The UK Food testing Services market is expected to reach USD 1,370.6 million in 2025, reaching a total value of USD 3,279.7 million by 2035. This represents a compound annual growth rate (CAGR) of 9.1% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,370.6 million |

| Industry Value (2035F) | USD 3,279.7 million |

| CAGR (2025 to 2035) | 9.1% |

The food testing services sector in the UK has been steadily prospering, attributing monopolistic growth to the rules set by the government, increased knowledge and choice of the populace, as well as the advancements in analytical testing methods.

This market is the most important channel of all for food safety and quality, it deals with problems related to food contamination, allergens, genetically modified organisms (GMOs), and nutritional labeling compliance. The major types of food testing services involve microbiological testing, chemical analysis, allergen testing, and GMO detection. These services are provided for various food items including dairy, meat, bakery, beverages, and processed foods.

Major uses of food testing services in the UK involve meeting the requirements of regulations from the UK Food Standards Agency (FSA), European Union (EU) food safety standards, and retailer-specific quality standards. Many manufacturers and food processors are now opting for the help of third-party analytics services to do fast and elaborate compliance with their customer demands or are putting investments in laboratory tests to cope with the stress of being in the market.

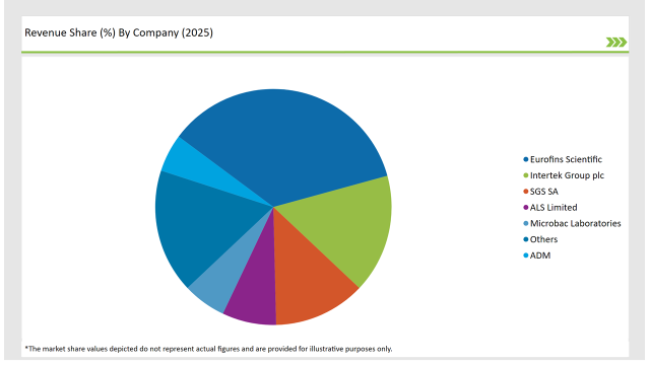

Some of the prominent companies in the UK market are Eurofins Scientific, ALS Limited, SGS SA, Intertek Group plc and Microbac Laboratories. The companies are fervently innovating by employing advanced techniques such as next-generation sequencing (NGS) while also expanding their laboratory nations in order to gain an additional market percentage. The manufacturers' proclivity indicates a fresh shoot towards speedy, automatic tests which not only increase precision but also reduce the turn-around time.

Industry dynamics are characterized by stricter and more complex food supply chains, stronger consumer desire for clarity, and higher food poisoning bacteria rates. Moreover, the UK leaving the EU has led to changes in food safety regulations, which have caused new compliance problems for businesses and, hence, have increased the need for specialized testing services.

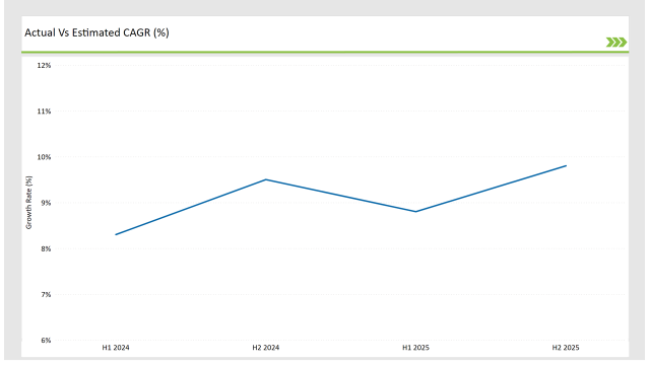

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Food testing Services market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December.

| Date | Development/M&A Activity & Details |

|---|---|

| March 2024 | Eurofins Scientific opened a new food testing laboratory in Manchester, aiming to enhance its regional presence and cater to increasing demand for rapid testing. |

| June 2024 | ALS Limited launched a rapid allergen testing service in the UK, significantly reducing testing time and catering to the rising prevalence of food allergies. |

| October 2024 | Intertek Group plc collaborated with a major UK retailer to provide bespoke in-house food testing solutions tailored to meet updated regulatory requirements. |

| December 2024 | SGS SA expanded its UK operations by investing in a new state-of-the-art laboratory facility to strengthen its position in microbiological and chemical testing. |

| November 2024 | Microbac Laboratories introduced a block chain-based traceability platform, enhancing transparency and authenticity across the UK food supply chain. |

Block chain Revolutionizes Food Traceability Allocation

Block chain technology is undergoing a massive metamorphosis in the UK food testing industry. It is the ruling technology that ensures the rap of the system is stable from the root level to the top. Thus, creating an audience and attracting customers through supply chain authentication and transparency. For instance, one of the companies, Microbac Laboratories has begun to use a block chain-enabled platform to cover the concerns of food fraud and food contamination. '

Such an innovation is especially relevant when addressing case scenarios of intricate food supply chains that are difficult to monitor concerning the source and quality. The adjustment to block chain is also due to the increasing regulatory duties to promote food quality and eliminate fraud in the UK.

Rapid Allergen Testing Becomes a Necessity

Food allergen testing has taken a significant and fast turn in the UK, especially with the rise of food allergies in consumers. The opening of a rapid allergen testing service by ALS Limited displays the determination of the industry against such problems. Fast service, which is less than 24 hours, allows manufacturers to act quickly to possible allergen contamination problems.

This is the primary trend that follows the direction given by both customers and retailers who advocate forsaking of the products guaranteed free of allergens. Food manufacturers are among the companies benefiting most from the introduction of ergonomic technology which enables the delivery of the allergen test within a reasonable budget.

Automation Enhances Laboratory Efficiency

Automation has been a breakthrough in the execution of processes and testing in food laboratories is no exception in the UK. Eurofins Scientific integrates robotic sample handling with AI-powered data analysis to maximize the testing accuracy and cut the turnaround time.

These advancements help the laboratories process more samples and at the same time ensure strict quality control. Automation is a further aid to the reduction of human error, which by itself is a big asset for large-scale food testing operations. In the wake of the ferocious competition, laboratories are switching to automation at a faster pace to keep ahead.

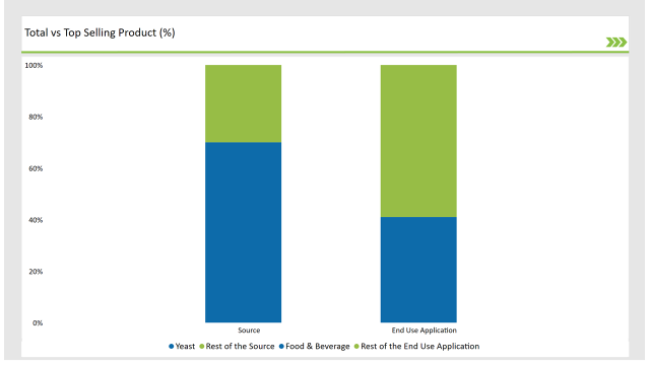

% share of Individual categories by Testing Method and Engagement type in 2025

The testing methods for microorganisms in addition to chemical testing, are major contributors to the revenue of the UK market, accounting for 35.3%. Microbial testing is the most prominent sector and its increased significance is due to the health problems that arise due to bacterial contamination concerning meat, dairy, and fresh produce.

Furthermore, the growth of the clean-label trend, has surged the demand amongst technical methods for chemical testing aimed at detecting pesticide residues, and contaminants. The leaders in the field are focusing their spending on the latest machines that would eliminate the backlog of the demand of specific tests completed quickly and accurately.

The UK food testing services market is largely owned and run by the company of the in-house testing and analytics services, which contributes 58.6% of the revenue. The big companies such as Tesco and Unilever are in the lead with in-house testing as it enables them to control the testing timelines and eld data integrity.

These facilities are at the forefront with advanced technology which allows real-time monitoring and therefore they are able to comply with regulations quickly. However, the third-party testing providers like SGS SA and ALS Limited are the ones who are completing their tasks with the companies that are cost-effective, Bureauveritas serices while not compromising quality.

The UK food testing services market has a weak consolidation with a few big companies like Eurofins Scientific and Intertek Group plc holding a sizeable part of the market. These companies target the expansion of the testing portfolio, enhancements to laboratory infrastructure, and the use of advanced technologies. Innovation and growth are also seen in the Tier 2 company ALS Limited, which is rendering its clientele a different verity of tests it can perform.

Parasite and GMO analysis for main applications. Intensifying rivalry is visible by the companies launching quick testing systems and block chain-based traceability schemes. New strategies aimed at localization and customization for changing regulatory requirements and business customer demo scopes have been highlighted, for instance, the commissioning of a UK-based testing firm by SGS SA.

2025 Market share of UK Food testing Services suppliers

Dairy Products Testing Methods, Dietary Supplements Testing Methods, Food Testing Methods, Meat Testing Analysis, and others

In House/ Captive Testing and Analytics Services, and 3rd Party/ Independent Testing and Analytics Service Providers

Within the Forecast period, the UK Food testing Services market is expected to grow at a CAGR of 9.1%.

By 2035, the sales value of the UK Food testing Services industry is expected to reach USD 3,279.7 million.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Examining Food Testing Services Market Share & Industry Outlook

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Food Safety Testing Services Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Food Authenticity Testing Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Latin America Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

UK Preclinical Medical Device Testing Services Market Outlook – Share, Growth & Forecast 2025-2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Service Equipment Market Trends – Growth, Demand & Forecast 2025–2035

UK Food Stabilizers Market Insights – Demand, Size & Industry Trends 2025–2035

UK Frozen Food Market Growth – Size, Share & Forecast 2025–2035

Food Allergen Testing Market - Size, Share, and Forecast Outlook 2025-2035

Food Pathogen Testing Market Analysis by Contaminant Type, Technology, Application, and Region through 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA