The UK Lactose market is expected to reach USD 158.5 million in 2025 and is projected to reach a total value of USD 323.5 million by 2035. This represents a compound annual growth rate (CAGR) of 7.4% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 158.5 million |

| Industry Value (2035F) | USD 323.5 million |

| CAGR (2025 to 2035) | 7.4% |

The lactose business in the UK is flourishing at a steady rate, and it is mainly due to its durable use in the food and pharmaceutical areas. The requirement for lactose with high purity in drug formulations and its addition as a sweetener, stabilizer, and bulking agent in food products are the main driving forces behind this market growth.

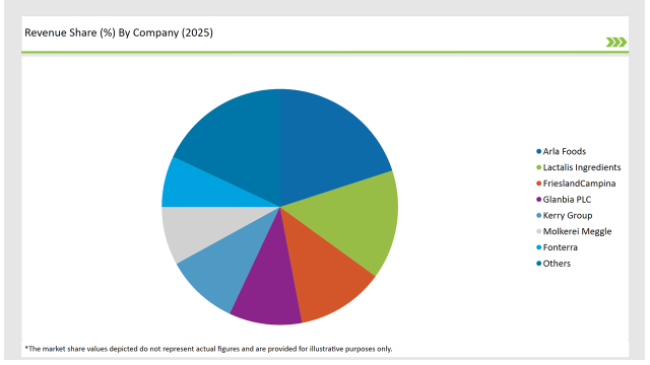

The UK market hosts several principal manufacturers namely, Arla Foods, Lactalis Ingredients, FrieslandCampina, Glanbia PLC, Kerry Group, Molkerei Meggle, and Fonterra. The companies are adopting different strategies for example product diversification, technological advancements, and gluten-free products line extension with the aim of their market share strength.

The major force that is playing a vital role in the UK lactose market is the rising consumer awareness about lactose intolerance. This is the reason for the companies' intention to produce lactose-free alternatives and manufacturers are forced to innovate and diversify their offerings. Also, the rules regarding infant formula and dairy pricing are likely to turn the market dynamics, specifically in retail and pharmaceutical areas.

Moreover, the market is benefiting from the technological breakthroughs that are coming about in the lactose processing sector, which lead to the more efficient and cleaner production of lactose derivatives. The improvements in purifying techniques of lactose bring about the more standardized and useful products, which in turn boost their use in pharmaceutical and food production.

Notwithstanding the disruption caused by fluctuating raw material prices and shifting consumer tastes towards plant-based alternatives, the UK lactose market is still showing remarkable resilience. The steady growth of the pharmaceutical sector in conjunction with the launching of new products and the formation of strategic alliances will be the primary motor powers for market growth in the foreseeable future.

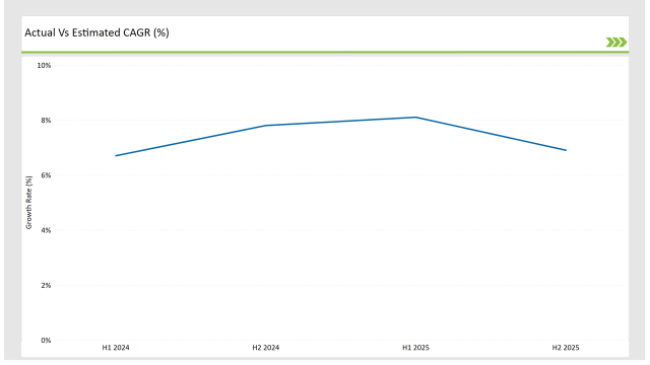

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Lactose market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | A new lactose-free custard product was launched in the UK by a collaboration between a well-known dairy alternative brand and a British rapper to target lactose-intolerant consumers. |

| Oct 2024 | A leading UK dairy producer announced a new range of lactose-free dairy products to meet rising consumer demand. |

| Sep 2024 | A major pharmaceutical company established a new facility in the UK dedicated to the production of high-purity lactose monohydrate for tablet formulations. |

| Aug 2024 | A UK-based dairy cooperative expanded its lactose production capacity by upgrading processing facilities to meet the growing demand from food and pharmaceutical industries. |

| Jul 2024 | A prominent food ingredient supplier launched an innovative lactose-based sweetener aimed at reducing sugar content in processed foods. |

Collaboration for lactose-free alternatives

In the last couple of years, lactose-free substitutes have become popular in the UK. Concerning this, a noteworthy bond was formed between a British rapper and a plant-based company which led to the introduction of the first lactose-free custard.

These types of partnerships are the ones that have moved brands towards more inclusive product offerings that accommodate lactose-intolerant consumers, particularly, in ethnic communities where lactose intolerance is a major challenge. This is proof of how brands are using celebrity endorsement to appeal to different and diverse groups, especially, to promote lactose-free products.

Government Intervention in Infant Formula Pricing

The British government aims to cut high pricing strategies of infant formulas set by major dairy companies by introducing NHS-branded infant formula at a lower price. This would be expected to trigger a price competition in the infant nutrition segment, which would, in turn, affect the demand for lactose-based products.

This kind of policy would deal with the price issues of lactose-based formulas, making them more accessible to a broader population range if it were introduced. Additionally, this could mobilize private manufacturers to rethink their pricing strategies and to offer even lower price products, thus reshaping the market.

Expansion of Lactose-Free Dairy Ranges

Lactose intolerance free food consumption is gaining a foothold in the UK, and this has caused big dairy producers to roll out a range of new lactose-free product lines.

The firms are channeling money to research to produce lactose-free products of milk, cheese, and yogurt such that the tastes and textures are like the conventional dairy products.

This culture has the impact of reshaping the organizational structure of the supermarket dairy area, with separator lactose-free aisles that are more and more popular. Besides, foodservice providers and cafes are adding lactose-free options to their menus as a way of meeting the demand.

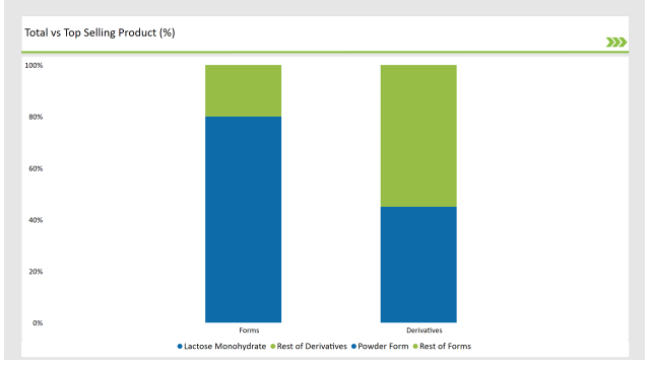

% share of Individual categories by Form and Derivative Type in 2025

Lactose Monohydrate: The Backbone of UK Pharmaceutical Industry

Lactose monohydrate is the most popular pharmaceutical excipient in the industry, and it represents 45% of the lactose market in the UK. Its high compressibility and excellent stability make it a preferred filler for tablets. The high purity of lactose monohydrate guarantees that it can be used with a wide range of active pharmaceutical ingredients (APIs), which helps to sustain its supremacy in this area.

In the meantime, drug companies are also looking for superior quality lactose monohydrate to make tablets more easily dissolved and comply better with patients. In the light of strict regulations on quality, UK manufacturers are concentrating on producing the pharmaceutical-grade lactose which is more consistent and has better safety standards.

Powdered Lactose: A Preferred Choice in the Food Industry

Powdered lactose is the sole leading form in the UK lactose market as it accounts for 80% of the total lactose consumption. This type is chosen for its convenience, long shelf life, and compatibility with various food formulations.

As both sweetener and stabilizer, this ingredient is used in bakery, confectionery, and dairy processing. With the food manufacturers looking desperately for cheap sugar alternatives that comply with the health issue, powdered lactose has found its way as a quality alternative.

Note: above chart is indicative in nature

The UK lactose market is a relatively concentrated one, with a couple of notable manufacturers striving for supremacy. Companies such as Arla Foods, Lactalis Ingredients, FrieslandCampina, Glanbia PLC, Kerry Group, Molkerei Meggle, and Fonterra are the dominant players holding a lot of shares in the market.

Tier 1 companies are in charge of pharmaceutical and food-grade lactose and Tier 2 players deal with niche applications. Manufacturers' lactose waste-free inventions, product safety assuredness, and investments on high-purity lactose have been the key routes of development.

Powder, Granule

Food and Beverage, Pharmaceutical, Animal Feed, Others

Lactose Monohydrate, Galactose, Lactulose, Tagatose, Others.

Within the Forecast Period, the UK Lactose market is expected to grow at a CAGR of 7.4%.

By 2035, the sales value of the UK Lactose industry is expected to reach USD 323.5 million.

Prominent players in the UK Lactose manufacturing include Arla Foods, Lactalis Ingredients, FrieslandCampina, Glanbia PLC, Kerry Group, Molkerei Meggle, and Fonterra. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA