projected to expand at a CAGR of 3.1% from 2025 to 2035.

Key players include Tate & Lyle, Cargill, DuPont, Ingredion, Aspartame International, and other regional and specialty suppliers.

Tate & Lyle is projected to lead the UK market in 2025 with a 20% value share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA