The UK Food Emulsifier market is expected to reach USD 172.3 million in 2025 and is projected to reach a total value of USD 226.6 million by 2035. This represents a compound annual growth rate (CAGR) of 2.8% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 172.3 million |

| Industry Value (2035F) | USD 226.6 million |

| CAGR (2025 to 2035) | 2.8% |

The UK food emulsifier market is on a growth trajectory, propelled by the ever-rising demand for processed and convenience food items. Emulsifiers are the ones that make a significant difference in the texture, quality, stability, and shelf life of the final products including the likes of baked goods, dairy products, sweets, and processed meats, among others.

As the trends switch from the use of synthetic emulsifiers to clean-label, natural, and plant-based ingredients, plant-based emulsifiers have been catching on with food manufacturers the most. The development of plant-based and vegan foods in a fast-expanding manner has to a large extent brought about a growing emulsifier market.

Plant-based emulsifiers that constitute a large portion of the market have become the norm for the suppliers who are looking for health-friendly and environmentally the most sustainable consumers. In addition to that, the progressive trend toward functional emulsifiers, which provide other health advantages like better digestion and lower fat level, is changing the market structure.

Mono- and diglycerides are the leaders in the emulsifier market taking up 35% of the share. These emulsifiers are frequently utilized because of their profit in stabilizing the emulsions, the benefit that they have in the addition of dough conditioners in baked goods, and the virtue of a thicker texture of margarine and spreads that they bring.

With the current demand being for functional food ingredients, the producers are engaging in research and development to come up with emulsifiers that provide greater stability while still being clean-label products that are in line with the regulatory and consumer expectations.

Nothing less than fluctuating raw material prices and tough food safety regulations emerge as formidable challenges during the quest for market growth. Nevertheless, the West is forecasted to continue its growth through the development of natural emulsifiers and the rising demand for top-grade and organic food products.

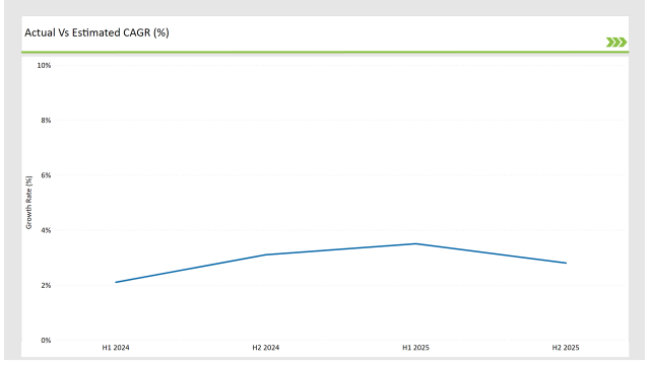

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Food Emulsifier market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Cargill introduced a new range of plant-based emulsifiers for bakery and confectionery applications in the UK. |

| Oct 2024 | Kerry Group launched a clean-label emulsifier alternative targeting the dairy and beverage industries. |

| Sep 2024 | DuPont expanded its emulsifier production facility in the UK to meet the rising demand for sustainable food ingredients. |

| Aug 2024 | Palsgaard partnered with UK food manufacturers to develop palm-free emulsifier solutions for bakery products. |

| Jul 2024 | ADM introduced a multi-functional emulsifier blend designed to enhance the texture of plant-based dairy alternatives. |

Escalating Interest in Clean-Label and Pure Emulsifiers

People in the UK are gradually favoring clean-label items which, in turn, is enacting change in the form of going away from artificial emulsifiers. Consequently, as the food manufacturers look for ways to meet the requirements of the customers concerning the environment and the regulations, they tend to the employment of plant-based and natural emulsifiers.

The ingredients that are associated with being not genetically modified, free from allergens, and the environmentally friendly qualities are lecithin, gum arabic, and sunflower emulsifiers. Enterprises revise their product ranges by removing artificial additives, they target cleanliness in processing, and provide transparent supply chain information.

Spreading Set of Applications for Plant-Based and Vegan Foods

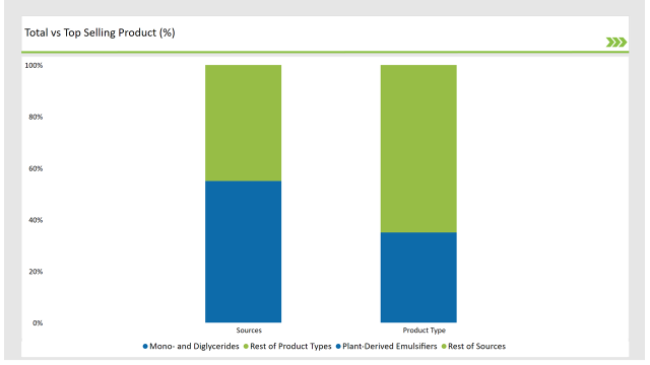

The increasing of plant-based diets has a considerable impact on the emulsifiers' marketplace, presently comprising plant-derived emulsifiers of 55% of the total market share. The products identical to dairy and meat that are vegan and plant-based, compared to the original ones require more effective emulsifiers to retain physical stability and improve the mouthfeel.

Consequently, the development of alternative plant-based dairy, cheese, and meat substitutes is spurred by food manufacturers that are coming up with new emulsifier combinations that require no compromise on flavor or texture.

Technological Improvements in Functional Emulsifiers

Firm manufacturers of food emulsifiers are investing in R&D on the development of multifunctional emulsifiers that provide additional health effects. The latest technology involves emulsifiers that help in reducing fat in processed foods, increase the absorption, and improve gut health.

These products are in sync with the expanding market trends that favor functional, nutrient-enriched foods for the customer. Majority of companies adopt the same strategy with measures like multi-functional emulsifier mixtures that collaboratively affect food texture, manage shelf life stability, and contribute to a clean-label product profile.

% share of Individual categories by Product Type and Source in 2025

Mono- and diglycerides are the most widely used emulsifiers in the UK food market, controlling a 35% market share. This is due to their functionality and extensive application across different food categories. The use of these emulsifiers is pivotal in the improvement of bakery products by modifying the dough texture and crumb structure.

They also help margarine, spreads, and dairy products by enhancing the emulsification and stability. As the trend for healthier baked goods and lower fat manifestations increase, producers are working on advanced mono- and diglycerides technology outcomes that perform better with a clean label.

Plant-derived emulsifiers which cover 55% of the market in the UK are becoming popular due to manufacturers consuming fewer animal and synthetic alternatives. The most common examples are the use of soy lecithin, sunflower lecithin, and alginate in candy, dairy, and plant-based products respectively.

These emulsifiers perform excellently while they keep up with the increased request for vegan, allergen-free, and non-GMO food components. The study of new plant-sourced emulsifiers, such as pea protein-based emulsifiers is being carried out with a view to provide a sustainable and practical alternative which is effective than the products used currently.

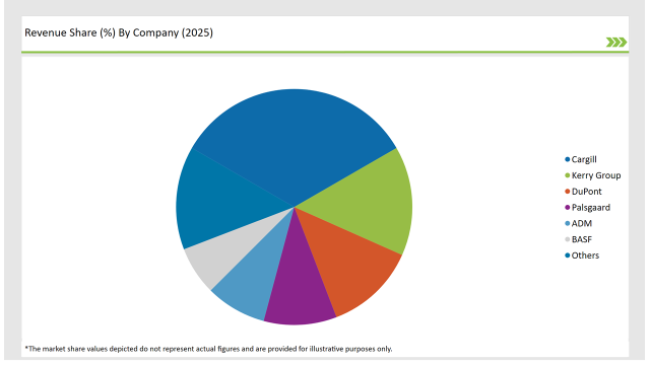

The UK emulsifier food market is fairly contended, with the companies striving in product development, sustainability, and forming partnerships with food processors. The leading players in the marketplace are Cargill, Kerry Group, DuPont, Palsgaard, ADM, and BASF. These firms are intensely putting cash into research to create clean-label, functional, and sustainable emulsifier routes that cope with the ever-changing demands of the industry.

2025 Market share of UK Food Emulsifier suppliers

Note: above chart is indicative in nature

Within the Forecast Period, the UK Food Emulsifier market is expected to grow at a CAGR of 2.8%.

By 2035, the sales value of the UK Food Emulsifier industry is expected to reach USD 226.6 million.

Key factors propelling the UK Food Emulsifier market include the Growing demand for processed and packaged food products, which rely on emulsifiers to improve texture, stability, and shelf-life. Increasing consumer preference for clean-label and natural food ingredients, leading manufacturers to explore plant-based and natural emulsifier alternatives.

Prominent players in the UK Food Emulsifier manufacturing include Cargill, Kerry Group, DuPont, Palsgaard, ADM, and BASF. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

UK Chickpea Protein Market Insights – Demand, Size & Industry Trends 2025–2035

UK Pulses Market Growth – Trends, Demand & Innovations 2025–2035

UK Probiotic Strains Market Trends – Growth, Demand & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA