UK Probiotic Strains sales will reach approximately USD 240.5 million by the end of 2025. Forecasts suggest the market will achieve a 3.2% compound annual growth rate (CAGR) and exceed USD 329.5 million in value by 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 240.5 million |

| Industry Value (2035F) | USD 329.5 million |

| CAGR (2025 to 2035) | 3.2% |

Owing to the rise in consumer consciousness about gut health and probiotics' effect on overall health, the probiotics strains market in the UK is thriving. Probiotics, which are live microorganisms that if taken in adequate amounts, provides health benefits, are mostly added to dietary supplements, functional foods, and pharmaceutical applications.

The increasing demand for probiotic strains is attributed to the major part of digestive disorders, probiotics, and health concerns related to the immune system, and expanding interest in preventive healthcare.

The high demand for probiotic-based products has been partly the result of the demographic shift in the UK and the lifestyle changes which have led to digestive disorders such as irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD).

Furthermore, it has been the growing introduction of probiotics in products like gluten-free bread that gives them more market opportunities. Aiding in the growth of the probiotic market are the antigenic frameworks in the UK especially after Brexit.

Protective labeling and health claim regulations have been a burden for the producers, which have resulted in the provision of scientifically validated products to meet compliance standards.

As a result, the major players are engaging in the clinical researches that provide evidence of the health benefits of these microorganisms and that are a tool to the increase in consumer trust. Not only the interest in research on the gut microbiome is rising but also is the expansion of knowledge about specific strains of probiotics; as a result, the UK probiotic strains market is anticipated to develop continuously.

The industry is transitioning with innovations in the formulations, increased product life, and the launch of new formats of delivery; capsules, powders, and gummies.

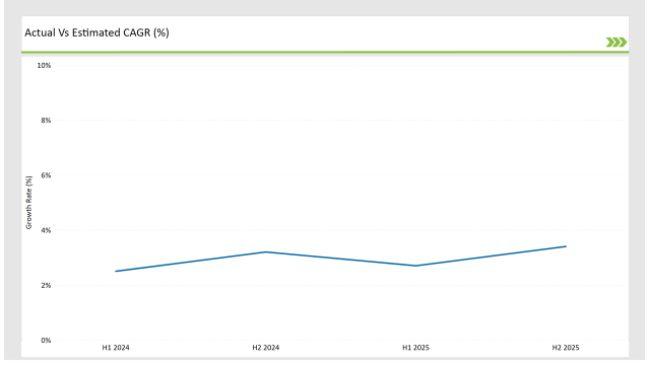

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Probiotic Strains market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | BioGaia introduced a new probiotic strain targeted at improving gut microbiome balance in elderly populations, enhancing digestive health support. |

| April 2024 | Chr. Hansen launched a clinically backed Lactobacillus strain specifically designed to support immune system function, expanding its probiotic portfolio. |

| June 2024 | DuPont Nutrition & Biosciences partnered with UK-based supplement brands to introduce shelf-stable probiotic capsules with enhanced bioavailability. |

| August 2024 | A study by UK Probiotic Research Institute reported a 12% year-over-year increase in probiotic supplement consumption, reflecting rising health consciousness. |

| October 2024 | Yakult UK expanded its product range with a high-potency probiotic drink formulated for individuals with lactose intolerance, diversifying its consumer base. |

Personalized Probiotics Gaining Traction

The probiotic market is undergoing a transformative journey as the demand for personalized nutrition continues to surge, with a special emphasis on customized probiotic strains. As consumers become more conscious of their health, they are showing a preference for probiotics that are specifically tailored to their individual needs, for instance, those that aid digestion, support mental health, or improve skin conditions.

Companies are engaging in microbiome testing services that provide a strain-specific probiotic supplement recommendation based on gut profile analysis, hence advancing the precision nutrition movement. In the same way, probiotic outlets and brands are introducing subscription-based plans offering monthly personalized formulations of probiotic products that would promote easier access to personalized gut health solutions.

Moreover, the novelties derived from the use of AI technology and the processing of data that are also evident in microbiome research are leading the companies to the correct probiotic decisions based on the scientific research which will in turn increase the sales.

The Expansion of Non-Dairy Probiotic Products

The increasing popularity of plant-based and lactose-free diets has encouraged the invention of non-dairy probiotic formulations. Manufacturers are fortifying plant-based yogurt, kefir, and functional beverages with probiotics to meet the needs of vegan and lactose-intolerant customers.

The microencapsulation technology promotion is allowing probiotics to be included in non-dairy matrices which leads to higher stability and efficacy in different food and beverage applications. Major food and drink manufacturers are collaborating with biotech enterprises to existing probiotic strains for the plant-based formulations.

Overall, the demand for non-dairy probiotics has increased, thus, powdered and freeze-dried formats, which are easy to use in food products, have been developed.

Growing Research on Probiotic-Mediated Mental Health Benefits

The newly released findings concerning gut-brain connections are persuading the public to show more interest in probiotic organisms that could positively affect their mental health. Many Lactobacillus and Bifidobacterium strains have been found to help in alleviating anxiety, depression, and cognitive decline.

As a result, probiotic products marketed with mood-improving properties have begun to be produced, which, in turn, have caused the spread of "psychobiotics" in the holistic health sector in the UK. Psycho-probiotics trials proved that the studied strains had positive effects on stress levels, sleep patterns, and inflammation, therefore packaging these strains with other health benefits is further justification for their use.

The supplement brands and the pharmaceutical industries are consequently being inspired by the growth of the evidence to create probiotics directed at the mental health field that is including combinations of probiotics with adaptogens and nootropics.

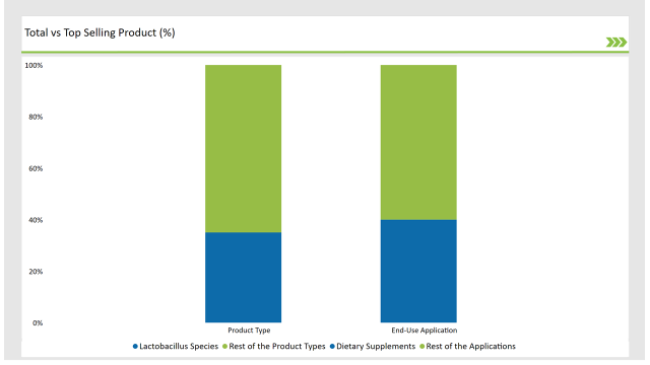

% share of Individual categories by Product Type and Applications in 2025

Relatively speaking, the Lactobacillus species is the biggest strain with 35% of the marketing share. They have also been known to be the strains that support gut health the best, thus, they are in the first place in the immune-boosting process and are helpful for the digestion process.

Found mostly in fermented foods, Lactobacillus probiotics are getting widely used in food, and dietary and medicinal applications. They favor the formulation of probiotics because of their capacity to survive stomach acid and bile.

Dietary supplements supply the biggest end-use market for probiotic strains, comprising 40% of the industry. The availabilities of preventive health solutions have caused a substantial increase of interest in probiotic products dealing with caps, gummies, and powders.

The superiority of these supplements in offering controlled doses and a longer time of the shelf life is better than their food equals, and this is the reason they are used as a simple regular consumption option. Another reason explaining the fast growth of the probiotic dietary supplements sector is the online shopping boom of e-commerce and other direct-to-consumer supplement companies.

Note: above chart is indicative in nature

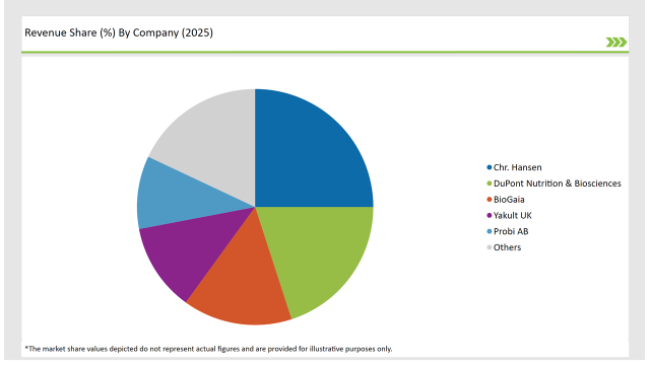

Because of the moderately competitive nature of the UK probiotic strains market, uh, there are both global and local players engaging in fierce competition through innovations, research, and construction of strategic partnerships. As a matter of fact, the dominating probiotic strains manufacturers such as Chr. Hansen, biotechnological, NutraFruit, BioGaia, and Yakult do lead the market through scientific investigation and clinical research results.

To keep their competitors at bay, they strive to be at the forefront of strain-specific clinical trials and in that way to demonstrate their probiotic product's efficacy and compliance with UK regulatory standards. Collaboration with drug companies, and supplement retailers and suppliers also support the expansion of probiotics to other health areas they have not targeted before.

Moreover, consumers have shown a strong desire for high-potency, shelf-stable, and thus the drive-forces for the delivery system development for the next generation of probiotic products.

Constant innovations in gut microbiome science alongside a growing consumer preoccupation with preventive health should keep the UK probiotic strains market on a forward path of expansion and discovering the new product possibilities and new pathways for the marketplace.

Lactobacillus Species, Bifidobacterium Species, Bacillus Species, Others

Food & Beverage Processing, Dietary Supplements, Personal Care & Cosmetics, Others.

Within the Forecast Period, the UK Probiotic Strains market is expected to grow at a CAGR of 3.2%.

By 2035, the sales value of the UK Probiotic Strains industry is expected to reach USD 329.5 million.

Key factors propelling the UK Probiotic Strains market include the increasing consumer awareness of gut health and the role of probiotics in maintaining overall well-being.

Prominent players in the UK Probiotic Strains manufacturing include Chr. Hansen, biotechnological, NutraFruit, BioGaia, and Yakult. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Probiotic Supplements Market Report – Size, Share & Outlook 2025-2035

UK Probiotic Ingredients Market Analysis – Size, Growth & Industry Trends 2025-2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

USA Probiotic Strains Market Report – Trends, Demand & Industry Forecast 2025–2035

ASEAN Probiotic Strains Market Analysis – Size, Share & Forecast 2025–2035

Europe Probiotic Strains Market Outlook – Share, Growth & Forecast 2025–2035

Australia Probiotic Strains Market Growth – Trends, Demand & Innovations 2025–2035

Latin America Probiotic Strains Market Insights – Demand, Size & Industry Trends 2025–2035

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA