The UK Chickpea Protein market is currently valued at around USD 8.5 million, and is anticipated to progress at a CAGR of 7.5% to reach USD 17.6 million by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 8.5 million |

| Industry Value (2035F) | USD 17.6 million |

| CAGR (2025 to 2035) | 7.5% |

The UK chickpea protein market is on a lean but assured upward trajectory. The surge in plant-based proteins' uptake in the food sector, soft drinks, and nutritionals has really driven the demand. In addition to that, the chickpea protein side which is actually a special protein source from chickpeas with right definitions for protein biology has been gaining attention from medical science as the chickpea has very low antinutrients.

So it can be reliably recommended as a protein source. Its high content of proteins that the human body cannot synthesize, and its good acceptance on the part of a diet with low saturated fats, etc. make it one of the most widely accepted substitutes to traditional animal proteins. Chickpea protein is the most appealing protein source which perhaps could replace other animal protein sources that fail to do so.

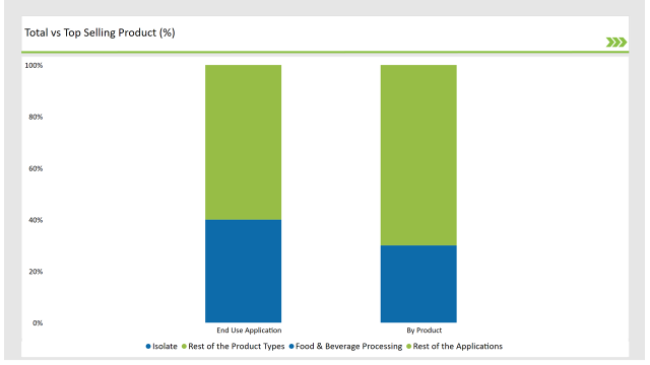

Isolate is the most popular product type for chickpea protein, accounting for a 30% market share mainly because of its concentrated protein and versatile application in product formulations. Isolates, which are the main products, are very popular among the manufacturers of plant-based dairy substitutes, protein powders, and functional foods.

The food and beverage processing sector, with a market share of 40%, is the leading end-user of chickpea proteins. This segment comprises a wide variety of products, including plant-based snacks, baked goods, protein-enriched beverages, and meat substitutes.

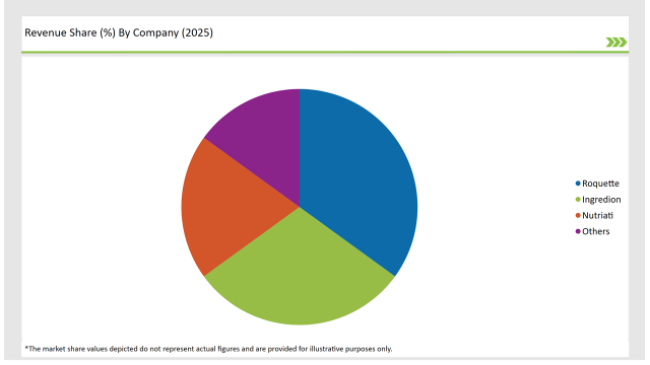

In the UK, the leading companies in the market, such as Roquette, Nutriati, and Ingredion, are extending the capacity while at the same time innovating the products and processes to meet the growing demand. The emphasis of these companies is to develop high-functional, chickpea protein ingredients that can support food producers in their quest for health and well-being. The market also received a major boost from the considerable rise in vegan and flexitarian diets in the UK, as now consumers are looking for ways to get their proteins without the use of gluten, dairy, and nuts.

The efforts undertaken by the UK with respect to sustainability and innovation in food manufacturing have translated into a regulatory background of support and incentives for the production of plant-based proteins. As well, advancements in the extraction and processing methods are rendering chickpeas a more attractive choice.

The technological improvements are the focus of most of our efforts in this area both to allow us to offer new products as well as improve our capacity. We see processing improvements both in terms of better functional properties of chickpea protein and also the environmental benefits coming from less waste and energy. The UK chickpea protein market is on its way to grow unprecedentedly.

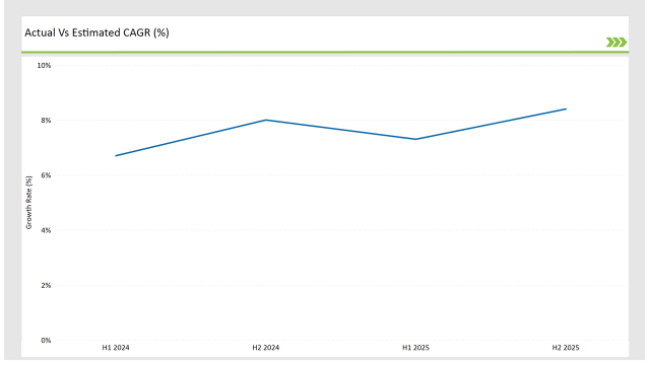

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Chickpea Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | Ingredion launched a new chickpea protein isolate tailored for use in dairy alternatives and functional beverages. |

| April 2024 | Roquette opened a new protein innovation center in the UK to enhance R&D efforts and product development. |

| July 2024 | Nutriati partnered with a leading UK bakery chain to supply chickpea protein for high-protein bread and pastries. |

| September 2024 | Ingredion introduced an organic chickpea protein line to meet the rising demand for clean-label and sustainable ingredients. |

| November 2024 | Roquette expanded its production capacity in the UK to cater to increasing demand from food manufacturers and retailers. |

Organic Chickpea Protein Popularity on the Rise

The organic chickpea protein is becoming ever more popular in the UK market, as customers are increasingly choosing environmentally friendly and sustainable products. Such companies as Ingredion are launching organic lines of chickpea protein to satisfy this demand, which helps manufacturers to produce high-end products for health-conscious and environmentally aware consumers. The organically maintained certifications offer an advantage to this segment, which is growing rapidly.

Chickpea Protein in High-Chickpea Protein Bakery Products

Chickpea protein enriched bakery products have greatly gained their popularity in the UK market as of late. The largest bakery chains are introducing chickpea protein into their bread, pastries, and snacks to answer to the rising consumer demand for high-protein, plant-based options. These product developments act as dual solutions that meet the needs for indulgence and nutrition in one go which is why they are one of the most fast-moving categories in the food and beverage processing segment.

Functional Beverage Innovation

Chickpea protein is being increasingly used for functional beverages such as protein shakes, smoothies, and plant-based milks. Its mild flavor and smooth texture make it a perfect component for these applications. Roquette has been R&D focusing on lithium chickpea protein solubility and stability in liquid formulations, which has in turn helped us to make beverages for active and health-conscious people even better.

% share of Individual categories by Product Type and Applications in 2025

Chickpea protein isolate is the most popular leaking product type, and the market catches 30% of it. Its practicality increases while this plant protein isolate is added to oil foods, emulsifiers, and even in beverages. People in the food sector are employing isolates in order to boost the protein content of products like dairy alternatives, protein bars, and meat substitutes. Ingredion and Nutriati are some of the companies that are leading this innovation in the area.

Food and beverage processing is the major end-user segment, accounting for 40% of market share partly due to its extensive applications. Chickpea protein finds its way into a vast array of foods and drinks, including plant-based snacks, baked goods, drinks with added protein, and many others because of its great nutrition and multipurpose usage.

The increasing demand for foods that are clean and free from allergens is another factor that has contributed to its growth in this segment. Empirical evidence has also shown that chickpea protein can be used to demonstrate additional vegan and flexitarians product features.

Note: above chart is indicative in nature

The UK chickpea protein market is moderately consolidated with a mixture of global and local manufacturers that is the main propeller of competition. Tier 1 firms like Roquette, Ingredion, and Nutriati can be found at the top of the list due to their well-established R&D and distribution formats and a concentration on innovation.

Tier 2 companies tend to explore niche markets such as organic while also emphasizing the specific functions they are making. Players are pushing the envelope to stay competitive by utilizing sophisticated processes that both elevate the quality and nutritional profile of chickpea protein.

On the other side, such mergers and collaboration with the food and drink manufacturers have both practical benefits and the social environment attached to them. Sustainability-oriented and clean-label products are expected to be a driver for further innovation in the market as a result of both.

Isolate, Concentrate, Textured, and Hydrolyzed

Food & Beverage Processing, Sports Nutrition, Infant Nutrition, Pharmaceutical Products, Personal Care Products, and Animal Nutrition.

The UK chickpea protein market is driven by the rising consumer demand for plant-based, sustainable protein sources that cater to the growing trend of flexitarianism and veganism. Factors such as the health benefits of chickpea protein, its versatility in food and beverage applications, and the increasing awareness of environmental concerns surrounding traditional protein sources are fueling the market's expansion in the UK.

Prominent players in the UK Chickpea Protein manufacturing include Nutriati, Tesco, Hodmedod's, Protein Rebel, Bühler Group, Cosucra, and Roquette. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Fish Protein Market Outlook – Share, Growth & Forecast 2025–2035

Chickpea Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Overview of Chickpea Protein Companies

UK Fungal Protein Market Growth – Innovations, Trends & Forecast 2025–2035

USA Chickpea Protein Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Chickpea Protein Market Trends – Growth, Demand & Forecast 2025–2035

Europe Chickpea Protein Market Outlook – Size, Share & Forecast 2025–2035

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

Australia Chickpea Protein Market Outlook – Demand, Trends & Forecast 2025–2035

Latin America Chickpea Protein Market Analysis – Demand, Share & Forecast 2025–2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA