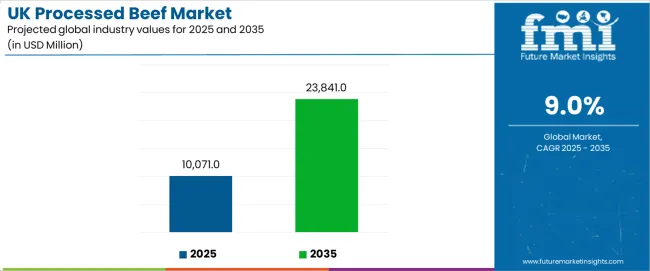

The UK processed beef market is valued at USD 10,071 million in 2025 and is set to reach USD 23,841 million by 2035, growing at a CAGR of 9.0%. The market stands at the forefront of a transformative decade that promises to redefine meat processing infrastructure and protein distribution excellence across food service establishments, retail chains, meat processors, and consumer sectors. The market's journey from USD 10,071 million in 2025 to USD 23,841 million by 2035 represents substantial growth, demonstrating the accelerating adoption of value-added beef products and sophisticated processing technologies across butcher shops, supermarkets, restaurants, and convenience food applications.

The first half of the decade (2025-2030) will witness the market climbing from USD 10,071 million to approximately USD 15,495 million, adding USD 5,424 million in value, which constitutes 39% of the total forecast growth period. This phase will be characterized by the rapid adoption of convenience food culture, driven by increasing demand for ready-to-cook products and enhanced food safety requirements nationwide. Superior protein quality standards and traceability systems will become standard expectations rather than premium options.

The latter half (2030-2035) will witness sustained growth from USD 15,495 million to USD 23,841 million, representing an addition of USD 8,346 million or 61% of the decade's expansion. This period will be defined by mass market penetration of specialized beef products, integration with comprehensive supply chain platforms, and seamless compatibility with existing retail infrastructure. The market trajectory signals fundamental shifts in how meat processors and food retailers approach protein distribution solutions, with participants positioned to benefit from sustained demand across multiple consumption segments.

The UK processed beef market demonstrates distinct growth phases with varying market characteristics and competitive dynamics. Between 2025 and 2030, the market progresses through its convenience food adoption phase, expanding from USD 10,071 million to USD 15,495 million with steady annual increments averaging 8.9% growth. This period showcases the transition from traditional butchery to advanced processing systems with enhanced shelf life extension and integrated quality control becoming mainstream features.

The 2025-2030 phase adds USD 5,424 million to market value, representing 39% of total decade expansion. Market maturation factors include standardization of processing protocols, declining operational costs for automated meat processing, and increasing consumer awareness of convenience beef products reaching 80-85% penetration in urban markets. Competitive landscape evolution during this period features established processors like ABP Food Group and Dunbia expanding their product portfolios while new entrants focus on specialized organic beef solutions and enhanced packaging technologies.

From 2030 to 2035, market dynamics shift toward premiumization and health-conscious offerings, with growth accelerating from USD 15,495 million to USD 23,841 million, adding USD 8,346 million or 61% of total expansion. This phase transition logic centers on grass-fed beef products, integration with blockchain traceability systems, and deployment across diverse retail scenarios, becoming standard rather than specialized offerings. The competitive environment matures with focus shifting from basic processing to comprehensive quality assurance and compatibility with omnichannel distribution operations.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 10,071 million |

| Market Forecast (2035) | USD 23,841 million |

| Growth Rate | 9.00% CAGR |

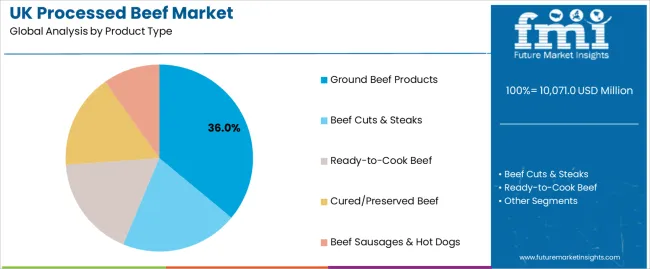

| Leading Product Type | Ground Beef Products |

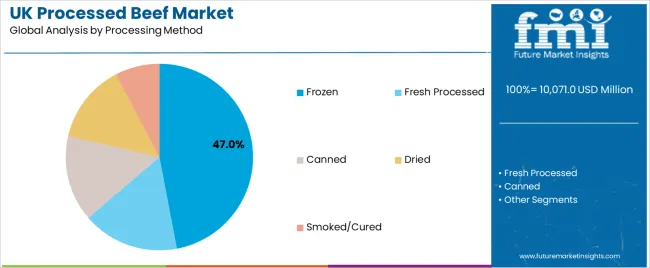

| Primary Processing Method | Frozen |

The market demonstrates strong fundamentals with ground beef products capturing a dominant share through superior versatility and convenient preparation capabilities. Food service industry applications drive primary demand, supported by increasing quick-service restaurant expansion and ready meal production requirements. Geographic expansion remains concentrated in urban centers with established retail infrastructure, while rural areas show accelerating adoption rates driven by convenience store modernization projects and changing consumer lifestyles.

The UK processed beef market represents a compelling intersection of food innovation, convenience trends, and protein consumption evolution. With robust growth projected from USD 10,071 million in 2025 to USD 23,841 million by 2035 at a 9.00% CAGR, this market is driven by increasing time-pressed lifestyles, foodservice sector expansion, and commercial demand for consistent quality beef products.

The market's expansion reflects a fundamental shift in how meat processors and food retailers approach protein distribution infrastructure. Strong growth opportunities exist across diverse applications, from quick-service restaurants requiring consistent portioning to home consumers demanding convenient meal solutions. Geographic expansion is particularly pronounced in urban markets across England and Scotland, while Wales and Northern Ireland show emerging growth potential through retail modernization and foodservice development.

The dominance of ground beef products and frozen processing underscores the importance of proven convenience factors and shelf life extension in driving adoption. Food safety regulations and traceability requirements remain key considerations, creating opportunities for companies that can deliver reliable performance while maintaining quality consistency.

Market expansion rests on three fundamental shifts driving adoption across food industry and retail sectors. Convenience lifestyle evolution creates compelling advantages through processed beef products that provide comprehensive meal solutions with minimal preparation time, enabling working households to maintain protein consumption while justifying premium pricing over raw meat purchases. Quality standardization accelerates as food service operators nationwide seek consistent beef products that deliver uniform portion control and predictable cooking outcomes, enabling operational efficiency that aligns with commercial kitchen requirements and maximizes profit margins. Food safety advancement drives adoption from retailers requiring traceable beef products that maximize shelf life while maintaining organoleptic qualities during distribution and storage operations.

However, growth faces headwinds from health perception challenges that persist across processed meat categories regarding nutritional concerns and preservative content, potentially limiting consumption frequency in health-conscious consumer segments. Environmental considerations also persist regarding carbon footprint and animal welfare standards that may increase production complexity in markets with demanding ethical requirements.

Primary Classification: The market segments by product type into ground beef products, beef cuts & steaks, ready-to-cook beef, cured/preserved beef, and beef sausages & hot dogs categories, representing the evolution from basic minced meat to premium convenience formats for comprehensive meal preparation operations.

Secondary Breakdown: Processing method segmentation divides the market into frozen, fresh processed, canned, dried, and smoked/cured sectors, reflecting distinct requirements for shelf life, storage efficiency, and quality preservation.

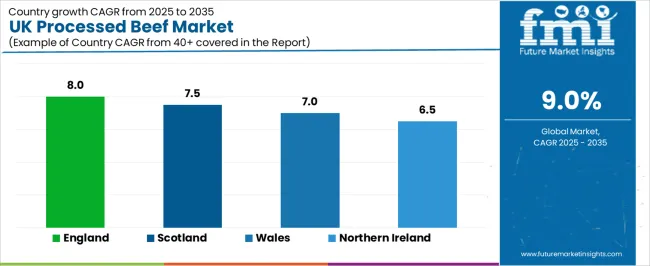

Regional Classification: Geographic distribution covers England, Scotland, Wales, and Northern Ireland, with England leading consumption while Scotland shows premium segment strength driven by Aberdeen Angus beef programs.

The segmentation structure reveals technology progression from traditional butchery toward automated processing platforms with enhanced portion control and packaging innovation capabilities, while application diversity spans from retail operations to foodservice requiring comprehensive product ranges and customized specifications.

Ground beef products segment is estimated to account for 36% of the UK processed beef market share in 2025. The segment's leading position stems from its fundamental role as a versatile protein component in British cuisine and its extensive use across multiple burger chains and ready meal sectors. Ground beef's dominance is attributed to its superior cooking convenience, including rapid preparation times, consistent texture, and balanced fat content that make it indispensable for commercial kitchen operations.

Market Position: Ground beef systems command the leading position in the UK processed beef market through advanced grinding technologies, including comprehensive fat-to-lean ratios, uniform particle size, and reliable packaging systems that enable processors to deploy products across diverse culinary applications.

Value Drivers: The segment benefits from consumer familiarity with proven cooking methods that provide exceptional meal versatility without requiring specialized culinary skills. Efficient production capabilities enable deployment in retail operations, restaurant chains, and meal kit services where convenience and consistency represent critical selection requirements.

Competitive Advantages: Ground beef products differentiate through excellent portion flexibility, proven freezing characteristics, and compatibility with automated cooking equipment that enhance operational efficiency while maintaining economical price points suitable for diverse market segments.

Key market characteristics:

Frozen segment is projected to hold 47% of the UK processed beef market share in 2025. The segment's market leadership is driven by the extensive use of frozen beef in foodservice operations, retail distribution, ready meal production, and export markets, where freezing serves as both preservation method and logistics enabler. The cold chain infrastructure's consistent reliability supports the segment's dominant position.

Market Context: Frozen processing applications dominate the market due to widespread adoption of extended shelf life solutions and increasing focus on inventory management, waste reduction, and year-round availability that extend product value while maintaining quality integrity.

Appeal Factors: Food operators prioritize storage flexibility, batch cooking capabilities, and integration with existing cold storage infrastructure that enable coordinated deployment across multiple distribution points. The segment benefits from substantial freezer technology advancement and quality standards that emphasize texture retention for thawed product consumption.

Growth Drivers: Foodservice expansion programs incorporate frozen beef as standard inventory items for consistent supply management. At the same time, retail initiatives are increasing demand for frozen convenience products that comply with food safety regulations and enhance shopping convenience.

Market Challenges: Energy cost fluctuations and cold chain maintenance requirements may limit deployment flexibility in small-scale operations or extreme price-sensitive scenarios.

Processing dynamics include:

Growth Accelerators: Convenience culture expansion drives primary adoption as processed beef products provide exceptional meal solutions that enable time savings without compromising protein nutrition, supporting household efficiency and lifestyle management that require ready-to-cook formats. Foodservice sector growth accelerates market expansion as restaurants seek consistent beef products that maintain quality standards during peak service while enhancing operational predictability through standardized portions. Packaging innovation increases nationwide, creating sustained demand for modified atmosphere systems that extend shelf life and provide competitive advantages in waste reduction.

Growth Inhibitors: Health consciousness challenges persist across consumer segments regarding processed meat consumption and preservative concerns, which may limit market penetration in wellness-focused categories with demanding nutritional requirements. Price volatility concerns persist regarding beef commodity fluctuations and import dependencies that may increase cost pressures in price-sensitive applications with tight margin specifications. Market competition from alternative proteins and plant-based substitutes creates category pressure between traditional beef products and emerging protein innovations.

Market Evolution Patterns: Adoption accelerates in urban centers and convenience retail sectors where time-pressed lifestyles justify premium processed products, with geographic concentration in England transitioning toward nationwide adoption across all regions driven by retail modernization and foodservice expansion. Technology development focuses on clean label formulations, natural preservation methods, and integration with traceability platforms that optimize product integrity and consumer trust. The market could face disruption if cultivated meat technologies or hybrid protein innovations significantly challenge conventional beef advantages in processed food applications.

| Region | CAGR (2025–2035) |

|---|---|

| England | 8.0% |

| Scotland | 7.5% |

| Wales | 7.0% |

| Northern Ireland | 6.5% |

The UK processed beef market is projected to grow steadily through 2035, with regional CAGR estimates varying across the country. England leads the market at 8.0%, supported by its large population, strong retail and foodservice sectors, and high consumer demand for value-added and convenience beef products. Scotland follows at 7.5%, driven by local production excellence, expanding processing capabilities, and increasing exports. Wales is expected to grow at 7.0%, backed by investments in modern processing facilities, quality control initiatives, and rising consumer preference for high-quality beef products. Northern Ireland records 6.5% growth, fueled by adoption of advanced processing technologies, expanding cold chain infrastructure, and distribution network enhancements. Overall, modernization of processing facilities, increasing consumer demand, and supply chain improvements are propelling market expansion across the UK.

The report covers an in-depth analysis of 40+ regions top-performing regions are highlighted below.

Revenue from the processed beef market in England is projected to grow at a CAGR of 8.0% through 2035, driven by increasing consumer demand for high-quality, convenient meat products and expanding retail and foodservice channels. Innovations in processed beef products, including ready-to-cook and ready-to-eat options, are fueling market expansion. Strong domestic livestock production, coupled with sustainable farming practices and technological advancements in meat processing, is enhancing product availability and safety. England’s robust distribution networks, rising disposable incomes, and growing preference for protein-rich diets are further accelerating adoption. Leading food manufacturers and retailers are investing in product development, cold chain logistics, and marketing initiatives to capture market share.

Revenue from processed beef in Scotland is expected to grow at a CAGR of 7.5% through 2035, supported by the country’s strong agricultural sector, traditional beef production expertise, and rising consumer preference for value-added meat products. Innovations in product variety, including marinated, smoked, and pre-cooked beef offerings, are driving adoption across retail and foodservice segments. Investments in cold chain infrastructure, quality assurance, and regional branding initiatives are enhancing consumer confidence. The Scottish government’s support for sustainable livestock farming and premium beef exports further strengthens market prospects. Leading processors are expanding production and distribution networks to serve both domestic and export markets.

Revenue in Wales’ processed beef market is projected to grow at a CAGR of 7.0% through 2035, fueled by increasing domestic consumption, high-quality local beef production, and growing interest in ready-to-eat and convenience meat products. Investments in processing technology, packaging innovation, and supply chain efficiency are enhancing product quality and availability. Government initiatives promoting sustainable farming practices and regional branding of Welsh beef are driving both domestic and export demand. Processors and retailers are collaborating to meet rising consumer expectations for traceable, safe, and convenient beef products, further strengthening market growth.

Revenue from processed beef in Northern Ireland is expected to grow at a CAGR of 6.5% through 2035, supported by the region’s strong cattle farming industry, traditional expertise in beef production, and increasing consumer preference for convenience and value-added products. Investments in modern processing facilities, product diversification, and cold chain logistics are enhancing supply capabilities. Government programs promoting sustainable and traceable beef production, along with marketing campaigns highlighting Northern Irish beef quality, are further driving market growth. Retailers and foodservice operators are expanding processed beef offerings to meet changing consumer preferences, ensuring consistent adoption across the region.

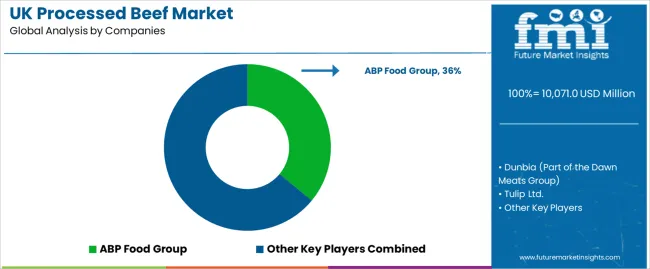

The UK processed beef market operates with moderate concentration, featuring approximately 20-28 participants, where leading companies control roughly 48-55% of the market share through established processing networks and comprehensive retail relationships. Competition emphasizes quality consistency, food safety compliance, and supply chain efficiency rather than price-based rivalry.

Market leaders encompass ABP Food Group, Dunbia (Dawn Meats), and Tulip Ltd., which maintain competitive advantages through extensive processing facility networks, integrated supply chains, and comprehensive retail partnerships that create volume advantages and support market position. These companies leverage decades of meat processing experience and ongoing technology investments to develop advanced product lines with exceptional quality control and traceability features.

Specialty challengers include Kepak Group, Moy Park, and regional processors, which compete through specialized product innovation and targeted market segments that appeal to foodservice operators seeking customized solutions and flexible supply arrangements. These companies differentiate through customer service emphasis and specialized processing capabilities.

Market dynamics favor participants that combine reliable quality delivery with comprehensive food safety systems, including BRC certification and retailer compliance. Competitive pressure intensifies as international processors enter the UK market. At the same time, local producers challenge established players through artisan positioning and provenance storytelling targeting premium consumer segments.

| Item | Value |

|---|---|

| Quantitative Units | USD 10,071 million |

| Product Type | Ground Beef Products, Beef Cuts & Steaks, Ready-to-Cook Beef, Cured/Preserved Beef, Beef Sausages & Hot Dogs |

| Processing Method | Frozen, Fresh Processed, Canned, Dried, Smoked/Cured |

| Distribution Channel | Food Service Industry, In-store Retail, Online Retail, Others |

| Packaging Type | Vacuum Packaging, Modified Atmosphere Packaging, Fresh Wrapped, Canned |

| Regions Covered | England, Scotland, Wales, Northern Ireland |

| Export Markets Covered | China, India, Germany, USA, Japan, and 20+ additional countries |

| Key Companies Profiled | ABP Food Group, Dunbia, Tulip Ltd., Kepak Group, Moy Park |

| Additional Attributes | Dollar sales by product type and processing method categories, regional consumption trends across UK regions, competitive landscape with meat processors and retail suppliers, foodservice preferences for portion control and quality consistency, integration with supply chain management and traceability systems, innovations in packaging technology and shelf life extension, and development of specialized products with enhanced convenience features and premium positioning |

The global UK processed beef market is estimated to be valued at USD 10,071.0 million in 2025.

The market size for the UK processed beef market is projected to reach USD 23,841.0 million by 2035.

The UK processed beef market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in UK processed beef market are ground beef products, beef cuts & steaks, ready-to-cook beef, cured/preserved beef and beef sausages & hot dogs.

In terms of processing method, frozen segment to command 47.0% share in the UK processed beef market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UK Cruise Tourism Market Size and Share Forecast Outlook 2025 to 2035

UK Outbound Travel Market Analysis – Size, Share, and Forecast 2025 to 2035

United Kingdom Sweetener Market Trends – Size, Demand & Forecast 2025–2035

United Kingdom Allergen-Free Food Market Report – Trends & Growth Forecast 2025–2035

United Kingdom Wild Rice Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Frozen Ready Meals Market Analysis – Growth, Trends & Forecast 2025–2035

United Kingdom Whole Grain and High Fiber Foods Market Report – Trends & Forecast 2025–2035

United Kingdom Tartrazine Market Outlook – Growth, Trends & Forecast 2025–2035

United Kingdom Wood Vinegar Market Insights – Growth, Trends & Forecast 2025–2035

United Kingdom Vinegar and Vinaigrette Market Insights – Demand & Forecast 2025–2035

United Kingdom Bakery Ingredients Market Outlook – Size, Demand & Forecast 2025–2035

United Kingdom Bakery Mixes Market Insights – Growth, Demand & Forecast 2025–2035

United Kingdom Chitin Market Trends – Size, Share & Forecast 2025–2035

UK Non-Alcoholic Malt Beverages Market Analysis from 2025 to 2035

United Kingdom Non-Dairy Creamer Market Insights – Demand, Growth & Forecast 2025–2035

UK Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

UK Banking as a Service (BaaS) Platform Market Growth - Trends & Forecast 2025 to 2035

UK Stationary Battery Storage Industrial Market Growth - Trends & Forecast 2025 to 2035

UK Food Emulsifier Market Analysis – Size, Share & Forecast 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA