UK Bakery Ingredients market sales will reach approximately USD 3,287.5 million by the end of 2025. Forecasts suggest the market will achieve a 4.4% compound annual growth rate (CAGR) and exceed USD 5,056.7 million in value by 2035

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,287.5 million |

| Industry Value (2035F) | USD 5,056.7 million |

| CAGR (2025 to 2035) | 4.4 % |

The UK bakery ingredients market is having continuous expansion largely due to the increasing demand of the consumers for high-quality baked products, clean-label ingredients, and creative formulations. While the home baking and artisanal bakery trends are on the rise, manufacturers are focusing on giving the customers premium ingredients that meet their changing preferences. The demand for gluten-free, organic, and plant-based baking has led to the rise of specialized ingredients that positively affect the texture, taste, and the number of days the product can be stored.

The market is largely shaped by the fact that health-conscious consumers are gradually taking over the choice of the raw materials with a preference for natural and minimally processed ingredients in their baked products. As a result, there has been a newly found interest for the demand of wholegrain flours, alternative sweeteners, and functional ingredients such as fiber-enriched and high-protein blends. Moreover, the quest for sustainability and ethically sourced materials, which have become major concerns, pushed bakery ingredient suppliers to commit to sourcing from known and responsible suppliers.

Super bakeries, foodservice providers, and industrial baking units are persistently renewing their operations to meet the convenience and on-the-go bakery snacks demand. The fact that frozen and pre-packaged bakery products are mostly favored by the customers also adds on the overall consumption of ingredients in the commercial sector.

Progressing with innovation in formulating and product development, the UK bakery ingredients market is projected to maintain on the rise. In their quest for both healthier and more decadent trends in the baked goods, the ingredient manufacturers are entering the field with advancements such as new solutions that not only visibly improve the products but also attract a larger audience.

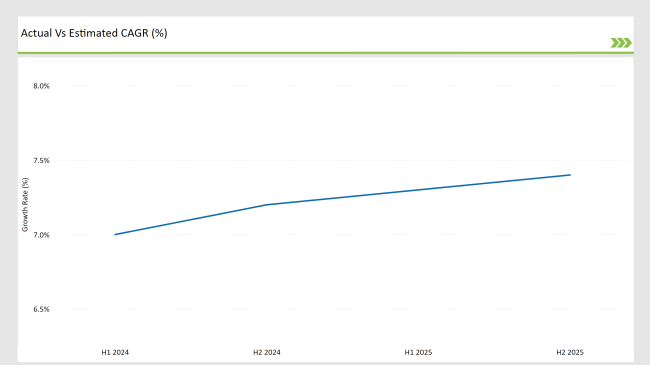

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Bakery Ingredients market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Dawn Foods UK introduced a new line of clean-label bakery mixes free from artificial preservatives. |

| March 2024 | AB Mauri expanded its UK operations with a new manufacturing facility specializing in specialty flours. |

| June 2024 | Tate & Lyle launched a fiber-enriched baking ingredient aimed at improving gut health in bakery products. |

| August 2024 | A report from UK Bakery Insights highlighted a 10% increase in demand for gluten-free bakery ingredients. |

| October 2024 | Puratos UK partnered with artisanal bakers to develop premium sourdough-based ingredient solutions. |

Growth in Demand for Clean-Label and Functional Ingredients

The majority of consumers nowadays are into the trend of buying products that are made from natural materials. This is the primary reason why the clean-label has gained such growth. There is no artificial additive, preservatives, and emulsifiers.

Ingredient companies do their best to keep up with this trend by offering less processed, organic, and gluten-enriched products that are healthier as for the customers. Furthermore, the inclusion of such functional ingredients as protein-enriched flours and plant-derived emulsifiers is becoming popular in both commercial and retail baking sectors.

Artisanal and Specialty Baking on the Rise

The artisanal and specialty baking sector in the UK has a positive tendency for growth as more consumers demonstrate their interest in traditional and luxurious food. It is this tendency that has pushed the need for high-quality flours, slow-fermentation starters, and naturally fermented baking agents.

A variety of the local bakeries and specialty food stores are concentrating on heritage grains and long-fermentation techniques to increase flavor and nutritional value. To respond to this trend, some suppliers are providing tailor-made solutions for craft bakers.

Expansion of Bakery Ingredient Innovation

Manufacturers are directing their funds to the product innovation scheme with the objective of getting the products to have improved performance and sensory appeal to the consumers. This line of action includes the development of such advanced enzyme-based solutions which not only retain moisture but also stabilize dough and extend shelf life.

Ground-breaking developments also come from the sugar reduction field which is achieved with the application of naturally derived sweeteners and fiber-based sugar substitutes. As bakery formulations change, enterprises are putting emphasis on the use of the right ingredients in the proper proportions for the products to be added to the customer health issues list.

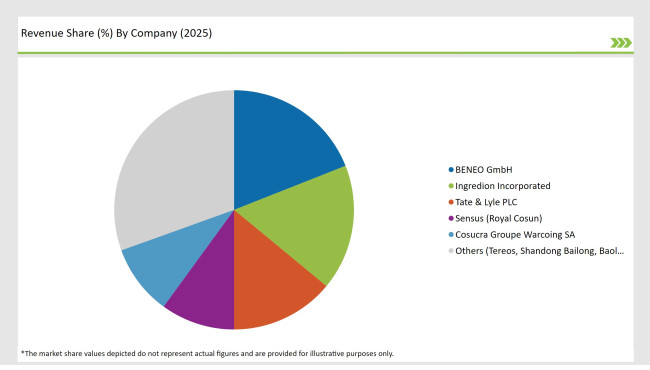

The UK bakery ingredients market is quite cutthroat, populated by global and local actors who consistently push the envelope when it comes to innovation, sustainability, and product quality to increase their market share. The foremost companies including Tate & Lyle, AB Mauri, Dawn Foods UK, and Puratos UK have the wheelhouse of the development of specialty ingredients responding to the reshaping consumer trends.

In order to keep a competitive edge, manufacturers are committing to the delivery of sustainable ingredient sourcing, plant-based alternatives, and sugar-reduction technologies. Besides, the partnerships with commercial bakeries and foodservice providers are the main catalyst for the sale expansion which in turn creates a solid ground in the already flourishing UK bakery industry. As the premium, functional, and artisanal food products gain much customer trust, the bakery ingredient market in the UK is predicted to grow continuously per the same trajectory in the near future.

2025 Market share of UK Bakery Ingredients suppliers

Note: above chart is indicative in nature

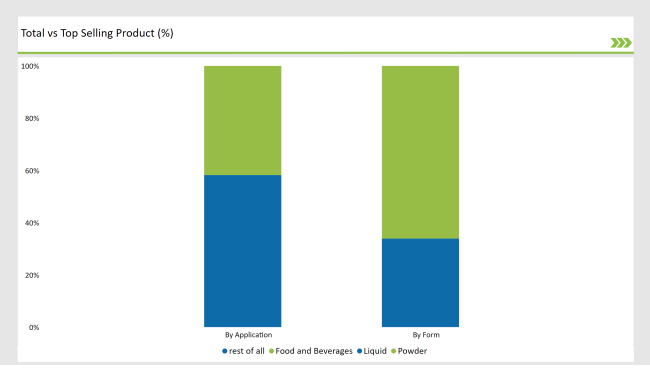

Flours: The Foundation of the Bakery Ingredients Market

Flours remain the most significant and irreplaceable element in the UK bakery ingredients market. They possess no less than 35% of the total sales. The demand for specialty flours, such as whole wheat, rye, and ancient grains, is surging as consumers are on the lookout for increased nutrition and taste in their baking.

The segment is witnessing the expansion of gluten-free and alternative flours like almond, coconut, and oat flour that are also on the rise. Commercial bakeries are upgrading their flour with fiber and protein fortification and essential vitamins added to keep up with the latest dietary trends.

Commercial Baking: The Largest End-User Industry

The commercial baking sector tops the UK bakery ingredients market, accounting for 45% of the total ingredient consumption. Large-scale bakeries, food manufacturers, and quick-service restaurant chains are key buyers, fueling demand for bulk flours, emulsifiers, stabilizers, and bakery enhancers. Still, the recently grown frozen and ready-to-bake product trends have stamped on shelves longer products of high quality with the assistance of shelf-stabilizing ingredients.

Flours, Sweeteners, Leavening Agents, Fats and Oils, Others

Commercial Baking, Home Baking, Industrial Baking.

Within the Forecast Period, the UK Bakery Ingredients market is expected to grow at a CAGR of 4.4%.

By 2035, the sales value of the UK Bakery Ingredients industry is expected to reach USD 5,056.7 million.

Key factors propelling the UK Bakery Ingredients market include growing influence of health-conscious consumers, increasing consumer demand for high-quality baked goods, clean-label ingredients, and innovative formulations.

Prominent players in the UK Bakery Ingredients manufacturing Tate & Lyle, AB Mauri, Dawn Foods UK, and Puratos UK. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA