The UK Bubble Tea market is poised to reach a value of USD 168.4 million in 2025, and further expand at a CAGR of 5.1% to reach USD 276.9 millionby the year 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 168.4 million |

| Industry Value (2035F) | USD 276.9 million |

| CAGR (2025 to 2035) | 5.1% |

The bubble tea sector in the UK is benefitting from the increase in consumer interest in Asian beverages, more experimentation with flavors, and the escalation of food that is designed for social interaction. Bubble tea, which is of Taiwanese origin, has become a phenomenon in the UK with popularity not least of that which is shown by the so-called generation Z customers who want to drink something exclusive and customizable. The market sees creations from standalone bubble tea chains and coffee shops including bubble tea in their menus.

The available variety of the newly launched or ready-to-drink (RTD) bubble tea is one of the primary reasons for the market's expansion. Supermarkets, convenience stores, and online retailers have introduced bottled and canned options that are ready-to-drink, which makes it possible for customers who prefer on-the-go drink options to acquire them easier. The RTD bubble tea has the addition of various flavors such as fruit-infused and the classic milk tea which enhances its popularity.

The other prevailing trend is that more and more people prefer to drink plant-based or dairy-free alternatives. The offer for beverages made with almond, oat, and soy milk has grown with the expansion of the vegan community, whereas, several brands of bubble tea have started to include them in their lists. What's more, the use of natural sweeteners along with the recent trend of skinny drinks that are reduced in sugar find the support from the health-conscious diet in the UK beverage industry.

The surge of independent bubble tea stores in high-footfall locations and cities shows that the market is on an upwards trajectory. The amalgam of creative product lines, user-friendly formats, and brand engagement through social media is molding bubble tea's future in the UK.

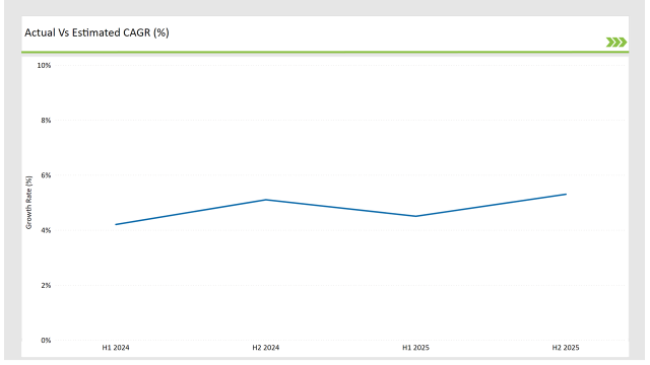

The table below offers a detailed comparative assessment of the changes in the compound annual growth rate (CAGR) over six months for the base year (2024) and the current year (2025) specifically for the UK Bubble Tea market.

This semi-annual analysis highlights crucial shifts in market dynamics and outlines revenue realization patterns, providing stakeholders with a more precise understanding of the growth trajectory within the year. The first half of the year, H1, covers January to June, while the second half, H2, spans July to December.

H1 signifies period from January to June, H2 Signifies period from July to December

| Date | Development/M&A Activity & Details |

|---|---|

| January 2024 | Gong Cha announced plans to open 15 new stores across the UK, focusing on high-traffic urban locations. |

| March 2024 | Boba Guys UK introduced a new range of plant-based bubble tea options featuring oat milk and agave sweeteners. |

| June 2024 | Taiwan Tea House launched an RTD bubble tea line in collaboration with major UK supermarket chains. |

| August 2024 | A report by UK Beverage Trends revealed a 20% year-over-year increase in online bubble tea orders, reflecting strong demand for delivery-based consumption. |

| October 2024 | Chatime UK partnered with a food delivery app to introduce a nationwide bubble tea subscription service. |

Customization on the Rise in Bubble Tea

Costumers have shown a considerable interest in tailored products, hence, the rise of customizable bubble tea. Companies step up to the plate by offering various degrees of sweetness, non-dairy milk, and an array of additives that include popping boba, fruit jellies, and aloe vera. Through this new trend, customers are becoming more actively engaged by discussing their own preferences with the companies from which they buy.

Moreover, social media outlets have been the drivers of the demand for personalized drinks, for instance, interesting or appealing combinations that are unique to the user have been shared across online platforms. Bubble tea outlets make available digital ordering systems that not only enable customers to order but customize the drinks by the use of their mobile applications thus bringing the idea of personalization to the forefront.

Increasing Availability of RTD Bubble Tea

RTD (ready-to-drink) bubble tea has emerged as a product line that practically everyone is laying their hands on, as they have become easily found in very many places, beyond traditional tea shops. Big names in the beverage industry are launching their brand of the beverage that is packed in cans and bottles available at retail stores.

The convenience of the product and wide distribution channels have driven the popularity of RTD options up. Furthermore, RTD bubble tea has adopted novel packaging solutions, such as resealable and biodegradable bottles, that are aimed at drawing the attention of eco-conscious population. Companies have undertaken a joint effort with e-commerce platforms and executed subscription delivery services which enable consumers to receive the RTD bubble tea regularly.

Implementation of Healthier Ingredients

The practical reality of a growing number of drinkers' health concerns has resulted in sponsorships and partnerships with major beverage companies that are functional-based and use fewer sugars and organic plants. Many shops are now offering organic teas, fruit flavors that are natural, and low-calorie toppings.

Moreover, brands are trying to cover lactose-intolerant and vegan people by using non-dairy products as ingredients which in turn will gain them the involvement of a larger audience. Some bubble tea brands are also promoting health trends through the introduction of functional ingredients like collagen, probiotics, and adaptogens.

Companies throughout the industry are demonstrating their commitment to transparency in ingredient sourcing by ensuring that they only use high-quality teas and natural sweeteners in their products that are marketed to health-conscious customers who are looking for cleaner labels.

% share of Individual categories by Product format and flavor in 2025

RTD (Bubble Tea) has a 51% market share and it is bottled and canned options that add strength to its share as they are accepted in convenience and supermarkets. The buying of packaged bubble tea is a perfect solution for busy people as it allows them to really enjoy their drink without having to spend time in queues.

Having the option of multiple flavors in pre-packaged RTD versions has further emphasized the product category's place in supermarkets. As a reaction to the growing demand, beverage brands are pouring money into new packaging types, which include the introduction of sustainable and resealable bottles that connect with ecology-conscious individuals.

Furthermore, the embedment of e-commerce and subscription delivery services has resulted in the advancement of RTD bubble tea, which has become a regular item in e-grocery platforms.

Bubble Tea with Fruit Flavors: The Customers’ First Choice Flavored bubble tea takes the lead in the market and has a 65% share, which indicates the strong demand coming from consumers for the fruit-infused kinds. The names of the most favored fruit that are associated with their products include mango, lychee, passion fruit, and strawberry needless to say, bacteria are also powerful allies here with brands inventing new mixtures.

One of the reasons flavored bubble tea has become so popular among the younger generation and bubble tea fans is that it is associated with bright, cheerful flavors. Companies are putting their focus on the process of exploration interdisciplinary techniques which are utilized to innovate products like a mix of functional ingredients such as collagen and probiotics into flavored bubble teas addressing health-conscious consumers.

he seasonal and unique flavors, which are often associated with different cultural celebrations and trends, have made it possible for flavored bubble tea to remain sought after for a long time.

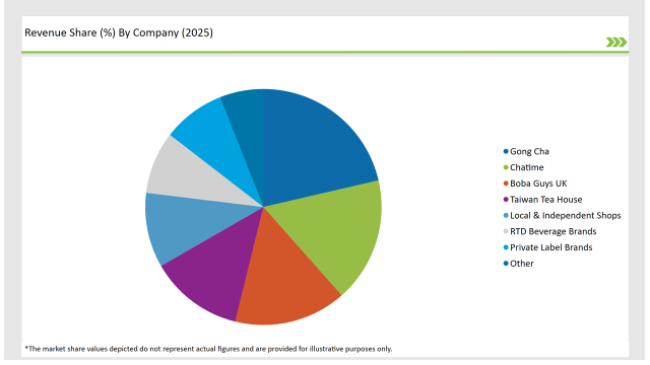

2025 Market share of UK Bubble Tea suppliers

Note: above chart is indicative in nature

The UK bubble tea market is moderately split with international chains domestic brands, and independent tea shops reconciling market sectors. Top players like Gong Cha, Chatime, Boba Guys UK, and Taiwan Tea House dominate the business with the help of shop openings, franchises, and digital marketing to broaden their reach.

The ways in which bubble tea brands are defeating their rivals include the opening of new stores, product line extensions, and online shopping. Subscription models, distribution partnerships, and influencer-led promotions have been the channels used by brands in acquisition of new customers and retaining existing ones.

Alongside the development in the flavor of the drink, which comes from consumer demand for novelty drinks, the UK bubble tea sector will also witness further growth with the introduction of functional ingredients such as packaging formats.

Ready-To-Drink, Ready-To-Mix

Flavored, Unflavored

Tapioca Pearls, Popping Bob Bursting Bubbles, Taro Balls, Coconut Jelly

Indirect Sales, Direct Sales.

Within the Forecast Period, the UK Bubble Tea market is expected to grow at a CAGR of 5.1%.

By 2035, the sales value of the UK Bubble Tea industry is expected to reach USD 276.9 million.

Key factors propelling the UK Bubble Tea market include the increasing consumer interest in Asian-inspired beverages, the demand for innovative flavors, and the rise of experiential food trends.

Prominent players in the UK Bubble Tea manufacturing include Gong Cha, Chatime, Boba Guys UK, and Taiwan Tea House. These companies are noted for their innovation, extensive product portfolios, and strategic market positioning.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Processed Beef Market Size and Share Forecast Outlook 2025 to 2035

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA