The UK lactase market is projected to reach USD 187.1 million by 2025, with strong growth expected to drive its value to USD 293.7 million by 2035. This represents a compound annual growth rate (CAGR) of 4.6%, fueled by increasing lactose intolerance awareness, rising demand for lactose-free dairy products, and advancements in enzyme technology.

The market is experiencing notable expansion due to innovations in fungal and yeast-derived lactase enzymes, improving efficacy, stability, and cost-effectiveness across various applications.

| Attributes | Values |

|---|---|

| Estimated UK Industry Size in 2025 | USD 187.1 million |

| Projected UK Industry Size in 2035 | USD 293.7 million |

| Value-based CAGR from 2025 to 2035 | 4.6% |

Profits in the UK's lactase industry are accelerating as the demand for lactose free products increases in the dairy and beverage industries. The expansion is being driven by improvement in knowledge about digestive health, innovation of new product features such as enzyme efficiency, and increased availability of dairy substitutes.

The primary industry changes that are observed are increased use of lactase especially in infant formulas, increased formulations of liquid lactase for industrial dairy use, and the established superiority of lactase from fungi sources. The Kerry Group, Novozymes, and DSM-Firmenich are the major players in the market and are using competitive strategies through enzyme modification, improvement in sustainability, and greater collaboration with dairy industry players.

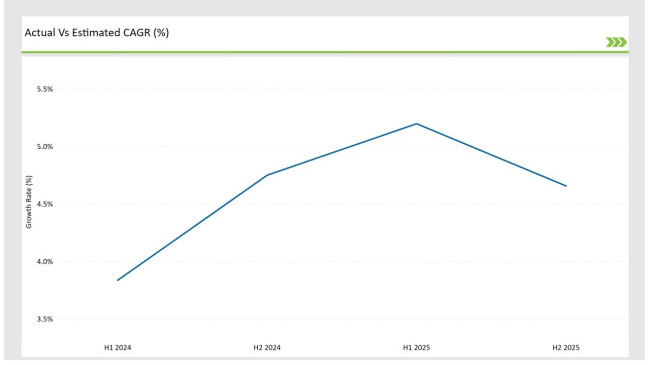

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Lactase market. This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Year | 2024 |

|---|---|

| H1 Growth Rate (%) | 3.8% |

| H2 Growth Rate (%) | 4.7% |

| Year | 2025 |

|---|---|

| H1 Growth Rate (%) | 5.2% |

| H2 Growth Rate (%) | 4.7% |

For the UK market, the Lactase sector is projected to grow at a CAGR of 3.8% during the first half of 2024, with an increase to 4.7% in the second half of the same year. In 2025, the growth rate is anticipated to slightly rise to 5.2% in H1 and reach 4.7% in H2.

| Date | Details |

|---|---|

| Dec-2024 | Chr. Hansen UK launched a new high-stability lactase enzyme for plant-based dairy alternatives. The enzyme shows exceptional stability in oat and soy matrices, enabling longer shelf life for lactose-free products. |

| Oct-2024 | DuPont Nutrition & Biosciences acquired Cambridge-based enzyme specialist EnzymeTech for £30M. The acquisition strengthens DuPont's position in the UK's growing lactose-free dairy market. |

| Aug-2024 | Kerry Ingredients unveiled a new manufacturing line in Liverpool for concentrated lactase production. The facility uses novel immobilization technology to produce enzyme preparations with 50% higher activity. |

| May-2024 | Novozymes partnered with major UK dairy producer Arla to develop customized lactase solutions. The collaboration aims to expand Arla's lactose-free product range with improved taste profiles. |

| Mar-2024 | DSM Food Specialties opened an enzyme technology center in Manchester focusing on lactase innovation. The facility specializes in developing lactase enzymes optimized for various dairy applications. |

Growing Demand for Fungal-Derived Lactase in Industrial Dairy Processing

The lactase enzyme sourced from fungi is gaining ground as the method of choice in the UK because it is very efficient, stable and tolerant to a wide range of pH levels. Major companies such as Novozymes and DSM-Firmenich are developing specialized fungi to achieve better lactose hydrolysis rates during large scale milk processing. The increase in consumption of lactose free milk, cheese, and yogurt is fueling the use of fungal lactase due to its consistent high enzyme activity and ease of control in commercial dairy processing.

Expansion of Lactase Enzymes in Infant Formula Manufacturing

There is an increase in the use of lactase enzymes in the UK infant formula market, and this is being witnessed by firms such as Kerry Group and Chr. Hansen. These techniques focus on making life easier for lactose intolerant toddlers. As the general population becomes more aware of the importance of gut health, parents are increasingly turning to lactose-free or low-lactose formulas, which tend to amplify the need for high-purity lactase enzyme formulations that are specially designed for infants’ nutritional needs.

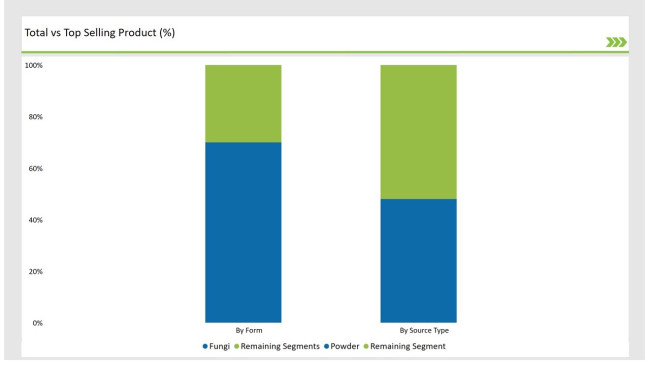

| Form | Market Share |

|---|---|

| Powder | 70% |

| Remaining Segments | 30% |

In the UK market, powdered lactase is the leading product, capturing considerable shares of the dry dairy constituents and nutritional supplements segments. Nevertheless, liquid lactase is gaining traction, especially in bulk process dairy production where it is more soluble and dissolves faster. The growth of liquid lactase usage in the dairy industry is expected to rise in the next few years as dairy producers become increasingly more efficient with using enzymes.

| Source | Market Share |

|---|---|

| Fungi | 48% |

| Remaining Segments | 52% |

Fungal lactase continues to expand its dominance in the UK market, outperforming yeast and bacterial alternatives due to its high thermal stability and enhanced lactose hydrolysis efficiency. The market for yeast-based lactase still exists, especially for use in dietary supplements with infant formulas, but enzymes sourced from bacteria have a limited range because they are less efficient in mass producing dairy products.

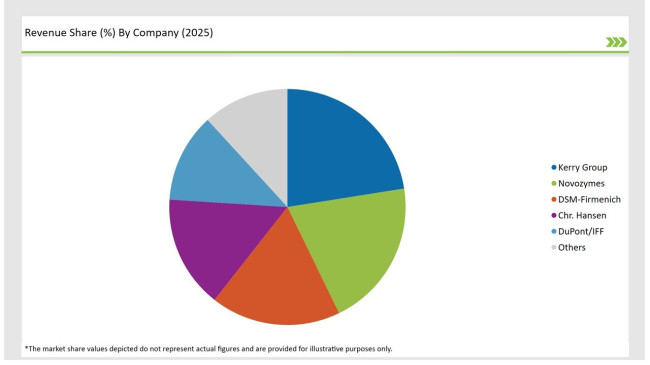

Due to the heavy protection on the innovations to the enzymes’ inventions alongside expensive production processes, lactase enzymes in the UK are processed and supplied by a few multinational corporations. Kerry Group, Novozymes, and DSM-Firmenich dominate the industry alongside possessing advanced supplies networks due to the high level of biotechnology.

Chr. Hansen and DuPont/IFF also formulate and lactase enzymes specific to the dairy sector. Even though there are throwaway regional competitors like Integra Biotech and Biocatalysts Ltd, the market is heavily driven by global players with strong technological and research advancements.

| Company | Market Share (%) |

|---|---|

| Kerry Group | 22.5% |

| Novozymes | 20.3% |

| DSM-Firmenich | 17.8% |

| Chr. Hansen | 15.4% |

| DuPont/IFF | 12.2% |

| Other Players | 11.8% |

The advanced regional players in the United Kingdom lactase market possess advanced supply and production facilities in Scotland and England where the food processing sector is also the strongest. Novozymes and Kerry Group are focusing on supporting the enzyme’s efficiency and stability by investing in fungal based lactase innovations. DMS, Chr. Hansen and DuPont/IFF are focusing on bioactive enzymes for infant formulas, supporting market positions of clean-label lactase, and strengthening the foundations for their bioactive enzymes.

These are all necessary in supporting the clean label lactase objectives. Collaborations with dairy and biotechnology provide assurance for rapid and effective supply and are effective means of distribution across the UK, so these partnerships can ensure efficient supply to both regions.

Powder, Liquid

Fungi, Yeast, Bacteria

Dairy Products Manufacturing, Infant Formula Production, Beverage Processing

Food-Grade, Feed-Grade

By 2025, the UK lactase enzyme market is projected to grow at a CAGR of 4.6%, fueled by increasing lactose-free dairy consumption and enzyme technology advancements.

By 2035, the UK lactase market is expected to reach USD 293.7 million, supported by strong demand in dairy processing and infant formula applications.

The UK lactase market is expanding due to rising lactose intolerance cases, increased demand for lactose-free dairy alternatives, advancements in enzyme efficiency, and sustainable enzyme production practices.

The South East and London lead in lactase enzyme demand, driven by high dairy consumption and the popularity of lactose-free products, while Scotland remains a stronghold for dairy processing innovations.

Major players in the UK lactase enzyme market include Kerry Group, Novozymes, DSM-Firmenich, Chr. Hansen, and DuPont/IFF, alongside regional enzyme specialists such as Biocatalysts Ltd and Integra Biotech.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA