The UK Frozen Ready Meals market is poised to reach a value of USD 2,007.3 million in 2025, and further expand at a CAGR of 6.4% to reach USD 3,734.9 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,007.3 million |

| Industry Value (2035F) | USD 3,734.9 million |

| CAGR (2025 to 2035) | 6.4% |

The UK frozen ready meals market is still making a mark in the industry worldwide and it is primarily due to new trends in consumer eating habits, convenience, and high-quality frozen meal options. The hectic lives of working professionals along with families are persuading them more and more to go for frozen meals, which is both convenient and includes stuff that they don’t eat in usual. As the households of single people are now at an all-time high, it can be seen that the growth of individually portioned frozen meals is actually making them a vital part of the food area in the UK.

The market is also in a divine state due to the change in consumer dietary habits, with the number of brands injecting their product lines with new and forthcoming healthier frozen meals. A visible shift towards controlling the sizes of the portions of food and a dedicated approach to balanced diets is affecting the choices of the consumers, which in return, is leading the companies to change their recipes to the demands of the health-oriented society.

The trend among the UK consumers is also that they are more and more ready to pay for a premium frozen meal which is resembling the restaurant quality of the food the most. The scenario has taken a toll on the companies concerning product innovation that focused on different cuisines, chef-designed recipes, and new methods for taste enhancement and material preservation.

Although the price of raw materials goes up and down, the market is still holding its fort because of strong dealer relations and a rising focus on direct-to-consumer frozen meal subscription models. Supermarkets and online retailers are increasing the space for frozen products and online promotions thus feeding back their dominance in the market.

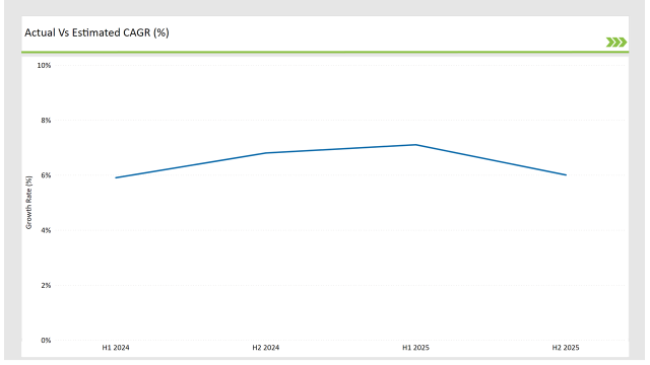

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025), specifically for the UK Frozen Ready Meals market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Nomad Foods launched a premium frozen chicken meal range focusing on high-protein, low-fat options. |

| Oct 2024 | Iceland Foods expanded its plant-based frozen ready meal portfolio with vegan-friendly chicken alternatives. |

| Sep 2024 | McCain Foods partnered with leading food chain services to enhance the quality and diversity of frozen meal offerings. |

| Aug 2024 | Birds Eye introduced frozen gourmet ready meals targeting health-conscious consumers. |

| Jul 2024 | Greencore Group announced investment in eco-friendly packaging for its frozen ready meal line. |

Growth of Restaurant-Inspired Frozen Ready Meals

The increasing demand by consumers for restaurant-quality dishes in frozen form has brought about a significant change in the UK frozen ready meals market. The trend for premium frozen options imitating the dining-out experience is more and more popular with the consumers.

Brands are collaborating with world-class chefs and restaurants to make gourmet frozen meals using only the best ingredients and real authentic flavors. This trend is on the rise also due to the cost-efficient approach of consumers who want to eat like in a restaurant without the price.

Rise of Limited-Edition and Seasonal Frozen Meal Offerings

Brands are making the most of seasonal trends to introduce unique frozen meals for a limited time, thus tailoring their products with consumer preferences during specific eras. Holiday-themed frozen meals, summer BBQ dishes, and the like are becoming popular, adding an extra fun element to the frozen foods category. This measure not only increases engagement with the brand but also compels the clients to act on impulse buying by looking for different, and more unique meal options.

Surge in Subscription-Based Frozen Meal Services

The frozen meal ready-to-eat services that are provided over subscription are rising to predominantly become the driving force in this area. They have prepared custom meal plans comprising of the kind of meals people prefer that also take into account the amount of calories and the kind of protein accordingly.

These solutions target busy consumers who look for a more organized way of meal planning and enjoy the simple fact of getting pre-prepared frozen dishes that are delivered to them. The growth of digital food platforms and tailored meal schemes that go with them is making the demand go up for subscription-based frozen products, which in turn is captivating the interest of firms away from the traditional retail channels.

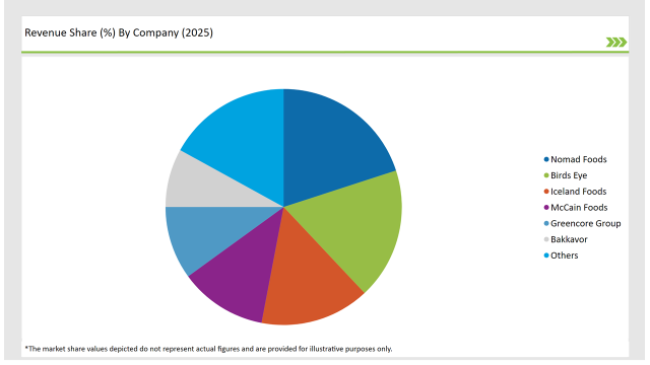

With moderate levels of competition, the UK frozen ready meals market is home to key players who are pursuing various alternatives, including new product innovations, exclusive brand partnerships, and expansions of the frozen meal categories to meet the consumers' constantly changing choices.

Some of the frontrunners in this segment consist of Nomad Foods, Birds Eye, Iceland Foods, McCain Foods, Greencore Group, and Bakkavor. These brands are famous for the introduction of multiple meal types and this number includes those that meet various dietary needs, like protein-loaded, calorie-restricted, and gourmet-style meals.

Retailers and frozen meal brands are moreover pumping in a considerable amount in the direct-to-consumer strategies that come along with the introduction of frozen ready meal delivery services and meal subscriptions. This transformation has let the businesses cover niches such as low-carb, high-fiber, and allergen-free with producing meals targeted just to that. Additionally, partnerships with food chain services have facilitated manufacturers to broaden their footprint which is found in the fast-moving takeaway and food delivery sector.

The competitive landscape is changing rapidly, with premium meal options and specialty frozen products taking on a bigger market share than before. It is anticipated that the constant investments in R&D and product differentiation will be the driving force of competition, ensuring that brands are forever relevant within a rapidly changing market setting.

2025 Market share of UK Frozen Ready Meals suppliers

Note: above chart is indicative in nature

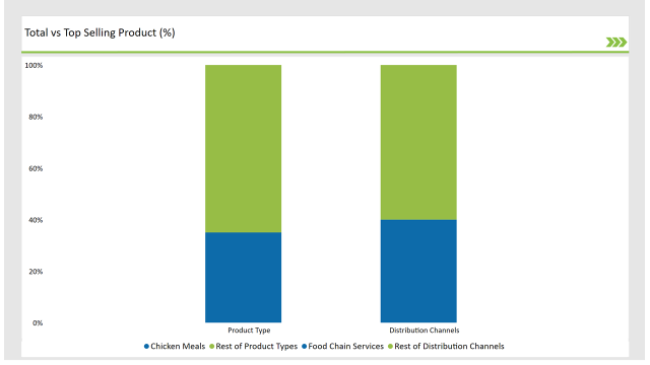

Chicken Meals: The Preferred Choice Among Consumers

Chicken meals account for one of the highest shares of the frozen ready meals market in the UK, and it is because chicken meals are popular and cheap. Customers prefer chicken-based dishes as they are rich in protein, fit for many types of cooking, and are great with different sauces.

The feedback from the customers about the fresh and healthy options has directed the brands towards the innovation of new products, with options like grilled, roasted, and marinated chicken ready meals made with low sodium and healthier seasoning options.

Food Chain Services: A Major Growth Driver

The food chain services together comprise 40% of the total market, mainly due to suppliers, catering, and quick-service restaurants, which are the major buyers of frozen ready meals. The easy use, profitable advantages, and adaptability of frozen meals have triggered their use across the foodservice sector. The consumers' pursuit of getting food via delivery and takeaway has further increased the demand, which has caused manufacturers to innovate meal solutions specific to the foodservice operators.

Vegetarian Meals, Chicken Meals, Beef Meals, Others

Food Chain Services, Modern Trade, Departmental Stores, Online Stores, Other Distribution Channel

Plastic, Aluminum Can, Glass.

Within the Forecast Period, the UK Frozen Ready Meals market is expected to grow at a CAGR of 6.4%.

By 2035, the sales value of the UK Frozen Ready Meals industry is expected to reach USD 3,734.9 million.

Key factors propelling the UK Frozen Ready Meals market include Busy lifestyles and the need for convenient, time-saving meal options, leading to increased demand for frozen ready meals among consumers. Advancements in product development and manufacturing processes, which have improved the quality, taste, and nutritional profile of frozen ready meals, making them more appealing to health-conscious consumers.

Prominent players in the UK Frozen Ready Meals manufacturing include Nomad Foods, Birds Eye, Iceland Foods, McCain Foods, Greencore Group, and Bakkavor. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA