UK Pulses sales will reach approximately USD 3,301.2 million by the end of 2025. Forecasts suggest the market will achieve a 4.1% compound annual growth rate (CAGR) and exceed USD 4,933.8 million in value by 2035.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size (2025) | USD 3,301.2 million |

| Projected UK Industry Value (2035) | USD 4,933.8 million |

| Value-based CAGR (2025 to 2035) | 4.1% |

Enhanced demand for plant-based and sustainable food products has triggered the UK pulses market to achieve massive growth. Among the pulses, peas, lentils, chickpeas, and beans, are the most sought-after ones credited for their health advantages.

Apart from the fact that they are a source of protein, fiber, and necessary vitamins, the inclusion of these legumes in the daily meals they help to balance the diet of a person. The notable factor is the wave of pulses in such products as plant-based protein and clean-label formulations.

To the delight of consumers, who have been gradually opting for natural foods with no additives, pulses have found a place in several creative food products such as mock meats or high-protein snacks. They are also now getting more common in gluten-free and allergen-friendly food byproducts, a step towards the health of these specific consumer groups.

Prominent players such as AGT Foods, Bühler Group, Cargill, and Bonduelle are increasing their operations and improving their processing technologies to meet the demand surges.

These improvements involve the installation of the latest high-tech sorting, cleaning, and milling machines, the ultimate goal is a superior-quality pulse product to catch a meticulous consumer's attention. The manufacturers' partnership with food innovators contributes even more to the development of new, tailored products that resonate with contemporary eating habits.

As the first, pulses improve soil microbiology and decrease competition with other plants, which is a part of UK sustainability objectives. Thus, pulses featuring this double environmental and nutritional value support the food industry transformation towards a greener era.

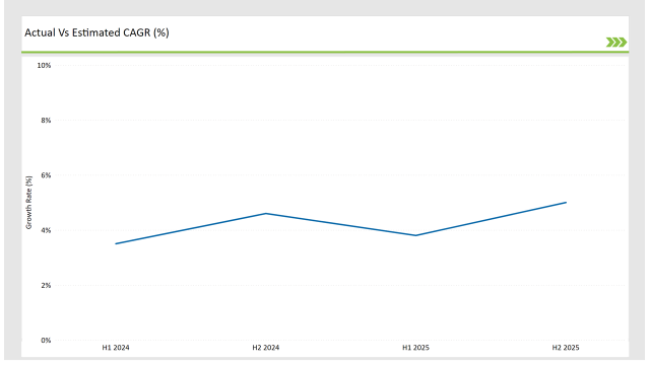

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Pulses market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| February 2024 | AGT Foods launched a new range of pre-cooked pea-based products targeting the convenience food segment. These products are designed for quick preparation while retaining their nutritional value. |

| April 2024 | Cargill expanded its UK operations by opening a new processing facility for pulse-based protein ingredients. This facility focuses on producing high-quality pea protein for plant-based meat and dairy alternatives. |

| June 2024 | Bühler Group introduced advanced sorting technology for pulses, ensuring higher quality and reduced waste during processing. This innovation aims to enhance product appeal for both manufacturers and end consumers. |

| August 2024 | A report by The British Dietetic Association highlighted a 12% year-over-year increase in pulse consumption in the UK, driven by health and sustainability trends. The report also emphasized the growing role of peas in plant-based food innovations. |

| October 2024 | Bonduelle partnered with a leading UK retailer to launch a private-label range of pulse flours, catering to the demand for gluten-free and plant-based baking solutions. |

The Surge in Pulse Protein Ingredients

The UK market is experiencing a boom in the processing of pulse-based protein ingredients. Pea protein, especially, is the most popular one used by makers of plant-based meat and dairy substitutes.

Companies like Cargill are stepping up their investment in new plants to make the hexane-free protein isolates that meet food formulation requirements for clean label and allergen-free products. The progress in other parts of the food industry is observable in such practices as incorporation of pulses in high-protein snacks and beverages.

Rising Pre-Cooked Pulse Products

Pre-cooked pulse products are becoming a transient key issue in the UK market. These products are addressed to busy consumers looking for convenient, ready-to-use products that maintain the quality of nutrition.

A representative example is AGT Foods’ introduction of pre-cooked pea products, which emphasize the shift towards purpose-driven convenience in the pulses category. Products like that also target foodservice providers who desire the management of quality and efficiency.

The Retail Sector of Pulses

Private-label retail sector is starting to make pulses a part of their own product lines, this is from canned pulses to snacks and ready meals. The agreement between pulse makers and retailers are yielding the birth of cheaper, nicely done pulse products in the UK.

These steps back consumer's great lifestyles by providing the option to get health and food products at lower prices. In particular, the garlic products launched by Bonduel under their private-label purist range are an exact answer to the explosion of demand for gluten-free baking and cooking products.

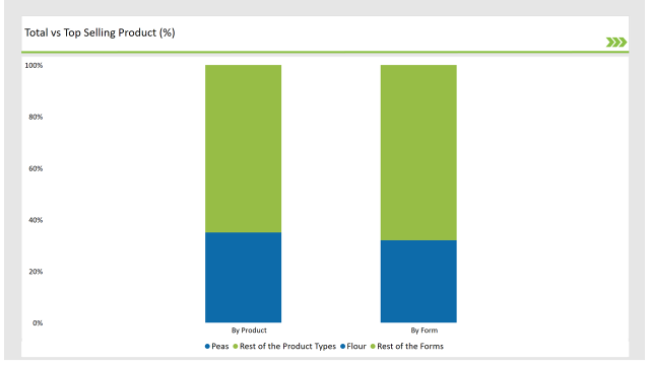

% share of Individual categories by Product Type and form in 2025

Peas comprised a stunning 35% of the UK pulses market by product type, thus making them the most consumed choice, both by consumers and producers. Their broad use and ample protein are the reasons that peas are often placed in soups, stock, and other foods that contain plant protein.

On the wave of the good reception of pea-based ingredients, such companies as Cargill and AGT Foods seize the moment and invest in the state of the art processing equipment and increase their range of products.

Flour gets a share of 32% of the UK pulses market due to the broad use fiber flour brings in gluten-free baking, snacks, and plant-protein products. Pulse flour is turning out to be a good source in some pasta, bread, and batter that offers a more nutritious option than traditional wheat flour. The newly-milled, high-quality pulse of Bühler Group made it possible for people to eat healthier and reduce food allergies.

Note: above chart is indicative in nature

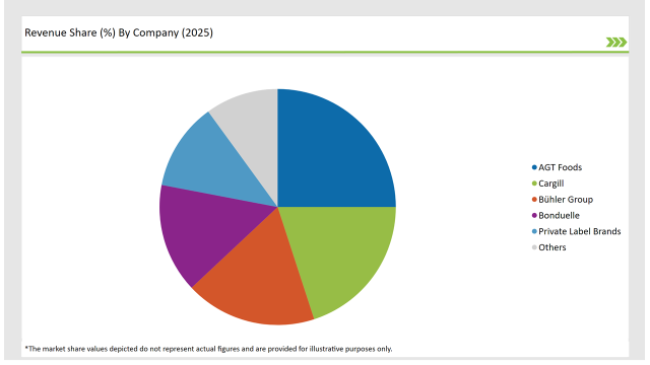

The UK pulses market is somewhat diversified with both multinational and domestic players competing and innovating. The market is dominated by Tier 1 players including AGT Foods, Cargill, Bühler Group, and Bonduelle thanks to their broad product range, state-of-the-art processing technologies, and well-established distribution networks. Differentiation comes from Tier 2 and Tier 3 companies, which specialize in organics and special pulse products.

In order to stay ahead of the competition, companies are pouring money into research and development of new pulse food products that meet the shifting demands of the customers.

Teaming up with chain stores and food manufactures also acts as an effective tool in expanding the market. For example, Bühler Group has made significant progress in the milling technology and Bonduelle has partnered with various retailers that have together bolstered their presence in the industry.

The UK pulses market is projected to maintain its growth trend due to the rising appeal of plant-derived proteins, innovation focused on convenience, and sustainability initiatives.

Chickpea, Lentils, Yellow Peas, Pigeon Peas

Whole, Split, Flour, Grits and Flakes

Business to Business, Household Retail, Food Service and Institutional.

Key factors propelling the UK Pulses market include Increasing demand for plant-based proteins, shift towards flexitarian and vegetarian diets, government initiatives and policies, sustainability and environmental concerns, health benefits of pulses, product innovation and diversification, improved farming techniques and yields.

Prominent players in the UK Pulses manufacturing include Hodmedod's, Tesco, Merchant Gourmet, Clearspring, Hodson Foods, Gilchesters Organics. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA