The UK Fish Meal market is poised to reach a value of USD 2,228.6 million in 2025, and further expand at a CAGR of 3.4% to reach USD 3,219.3 million by the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 2,228.6 million |

| Industry Value (2035F) | USD 3,219.3 million |

| CAGR (2025 to 2035) | 3.4% |

The fishmeal market in the UK is experiencing constant growth, primarily because of its utilization in aquaculture, animal feed, and pet food industries. Fishmeal derived from small fish species, fish trimmings, and processing by-products is a powerful protein source and contributes significantly to livestock and aquaculture feed ingestion.

The progress of the country’s aquaculture sector and the increased number of fish farmers collecting fish, especially salmon and trout, have tremendously raised the need for top-notch fishmeal.

Biomar, Skretting, Pelagia, United Fish Industries (UFI), and Ff Skagen are among the top manufacturers driving the UK market with substantial investments in the sustainability of the marine resources and advanced technical fishmeal processing. The trend of high-protein and low-carbon feed components is motivating firms like these to look for alternative sources of fishmeal which can come from algae, and insects.

Regulators like the UK Marine Management Organisation (MMO) and the Food Standards Agency (FSA) are working on a set of sustainability rules to ensure that fishing is carried out in a responsible manner and that raw materials are sourced ethically. Therefore, fishmeal producers in the UK are focusing more on the utilization of by-products and traceable supply chains in an effort to meet the set industry standards.

Even though there are issues such as the fluctuation of raw material prices, concern over the environment, and competition from plant-based proteins, the UK fishmeal market continues to grow due to the increasing demand for nutritional and digestible protein sources. Technical improvements in processing, fishery sustainability, and feed optimization will be causes for further market growth.

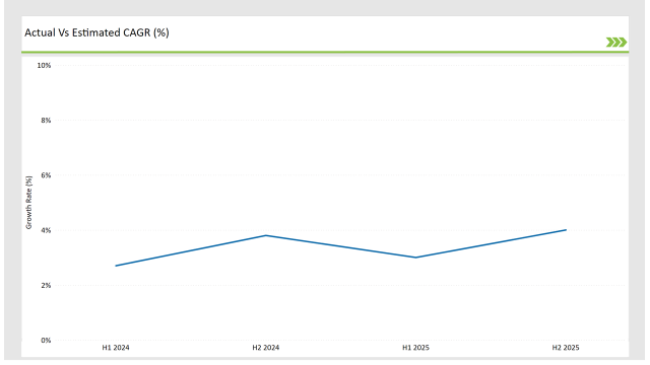

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Fish Meal market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| Nov 2024 | Biomar introduced a sustainable fishmeal alternative using algae-derived protein. This initiative aims to reduce reliance on wild fish stocks while maintaining high nutritional value. |

| Oct 2024 | Skretting expanded its UK fishmeal production facility to meet the growing demand for aquaculture feed, particularly for salmon farming. The expansion aligns with the company's sustainability commitments. |

| Sep 2024 | Pelagia announced a partnership with the UK seafood industry to improve fishmeal production efficiency by utilizing more fish processing by-products. The collaboration aims to minimize waste and improve resource efficiency. |

| Aug 2024 | United Fish Industries launched a low-impact fishmeal range designed for premium aquaculture feed. This product is formulated to enhance feed conversion ratios and reduce environmental impact. |

| Jul 2024 | Ff Skagen developed a new traceability system for fishmeal supply chains, ensuring full transparency and compliance with sustainability certifications. |

Transition to Circular Economy in Fishmeal Production

The fishmeal industry not only addresses the traditional arguments about resource scarcity and economic profit, but also brings sustainability in the long run by operating virtually waste-free. Companies are pushing initiatives that recycle fish processing by-products instead of just making fishmeal from whole fish.

This innovative strategy is facilitating the integration of seafood processing plants where fishmeal is produced together with the main product. The government-supported schemes for zero waste are giving a new push to fishmeal producers to recover and use protein-rich fish discards by means of upcycling them into high-quality feed.

Rising Adoption of Functional Additives in Fishmeal

Fishmeal producers are increasingly adding functional additives and bioactive compounds in fishmeal formulas to enhance fish health, immunity, and feed efficiency. These functional additives mostly come in forms like probiotics, prebiotics and omega-3-rich supplements that are meant to increase the nutrient digestibility and disease resistance in farmed fish.

With the help of new enzymes and improved protein hydrolysis, fishmeal has been designed to be more easily digestible and to have an optimized amino acid profile. The problem of sustainability is increasing, but these functional additives are gradually becoming crucial for reducing feed conversion ratios (FCR) and environmental impacts.

Diversification of Fishmeal Usage to Other Sectors

Aquaculture has been the largest fishmeal consumer, but fishmeal in the pet food, livestock feed and organic fertilizers segment is on the increase. The pet food sector is emphasizing fishmeal's high protein and omega-3 feature to introduce premium, grain-free, and functional pet nutrition products.

In the same manner, organic livestock is aggressively sourcing sustainable, marine-derived ration instead of using soy feed. Also, fishmeal is now being used in bio-fertilizers and soil enhancers thereby helping in regenerative agriculture and positively affecting soil microbiomes.

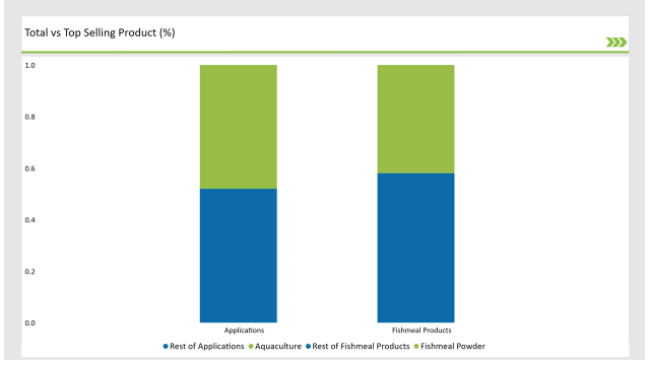

% share of Individual categories by Product Type and Applications in 2025

Fishmeal powder is the dominant form of the feedstock in aquafeed, livestock feed, and pet food applications in the UK, accounting for 42% market share. The climb in the demand for low carbon and nutrient-rich animal feed ingredients has accelerated the use of top-quality fishmeal powders.

The advancement of fishmeal blending processes and micronization is leading to improved nutritional stability and digestibility levels, which in turn, has driven market penetration to a higher level.

Aquaculture is the major sector accounting for 48% of the total fishmeal applications, being still a vital additive for premium fish. The growth of the fishing sector in the UK through salmon, trout, and shellfish farming has added to the need for more efficient and sustainable fishmeal-based feed products.

Moreover, the formulations made with bioavailable fishmeal are seen to accelerate growth, bolster immunity, and improve feed conversion of fish species under culture.

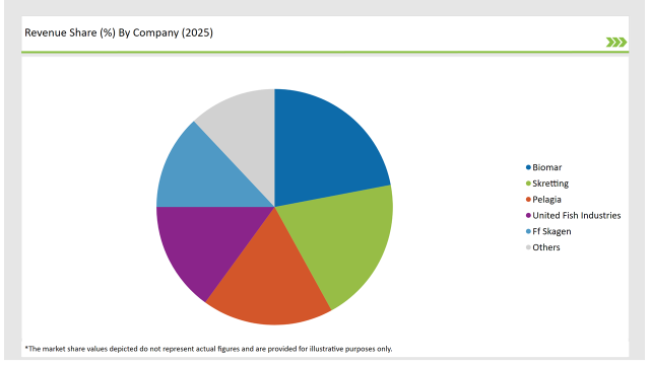

2025 Market share of UK Fish Meal suppliers

Note: above chart is indicative in nature

The competition in the UK fishmeal market is of a moderate nature with the top players focusing on sustainable sourcing, alternative protein, and process optimization. The big companies like Biomar, Skretting, Pelagia, United Fish Industries, and Ff Skagen are putting their money into the transparency of the supply chain, new fishmeals, and waste reduction projects in order to be more competitive in the market.

Also, the manufacturers have been looking into insect meal, algae proteins, and microbial proteins as fishmeal alternatives that, in addition, would diversify their product range, and help to protect the environment. Joint activities with fishing cooperatives, government bodies, and aqua feed producers are contributing to a stronger market presence and stable raw material supply.

Fish Meal Powder, Fish Meal Pellets, Fish Oil, Fish Protein Hydrolysate.

Wild-Caught Fish, Farmed Fish, Bycatch, Processing Byproducts.

Aquaculture, Animal Feed, Pet Food, Fertilizers, Nutraceuticals.

Within the Forecast Period, the UK Fish Meal market is expected to grow at a CAGR of 3.4%.

By 2035, the sales value of the UK Fish Meal industry is expected to reach USD 3,219.3 million.

The market is expanding due to increased aquaculture feed demand, sustainability efforts, and technological advancements in fishmeal processing.

Prominent players in the UK Fish Meal manufacturing include Biomar, Skretting, Pelagia, United Fish Industries, and Ff Skagen, all of which focus on marine sustainability and alternative protein development.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA