The UK animal feed alternative protein market is forecasted to reach USD 689.2 million in 2025 and is expected to witness robust expansion, reaching approximately USD 1,981.0 million by 2035. This growth corresponds to a compound annual growth rate (CAGR) of 11.1% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 689.2 million |

| Industry Value (2035F) | USD 1,981.0 million |

| CAGR (2025 to 2035) | 11.1% |

A strong growth momentum for the UK animal feed alternative protein market is created by a significant shift in livestock and aquaculture sectors toward sustainable, high-efficiency sources of protein. The increasing prices of traditional protein ingredients such as soybean meal and fishmeal, along with growing concerns regarding environmental sustainability, are forcing manufacturers to innovate and diversify.

One main trend is how insect-based proteins are becoming rapidly adopted, together with a further increase in single-cell protein sales in aqua feed. However, plant-based protein sources show expansion, following the general awareness of affordability and availability. Using advanced feed formulation, enhanced digestive solutions, as well as nutritional precision, makes companies differentiate better in the emerging competitive market arena.

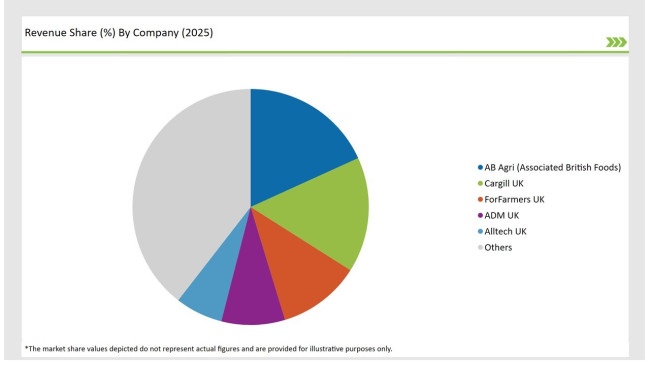

The competition within the sector is fierce, with established players like AB Agri, Cargill UK, and ForFarmers UK endeavoring into partnerships, vertical integration, and new product innovations in order to build strength. The new players are also spearheading investments in alternative protein R&D as evolutions in livestock dietary needs, especially in poultry and aquaculture segments.

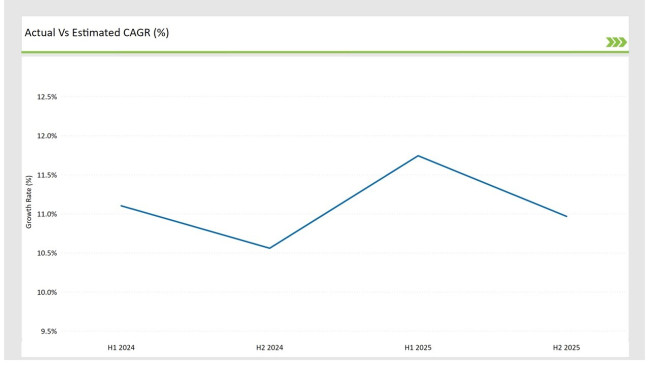

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Animal Feed Alternative Protein market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | H1 Growth Rate (%) |

|---|---|

| 2024 | 11.1% |

| 2025 | 11.7% |

| Year | H2 Growth Rate (%) |

|---|---|

| 2024 | 10.6% |

| 2025 | 11.0% |

For the UK market, the Animal Feed Alternative Protein sector is projected to grow at a CAGR of 11.1% during the first half of 2024, with an increase to 10.6% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 11.7% in H1 and reach 11.0% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Entocycle secured £15M in Series B funding to expand their insect protein production facility in Scotland. The facility aims to produce 100,000 tonnes of insect-based protein annually for the UK animal feed market. |

| Oct-2024 | Smart Proteins Ltd opened their first commercial-scale mealworm protein facility in Manchester with £20M investment. The company expects to supply major UK pet food manufacturers and aquaculture companies starting Q1 2025. |

| July-2024 | AgriProtein UK partnered with major poultry producer Avara Foods to supply black soldier fly protein for chicken feed. The partnership marks a significant shift towards sustainable protein sources in UK's poultry industry. |

| Apr-2024 | Yorkshire-based Future Feed Solutions acquired vertical farming startup GreenProtein for £8M. The acquisition aims to combine vertical farming technology with protein extraction methods for creating plant-based feed alternatives. |

| Feb-2024 | British algae protein manufacturer AlgaeFeed launched their new microalgae-based protein concentrate for pig feed. Early trials showed improved growth rates and reduced environmental impact compared to traditional soybean meal. |

Rise of Insect-Based Protein for Poultry and Aquaculture Feed

The rapid emergence of insect-based protein is happening in the UK as a sustainable and highly efficient feed ingredient. Companies, such as Protix and Entocycle, are scaling up their production levels, since these products - including black soldier fly larvae and mealworms- show better digestibility and low environmental impact.

Increased acceptance by poultry and aquaculture companies of insect-based protein is related to high protein content, higher feed conversion rates, and also to regulatory approval. As the UK prioritises sustainable agriculture, insect protein adoption is set to surge.

Expansion of Fish Meal Alternatives Amid Overfishing Concerns

There is a growing need for fish meal alternatives because of the UK's efforts to reduce pressure on marine resources. Some of the single-cell proteins, algae-based feeds, and fermentation-derived proteins have emerged as the potential substitutes.

Companies like Calysta and Unibio are investing in fermentation-based protein sources to help the aquaculture industry. With growing EU and UK regulations on sustainable fishing practices, it is expected that fish meal alternatives will capture considerable market share in the near future.

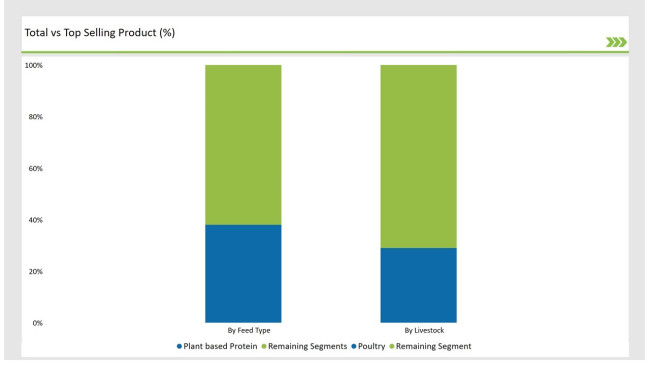

| Feed Type | Market Share |

|---|---|

| Plant-Based Protein | 38% |

| Remaining Segments | 62% |

Plant-based proteins will continue to hold the majority in the UK alternative protein market in animal feed as they are the most cost-effective and readily available. Soy, pea, and wheat proteins dominate poultry and livestock feed. Insect-based protein is increasingly finding acceptance, mainly in aquaculture and poultry, because of its high amino acid profile and environmental advantages.

Single-cell proteins and algae-based feeds are attracting investment but remain niche compared with traditional plant-based alternatives.

| Livestock | Market Share |

|---|---|

| Poultry | 29% |

| Remaining Segments | 71% |

The alternative feed proteins continue to be mainly consumed by the poultry sector due to high demand for cost-effective high-protein feed formulations. Trending towards sustainable broiler farming and antibiotic-free poultry production has, on the other hand, further increased this trend.

Aquaculture is another fast-growing sector where fish meal alternatives are more widely available. Swine and cattle segments are relatively slow to adapt to alternative proteins in preference for conventional feed sources and diets.

UK market leading firms are investing in increased production facilities and research and development on alternative protein sources. AB Agri and Cargill UK have the significant feed production centers located in England and Scotland. ForFarmers UK and ADM UK emphasize strategic collaboration with regional raw material suppliers.

Direct sourcing of supply chains includes the producer networks for soybean, insect, and algae protein; these also possess significant distributor networks throughout key livestock and aquaculture clusters. Sustainability-focused initiatives, including low-carbon footprint feed formulations and alternative ingredient integration, are gaining traction across the sector.

Plant-Based Protein, Insect-Based Protein, Fish Meal Alternative, Single-Cell Proteins, Others

Poultry, Aquaculture, Swine, Cattle, Equine

Meal, Pellets, Liquid, Freeze-Dried

The UK animal feed alternative protein market is projected to grow at a CAGR of 11.1% from 2025 to 2035, driven by increasing demand for sustainable and cost-effective protein sources in livestock nutrition.

By 2035, the UK animal feed alternative protein market is forecasted to reach a total value of USD 1,981.0 million, showing strong industry expansion due to technological advancements and regulatory support.

The UK market is expanding due to the rising costs of traditional feed ingredients, regulatory pressure to reduce environmental impact, and growing demand for high-efficiency protein sources in poultry and aquaculture sectors.

Livestock-intensive regions such as East Anglia, Yorkshire, and Scotland lead in consumption, with a growing presence in Wales and the South West, where aquaculture and sustainable farming initiatives are expanding.

Major players in the UK market include AB Agri (Associated British Foods), Cargill UK, ForFarmers UK, ADM UK, and Alltech UK, alongside regional firms such as Devenish Nutrition and Premier Nutrition.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA